Unlocking a 95% CLTV Jumbo Mortgage in 2025: Buy High-End Homes with Just 5% Down

Are you dreaming of buying a high-end home but don’t have the full 20% down payment that jumbo loans typically require? Good news: At Gustan Cho Associates, we can help you qualify for a 95% CLTV jumbo mortgage — even with just 5% down. This means you can buy your dream home in places like Los Angeles, Denver, Chicago, or Miami without draining your savings.

Let’s break down exactly what a 95% CLTV jumbo mortgage is, how it works, and how you can qualify in 2025.

What Is a 95% CLTV Jumbo Mortgage?

A 95% CLTV jumbo mortgage is a special financing option for homebuyers who want to buy a property that costs more than standard loan limits. CLTV means Combined Loan-to-Value, which lets buyers finance up to 95% of the home’s price using a mix of loans.

This usually includes an 80% first mortgage, a regular loan, and a 15% second mortgage, often called a piggyback loan. This setup allows buyers to cover a large part of their home’s value without making a big down payment like with traditional jumbo loans.

One major benefit of the 95% CLTV jumbo mortgage is that it can lower upfront costs. Buyers only need to provide a 5% down payment, making it easier to buy a home. Also, the piggyback loan can help borrowers avoid costly private mortgage insurance (PMI), which further cuts down on the total cost of the mortgage. This financing option is attractive for those looking to buy a high-value home while keeping their initial cash investment low.

Buy Your Dream Home With Just 5% Down

Our 95% CLTV jumbo mortgage makes luxury homeownership more affordable than ever.

Why Is This Important in 2025?

Home prices have jumped in recent years, and in many areas, even entry-level homes exceed the conforming loan limits. As of 2024, the standard limit for conforming loans is $766,550. In expensive areas like California and New York, this limit can reach up to $1,149,825.

If your dream home costs over these limits, you’re in jumbo territory. But most jumbo loans require 10% to 20% down, often over $100,000. With a 95% CLTV jumbo mortgage, you only need 5% down, making high-end homeownership more accessible.

Example of a 95% CLTV Jumbo Loan

If you are thinking about buying a $1.1 million home in an area with standard costs, you can use a specific financing plan. First, you can get a mortgage for $766,550, which is within the conforming loan limit. To help with the rest of the cost, you can also take out a second mortgage, called a piggyback loan, for $268,450. You will also need to make a down payment of $55,000, which is 5% of the home’s purchase price.

Together, this plan gives you a total combined loan-to-value (CLTV) of 95%. This way, you can buy your dream home without needing a large down payment for a jumbo loan.

Who Offers 95% CLTV Jumbo Mortgages?

Very few lenders offer this type of mortgage. That’s where Gustan Cho Associates comes in. We work with specialized wholesale lenders to bring you these flexible programs. Our team helps you structure the loan and guides you through every step of the process.

You get:

- Expert help building your two-loan structure

- Access to lenders with no overlays

- One-stop processing and underwriting

What Are the Requirements for a 95% CLTV Jumbo Mortgage?

To qualify for this unique program, borrowers must meet specific requirements. Here’s what you need to know:

1. Credit Score

- Minimum 700 credit score required

2. Debt-to-Income (DTI) Ratio

- Max DTI allowed: 43%

3. Reserves

- Typically 12 months of reserves (can be cash or retirement funds)

4. Tradelines

- At least 3 tradelines per borrower contributing income

- One must be active for 12 months, or substitute 36 on-time housing payments

5. Rental History

- Verified 12-month rental history required

6. Loan Size

- First mortgage: Up to local conforming loan limit (max $1,149,825 in high-cost areas)

- Second mortgage: Up to $500,000

- Combined total not to exceed $2 million

High-End Home? Low Down Payment? Yes, It’s Possible

Finance up to 95% of your luxury home’s value—no private mortgage insurance required.

Can You Qualify with Past Credit Issues?

Yes, depending on how long ago your financial hardship occurred. Here are the seasoning requirements:

- Foreclosure: 7 years

- Short Sale / Deed-in-Lieu: 4 years

- Modified Mortgage: 4 years

- Chapter 7 or 11 Bankruptcy: Four years after discharge/dismissal.

- Chapter 13 Bankruptcy: Two years after release or four years following dismissal.

Note: If you’ve had multiple events, both must be at least 7 years old to qualify. And no late mortgage payments in the past 24 months.

Do You Pay Extra for Two Mortgages?

Not necessarily. With Gustan Cho Associates, both your first and second loans are processed and underwritten together, often using one appraisal. This saves you time and money.

We also allow seller concessions up to 3%, which can help cover your closing costs.

Why Choose a 95% CLTV Jumbo Mortgage Over Other Options?

Here’s why many high-end homebuyers are choosing this strategy:

- Lower Down Payment: Keep more money in your savings or use it for improvements

- Avoid Jumbo PMI: Private mortgage insurance isn’t typically required

- Flexible Approval: Great for buyers just under traditional jumbo requirements

- Quick Close: We streamline the process for fast approval and funding

Are You in a High-Cost Area?

The higher your local loan limit, the more you can finance on the first mortgage. Use the FHFA Loan Limit Map to check your area.

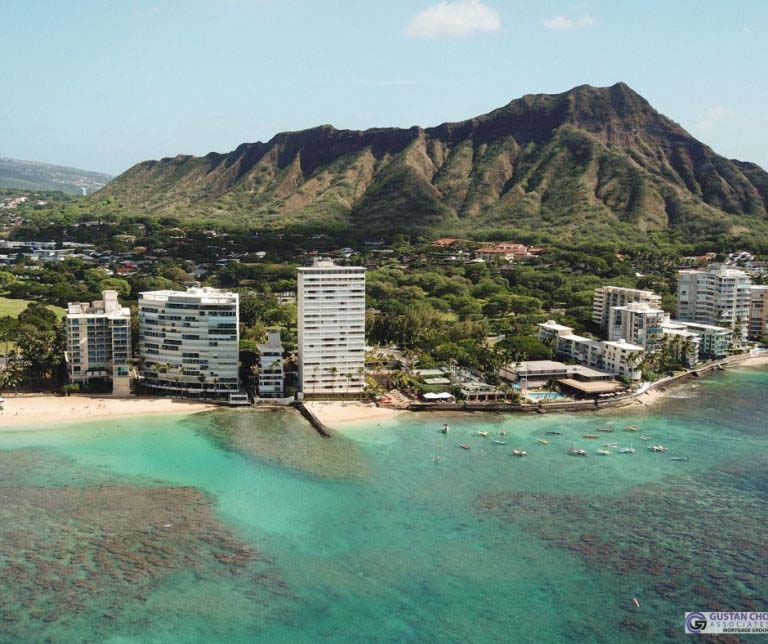

If you live in California, Colorado, Hawaii, D.C., or the Northeast, this loan program can help you afford more home with less down.

How to Apply for a 95% CLTV Jumbo Mortgage

It’s simple:

- Schedule a free consultation with our team

- Go over your credit, income, and goals

- Get pre-approved for a two-loan jumbo structure

- Shop for your dream home with confidence

Call us at 800-900-8569 or email alex@gustancho.com to get started.

Ready to Get Started?

If you’re ready to buy your dream home and want to take advantage of the 95% CLTV jumbo mortgage, Gustan Cho Associates is here to help.

We’re licensed in 50 states, available 7 days a week, and specialize in helping homebuyers who were told “no” elsewhere. With no lender overlays and flexible programs, we make homeownership possible.

Contact us today at 800-900-8569 or email alex@gustancho.com to begin your journey.

Frequently Asked Questions About 95% CLTV Jumbo Mortgage:

Q: What is a 95% CLTV Jumbo Mortgage?

A: A 95% CLTV jumbo mortgage lets you buy a high-priced home with just 5% down. It combines two loans—a first mortgage and a second piggyback loan—to cover 95% of the home’s price.

Q: Can I Really Buy a Million-Dollar Home with Only 5% Down?

A: Yes! With a 95% CLTV jumbo mortgage, you can buy a $1.1 million home by putting just 5% down. The rest is covered by two loans.

Q: Who Offers 95% CLTV Jumbo Mortgages?

A: Not many lenders offer this program, but Gustan Cho Associates does. We help you structure both loans and guide you through the whole process.

Q: What Credit Score do I Need for a 95% CLTV Jumbo Mortgage?

A: You’ll need at least a 700 credit score to qualify for a 95% CLTV jumbo mortgage.

Q: Do I Need Perfect Credit to Get Approved?

A: No. If your past credit issues are older (like a bankruptcy or foreclosure), you may still qualify for a 95% CLTV jumbo mortgage as long as they meet the waiting period rules.

Q: Will I have to Pay Private Mortgage Insurance (PMI)?

A: Usually not. The second mortgage in a 95% CLTV jumbo mortgage setup often helps you avoid PMI altogether.

Q: What’s the Biggest Loan Amount I Can Get with this Program?

A: With a 95% CLTV jumbo mortgage, you can borrow up to $2 million combined (between the first and second mortgages).

Q: Can I Use Gift Money for the 5% Down Payment?

A: Yes! Many borrowers use family gift funds to cover the 5% down on a 95% CLTV jumbo mortgage.

Q: How Long Does it Take to Get Approved?

A: Most borrowers get pre-approved quickly. Since both loans are done together, we can help you close fast with a 95% CLTV jumbo mortgage.

Q: How do I Apply for a 95% CLTV Jumbo Mortgage?

A: It’s easy. Call 800-900-8569 or email alex@gustancho.com to get started. We’ll walk you through the steps and help you qualify for your 95% CLTV jumbo mortgage.

This blog about “95% CLTV Jumbo Mortgage For High-End Home Purchases” was updated on July 9th, 2025.

Keep More Cash in Your Pocket With 95% CLTV Financing

Secure your upscale home with a small down payment and flexible terms.