In this blog post, we’ll discuss qualifying for FHA loans with top North Carolina FHA lenders for bad credit. It’s important to note that not all North Carolina FHA lenders have identical loan criteria. First-time homebuyers with lower credit scores or lacking credit history may be rejected by one lender but approved by another lender specializing in borrowers with bad credit.

What is a No Overlay Lender?

A “no overlay” lender in North Carolina strictly follows established regulations without adding extra requirements or restrictions.

For FHA loans in North Carolina, the FHA establishes specific criteria for approving borrowers, including credit score prerequisites, debt-to-income ratios, and minimum down payment amounts. Some North Carolina FHA lenders for bad credit may impose additional requirements, known as overlays, such as more stringent credit score criteria, lower debt-to-income ratios, or additional documentation requests.

In contrast, in North Carolina, no overlay lender adheres solely to the guidelines outlined by the FHA or other agencies without adding supplementary criteria. This can benefit borrowers in North Carolina who meet the loan qualifications based on the agency’s guidelines but may need to avoid denials from North Carolina lenders with stricter overlays.

Get Approved in North Carolina With Bad Credit—No Overlays!

Apply Now With a North Carolina FHA Lender That Says Yes When Others Say No

What is the Minimum Credit Score to Buy a House in NC?

North Carolina FHA lenders for bad credit are equipped to approve borrowers with non-traditional credit histories, including those with high debt-to-income ratios, collections, charged-off accounts, and overall bad credit.

The overseer of FHA loans, HUD, has implemented North Carolina FHA Loan Requirements that are more lenient, allowing homebuyers with credit scores as low as 500 FICO, as well as outstanding collections and charged-off accounts, to qualify for a home purchase with a 3.5% down payment.

This reflects the minimum credit score requirement for FHA loans in North Carolina for individuals facing credit challenges such as low credit scores, outstanding collections, and charged-off accounts.

What Credit Score Do You Need For an FHA Loan in NC?

Borrowers with credit scores as low as 500 FICO are eligible for an FHA loan in North Carolina. For credit scores between 500 and 579 FICO, HUD mandates a 10% down payment rather than the standard 3.5%. Higher credit scores generally lead to lower mortgage rates like other loan options. Improving your credit scores before applying for an FHA loan in North Carolina is advisable.

The state’s housing market is thriving, attracting many individuals from high-tax areas due to its affordability in terms of taxes, living expenses, and housing costs. Thanks to their lenient guidelines, FHA loans remain the top choice among North Carolina FHA lenders for bad credit borrowers. This article will delve into North Carolina FHA Loan Requirements for homebuyers.

How To Apply With North Carolina FHA Lenders For Bad Credit

North Carolina FHA Lenders For Bad Credit allows homebuyers and homeowners to apply for an FHA loan with any bank, credit union, or mortgage company that is a HUD-approved lender licensed in the state of North Carolina. The majority of mortgage loan applications are processed online through a secure website.

The mortgage industry is highly regulated, and lenders must adhere to strict laws and regulations. All loan officers and mortgage companies operating in North Carolina are licensed or registered with the NMLS (Nationwide Multistate Licensing System & Registry).

The Scope of Work and Role of the NMLS in the Mortgage Industry

North Carolina FHA lenders for bad credit must adhere to NMLS regulations. The NMLS oversees both state-regulated mortgage companies and FDIC-registered banks and credit unions. Mortgage lenders operating in North Carolina, including those specializing in FHA loans for borrowers with bad credit, must obtain licenses to conduct business, process applications, and offer rate and term quotes to potential clients.

While FDIC banks and credit unions are exempt from NMLS state licensing requirements, they must still be registered with the NMLS.

North Carolina FHA Lenders For Bad Credit Using Only Agency Guidelines

North Carolina FHA Lenders For Bad Credit must ensure compliance with HUD’s minimum agency mortgage guidelines. However, these lenders may impose higher lending standards, known as lender overlays, beyond HUD’s requirements. These overlays can affect various aspects of the loan process, including credit score requirements and debt-to-income ratios. We will discuss typical lender overlays in more detail later in this article.

Is Buying A Home In North Carolina A Good Investment?

North Carolina, nestled in the Southeastern United States, is the 28th largest state nationally and houses the 9th most populous region. With its coastal proximity to the Atlantic Ocean, the state draws in many vacation and second homeowners, particularly in oceanfront properties and condominium complexes along coastal cities.

North Carolina is a state with beautiful landscapes and a reasonable cost of living, making it a popular choice for retirement. For individuals with credit challenges, North Carolina FHA lenders for bad credit are crucial in helping them purchase homes. This assistance in home buying makes North Carolina even more appealing for those looking to retire.

North Carolina Among Highest Numbers with New Americans Migrating to State

North Carolina, bordered by Virginia to the north and South Carolina and Georgia to the south, with Tennessee to the west, boasts Charlotte as its largest and most populous city, home to 2.6 million people. Charlotte ranks as the 23rd most populous city in the nation and is a hub for numerous financial institutions, including North Carolina FHA lenders for bad credit.

Over the past few years, home prices in North Carolina, including those approved by FHA lenders for bad credit, have experienced significant double-digit surges, mirroring trends across the country.

North Carolina’s Housing Forecast Continues Strong With No Expected Corrections

Home prices in North Carolina continue to rise. Despite this trend, homes remain affordable, and many prospective buyers quickly purchase homes in the state. North Carolina is experiencing rapid growth, with new residents and businesses relocating from high-tax states. It is a popular choice for Americans looking for a permanent residence or retirement destination.

Gustan Cho Associates, one of the leading North Carolina FHA lenders for bad credit, is well-established in the state. We have a substantial client and realtor network and are licensed in multiple states, including North Carolina. Our commitment to providing FHA loans without lender overlays has earned us a national reputation for excellence in mortgage lending.

North Carolina FHA Home Loans for Low Credit Scores

No overlays. No judgment. Just real approvals. Talk to a North Carolina FHA Specialist Today

North Carolina FHA Lenders For Bad Credit For First-Time Homebuyers

North Carolina FHA Loan Requirements are lenient for first-time homebuyers. Full-time students who recently graduated from high school, trade school, junior college, college, or graduate/professional schools can qualify for FHA loans without a prior work history. Recent graduates can qualify for an FHA loan as long as they are recent graduates and get a full-time job offer, you are exempt from the past two-year work experience requirement.

North Carolina FHA Lenders For Bad Credit with No Overlays For Non-QM and Alternative Financing Mortgage Options

Lenders will go with the income stated on your employment offer letter. Lenders will require 30 days of paycheck stubs prior to closing. The years as a full-time student will be comparable to the past two years of work experience. If the recent graduate has no credit scores or lacks credit history, the lender can use non-traditional credit in lieu of traditional credit. Renters can qualify for an FHA loan to qualify for a home purchase with a 3.5% down payment.

What is the Lowest Credit Score Needed for FHA Loan?

Two costs that homebuyers need to come up with when purchasing a home in North Carolina are the down payment and the closing costs. The down payment is a fixed percentage of the home purchase price. The closing costs vary depending on the type of property, the location of the property, and the borrower.

The down payment on a home purchase is 3.5% if the homebuyer has at least a 580 credit score. If the homebuyer’s credit scores are between 500 to 579 FICO, HUD requires a 10% down payment for borrowers with credit scores under 580 FICO.

Seller Concessions And Lender Credit For Closing Costs

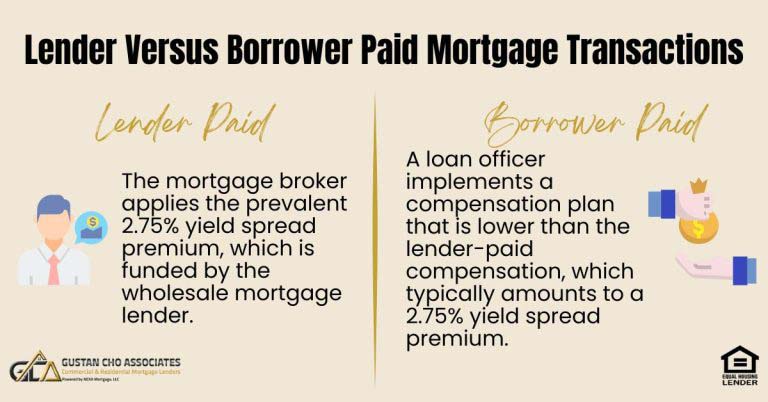

There are closing costs on home purchase and refinance transactions. However, closing costs can be covered with a seller concession by the home seller. Per HUD guidelines, a home seller can contribute up to a 6% seller concession towards a buyer’s closing costs. Your loan officer will structure how your closing costs will be covered by guiding the real estate agent on how to structure the home purchase contract.

FHA Loans With Bad Credit with Low Mortgage Rates

A seller concession is when the home seller will add the closing costs as part of the home purchase price. If the homebuyer is short to cover the closing costs on a home purchase, the lender assists with covering the closing costs for the homebuyer if they are short covering closing costs with the seller concession.

The lender can offer a lender credit to cover the shortage of closing costs in lieu of a higher mortgage rate. The seller concession will be paid by the seller to cover the homebuyer’s closing costs. The team at Gustan Cho Associates are experts in helping first-time homebuyers purchase a home with as little money as possible.

FHA Loans With Late Payments

Every hard-working American can run into financial difficulties at one time in their lives. They can have periods of unemployment, illness, death in the family, be affected by the coronavirus pandemic, or divorce. FHA loans are the best loan program for borrowers with prior bad credit or lower credit scores to buy a home in North Carolina.

The mission of HUD, the parent of FHA, is to help hard-working Americans qualify for a home loan with little down payment, lower credit scores, and prior bad credit.

FHA Credit Score Guidelines Versus Down Payment Requirements

If your credit scores are under 580 FICO, HUD requires borrowers to put a 10% versus a 3.5% down payment. Some of the many reasons why FHA loans are so popular are the low down payment requirements, low credit scores allowed, high debt to income ratio caps, and not being required to pay outstanding collections and charged-off accounts.

FHA Guidelines on Chapter 13 Bankruptcy

North Carolina FHA Loan Requirements allow for borrowers to qualify for an FHA loan after the Chapter 7 Bankruptcy discharged date. There is a two-year waiting period after the Chapter 7 Bankruptcy discharge date to be eligible for an FHA loan. There is a three-year waiting period after foreclosure, deed in lieu of foreclosure, and short sale to qualify for FHA loans in North Carolina.

HUD Guidelines To Get An Approve/Eligible Per Automated Underwriting System

HUD, the parent of FHA is the government agency that creates and implements FHA loans. The following are the North Carolina FHA Loan Requirements:

- HUD requires a 580 credit score for a 3.5% down payment home purchase FHA mortgage loan

- Homebuyers with credit scores between 500 to 579 can qualify for an FHA loan with a 10% down payment versus a 3.5% down payment

- 2-year prior work employment history

- Gaps in employment in the past two years are allowed

- Debt to income ratio cannot exceed 46.9% front-end and 56.9% back-end to get an approve/eligible per automated underwriting system findings

FHA Guidelines on Debt to Income Ratio

Per North Carolina FHA loan requirements, closing costs can be covered with either a seller concession and/or a lender credit report. Non-occupant co-borrowers allowed for borrowers with high debt-to-income ratios. Borrowers need to provide 60 days of bank statements and/or other financial statements showing the down payment.

FHA Loan Requirements on Bank Overdrafts

Bank overdrafts are not part of North Carolina FHA loan requirements. Overdrafts frown upon by underwriters. Mortgage underwriters view bank overdrafts as financial irresponsibility which could affect the borrower’s ability to pay the new mortgage payments. Borrowers should not have had any bank overdrafts in the past 12 months.

Borrowers should not have overdrafts. Lenders see clients with overdrafts as irresponsible. Multiple bank overdrafts can be a deal killer. Timely payments in the past 12 months are a must. No late payments in the past 12 months.

North Carolina FHA Lenders For Bad Credit

Only one to four-unit residentially zoned owner-occupant primary homes are eligible for FHA financing. Second homes and investment properties are not eligible for FHA mortgages. There is a one-time 1.75% FHA mortgage insurance premium. There is an annual 0.85% FHA mortgage insurance premium charged on all 30-year fixed-rate mortgage loans that cannot be canceled unless the FHA loan is paid off. FHA loan limits for 2022 are $420,680 unless the property is located in a high-cost area.

FHA Loan Waiting Period After Bankruptcy and Foreclosure

There is a two-year waiting period after the Chapter 7 Bankruptcy discharge date. There is a three-year waiting period after foreclosure, deed in lieu of foreclosure, and short sale to qualify for an FHA loan. Borrowers in an active Chapter 13 Bankruptcy can qualify for an FHA loan during their repayment period after making the first 12 payments with trustee approval. It needs to be a manual underwrite.

Chapter 13 Bankruptcy does not have to be discharged. There is no waiting period after the Chapter 13 Bankruptcy discharged date to qualify for an FHA loan. If the Chapter 13 Bankruptcy discharge has not been seasoned for two years, the file needs to be a manual underwrite. Manual underwriting guidelines apply.

Bad Credit? No Problem. FHA Loans Available in North Carolina

We approve what most lenders won’t. Start Your FHA Loan Application With No Overlays Today

The Best North Carolina FHA Lenders for Manual Underwriting

Gustan Cho Associates are experts in originating, processing, and closing FHA manual underwriting files in North Carolina. The team at Gustan Cho Associates closes thousands of FHA and VA loans for borrowers with 500 credit scores and higher debt to income-ratios.

Over 75% of our borrowers are folks who could not qualify at other lenders due to a last-minute mortgage loan denial or because the other lender had lender overlays. At Gustan Cho Associates, we have zero lender overlays on FHA, VA, USDA, and conventional loans.

Below are the Best North Carolina FHA Lenders For Manual Underwriting:

- Mortgage Solutions Financial

- Village Mortgage Services

- PRMG

- Quicken Loans

- Guaranteed Rate

- Allegacy Credit Union

- Raleigh Mortgage Group

- Carolina Home Mortgage

- Capital South Funding

Getting Pre-Approved For An FHA Loan In North Carolina

The North Carolina FHA loan requirements we covered in this article are the agency mortgage guidelines by HUD. Most mortgage companies in North Carolina will have higher lending requirements on FHA loans in North Carolina. North Carolina mortgage lenders need to meet the minimum North Carolina FHA loan Requirements set by HUD.

Who Sets The Guidelines on FHA Loans in North Carolina

HUD is the parent of HUD and sets all North Carolina FHA loan requirements for all 50 states. However, each individual lender can have higher lending requirements that are above and beyond the HUD minimum agency mortgage guidelines called lender overlays. Mortgage companies can have higher lending requirements on just about anything than the minimum FHA loan requirements.

HUD Agency Guidelines Versus Overlays By Mortgage Companies

Typical lender overlays by lenders include higher credit score requirements, lower debt to income ratio caps, not accepting outstanding collections and/or charged-off accounts, not accepting manual underwriting, not accepting gift funds, and not taking any FHA loans under 580 credit scores. North Carolina mortgage lenders can not accept FHA loans on just about anything the lender considers high risk.

North Carolina FHA Lenders For Low Credit Scores

Every lender originating FHA loans needs to meet the minimum North Carolina FHA loan requirements. North Carolina mortgage lenders are allowed higher lending standards than the minimum HUD Agency North Carolina FHA Loan Requirements.

Gustan Cho Associates is a North Carolina mortgage company licensed in multiple other states with zero lender overlays on government and conventional loans. Gustan Cho Associates has zero lender overlays. We only go by the minimum agency mortgage guidelines of HUD, VA, USDA, Fannie Mae, and Freddie Mac.

Best North Carolina FHA Lenders For Low Credit Scores

Over 75% of our borrowers are folks who could not qualify at other lenders. Most of these borrowers met the minimum North Carolina FHA Loan Requirements but the lender they went to had lender overlays. Lender overlays are lending guidelines above and beyond the minimum North Carolina FHA Loan Requirements.

Below Is A List of the Best North Carolina FHA Lenders For Low Credit Scores:

If you are looking to get qualified for an FHA loan in North Carolina with a lender with no lender overlays, please contact us at 800-900-8569 or text us for a faster response. Or email us at 800-900-8569. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

Mortgage Broker Licensed in 48 States With Over 160 Wholesale Lenders

Gustan Cho Associates has a national reputation for being able to do loans other loan officers cannot do. We are experts in handling FHA loans with 500 credit scores, folks in Chapter 13 Bankruptcy repayment plans, borrowers with large outstanding collections and charged-off accounts, borrowers with high debt to income ratios, and other folks with credit and income issues

FAQ: North Carolina FHA Lenders For Bad Credit with No Overlays

- 1. What is a No Overlay Lender? A lender with no overlays is a mortgage lender who adheres to the guidelines established by government-backed entities or agencies such as the Federal Housing Administration (FHA) without imposing additional requirements or limitations. These lenders adhere only to the criteria provided by the FHA or other agencies.

- 2. What is the Minimum Credit Score to Buy a House in NC? Credit score requirements for FHA loans in North Carolina vary by lender. HUD guidelines state that a score of 500 FICO or higher is required for a loan with a 10% down payment, while a 580 credit score or higher may qualify for a loan with only a 3.5% down payment.

- 3. How To Apply With North Carolina FHA Lenders For Bad Credit? Homebuyers and homeowners can apply for an FHA loan in North Carolina with any HUD-approved lender licensed in the state. The application process is typically done online through a secure website, and borrowers should be prepared to provide financial documents and information as the lender requires.

- 4. What is the Scope of Work and Role of the NMLS in the Mortgage Industry? The NMLS (Nationwide Multistate Licensing System & Registry) administers state-regulated mortgage companies, FDIC-registered banks, and credit unions. Mortgage lenders in North Carolina must be licensed or registered with the NMLS to conduct business and offer mortgage products.

- 5. Is Buying a Home in North Carolina a Good Investment? North Carolina offers a favorable housing market for homebuyers and investors. With affordable living costs, low taxes, and a growing population, many consider it a good investment destination. The state’s housing market remains strong, with rising home prices but continued affordability compared to other regions.

- 6. What Are the FHA Loan Waiting Periods After Bankruptcy and Foreclosure? FHA loans in North Carolina have two years after a Chapter 7 bankruptcy discharge and three years after foreclosure, a deed in lieu of foreclosure, or a short sale. Borrowers in an active Chapter 13 bankruptcy may qualify with trustee approval and timely payments.

- 7. Who Sets the Guidelines for FHA Loans in North Carolina? HUD sets the minimum guidelines for FHA loans in North Carolina and nationwide. Individual lenders may have additional requirements known as lender overlays, which are guidelines that exceed the minimum FHA requirements.

- 8. How Can I Find the Best North Carolina FHA Lenders for Low Credit Scores? To find the best North Carolina FHA lenders for low credit scores, borrowers should look for lenders with no or minimal lender overlays. These lenders strictly follow the HUD guidelines and offer FHA loans to borrowers with credit challenges such as low credit scores or past credit issues.

This blog about North Carolina FHA Lenders For Bad Credit with No Overlays was updated on April 5th, 2024.

FHA Home Loans in NC With Credit Scores as Low as 500

No lender overlays. Just straight HUD guidelines. Get Pre-Approved With a Trusted North Carolina FHA Lender