Maximum Debt-To-Income Ratios for AUS Approval: What You Need to Know in 2024

When applying for a mortgage, your debt-to-income (DTI) ratio is a major consideration for lenders.

But what exactly is a DTI ratio, and why is it so important? If you’re wondering how to make sure your DTI ratio falls within the guidelines for Automated Underwriting System (AUS) approval, you’re in the right place.

In this guide, we’ll break down everything you need to know about maximum debt-to-income ratios for AUS approval in 2024. Whether you’re looking to buy your first home, refinance your current mortgage, or explore your loan options, understanding these guidelines can help you get approved faster and with fewer headaches.

What Is Debt-to-Income Ratio?

Your debt-to-income ratio (DTI) is the percentage of your total monthly income allocated to paying your monthly debts. Lenders use this ratio to evaluate whether you can handle an additional mortgage payment. Lenders typically consider two DTI ratios:

- Front-End DTI: This is also known as your housing DTI. It calculates the portion of your income that will go toward your housing expenses, including your mortgage payment, property taxes, homeowners insurance, and any homeowners association (HOA) fees.

- Back-End DTI: Your debt-to-income ratio considers your housing costs and all other monthly debt payments, such as credit card bills, car loans, student loans, and other debts.

Excluding Debts from DTI Calculations Could Be the Key to Qualifying for Your Home Loan!

Reach out now to see how this strategy works and get started with your mortgage application.

Why Does Debt-to-Income Ratio Matter for AUS Approval?

Lenders use Automated Underwriting Systems (AUS) to quickly assess whether a borrower qualifies for a mortgage. One of the most widely used AUS programs is Fannie Mae’s Desktop Underwriter (DU).

Your DTI ratio is given significant consideration by the AUS when deciding on your mortgage application. A higher DTI ratio might indicate to the system that you have too many financial commitments, which could potentially make it harder to get your loan approved.

In 2024, understanding the maximum debt-to-income ratios for AUS approval can help you better prepare for the mortgage process, whether you’re applying for an FHA loan, VA loan, USDA loan, or conventional loan.

What Are the Maximum Debt-to-Income Ratios Allowed for AUS Approval?

Every loan program has different DTI ratio requirements, and understanding these limits can make the difference between approval and denial. Here’s a breakdown of the maximum DTI ratios for AUS approval across different loan types in 2024:

1. FHA Loans

For borrowers seeking approval through FHA loans, the maximum DTI ratios for AUS approval are:

- Front-End DTI: 46.9%

- Back-End DTI: 56.9%

FHA loans are known for being more flexible than other loan types, especially for borrowers with lower credit scores or higher debt levels. However, if your front-end DTI ratio exceeds 46.9%, you may not receive AUS approval for an FHA loan. In that case, you might need to lower your mortgage loan amount or find a property with lower taxes to reduce your monthly housing costs.

2. USDA Loans

For USDA loans, which are designed to help low- to moderate-income buyers purchase homes in eligible rural areas, the maximum debt-to-income ratios for AUS approval are stricter:

- Front-End DTI: 29%

- Back-End DTI: 41%

These limits reflect the USDA’s focus on ensuring buyers can comfortably afford their housing payments while managing other debts.

3. Conventional Loans

Conventional loans, which are not backed by the government, like FHA, VA, and USDA loans, have their own set of guidelines:

- Front-End DTI: There is no specific maximum for front-end DTI on conventional loans.

- Back-End DTI: The back-end DTI ratio is capped at 50% for AUS approval.

In certain cases, conventional loans can be more flexible than government-backed loans, but maintaining a DTI ratio under 50% is key to getting AUS approval.

4. VA Loans

VA loans are extremely flexible in terms of debt-to-income ratios. They are accessible to eligible veterans, service members, and their families.

- Front-End and Back-End DTI: There are no set maximum limits. Your DTI ratio is acceptable as long as you receive AUS approval.

VA loans are frequently the top option for veterans since they necessitate no down payment and have lenient DTI caps. AUS approval depends significantly on your financial profile, credit score and residual income.

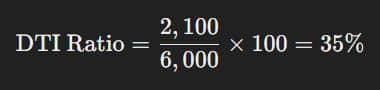

How to Calculate Your Debt-to-Income Ratio

Let’s break it down with an example:

- Monthly debts:

- Mortgage payment: $1,500

- Car loan: $300

- Credit card minimum payments: $200

- Student loan payment: $100

- Total monthly debt payments: $2,100

- Gross monthly income: $6,000

In this example, the borrower has a 35% DTI ratio, which would be considered good for most loan programs.

What Is a Good Debt-to-Income Ratio?

A “good” DTI ratio is generally considered 36% or lower. Less than 36% of your monthly income goes toward paying debts. Keeping your DTI ratio in this range shows lenders that you have enough income left over to make your mortgage payments comfortably.

If your DTI ratio exceeds 36%, you might still be eligible for a loan, but you could encounter increased interest rates or added examination from the AUS.

Take First Step Toward Making Your Dream A Reality

Apply Now And Get recommendations From Loan Experts

How to Lower Your Debt-to-Income Ratio

If your DTI ratio is too high, don’t worry—there are steps you can take to lower it and increase your chances of getting AUS approval:

- Pay off small debts: Reducing credit card balances or paying off small loans can quickly lower your back-end DTI ratio.

- Increase your income: Taking on a part-time job or finding new income streams can help improve your DTI ratio by boosting the “income” part of the equation.

- Refinance other debts: Consolidating high-interest debt into lower-interest loans can reduce your monthly payments and improve your DTI ratio.

- Consider a less expensive property: If your front-end DTI ratio is too high, looking for a home with lower property taxes or homeowners association (HOA) fees can help reduce your monthly housing costs.

Strategies to Get AUS Approval with High DTI Ratios

If your DTI ratio is pushing the upper limits, don’t panic! There are several strategies you can use to improve your chances of AUS approval:

- Consider a co-borrower: Adding a co-borrower with a lower DTI ratio can help offset your own DTI and increase your chances of approval.

- Save for a larger down payment: Set aside money for a larger initial payment, as this will decrease the amount you have to borrow and reduce your monthly payments, ultimately lowering your debt-to-income ratio.

- Explore no-overlay lenders: Some lenders, like Gustan Cho Associates, do not have overlays (additional guidelines), meaning they only follow the AUS findings. This can make it easier to get approved if your DTI ratio is higher than usual.

2024 Updates: What You Need to Know

In 2024, several updates and trends are influencing AUS approvals, including:

- Stricter guidelines for high DTI ratios: While many loan programs remain flexible, some lenders are tightening their DTI requirements, especially for borrowers with lower credit scores.

- Higher property taxes and housing costs: With rising property values and taxes in many areas, keeping your front-end DTI ratio within limits may become more challenging. If your DTI ratio is borderline, consider shopping in areas with lower tax rates.

- Expanded use of residual income: VA loans and some other programs emphasize residual income—the amount of income left over after all debts are paid—rather than strict DTI ratios. Make sure you understand your lender’s approach.

Conclusion: Get AUS Approval and Achieve Your Homeownership Goals

Understanding maximum debt-to-income ratios for AUS approval is an important step in preparing for your mortgage application. Remember to maintain your DTI ratio within the limits set for FHA, USDA, VA, or conventional loans to improve your likelihood of approval and obtain more favorable loan terms.

Remember, lenders like Gustan Cho Associates specialize in helping borrowers with higher DTI ratios find solutions and get approved without overlays.

If you’re ready to take the next step toward homeownership or refinancing, please reach out today for personalized assistance! Borrowers who need to qualify without mortgage lender overlays can contact us at 800-900-8569 or alex@gustancho.com.

Frequently Asked Questions About Maximum Debt-to-Income Ratios for AUS Approval:

Q: What is a Debt-to-Income (DTI) Ratio?

A: A debt-to-income ratio (DTI) is the percentage of your monthly income that goes toward paying your debts. Lenders use it to see if you can afford a mortgage. Keeping your DTI ratio within the maximum debt-to-income ratios for AUS approval is important to get your mortgage application approved.

Q: What are the Two Types of DTI Ratios?

A: There are two types of DTI ratios: front-end and back-end. The front-end ratio covers your housing costs (mortgage, insurance, property taxes). In contrast, the back-end ratio includes monthly debt payments like credit cards and car loans. Both are used to calculate maximum debt-to-income ratios for AUS approval.

Q: Why Does My DTI Ratio Matter for AUS Approval?

A: Your DTI ratio matters because it shows lenders how much of your income is used to pay debts. Automated Underwriting Systems (AUS) check if your DTI ratio fits within the guidelines for approval. A higher DTI may prevent you from getting approved. Understanding the maximum debt-to-income ratios for AUS approval helps you prepare better.

Q: What are the Maximum Debt-to-Income Ratios for FHA Loan Approval in 2024?

A: For FHA loans, the maximum debt-to-income ratios for AUS approval are 46.9% for the front-end ratio and 56.9% for the back-end ratio. Keeping your DTI within these limits increases your chances of getting your mortgage approved.

Q: What is the Maximum Debt-to-Income Ratio for USDA Loan Approval?

A: For USDA loans, the maximum debt-to-income ratios for AUS approval are stricter. The front-end ratio is capped at 29%, and the back-end ratio cannot exceed 41%. Staying below these limits is important for AUS approval.

Q: Is There a Maximum DTI Ratio for Conventional Loans?

A: Yes, the maximum debt-to-income ratio for AUS approval on conventional loans is 50% for the back-end ratio. There’s no specific limit on the front-end DTI ratio, but keeping your overall DTI below 50% helps with approval.

Q: What is the Maximum DTI Ratio for VA Loans?

A: VA loans don’t have strict maximum debt-to-income ratio limits. As long as you get an Automated Underwriting System (AUS) approval, your DTI ratio is acceptable. VA loans are very flexible when it comes to DTI ratios.

Q: How Can I Lower My DTI Ratio if it’s Too High?

A: To lower your DTI ratio, you can pay off small debts, increase your income, or refinance high-interest loans to reduce monthly payments. These strategies can help you meet the maximum debt-to-income ratios for AUS approval.

Q: Can I Still Get Approved if My DTI Ratio is High?

A: Yes, you can still get approved with a high DTI ratio by exploring solutions like adding a co-borrower or working with a lender that doesn’t have overlays. Lenders like Gustan Cho Associates specialize in helping borrowers with higher DTI ratios get approved.

Q: What Happens if My DTI Ratio Exceeds the Maximum Debt-to-Income Ratios for AUS Approval?

A: If your DTI ratio exceeds the maximum debt-to-income ratios for AUS approval, you may need to lower your loan amount, increase your down payment, or reduce your monthly debt to get approved. Working with a no-overlay lender can also help.

Related> Co-Signing: Solution To High Debt To Income Ratios

Related> Mortgage With High Debt To Income Ratios

Related> Solutions To High Debt To Income Ratios

This blog about “Maximum Debt-To-Income Ratios For AUS Approval” was updated on October 1st, 2024.

Struggling to Meet DTI Requirements? Excluding Debts Could Help You Qualify for a Home Loan!

Reach out now to learn how we can help you exclude debts and qualify for your dream home.

Hello Gustan,

Thank you for your immediate response. I’ve been trying to reach your agency since last week.

I would like to have my loan scenario either FHA or conventional loan.

This is for a home purchase.

I look forward to speaking with you!

I visited several websites however the audio feature for audio songs present at this web page is really superb.

Carolyn Stavro

A pleasure to meet you, Carolyn. Please don’t hesitate to contact me or Alex anytime you have any questions.

I’m not that much of a internet reader to be honest but your sites really nice, keep it

up! I’ll go ahead and bookmark your website to come back in the future.

Cheers

I don’t know if it’s just me or if everybody

else experiencing problems with your blog. It appears like

some of the text on your posts are running off the screen. Can somebody else please comment and let me know if this is happening to

them too? This might be a problem with my internet browser because I’ve had this happen before.

Many thanks

I appreciate your concise and clear context regarding the homebuying process. I seem to always refer back to your blog when I need questions answered.

Thanks. 🙂