This guide covers paying down credit cards during mortgage process due to high debt-to-income ratios. Debt-to-income ratios are one of the most important factors in the mortgage approval process. Paying down credit cards during mortgage process should be done if possible. High DTI borrowers should pay off all higher credit card balances before starting the mortgage process. There are strict debt-to-income ratio cap requirements.

The HUD debt-to-income ratio limits, set at 46.9% for the front-end and 56.9% for the back-end, typically apply to borrowers with credit scores of 620 or above. For those with credit scores below 620, the approved/eligible debt-to-income ratio is capped at 43% according to Automated Underwriting System (AUS) guidelines. The automated underwriting system algorithms deem borrowers with lower credit scores as higher risk, leading to a reduction in the allowable debt-to-income ratio caps.

For FHA loan programs, the Automated Underwriting System requires a maximum debt-to-income ratio of 46.9% for front-end DTI and 56.9% for back-end DTI, as per HUD lending guidelines. In the case of conventional loans, the maximum allowable debt-to-income ratio for an approved/eligible status through the Automated Underwriting System is 50% DTI. Conventional loan programs do not have front-end debt-to-income ratio caps. The subsequent paragraphs will discuss the significance of paying down credit cards during the mortgage process, particularly when faced with high debt-to-income ratios.

Initial Qualification Process For Homebuyers

Before issuing a pre-approval letter, loan officers assess the mortgage loan applicant’s debt-to-income ratio. This crucial factor hinges on the examination of the proposed housing payment. The front-end debt-to-income ratios are determined by the proposed interest rate, principal, interest, property taxes, and homeowners insurance.

Meanwhile, the back-end debt-to-income ratio considers all other minimum monthly debt payments. Individuals with a high debt-to-income ratio who meet the maximum allowed are considered high-risk borrowers. Even a minimal additional payment, such as ten dollars per month, could push them beyond the permissible maximum debt-to-income ratio.

For FHA loans, the highest allowable back-end DTI is 56.9%. A slight uptick in homeowners insurance might lead to disqualification for mortgage loan approval.

High DTI? Paying Down Your Credit Cards Can Help You Qualify for a Mortgage!

Contact us today to learn how reducing your debt can help you secure the home loan you need.

Borrower Paying Down Credit Cards During Mortgage Process

When a mortgage loan originator initially completes a loan application, they include the proposed housing payment. This payment encompasses the provisional interest rate, the suggested property taxes, and the homeowner’s insurance.

Additionally, the mortgage loan application outlines the borrower’s gross monthly income. The monthly mortgage payments are significantly influenced by the mortgage rates. The application imports all minimum monthly debt payments from the borrower’s credit report.

Subsequently, the debt-to-income ratio of the borrower is computed. In many instances, the debt-to-income ratio just meets the required thresholds. For those borrowers on the brink of meeting these requirements, a slight increase in monthly minimum payments could surpass the maximum allowable debt-to-income ratio.

Case of Surpassing The Maximum Debt-To-Income Ratio Caps

For example, here is a case scenario where a borrower is paying down credit cards during mortgage process due to high DTI. If the mortgage loan underwriter deducts part of the borrower’s gross monthly income because they took write-offs on their tax returns, that may boost the debt-to-income ratio threshold above the maximum allowed.

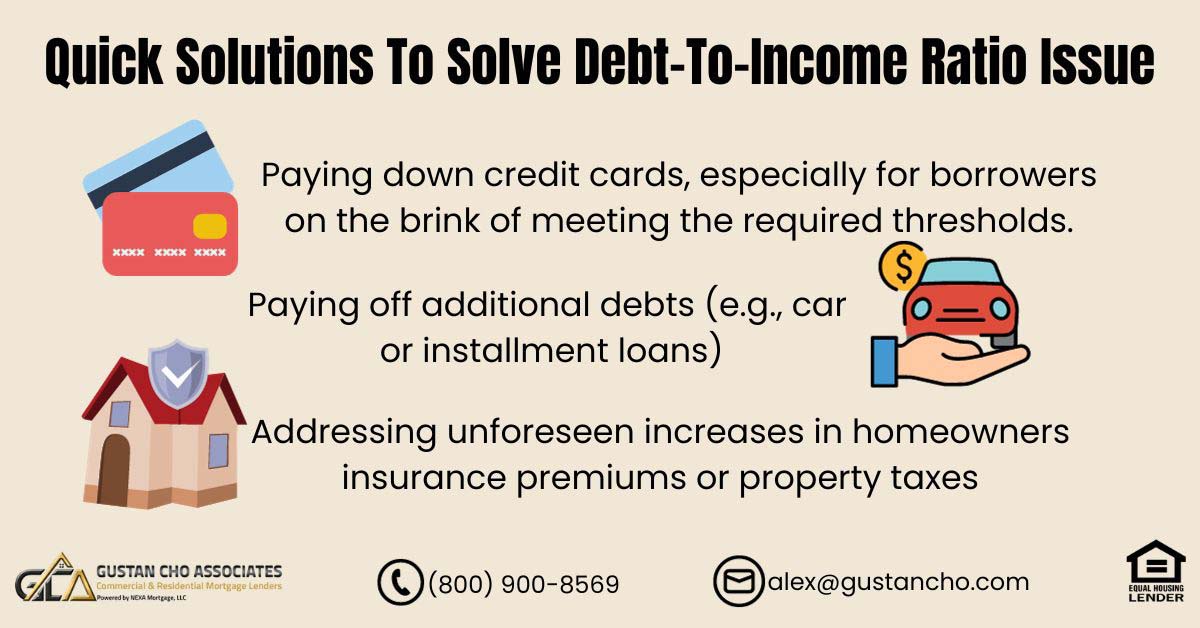

Paying down credit cards during mortgage process can be a solution to lowering the borrower’s debt-to-income ratios. Lowering the mortgage rate to lower the mortgage payments can be done by buying discount points.

Another solution is paying off debt such as a car or installment loan. If homeowner insurance premium comes in higher than the original estimated amount, that too may exceed the maximum debt-to-income ratio permitted.

If the property taxes exceed the amount stated on the original 1003 loan application, that too may exceed the maximum debt-to-income ratios. If the mortgage rates are higher than originally anticipated, that too can overthrow the maximum debt-to-income ratios allowed.

Quick Solution To Solve Debt-To-Income Ratio Issue

Most lenders will allow borrowers to correct the debt-to-income ratio issues during the mortgage process. If the debt-to-income ratio exceeds the maximum debt-to-income ratio allowed during the mortgage approval process, our underwriters do not deny the loan. There are ways to increase credit scores and lower debt-to-income ratios during the mortgage process, explains Dale Elenteny, a senior loan officer at Gustan Cho Associates:

Our underwriters want loan officers to devise solutions to salvage high DTI. Paying down credit cards during mortgage process may be a solution.

Occasionally, borrowers may find their debt-to-income ratio surpassing the maximum required, often because of altered circumstances, such as unexpectedly elevated homeowners insurance premiums, higher-than-anticipated mortgage rates, or unforeseen events.

A swift remedy to address challenges associated with a high debt-to-income ratio involves reducing credit card balances during the mortgage application process. Minimum monthly credit card payments can range from $50 to over $200.

Fannie Mae and Freddie Mac Guidelines on Paying Down Credit Cards During Mortgage Process

As mentioned, paying down credit cards during the mortgage process can eliminate the minimum monthly payment to solve a higher-than-anticipated debt-to-income ratio. However, suppose the loan is submitted to a Fannie Mae lender.

In that case, Fannie Mae requires borrowers to pay off a credit card to zero balance to eliminate the minimum monthly credit card payment. Fannie Mae is required to close out her credit card account after paying the credit card balance off. Alex Carlucci, a senior loan officer and credit repair expert, explains about lenders making you pay down credit cards during the mortgage process and closing them out at the same time:

Many borrowers do not like the fact that they need to close out their aged credit card accounts. But this is not the mortgage lender’s rule but Fannie Mae’s. Freddie Mac allows borrowers paying down credit cards during mortgage process to a zero balance.

Freddie Mac does not mandate the closure of credit card accounts. Loan officers need to submit mortgage applications to a lender affiliated with Freddie Mac. Fannie Mae and Freddie Mac follow distinct mortgage guidelines, and typically, lenders prefer Fannie Mae over Freddie Mac.

Struggling with High DTI? Let’s Help You Pay Down Credit Cards and Improve Your Mortgage Approval!

Reach out now to get advice on how paying down debt can improve your mortgage application.

Is There a Way To Avoid Closing Out Credit Card Account After Paying Off Credit Cards

With a higher debt-to-income ratio, borrowers must consider paying off all credit card balances before starting the mortgage process. Paying down credit cards during the mortgage process causes a delay in the loan process.

The mortgage processor can do a rapid rescore after the borrower pays down credit card balances to expedite the restoring process so the borrower can increase the credit score to qualify for a mortgage, explains Angie Torres, the national operations manager at Gustan Cho Associates about paying down credit cards during mortgage process as follows:

After paying down credit cards during mortgage process, the lender needs to do a rapid rescore and ensure the borrower’s credit is updated. A rapid rescore updates the borrower’s updated credit through a third-party credit agency in three to five days.

Engaging in a credit supplement or rapid rescore allows the borrower to receive an updated credit report without waiting for the standard 30-day period. Borrowers with higher debt-to-income ratios should settle credit card payments before initiating the mortgage process.

Despite the expedited nature of a rapid rescore, it can still lead to a delay of two weeks or more in the mortgage process, potentially impacting the closing of the home loan.

- Related> Solving high debt-to-income ratios

- Related> Mortgage denial due to high debt-to-income ratio

- Related> Maximum debt to income ratios for AUS Approval

- Related> Low credit scores and high debt-to-income ratios

- Paying Down Credit Card Balances To Boost Credit Scores

If you have any questions about paying down credit cards during mortgage process due to high DTI, please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

FAQ: Paying Down Credit Cards During Mortgage Process Due To High DTI

- 1. Why is paying down credit cards important during the mortgage process? Paying down credit cards can significantly impact your debt-to-income (DTI) ratio, a crucial factor in mortgage approval. High DTI ratios can pose risks for lenders and may lead to mortgage denial or higher interest rates.

- 2. What are debt-to-income (DTI) ratios, and why are they important? Debt-to-income ratios measure your monthly debt payments relative to your gross monthly income. Lenders use this metric to assess your ability to manage additional debt, like a mortgage payment while meeting your existing financial obligations.

- 3. How do I know if my debt-to-income ratio is too high for a mortgage? Lenders typically have maximum DTI ratio limits for mortgage approval. These limits vary depending on factors like credit score and loan type but generally range from around 43% to 57%. Exceeding these limits can jeopardize your mortgage application.

- 4. What can happen if my debt-to-income ratio is too high during the mortgage process? A high DTI ratio may result in mortgage denial or approval with less favorable terms, such as higher interest rates or larger down payments. Lenders may view high DTI ratios as a sign of financial strain and increased risk.

- 5. How can paying down credit cards help improve my DTI ratio? By reducing credit card balances, you lower your monthly minimum payments, which can decrease your DTI ratio. This can make you a more attractive borrower and improve your chances of mortgage approval or better loan terms.

- 6. Are there specific guidelines or requirements for paying down credit cards during the mortgage process? Lenders may have different policies regarding paying down credit cards, and specific guidelines can vary based on loan programs and underwriting standards. For example, Fannie Mae may require paying off a credit card balance entirely and closing the account to eliminate the monthly payment.

- 7. Can paying down credit cards cause delays in the mortgage process? Yes, paying down credit cards can potentially cause delays, especially if the lender needs to perform a rapid rescore to update your credit report. This process may take a few days to a couple of weeks, impacting the timeline for closing on your loan.

- 8. How can I expedite the process of paying down credit cards during the mortgage process? To expedite the process, communicate with your lender and be proactive in addressing any issues related to your DTI ratio. Consider options like rapid rescoring to update your credit report quickly and ensure timely processing of your mortgage application.

This blog about Paying Down Credit Cards During Mortgage Process Due To High DTI was updated on June 23th, 2024.

High DTI Holding You Back? Paying Down Credit Cards Can Improve Your Mortgage Chances!

Contact us today to find out how we can help you through the process.

Hello my husband and I are in the process of buying a home a VA loan we have balances on our credit cards we are to close on Dec 2,2020 the balances that are reported are balances how can we prove at closing if we have paid them off.

Your loan officer can do a rapid rescore and get it all updated in three to five days.

Your loan officer can do a rapid rescore and it will update your credit report in three to five business days