In this blog, we will cover and explain the Florida FHA loan requirements in detail and advise homebuyers on how to qualify and get approved with bad credit and credit scores down to 500 FICO. Due to the lenient Florida FHA loan requirements, FHA loans are hands down the best mortgage loan program for first-time homebuyers, borrowers with credit scores down to 500 FICO, borrowers with collections and charged-off accounts, borrowers with high debt-to-income issues, and homebuyers with recent late payments in the past 12 months.

FHA Loans Is The Mortgage Loan Of Choice Due To Lenient FHA Loan Requirements And Guidelines

HUD, the parent agency of FHA, is tasked with creating lenient credit and income mortgage loan requirements and guidelines to promote the dream of homeownership becoming a reality for hard-working Americans.

FHA loans are for owner-occupant primary homes only. Second homes and investment properties are not eligible for FHA financing. FHA loans are the most popular loan program in Florida.

FHA loans are the easiest mortgage loan program to get approved/eligible for, per the automated underwriting system, with lower credit scores, high debt-to-income ratios, large outstanding collections and/or charged-off accounts, and recent late payments in the past 12 months.

Homebuyers Still Find Florida Home Prices Affordable Despite The Surge Of Home Values

Tens of thousands of people are migrating to Florida for several reasons. The top reasons movers choose Florida as their final home are the strong economy, great job opportunities, low cost of living, affordable housing, and no state income taxes. Home prices in Florida have been skyrocketing for the past several years. However, even with the surge of home values, home prices are still reasonable compared to most other states in the nation.

Buy Your Florida Home With FHA Financing

With just 3.5% down and easier credit requirements, FHA loans are a great choice for many Florida buyers.

Why Are So Many People Moving To Florida?

The economy is booming. First-time elected governor Ron DeSantis is doing everything right to attract people from other states to call Florida home.

If a borrower meets the minimum HUD mortgage guidelines, they will get approved for an FHA loan with a lender with no lender overlays. Gustan Cho Associates is one of a few lenders that do not have any lender overlays on FHA loans.

Governor DeSantis does not have a coronavirus mask mandate in Florida. DeSantis also passed a state law that any employer mandating employees to take the controversial COVID-19 vaccine will face severe fines. Governor Ron DeSantis has issued an executive order stating it is illegal to fire workers for not taking the coronavirus vaccine.

Thousands Of First-Responders Moving To Florida to avoid COVID-19 Vaccine Mandates And Restrictions

Many cities nationwide have threatened police officers and firefighters with termination if they do not abide by the city’s vaccine mandate.

DeSantis offered a $5,000 recruitment bonus to police officers facing termination due to not abiding by the coronavirus vaccine mandate to come and work for any police agency in Florida.

Ron DeSantis’ creative recruitment technique will not add more people to the Sunshine State, but will fill the shortage of police officers the state has been facing. Florida has no state tax, and property taxes are lower than the national norm.

Florida’s Strong Economy And Housing Demand Makes Owning A Home An Excellent Investment

There has been a major demand for housing throughout the state. There is a housing shortage throughout the United States. However, Florida has a higher housing shortage due to the mass migration to the state from Americans fleeing high-taxed states like New York, Connecticut, Massachusetts, Vermont, Rhode Island, and California.

The governor never issued a shutdown in the state due to the coronavirus outbreak. Americans love their freedom and do not like being told what to do and how to live.

This is the principle Governor DeSantis preaches and practices, and it seems to be working. Housing demand in Florida is solid and is forecasted to remain stronger than in any other state. The most popular mortgage loan program in Florida is the FHA loan. Florida FHA loan requirements and guidelines are more lenient than any other loan program for first-time homebuyers, borrowers with lower credit scores and prior bad credit, and borrowers with higher debt to income ratio.

Florida FHA Loan Requirements With 500 FICO

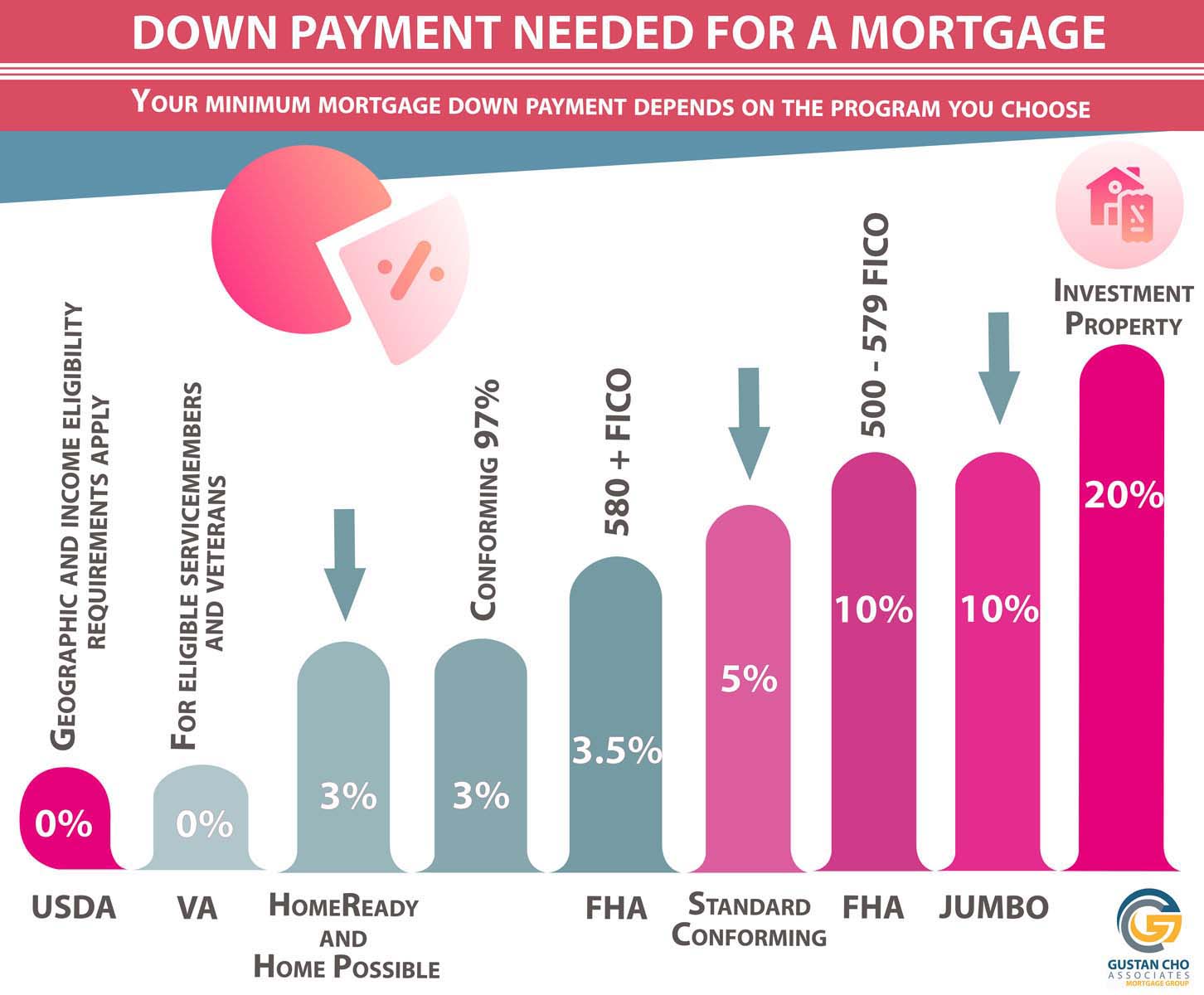

Homebuyers in Florida can qualify for an FHA loan with credit scores as low as 500 FICO. Per HUD agency mortgage guidelines, borrowers with 500 to 579 credit scores can qualify for an FHA loan with a 580 credit score and a 500 FICO with a 10% down payment.

To qualify for an FHA loan with a 3.5% down payment, a home purchase loan requires a 580 credit score. Most lenders will not approve borrowers with under 580 credit scores.

However, Gustan Cho Associates has no lender overlays on FHA loans and will approve borrowers with credit scores down to a 500 FICO. Timely payments in the past 12 months are key to getting an approved/eligible per the automated underwriting system with credit scores under 580 FICO.

The Role of HUD on FHA Loan Programs

The U.S. Department of Housing and Urban Development (HUD) is a large federal agency in charge of the Federal Housing Administration (FHA). HUD nor FHA originates, processes, underwrites, funds, or services FHA loans.

The role of HUD is to promote homeownership for American families by creating and implementing lenient, realistic lending requirements, called HUD agency guidelines so that any hard-working person can qualify for a Florida FHA loan.

A Florida FHA loan is originated, processed, underwritten, and funded by banks and private mortgage companies. Lenders must be qualified as HUD-approved lenders to work on FHA loans. If a lender follows all the HUD agency guidelines for a borrower for an FHA loan, the lender will get insured by HUD if the borrower ever defaults on their FHA loan.

Why Don’t all Mortgage Companies Have The Same Florida FHA Loan Requirements

The lender needs to follow the HUD minimum agency mortgage guidelines on FHA loans for the FHA loan in question to be insured in the event of default. Due to the government guarantee, lenders aggressively promote to originate and fund FHA loans with only a 3.5% down payment with a 580 FICO at a competitive rate.

Since the HUD-agency mortgage guidelines are very lenient, most mortgage companies have higher lending requirements called lender overlays. Every borrower needs to meet the minimum HUD agency mortgage guidelines.

However, lenders can have higher standards that surpass the minimum HUD agency mortgage guidelines. This is why many lenders require a 620 to 660 credit score on a 3.5% down payment home purchase, Florida FHA loan, when HUD’s minimum credit score requirement is 580 FICO. The higher credit score requirement is called a lender overlay on credit scores.

Understanding Agency Guidelines Versus Lender Overlays On Florida FHA Loans

Lenders must ensure every borrower meets the minimum HUD agency mortgage guidelines. However, most lenders have higher lending requirements above and beyond the minimum HUD agency Guidelines on FHA loans, often referred to as lender overlays.

All borrowers, especially folks with marginal credit or credit issues from the past, need to get familiar with HUD’s minimum agency mortgage guidelines. Not all lenders will have the same lending guidelines for FHA loans.

One lender may tell you their minimum credit score is 640 FICO, while another may say it is 660 FICO, when HUD guidelines state it is a 580 FICO to qualify for a 3.5% down payment FHA loan.

Florida FHA Loan Requirements for Getting An Automated Approval On FHA Loans With Recent Late Payments In The Past 12 Months

HUD, the parent of FHA, is the giant government agency that administers the agency’s mortgage guidelines of FHA loans. FHA loans have the most lenient mortgage guidelines when it comes to getting an approve/eligible per automated underwriting system with lower credit scores, large outstanding collections and/or charged-off accounts.

FHA loans is more forgiving with recent late payments in the past 12 months. FHA loans are the only loan program to accept and approve borrowers with recent late payments in the past 12 months.

However, a larger down payment is key in getting approved/eligible per the automated underwriting system with recent late payments and lower credit scores. A borrower with a 500 credit score and recent late payments in the past 12 months can get a guaranteed AUS approval with a 20% down payment. Not VA loans, though. VA loans do not care about the amount of down payment a veteran will put down if the borrower has had late payments in the past 12 months.

Don’t Let Credit Hold You Back

Even with low scores or past financial issues, FHA loans may still help you qualify. We follow FHA guidelines with no lender overlays.

How To Get An AUS Approval With Credit Scores Down To 500 FICO And Recent Late Payments On FHA Loans

An experienced loan officer will know how to manipulate the automated underwriting system to get an AUS approval. The worse the borrower’s credit profile, the more down payment the borrower needs to put down to get an AUS approval. For example, if a borrower has a 500 FICO and recent late payments that have been seasoned less than 12 months, a 15% to 20% down payment may do the trick to get an approved/eligible per the automated underwriting system.

FHA Loans Versus VA Loans for 500 Credit Score Borrowers With Late Payments

Gustan Cho Associates has no lender overlays on government and conventional loans. We do not have any higher lending requirements above and beyond the minimum agency mortgage guidelines.

FHA and VA loans are the only two mortgage loan programs that allow borrowers with credit scores as low as 500 FICO.

However, all government and conventional loan programs consider recent late payments in the past 12 months a killer. However, FHA loans are the only loan program that will render an approved/eligible per the automated underwriting system (AUS Approval) if and only if the borrower puts a substantial down payment.

FHA And VA Manual Underwriting Guidelines On Late Payments In The Past 12 Months

FHA and VA manual underwriting guidelines require borrowers to have timely payments in the past 24 months. Therefore, borrowers with late payments in the past 24 months will not qualify for an FHA and/or VA manual underwriting. HUD and VA have the exact manual underwriting guidelines.

VA loans do not have a minimum credit score requirement, but they will not care how much money you put down as a down payment if you have had a recent late payment in the past 12 months.

VA loans will not approve borrowers’ late payments in the past 12 months, no matter how large the down payment the borrowers put down. However, FHA loans are totally different. With a large down payment, such as a 20% down payment, the chances are very favorable that homebuyers with credit scores down to 500 FICO and recent late payments in the past 12 months will get an approved/eligible per AUS on FHA loans.

Florida FHA Loan Requirements for a 500 Credit Score Mortgage Approval

HUD allows borrowers with credit scores as low as 500 FICO to be eligible for an FHA loan. Per HUD guidelines, borrowers with credit scores between 500 and 579 require a 10% down payment.

Most lenders will say you do not qualify for a Florida FHA loan with a 500 FICO. They will not tell you that you meet HUD guidelines and can qualify for an FHA loan with a 500 credit score at another lender with no lender overlays.

They will say you do not qualify. This is why it is important to understand the basic agency guidelines on FHA loans, which we will cover in this article.

The Importance Of Understanding What Lender Overlays Mean

Lenders can have lender overlays on just about anything. One lender may have a lender overlay on gift funds where borrowers cannot get gift funds for their down payment or closing costs unless they have a 640 credit score, while another lender may not have this lender overlay.

Charged-off accounts are fine per HUD guidelines. However, many lenders require the charge-off to be paid off or the borrower needs to enter into a written payment plan with six-month seasoning.

This is why it is so important to find a lender with no lender overlays if you have less-than-perfect credit, lower credit scores, or prior credit issues. A mortgage company can implement many types of lender overlays. Each lender has its own. Some are petty and ridiculous. Gustan Cho Associates is a mortgage company licensed in multiple states with zero lender overlays on FHA loans.

HUD Agency Mortgage Guidelines On FHA Loans

Here are Florida FHA Loan Requirements:

- Minimum credit score requirement of 580 to qualify for a 3.5% down payment on a Florida FHA Loan

- Homebuyers with credit scores under 580 and down to 500 FICO can qualify for FHA Loans with a 10% down payment

- Maximum 46.9% front-end and 56.9% back-end debt-to-income ratio to get an approved/eligible per the automated underwriting system

- Manual underwriting for borrowers who can’t get an approved/eligible per AUS but get a referred/eligible

- Gift funds are allowed for the buyer’s down payment and closing costs

- Borrowers with no credit scores can qualify for a Florida FHA loan with non-traditional credit

- Non-traditional credit is alternative credit tradelines that do not report to the credit bureaus, such as cell phone bills, utilities, education bills, and other payments not reporting to the three credit bureaus, but the borrower has made timely payments for the past 12 months

- Up to a 6% seller concession

- Lender credit for borrowers who are short on closing costs

- Non-occupant co-borrowers allowed

- For a 3.5% down payment FHA loan with non-occupant co-borrowers, the non-occupant co-borrowers need to be related to the main borrower by blood, law, or marriage

HUD allows non-occupant co-borrowers to be added to the main borrowers on FHA loans who are not related to the main borrower by law, marriage, or blood, but if that is the case, then a 25% down payment is required.

FHA Loans Built for Florida Homebuyers

From first-time buyers to those with past credit challenges, FHA loans provide an affordable path to owning a home in Florida.

Florida FHA Loans After Chapter 7 Bankruptcy And Foreclosure

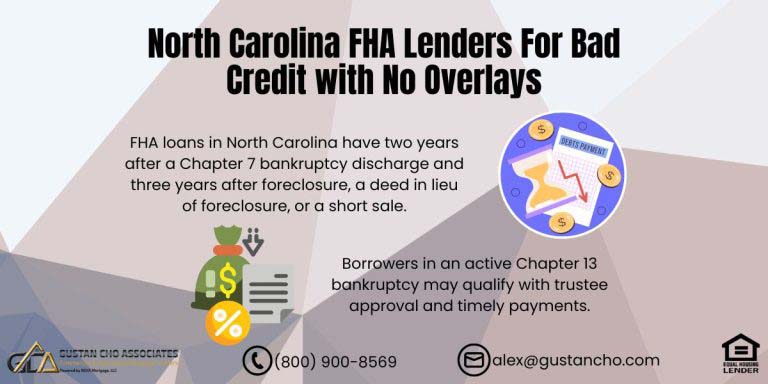

Florida homebuyers can qualify for an FHA loan after Chapter 7 Bankruptcy and Foreclosure after meeting the required waiting period requirements.

- There is a two-year waiting period after the Chapter 7 Bankruptcy discharge date to qualify for a Florida FHA loan

- There is a three-year waiting period after foreclosure, deed instead of foreclosure, short sale to qualify for a Florida FHA loan

Timely payments after bankruptcy and foreclosure are required. Borrowers should have rebuilt and re-established credit after bankruptcy and/or a housing event.

Florida FHA Loans During And After Chapter 13 Bankruptcy

Borrowers can qualify for a Florida FHA loan during Chapter 13 Bankruptcy repayment plan after they have made 12 timely payments with trustee approval and needs to be a manual underwrite

- There is no waiting period after the Chapter 13 Bankruptcy discharged date

- Needs to be a manual underwrite if the discharge has not been seasoned for at least 24 months

Outstanding collection and charge-off do not have to be paid off to qualify for FHA Loans.

Florida Loan Requirements On Outstanding Collections And Bad Credit

Homebuyers can now qualify for FHA Loans with credit scores down to 500 FICO, prior bad credit, outstanding collection and charged-off accounts, higher debt to income ratio, and prior bankruptcy and/or housing event.

HUD, the parent of FHA, is the government agency that is in charge of creating and implementing the agency mortgage guidelines on FHA loans.

You do not have to pay outstanding collections and/or charged-off accounts to qualify for an FHA loan in Florida per HUD agency guidelines. However, each individual mortgage lender can have their own individual higher lending standards called lender overlays. This is exactly why it is so very important for borrowers to fully understand the basics of HUD guidelines.

Does The Down Payment Assistance Program Work?

Home Buyers looking to buy a home can also explore Down Payment Assistance (DPA) programs. Down payment assistance gets recorded as a second mortgage on your property until the final terms and conditions have been met and satisfied. Although the funding for such programs is limited, it’s still possible for homebuyers to qualify for and obtain the needed help.

Most down dayment assistant programs require a lot of red tapes. DPA is normally a loan and needs to get paid back once the homeowner sells their home.

Florida Down Payment Assistance Programs can help home buyers with the down payment on FHA Loans but there is approval rate on DPA is not too high. The Team at Gustan Cho Associates is licensed in multiple states and can help homebuyers with advice in getting qualified for FHA loan programs and DPA.

Negative Of DPA Programs

Many homebuyers who got approved with a down payment assistance program were unfortunate and lost the homes they had under contract because, by the time they were about to close on their homes, the down payment assistance funds ran out. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about Florida FHA loan Requirements:

Homebuyers should understand that there are risks with taking up a down payment assistance loan program. Most DPA programs are not on a federal or state level.

DPA programs are on a county per county level. Candidates of DPA programs may need higher lending standards such as higher credit score requirements, lower debt to income ratio, or meet a maximum income cap. It is up to the homebuyer whether or not to participate in a particular down payment assistance program.

Carefully Read And Understand Conditions Of DPA Programs

Borrowers who plan on participating in a DPA program for their Florida FHA loan should carefully review the particular DPA program. Every DPA program is different. DPA programs are not uniform.

Each DPA has its own rules, requirements, and guidelines. Besides getting qualified and meeting the minimum Florida FHA loan requirements and guidelines, the borrower needs to meet lender overlays of the agency offering the down payment assistance.

Every down payment assistance agency has its own guidelines for its DPA program. Below is a general DPA agency guideline that most DPA agencies normally follow:

- Preference is given to first time home buyers

- Need to have income that is no larger than 80% of the area’s median income in the county they plan on purchasing

- Most DPA Programs require a 640 FICO Credit Score

- Owner Occupant Homes only

- There are terms and conditions of the funds of the down payment assistance.

DPA programs have terms and conditions of the funding the borrower gets. There may be conditions on the terms where if a homeowner sells the home within 7 to 10 years, the down payment assistance funds need to get paid back. Carefully read and fully understand the terms and conditions of the down payment assistance program.

Best Florida FHA Lenders: How To Qualify And Get Approved For An FHA Loan With Bad Credit

If you are buying a home in Florida and need a lender with a solid 5-star reputation of being able to do loans other lenders cannot do, Gustan Cho Associates is the team for you and your family.

We have a national reputation of not having any lender overlays on government and conventional loans. We are licensed in multiple states.

Over 80% of our borrowers at Gustan Cho Associates are folks who could not qualify at other lenders due to their lender overlays or have gotten a last-minute mortgage loan denial.

How To Qualify For An FHA Loan To Purchase A Home In Florida When Moving From A Different State

Being able to work with a mortgage professional who handles tough files daily is very important if you are buying a home in Florida and are relocating from another state.

We will not leave you hanging if you are relocating to Florida from a different state. Your pre-approval is as good as gold. You will not just close your loan, but you will close it on time.

If you want to qualify and get pre-approved, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays. Gustan Cho Associates is a mortgage banker, correspondent lender, and mortgage broker. We have our in-house underwriters and ops staff for FHA, VA, USDA, conventional loans.

Florida FHA Loan Requirements: Get Approved with Bad Credit

Check out Florida FHA loan rules for 2025: credit scores, down payments, and debt ratios. Get tips to secure an FHA loan with bad credit, plus state programs to make buying a home in Florida easier. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about Florida FHA loan requirements:

Buying a home in Florida may seem overwhelming, especially if your credit is less-than-stellar. Luckily, FHA loans provide a forgiving way to own property, backed by the U.S. Federal Housing Administration.

These mortgages are tailored for first-timers, low- to moderate-income households, and borrowers with imperfect credit. This guide will sort out FHA loan rules in Florida for 2025, show how to qualify with bad credit, and give you practical ways to strengthen your application. From a condo in Fort Lauderdale to a suburban house in St. Petersburg, knowing the ground rules will help smooth your path to ownership.

Don’t Wait—Secure Your Florida FHA Loan Now

FHA financing is one of the easiest ways to buy a home in Florida. Let our experts guide you from start to finish.

What is an FHA Loan?

An FHA loan is a type of mortgage insured by the Federal Housing Administration, or FHA, which is a part of the U.S. Department of Housing and Urban Development (HUD). Because the FHA backs the loan, lenders feel safer, and this lets them offer terms that are friendlier to borrowers than what you usually see with conventional loans. That’s one big reason FHA loans are so popular in Florida, where the housing market is varied and growing.

Benefits of FHA Loans in Florida

FHA loans are known for being easy to get. Here are the top perks that help Florida borrowers:

- Low Down Payment: You can qualify with just 3.5% down, so you don’t need to wait a decade to save for the big upfront cost.

- Flexible Credit: A score around 500 may still get you a yes, which is great for folks recovering from a job loss or medical bills.

- Competitive Rates: Even borrowers with less-than-stellar credit may see lower interest rates than conventional loans.

- Assumability: A buyer can take over your loan if you sell the home. That’s attractive during rising interest rate times.

- Local Extras: Florida’s down payment help programs can stack on top of the FHA loan, cutting your cash-needed-at-closing even more.

From the affordable lakeside towns to beachfront condos, home prices in Florida can surprise you. An FHA loan often fills the target for first-time buyers or anyone moving to the Sunshine State.

Key Florida FHA Loan Requirements for 2025

In Florida, FHA loans follow national rules but adapt to the state’s unique closing costs and loan ceilings. Here’s what you need to know if you want 2025 financing.

Credit Score Standards

FHA is friendlier to borrowers than most conventional products.

- A score of 580 or higher means you put down just 3.5%.

- Range of 500 to 579 bumps it down to 10%.

- Under 500?

- You usually can’t go FHA, yet rare cases exist if strong compensating factors are proved during hand-reviewed underwriting.

Remember that any prior bankruptcy needs 2 years of seasoning, and foreclosure needs 3.

Florida FHA Loan Requirements Down Payment Details

How much you set aside depends mostly on the score above.

- 3.5% for the 580-and-up crowd (that’s $17,500 for a $500,000 purchase).

- 10% for the slightly lower yet still eligible cohort ($50,000 on that same $500,000 sale).

Sources for the money include personal savings, qualified family gifts, or targeted Florida down payment help. FHA even lets you apply 100% of a family contribution toward that down amount.

Florida FHA Loan Requirements Debt-to-Income Ratio

To see if you can repay your FHA loan, the lender reviews two key ratios:

- Payment-to-Income (PTI): Your new mortgage payment can’t top 40% of your gross monthly earnings.

- Debt-to-Income (DTI): Every monthly debt, including the new mortgage, must stay under 50% of your income.

Even if your ratios climb higher, the lender may still say yes if you have bigger savings accounts or a long track record of steady work.

Employment and Income Verification

- You’ll need at least the last two years of steady earnings (short gaps can be okay if you explain them).

- Work for yourself? Send two years of signed tax returns.

- FHA doesn’t say you need a minimum pay level, but you have to show the loan can be comfortably handled.

People with on-and-off gig work or income that changes monthly can get FHA loans with manual underwriting.

Property Requirements

To qualify, the home must:

- Be your main place to live (you must move in within 60 days).

- Pass an FHA appraisal that checks for safety and livability.

- It can be a single-family home, condo (the project must have FHA approval), townhome, or multi-family home with up to 4 total units (you must live in one).

A manufactured home counts if it’s on a permanent foundation. You can’t use the loan for investment houses or recently flipped houses.

FHA Loan Limits in Florida

FHA limits change by county and property type to reflect local housing costs. For 2025, single-family home limits start at:

- Floor Limit: $524,225 (most counties, like Alachua, Bay, and Brevard).

- Ceiling Limit: $1,209,750 (for Monroe County).

Florida Limits by County:

- Broward, Miami-Dade, Palm Beach: $654,350.

- Collier: $764,750.

- Duval, Clay, St. Johns: $580,750.

- Lee, Orange, Seminole: $524,225.

- Martin, St. Lucie: $596,850.

- Okaloosa, Walton: $603,750.

For your specific county limit, visit the HUD website.

How to Get Approved for an FHA Loan with Bad Credit in Florida

Just because your credit score is low doesn’t mean FHA financing is out of reach. Many applicants in Florida with scores in the 500 range have closed loans by being strategic.

Bad Credit Accounts and FHA Rules

Generally, “bad credit” means scores below 620, but FHA allows lenders to accept scores as low as 500. Because the government backs the loan, the risk decreases for lenders. Still, always check individual policies since many lenders impose more stringent score requirements.

Simple Strategies That Help

- Grab Your Credit Reports for Free: Use AnnualCreditReport.com to request reports.

- If you see mistakes, dispute them to lift your score quickly.

- Tame Your Credit Card Balances: Aim to keep outstanding balances below 30% of each card’s limit.

Boost That FHA Loan Approval with Good Habits and Resources

- Build Positive Credit: Use a secured credit card and always pay the full balance before the due date.

- You can also report monthly rent to services like Experian RentBureau to add to your credit history.

- Save for the Down Payment: If your credit needs improvement, target a down payment of at least 10%.

- This can strengthen your loan package.

- Steer Clear of New Credit: Don’t apply for new credit accounts or make large purchases right before your mortgage application.

- Let your credit score stay steady.

FHA Loans With No Overlays

Most lenders add extra rules on top of FHA guidelines. At Gustan Cho Associates, we follow true FHA standards — giving more Floridians a chance to qualify.

Use Compensating Factors to Strengthen Your Application

Add extra job strength with factors like:

- Three months’ worth of mortgage payments sitting in the bank.

- A steady job history of at least five years.

- A debt-to-income ratio below 43%.

- A family member willing to co-sign the loan without living in the house.

Find the Right FHA Lender

Not every lender handles low-credit FHA loans. Head to the HUD lender list to find FHA-approved options in Florida, then compare interest rates and fees. Some institutions specialize in helping borrowers with credit challenges.

Explore Florida Down Payment Assistance Programs

In Florida, programs like the Florida Housing Finance Corporation’s grants or loans of up to $10,000+ can cut your upfront costs to zero. Check the income and location criteria to see if you qualify. These can stack with an FHA loan for lower out-of-pocket expenses.

The FHA Loan Application Process

Start organized best. This process is straightforward, but you must keep your paperwork in order.

Get Pre-Approved

Kick things off with pre-approval. Submit income documents, authorize a credit check, and provide basic personal info. This tells sellers you’re a serious buyer and helps you set your shopping budget.

Gather the Required Documentation

- Two years of tax returns, W-2s, and the last few pay stubs.

Documents Needed to Start

- Last two bank statements.

- Government-issued ID and Social Security card.

- Gift letters if family or friends provide any funds.

Closing Timeline on Your FHA Loan

Plan on 30 to 45 days. Be ready to pay closing costs ranging from 2% to 2.75% in Florida. That’s $5,000 to $7,000 on a $250,000 house. The seller can pay up to 6% of that. FHA also requires two types of mortgage insurance premiums: an upfront fee of 1.75% and a yearly fee from 0.45% to 1.05%.

Common Mistakes to Avoid

- Don’t apply without first checking your credit scores.

- Fix any problems early.

- Don’t overlook your debt-to-income ratio.

- Pay off loans before you apply.

- Don’t skip pre-approval letters.

- Sellers may not take weaker offers.

- Don’t forget about mortgage insurance premiums.

- They count when you budget.

- Don’t only talk to one lender.

- Rates can differ a lot.

By steering clear of these missteps, your application will move faster.

Florida FHA Loan Requirements FAQs

What’s The Lowest Credit Score That Will Qualify For an FHA Loan in Florida?

- If you can put 10% down, the score can be as low as 500. Otherwise, 580 is the limit for 3.5% down.

Can I Get an FHA Loan in Florida After I Declare Bankruptcy?

- Yes, generally two years after discharge, as long as you’ve re-established credit.

How Much Will Closing Costs For an FHA Loan Typically Be in Florida?

- Expect about 2% to 2.75% of the home price.

- That generally includes the $300 to $500 appraisal fee and title fees from $1,000 to $1,200.

Is Mortgage Insurance Required for FHA Loans?

- Yes, FHA calls it mortgage insurance premiums.

- You pay it up front and yearly, but if you put down 10% or more, the yearly fee can be canceled after 11 years.

Can I Have a Co-Signer on My FHA Loan if My Credit is Bad?

- Yes, you can bring in a co-signer who doesn’t live with you.

- This can strengthen your application by boosting your eligibility.

My Score is Under 500. Can I Still Get a Loan?

- The standard rule is a no, but manual underwriting might keep you in the race if you have a good reason—steady income, low debt, or a decent down payment.

Are There Income Caps on FHA Loans in Florida?

- Not formally, but the lender must see that your earnings can cover the monthly payment and keep you financially healthy.

Where Can I Find Florida Down Payment Assistance?

- Visit the Florida Housing Finance Corporation site or talk to a lender about deposit assistance programs like HFA Preferred or Hometown Heroes.

- This short guide gives you the basics to pursue an FHA loan in Florida, even with challenging credit. Always check with a licensed lender for tailored recommendations.

Non-QM And Alternative Specialty Mortgage Loan Programs In Florida

Gustan Cho Associates is a mortgage banker and correspondent lender on government and conventional loans with a business model of not having lender overlays.

We just go off the automated findings of AUS. Gustan Cho Associates has a hybrid business model where we are mortgage bankers on government and conventional loans.

Gustan Cho Associates has the ability to broker non-QM loans, no-doc home loans, non-QM jumbo mortgages with credit scores down to 500 Fico, non-QM mortgages one day out of bankruptcy and foreclosure, asset-depletion, condotel financing, P and L stated income loans, bank statement loans for self-employed borrowers, and dozens of other specialty and alternative mortgage loan programs. On the correspondent side, Gustan Cho Associates offers traditional 90% LTV jumbo mortgages with up to a 50% debt to income ratio cap and credit scores as low as 660 FICO.

FHA Loans for First-Time Florida Buyers

Buying your first home in Florida? FHA loans are one of the best programs to get you started.

Thanks for this amazing blog. I also a blogger so I won’t post my article on your website.

If you want to know more about the FHA Loan Florida then visit us, you may.