This guide covers manual underwriting versus automated approval. There are two types of Automated Underwriting Systems (AUS): Fannie Mae’s Automated Underwriting System is referred to as Desktop Underwriting (DU) and Freddie Mac’s AUS is known as Loan Prospector (LP). All government and conventional loans need to go through either DU and/or LP Automated Underwriting System for the following:

- Approve/Eligible

- Refer/Eligible

- Refer/Ineligible

Manual Underwriting Versus Automated Approval Findings

An approve/eligible means that the borrower has an automated mortgage approval per automated finding and the borrower meets all mortgage guidelines of the loan program submitted. A refer/eligible means that the borrower can get approved for a mortgage loan but the AUS cannot determine it through the Automated Underwriting System and needs a human mortgage underwriter to manually underwrite the borrower:

- Borrowers Who Are One Year Into a Chapter 13 Bankruptcy Repayment Plan

- Mortgage Borrowers Who Just Had a Chapter 13 Bankruptcy Discharge But The Discharge Has Not Been Seasoned 2 Years

- Assets Listed On The Mortgage Application Is Not Sufficient For Cash To Close

- Debt-to-Income Ratios Are Higher Than Required By Automated Mortgage Approval

Manual underwriting versus automated approval are two different methods used in the process of evaluating and approving loans or credit applications. In the following paragraphs, we will cover a brief overview of manual underwriting versus automated approval.

Speak With Our Loan Officer for Getting Mortgage Loans

Difference Between Manual Underwriting Versus Automated Approval

Human Involvement: In manual underwriting, human underwriters review and assess the loan application. They analyze various aspects of the borrower’s financial situation and creditworthiness. Manual underwriting allows for more flexibility in considering unique or non-traditional factors that may not be easily captured by automated systems. This can be beneficial for individuals with complex financial situations. The process of manual underwriting is generally more time-consuming compared to automated approval, as it involves a detailed review of documentation and individualized decision-making.

Automated Approval Versus Manual Underwriting

Algorithmic Decision-Making: Automated approval relies on algorithms and predefined criteria to evaluate loan applications. The decision is made based on factors such as credit score, income, debt-to-income ratio, and other quantitative metrics. Automated systems are faster and can process a large number of applications in a short period. This can lead to quicker decisions and responses for borrowers. Automated approval systems ensure consistency in decision-making, as they follow predetermined rules and criteria. This reduces the likelihood of human error or bias. Manual underwriting versus automated approval is only used as a last resort with a refer/eligible findings.

What Does Refer/Eligible AUS Findings Mean

A refer/ineligible is when the borrower does not meet mortgage guidelines such as bankruptcy, foreclosure, deed-in-lieu of foreclosure, short sale does not meet mortgage guidelines. Refer/eligible findings is rendered when the borrower does not meet the minimum credit score requirements. Fannie Mae’s AUS is more popular than LP AUS.

. Automated approval is suitable for high-volume processing of standard applications, while manual underwriting may be reserved for cases that require a more detailed review.

The majority of lenders in this country will only accept an approval via Fannie Mae’s Automated Underwriting System with an approve/eligible DU Findings in order for them to proceed with the mortgage underwriting and approval process. It is possible to get automated loan approval with Freddie Mac but not Fannie Mae and vice versa.

Difference Between Manual Underwriting Versus Automated Approval

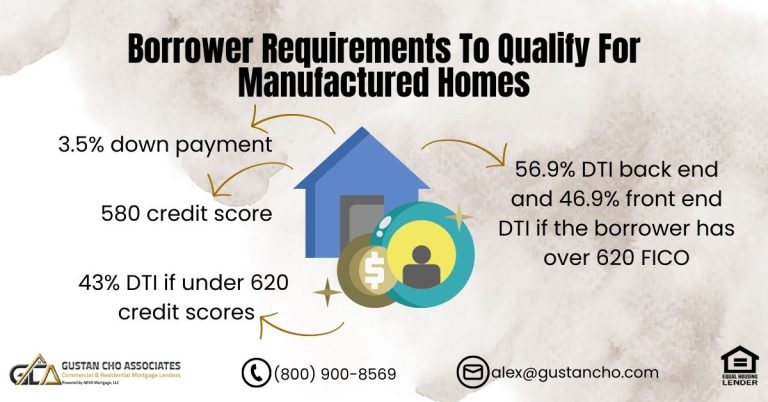

Manual underwriting versus automated approval has differences where it has caps on front-end and back-end debt-to-income ratio. Debt-to-income ratio caps are lower on manual underwriting versus automated approval files. Fannie Mae’s and Freddie Mac’s Automated Underwriting System is a sophisticated computer system that takes the following into consideration before rendering an automated mortgage loan approval:

- Income

- Assets

- Debts

- Liabilities

- Credit Scores

- Credit history

- Borrower’s Payment history

- Job longevity

- Public records

- Judgments

- Tax Liens

- Derogatory credit

- Foreclosure/deed-in-lieu of foreclosure/short sale

Fannie Mae’s Automated Underwriting System will also take debt-to-income ratios into consideration as well as asset and gift information. Manual underwriting may be more thorough in assessing unique risks associated with an individual borrower. Automated systems may prioritize efficiency over nuanced risk evaluation.

Qualify for automated or manual underwriting system for you Fannie Mae loans

Factors Taken Into Account By AUS

Manual Underwriting is mortgage loan applications that need to be manually underwritten by a mortgage underwriter. This is because the automated system cannot render an automated approval per Automated Underwriting System. Re-established credit is taken all into account. The Automated Underwriting Systems computes all of these items and renders a decision as follows:

- Approve/Eligible

- Refer/Eligible

- Refer/Ineligible

AUS will also determine whether or not collection accounts or charge offs need to be paid off. In the event, if a mortgage application gets a referred/eligible from the Automated Underwriting System, the mortgage application is not completely dead. There are lenders that can and will do Manual Underwrites on mortgage loan applications.

Why Manual Underwriting Versus Automated Approval

The automated mortgage approval system will pick up whatever is listed on the mortgage application as well as the information on the borrower’s credit report. Automated Underwriting System will pick up errors on the credit report. So if the loan officer needs an accurate AUS Approval, then the borrower’s credit report needs to be corrected prior to submission to AUS.

Rapid Rescores by the loan officer can fast track and expedite errors on the credit report. Once the errors are updated, the loan officer needs to re-pull credit with the correct updated credit report.

Unfortunately, very few mortgage lenders are able to do Manual Underwriting. Gustan Cho Associates is a national mortgage company licensed in multiple states with no overlays and does Manual Underwriting on FHA and VA loans. Manual underwriting versus automated approval is often preferred for complex cases where individual circumstances require a more personalized evaluation.

Types of Loans That Require Manual Underwriting Versus Automated Approval

Over 80% of our borrowers at Gustan Cho Associates are folks who either gotten a last-minute mortgage loan denial or are stressing during their mortgage process with their current lender. A large percentage of our borrowers are home buyers who are planning on buying a home during a Chapter 13 Bankruptcy repayment plan or those who recently were discharged of a Chapter 13 Bankruptcy.

Under FHA Guidelines on Chapter 13 Bankruptcy, a borrower can qualify for FHA loan one year into a Chapter 13 Bankruptcy repayment plan with proof of on-time payments for the past 12 months.

There is no waiting period after the Chapter 13 Bankruptcy discharged date. However, all FHA loans during a Chapter 13 Bankruptcy and any borrower who had a Chapter 13 Bankruptcy discharge but the discharged date has two years or less in seasoning, it needs to be manually underwritten.

The Now-Defunct HUD Back To Work Mortgage Program

Another example of Manual Underwriting Versus Automated Approval was the case of the now-defunct FHA Back To Work Loan Program. HUD, the parent of FHA, once shortened the waiting period for those mortgage loan borrowers who had a prior bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale to a mandatory one year waiting period via the FHA Back To Work mortgage program, which no longer exists. The FHA Back to Work extenuating circumstances due to an economic event mortgage program are all manually underwriting. Since it shortened the waiting period after bankruptcy and foreclosure to a one year waiting period instead of the two to three year waiting on traditional FHA loans, all of these loans had to be manually underwritten. The borrower needs to have been unemployed or underemployed for at least six months or more prior to the initiation of the following:

- Bankruptcy

- Foreclosure

- Deed in lieu of foreclosure

- Short sale

The FHA Back To Work Mortgage Program, which is no longer in existence and has been discontinued by HUD, was a temporary loan program that catered to Borrowers who were impacted by the Great Recession of 2008 and had a reduction of at least 20% of household income. The Back To Work Loan Program turned out to be a major flop and disaster where HUD discontinued it.

Speak With Our Loan Officer for back to work loan program

Qualify Today For FHA and VA Manual Underwriting Versus Automated Approval

In practice, financial institutions often use a combination of both methods. Automated systems may handle routine applications, while manual underwriting is reserved for cases that don’t fit standard criteria or require a more in-depth analysis. The choice between manual and automated processes depends on the specific needs, risk tolerance, and priorities of the lending institution. Borrowers who need to qualify for FHA and VA loans via manual underwriting versus automated approval, contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are direct lenders with no overlays licensed in multiple states with a five-star national reputation. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.