How To Appraise Your House to Get The Maximum Value

This guide covers must know facts on how to appraise your house to get maximum value. A house appraisal is…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers must know facts on how to appraise your house to get maximum value. A house appraisal is…

Appraisal Transfer Policy: How to Transfer a Home Appraisal to a New Lender If you’re changing mortgage lenders and have…

Walking Away After a Home Inspection: A Smart Decision or a Risky Move? Purchasing a house is among the most…

Appraisal Review in Mortgage Underwriting Process: Your Guide to Success in 2024 Buying a home is one of the most…

FHA Appraisals Versus Home Inspections: Why You Need Both to Make a Smart Home Purchase in 2024 When buying a…

In this guide, we’ll explain everything you need to know about FHA appraisal guidelines and what your home needs to…

This guide covers the home appraisal process timeline during the mortgage process. Gustan Cho Associates will update you on the…

HUD Guidelines On FHA Property Standards is the home needs to be safe, secure, and habitable. No need to be alarmed if the home is old. As long as the home is secured, safe, and habitable, it will pass FHA Home Appraisal.

The Federal Housing Administration (FHA), a segment of the United States Department of Housing and Urban Development, was established in…

In this blog, we will discuss and cover appraisal issues during the home buying and mortgage process. The word “appraisal”…

This guide covers upfront costs for mortgage loans prior to closing. What would you do as a borrower if a…

This article will cover and discuss when mortgage lenders require two appraisals. In general, only one appraisal is required—however, there…

This guide deep dives into the significance of the FHA and VA Amendatory Clause. We will explore the implications of…

In this blog, we will discuss and cover the FHA appraisal transfer from your old lender to a new mortgage…

This guide covers low appraisal on home purchase and solutions for mortgage borrowers. We will discuss solutions to low appraisal…

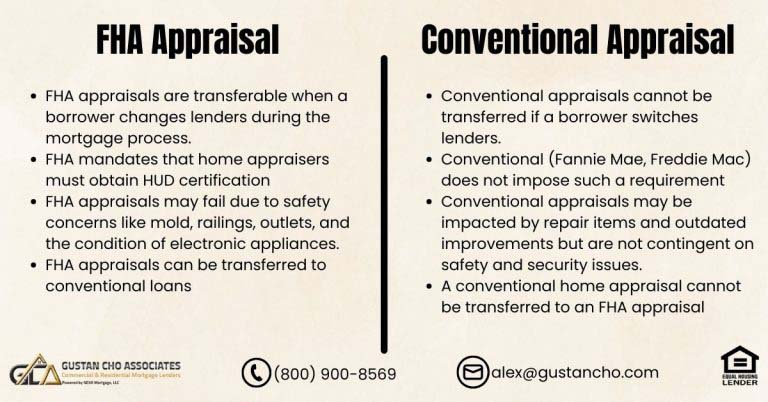

This article examines and clarifies the criteria for FHA Appraisals Versus Conventional Appraisals. There are significant differences in the guidelines…

This ARTICLE On Appraisals Will No Longer Be Required On Homes Under $400,000 Was PUBLISHED On September 29th, 2019 Appraisals…