This guide covers what is a conventional mortgage. One of the frequently asked question from homebuyers is what is a conventional mortgage? What is the difference between a conventional mortgage and a government-backed loan. A conventional mortgage is a type of home loan that is not insured or guaranteed by any government entity, such as the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), or the Department of Agriculture (USDA).

Private mortgage insurance companies are contracted on conventional loans for borrowers with less than 20% equity. Mortgage lenders including banks, credit unions, and mortgage companies, offer conventional mortgage loans.

In the following sections, we will cover the key aspects of conventional mortgage loans. There is a wide variety of conventional mortgage loans that are catered to each individual’s needs. Borrowers are eligible to finance primary homes, second homes, and investment properties with conventional mortgages. The minimum credit score requirement to qualify for conventional mortgages per Fannie Mae and Freddie Mac Agency Guidelines is 620 FICO.

Key Features of Conventional Mortgage Loans

Conventional loans are private mortgage loans not backed by any government agency. Unlike FHA, VA, and USDA, conventional mortgages are not insured by the government. HUD, VA, and USDA insures FHA, VA, and USDA loans. This is not the case with conventional mortgages. There are two types of conventional mortgage programs. Conforming and non-conforming loans.

Conforming loans adhere to the guidelines set by Fannie Mae and Freddie Mac, including max loan limits. As of 2024, the conforming loan limit for a single-family home is $766,550 in most areas, but it can be higher in high-cost areas.

Conforming loans are prevalent with lenders who sell their loans to Fannie Mae and Freddie Mac to be packaged into securities: meet guidelines set by Fannie Mae and Freddie Mac. They are simpler to obtain and oftern have a lower cost compared to non-conforming loans. Conforming loans adhere to the guidelines set by Fannie Mae and Freddie Mac, including maximum loan limits. As of 2024, the conforming loan limit for a single-family home is $766,550 in most areas, but it can be higher in certain high-cost areas. High-balance conforming loans is capped at $1,149,825 on single-family homes in high-cost areas.

Ready to Buy a Home with a Conventional Mortgage Loan?

Contact us today to learn how you can qualify for a conventional mortgage and start your journey to homeownership.Conventional Mortgage Loan Limit

Non-conforming loans do not qualify the requirement set Fannie Mae and Freddie Mac. Any mortgage loan higher than the conforming loan limit of $766,550 are considered non-conforming loans or jumbo loans. Jumbo loans are one of the most popular non-conforming loans, for home purchases above the loan limit. If the down payment is less than 20%, lenders usually require PMI, which protects the lender if the borrower defaults. PMI can be canceled once the borrower reaches 20% equity in the home. Non-conforming loans or jumbo loans, exceed the conforming loan limits and have different underwriting guidelines.

Down Payment Requirements on Conventional Mortgage

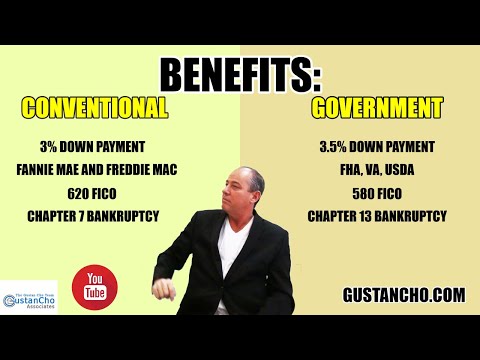

A conventional purchase loan’s minimum down payment requirement is a 3% down payment for first-time homebuyers with Fannie Mae and Freddie Mac. The 3% down payment only applies to homebuyers for first-time homebuyers. A first-time homebuyer is a buyer who did not own a home in the past three years. 5% down payment if they owned a home in the past three years.

Conventional loans typically require a down payment of at least 3% to 5%. However, 20% or more can help borrowers avoid private mortgage insurance (PMI).

Fannie Mae launched the 3% down payment conventional mortgage program to compete with HUD’s 3.5% down payment program on FHA loans. With HUD’s recent reduction in FHA annual mortgage insurance premiums from 0.85% to 0.55% and 3.5% down payment.

Credit Score Requirements on Conventional Mortgage Loans

Conventional mortgage loans generally require a higher credit score than government-backed loans. The minimum credit score required to qualify for a conventional mortgage is 620. Most lenders prefer a higher credit score than the minimum 620 as part of their lender overlays. The higher your credit scores, the lower your rates. A conventional mortgage is a popular choice for borrowers with good credit and stable incomes with a larger down payment. Conventional mortgage offer flexibility and competitive rates but have stricter qualification requirements and potential PMI costs. Understanding these aspects can help borrowers decide if a conventional mortgage is the right option for their home financing needs.

Interest Rates on Conventional Mortgage Loans

Conventional mortgage rates are determined by market conditions and the borrower’s credit profile. Generally, borrowers with higher credit scores and larger down payments receive lower interest rates. Conventional loans are available in various term lengths, commonly 15, 20, and 30 years. They also have fixed-rate and adjustable-rate options.

Eligibility and Guidelines on Conventional Mortgage Loans

Lenders require proof of stable income and employment history. Debt-to-Income Ratio (DTI) can be up to 50% back-end. There is no front-end debt-to-income ratio. Lenders prefer a DTI ratio of 45% or lower, though some may allow higher ratios with compensating factors. Borrowers need to document and verify sufficient assets and reserves to cover the down payment, closing costs, and a few months of mortgage payments.

Advantages of Conventional Mortgage Loans

Conventional loans can be used for various properties, including primary residences, second homes, and investment properties. Loan limit on conventional mortgage loans is higher than FHA loans. There is no upfront mortgage insurance premium on conventional mortgage loans. Unlike FHA loans, conventional loans do not require an upfront mortgage insurance premium (MIP).

Disadvantages of Conventional Mortgage Loans

Conventional mortgage loans have stricter qualification requirements than government-backed loans. Higher credit score and lower DTI ratio requirements compared to government-backed loans. If the down payment is less than 20%, the borrower must pay for PMI, which adds to the monthly mortgage payment. Down payment requirement may be higher than those of some government-backed loan programs that offer low or no down payment options.

Pros and Cons of Conventional Loans

Pros

- Possibly, having a lower interest rate for clients who have good credit.

- They offer flexible conditions and down payments.

- These loans do not demand any upfront mortgage insurance premium as happened in FHA loans.

- The LTV must be 80% or below before PMI can be dropped off.

Cons

- Higher credit scores and down payment requirements are there than in the government backed loans.

- Considerably stricter standards of qualification prevail.

- When the down payment falls below 20%, this requires PMI.

When to Consider a Conventional Loan:

- You are credit worthy because your score is high and you also have steady earnings.

- Due to changes and adaptations, you can afford a larger down payment to shun PMI.

- You are purchasing a home and this is being financed at or below conforming loan limits.

- You have your choice of locked-in fixed rate mortgage or an adjustable rate mortgage in which the rate and payment fluctuates over the term of the mortgage.

How Conventional Mortgage Works?

A conventional mortgage is simply a type of mortgage that enables home buyers to borrow money with which to buy a home. The borrower being required to pay back on the loan at a future specific date together with interest. Here is a step-by-step explanation of how a conventional mortgage works:

Steps Involved in a Conventional Mortgage

Pre-Approval: To begin the process the borrower gets pre-approval from the lender. This entails a credit check besides an analysis of the borrower’s income, assets, and liabilities. An initial approval gives the maximum amount that one is approved for in loans, which is useful in planning of the materials for home hunting.

Mortgage Application: A mortgage application is filled with the lending firm by the borrower or the mortgagor and his/her financial credentials. The lender maintains a home appraisal in which the property needs to be worth that of the loan amount currently being offered to a borrower.

Home Shopping: In pre-approval, the borrower begins searching for the house as a result of the budget set by the lending authority.

The process begins by identifying a home that matches the borrower’s needs, and an offer is made and, if accepted, a purchase contract is made.

Underwriting: It involves a lender’s underwriting team who shall go through the application, cross check the provided financial details of the borrower and evaluate the risk of the particular loan. The underwriter verifies that the borrower complied with the lender’s requirements and that the property value corresponds to the loan amount.

Loan Approval: If the underwriter passes the loan, the lender puts out a commitment to the loan. The borrower may be required to submit the additional documents or fulfil some requirements before the final approve.

Closing: Ending date, this is the date when the transaction is completed involving the borrower, the seller, and the lender.

The mortgage note is signed by the borrower in which he or she agrees to pay the borrowed amount plus the interest as stipulated.

Then, closing costs as well as fees for the appraisal of the property and the title, insurance, as well as origination of the loan are made. This is the amount in which the lender pays the amount of money for the loan, and the borrower for the home keys.

Repayment: The borrower starts to pay his monthly installments consisting of the principal, interest, property taxes, and required insurance or PMI (PITI). With fixed rate of interest, the amount of each instalment remains constant from the time of its disbursement up to the agreed period. For adjustable rate loans (ARMs), the interest rate as well as the payment may also fluctuate.

Ready to Secure a Conventional Loan for Your Dream Home?

Contact us now to discuss your options and get started with your mortgage application.Comparison of FHA Versus Conventional Mortgage

Fannie Mae and Freddie Mac developed the 3% down payment loan program for first-time homebuyers or borrowers with no property ownership in the past three years.

Borrowers with over 80% loan-to-value require annual private mortgage insurance, paid monthly until the home’s value falls to 78% LTV.

Homebuyers with less than 20% down payment can qualify for conventional loans with no monthly PMI if they pay the one-time upfront lender-paid mortgage insurance.

Borrowers have the option to pay one-time lender-paid mortgage insurance on a conventional loan and not pay monthly mortgage insurance. With LPMI, you pay one lump mortgage insurance just like FHA’s upfront MIP. The cost of private mortgage insurance is not a fixed rate like FHA loans.

Paying the LPMI conventional mortgages does not require the borrower to pay separate private mortgage insurance. The premium on mortgage insurance depends on the credit score and other risk factors of the borrower.

The no private mortgage insurance requirement is offered to borrowers who take advantage of the lender-paid mortgage insurance on conventional loans. LPMI ( Lender Paid Mortgage Insurance) is a one-time private mortgage insurance premium offered to borrowers of conventional loans. This is a one-time upfront private mortgage insurance program that eliminates the monthly mortgage insurance.

Second Homes and Investment Property Financing

To qualify for a second home or vacation home mortgage, a 10% down payment and a 620 FICO credit score are required. The minimum down payment requirement for an investment home mortgage loan is a 15% down payment. However, if the investment home borrower can use 75% of the potential rental income from the subject investment home purchase in order. To do so, the borrower must put a 25% down payment on an investment home property.

HomePath Mortgage Conventional Mortgage Loans

Unfortunately, Fannie Mae has discontinued the HomePath Loan and HomePath Renovation Mortgage program. Homebuyers can still purchase a HomePath property. However, the HomePath mortgage program has been discontinued. Alternative financing for HomePath properties includes a 3% down payment conventional loan and a 3.5% down payment FHA Loan. 0% down payment VA loan if you are a veteran. Or 0% down payment USDA loan if the property is in a USDA-approved area and you qualify for a USDA loan.

Fannie Mae and Freddie Mac Waiting Period After Short Sale and Deed-in-Lieu vs Standard Foreclosure

Fannie Mae and Freddie Mac have different waiting period requirements on a short sale and deed-in-lieu of foreclosure versus a standard foreclosure. The waiting period to qualify for conventional loan rules differs from a standard foreclosure. There is a four-year waiting period to qualify for a conventional loan after a deed-in-lieu of foreclosure.

The start of the waiting period on conventional loans is the date the property was recorded by the new owner. The borrower needs to have the deed out of their names for the waiting period to start.

The waiting period start date is four years from the recorded foreclosure date. To qualify for a conventional loan after a short sale is four years from the short sale date. The waiting period clock to qualify for a conventional loan after a short sale starts from the date shown on the HUD-1 Settlement Statement of your short sale.

Fannie Mae and Freddie Mac Waiting Period After a Standard Foreclosure

The waiting period to qualify for a conventional loan after a standard regular foreclosure is seven years from the recorded foreclosure date. The waiting period start date is the recorded and stamped date by the county recorder of the deeds office. The recorded date is reflected in public records. Gustan Cho Associates has no lender overlays on conventional loans.

Qualifying For Conventional Mortgage After Bankruptcy and Foreclosure

Fannie Mae recently changed the waiting periods after a deed-in-lieu of foreclosure and short sale. Fannie Mae treats deed-in-lieu of foreclosure and short sale differently than a standard foreclosure versus other mortgage programs. HUD treats a deed-in-lieu of foreclosure and short sale like a standard regular foreclosure. The waiting period to qualify for an FHA loan after a deed-in-lieu of foreclosure or a short sale is the same as a standard foreclosure: three years after the short sale date. The waiting period start date is reflected on the HUD-1 Settlement Statement. 3 years after the recorded date reflected on public records for a deed-in-lieu of foreclosure and standard foreclosure.

Qualifying For Conventional Mortgage After Bankruptcy

Fannie Mae has minimum waiting period requirements for borrowers to qualify for a conventional loan after a bankruptcy discharge date. There is a four-year mandatory waiting period after a Chapter 7 discharge date to qualify for a conventional loan. There is a mandatory 2-year waiting period after a Chapter 13 discharge date to qualify for a conventional loan. If your Chapter 13 has been dismissed instead of discharged, the waiting period is four years after a Chapter 13 dismissal date. Conventional Lenders want to see those with a prior bankruptcy not have been late with any payments and like to see a re-established credit history.

FAQs: What is a Conventional Mortgage

-

1. What is a Conventional Mortgage? A conventional mortgage is a type of home loan that doesn’t have the backing or insurance of any government agency, such as the FHA (Federal Housing Administration), VA (Department of Veterans Affairs), or the USDA (US Department of Agriculture). Private lenders like banks, credit unions, and mortgage companies usually offer these loans.

-

2. What are the key differences between a Conventional Mortgage and a government-backed loan? The primary difference is that conventional mortgages are not insured by the government. In contrast, government-backed loans like FHA, VA, and USDA loans are. This lack of insurance means conventional mortgages often have stricter credit and higher down payment requirements.

-

3. What types of properties can be financed with a Conventional Mortgage? Conventional mortgages can finance primary residences, second homes, and investment properties.

-

4. What is the minimum credit score required for a Conventional Mortgage? The lowest acceptable credit score for eligibility for a traditional mortgage is 620, as stated in the Fannie Mae and Freddie Mac guidelines.

-

5. What is the down payment requirement for a Conventional Mortgage? First-time homebuyers usually need a minimum down payment of about 3%, whereas others typically start at 5%. A 20% or higher down payment can help borrowers avoid private mortgage insurance (PMI).

-

6. What are Conforming and Non-Conforming Loans? Conventional loans follow the criteria set by Fannie Mae and Freddie Mac, and they have a top cap of $766,550 for a single-family residence. Conversely, non-conforming loans must meet these criteria and include jumbo loans surpassing the conforming loan limits.

-

7. What is Private Mortgage Insurance (PMI)? PMI is necessary for conventional loans when the borrower puts down less than 20%. It provides protection for the lender in case the borrower defaults. PMI can be terminated once the borrower attains 20% equity in the home.

-

8. What are the interest rates for conventional mortgages? Interest rates for conventional mortgages are impacted by market conditions and the borrower’s credit profile. Higher credit scores and larger down payments generally lead to lower interest rates. Conventional loans provide fixed-rate and adjustable-rate options.

-

9. What are the advantages of a Conventional Mortgage? Conventional mortgages provide various benefits, such as financing different properties. There is no requirement for an upfront mortgage insurance premium, and borrowers with good credit often benefit from lower interest rates. Additionally, loan limits with conventional mortgages are generally higher than those associated with FHA loans.

-

10. What are the disadvantages of a Conventional Mortgage? A conventional mortgage has disadvantages like stricter qualification requirements compared to government-backed loans. This option generally demands a higher credit score and a lower debt-to-income (DTI) ratio. Additionally, PMI (Private Mortgage Insurance) is necessary for down payments under 20%, which leads to an increase in the monthly payment.

-

11. What is Lender-Paid Mortgage Insurance (LPMI)? LPMI allows borrowers to pay a one-time upfront private mortgage insurance premium, eliminating the need for monthly PMI payments. This could be advantageous for borrowers who like receiving all the money at once.

-

12. Can I get a Conventional Mortgage for a second home or investment property? Yes, but the requirements are stricter. For a second home, a minimum down payment of 10% and a credit score 620 are required. For investment properties, a minimum down payment of 15% is needed, with the possibility of using rental income to qualify if a 25% down payment is made.

-

13. How do I apply for a Conventional Mortgage? The process involves getting pre-approved by a lender, filling out a mortgage application, shopping for a home, undergoing underwriting, and closing the loan. Regular payments include principal, interest, property taxes, and required insurance.

-

14. What are the waiting periods after foreclosure or bankruptcy to qualify for a Conventional Mortgage? If you’ve experienced a foreclosure, you must wait seven years before qualifying for a Conventional Mortgage. For a Short Sale or Deed-in-Lieu, the waiting period is four years. In the case of bankruptcy, it’s four years after a Chapter 7 discharge and two years after a Chapter 13 discharge.

-

15. Why might I choose a Conventional Mortgage over other types of loans? Suppose you possess a high credit score, a steady income, and the capability to make a substantial down payment to steer clear of PMI. In that case, you may opt for a traditional mortgage. Traditional mortgages provide flexibility in loan terms and the possibility of securing lower interest rates. You could opt for a traditional mortgage if you possess a high credit score, a steady income, and can provide a substantial down payment to avoid PMI. They offer flexibility in loan terms and the potential for lower interest rates.

-

16. Where can I apply for a Conventional Mortgage? You can seek a traditional mortgage from banks, credit unions, and mortgage companies. It is a good idea to evaluate proposals from various lenders to discover the most favorable terms and rates for your circumstances.

If you have any questions about Conventional Mortgage or borrowers who need to qualify for loans with a lender with no overlays, please contact us at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

I was approved for my mortgage loan but now my underwriter said that he won’t use my RSU income. I am closing my loan in next 45 days. Is there anything I can do now? I do want to lose that home since my sub lease ending in end of the November.