Homeowner Tax Benefits Versus Renting

Benefits of Being a Homeowner vs Renting: Which is More Cost Effective? This guide covers homeowner tax benefits versus renting….

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

Benefits of Being a Homeowner vs Renting: Which is More Cost Effective? This guide covers homeowner tax benefits versus renting….

The Effect of High Interest Rates on the Housing Market This guide covers how skyrocketing interest rates affect housing prices…

Deciding whether to go with an FHA loan or a conventional loan in Florida isn’t just about the interest rate…

Your credit score affects three things that matter most when you buy or refinance a home: Whether you get approved…

Quick Answer (who this is for + what “best rate” really means) This guide is for California homebuyers and homeowners…

This Article Is About Understanding VA Mortgage Rates And Loan Level Pricing Adjustments VA loans are the best home mortgage…

APR Versus Interest Rate: What Homebuyers Need to Know in 2025 When you shop for a mortgage, you’ll see two…

Buying a home is one of the biggest financial decisions most people will ever make — and understanding how your…

Remote job positions enable homebuyers to purchase homes in other states. This is because remote wage earners no longer have to report to a brick-and-mortar location. Many people are fleeing high-taxed cities and states to lower-taxed states with affordable housing and lower cost of living.

In this article, we will discuss and cover how FHA credit score determines mortgage rate pricing on FHA loans. FHA…

In this article, we will cover the correlation between credit card balance vs credit scores. There are mortgage guidelines on…

This guide covers how to increase credit scores before applying for mortgage. Consumer credit report and credit scores are probably the most…

The mortgage industry has gone through dramatic shifts over the past few years. From rising interest rates to new loan…

In this article, we will discuss and cover refinance mortgage rates pricing adjustments, and volatility. Refinance Mortgage Rates hit a…

Refinancing Non-QM to Conforming Loans in 2025: A Smart Move for Lower Rates If you have a non-QM loan and…

This guide covers mortgage interest rates on conventional versus FHA loans. Mortgage interest rates on conventional loans are more sensitive…

This guide covers tips in getting the lowest mortgage rates Florida. Borrowers who are thinking of getting a mortgage with…

This guide will cover the rise in mortgage rates for seven consecutive weeks with no sign of a correction. Mortgage…

Will mortgage rates rise or will there be a correction in 2025? With interest rates and home prices at the…

Why You Should Not Get a 15-Year Fixed-Rate Mortgage: Think Twice Before Choosing a 15-year Fixed-Rate Mortgage. If you’re considering…

Securing a mortgage with bad credit or a low credit score may be difficult, but it is still achievable. While…

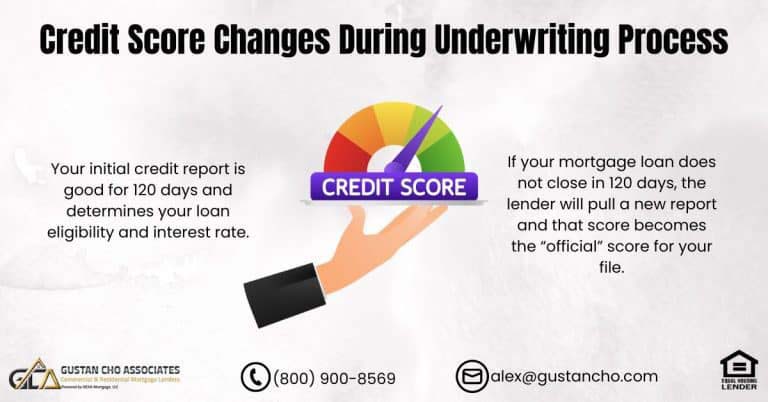

Your mortgage lender checks your credit when you apply for a home loan. Your credit score determines your mortgage rate and also if you qualify for a loan.