In this blog, we will cover and discuss qualifying for VA loans by Wisconsin VA mortgage lenders with no lender overlays and competitive mortgage rates. Gustan Cho Associates, empowered by NEXA Mortgage, LLC NMLS 1660690 has a large presence in Wisconsin. Gustan Cho Associates empowered by NEXA Mortgage, LLC is licensed in 48 states, including Wisconsin, and is based in Oakbrook Terrance, Illinois NMLS 1660690. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about Wisconsin VA mortgage lenders with no overlays and competitive rates:

Wisconsin is a great state with a strong economy, beautiful landscape, amazing lakes, and hundreds of historic tourist places.

Many families migrate to Wisconsin due to the strong economy, strong demand for jobs, low taxes, affordable housing, and low cost of living. Wisconsin is one of nine community property states. Many people from Illinois go to Wisconsin on the weekends to fish, waterski, hunt, and enjoy the hundreds of lakes. In the following paragraphs, we will cover qualifying and getting approved for VA loans by Wisconsin VA mortgage lenders with no overlays and competitive rates.

Buying a Second Home in Wisconsin

Many Americans have second homes in Wisconsin. A large number of borrowers at Gustan Cho Associates are homebuyers of second homes in Wisconsin. Wisconsin has four seasons and plenty of snow in the winter season. However, many tourists call Wisconsin their favorite place to vacation for 12 months of the year. John Strange, a senior mortgage loan originator at Gustan Cho Associates about Wisconsin VA mortgage lenders with no overlays and competitive rates:

There are activities during every season in the state. During the cold winter months, people can snowmobile, hunt, ice fish, cross country skiing, and enjoy the hundreds of ski hills throughout the state.

A large number of Illinoisans and retirees from other high-taxed states migrate to Wisconsin to retire. They can get a lot of house for their money, absolutely beautiful landscapes, lower property taxes, hundreds of places to vacation, affordable housing, acreage, and a low cost of living.

Veterans Deserve Easier Approvals

We offer VA loans in Wisconsin with no extra lender overlays.

Veteran Families in Wisconsin

Wisconsin has a large number of veterans who call this great state home. Fort McCoy is one of the largest military bases in the nation and is based in Fort McCoy, Wisconsin.

Gustan Cho Associates are experts in helping active duty and retired members of the United States Armed Forces qualify for VA loans. Many retired members of the U.S Military join local, county, or state police agencies in Wisconsin.

These public service workers include police officers, county sheriff’s deputies, Wisconsin State Patrol troopers, county and state corrections officers, firefighters, EMTs, doctors, nurses, pharmacists, and other silent heroes who serve our communities in the state of Wisconsin.

Homes For Heroes in Wisconsin

Gustan Cho Associates has the Homes for Heroes which are for law enforcement, first responders, medical field personnel, and public safety workers, and. The Homes for Law Enforcement Officers mortgage loan program can save each applicant anywhere between $2,000 to $7,000 on a home purchase.

The Homes for Law Enforcement and Public Safety Officers are for local, county, and state police officers, police and fire dispatchers, firefighters, EMTs, FBI/DEA/ATF/HUD, law enforcement, and public safety instructors, and other federal law enforcement agents.

Unlike many other mortgage lenders, Gustan Cho Associates has wholesale mortgage lending relationships with VA lenders with no lender overlays. Lender overlays are additional mortgage guidelines that are above and beyond the minimum agency guidelines of the Veterans Administration. In the next paragraph, we will discuss what lender overlays on VA loans are so our viewers have a full understanding.

Wisconsin VA Mortgage Lenders Licensed to Originate VA Loans

All mortgage lenders who originate VA loans need to be licensed and/or registered. Private mortgage lenders need to be licensed through the NMLS in the states they want to originate mortgage loans.

Mortgage loan originators who work for Federally Chartered Financial Institutions such as FDIC banks, credit unions, and other financial institutions under the supervision of the federal government and/or Office of the Comptroller are exempt from licensing.

However, they need to be registered with the NMLS. The financial institution is responsible for vetting individuals who are registered. All financial institutions originating VA loans in Wisconsin need to be approved by the Veterans Administration.

What Are Agency Mortgage Guidelines by the Veterans Administration

Wisconsin VA mortgage lenders, whether state-licensed or federally registered, need to make sure every borrower meets the minimum agency guidelines of the Veterans Administration.

The Department of Veterans Affairs is the government agency that insures and guarantees Wisconsin VA mortgage lenders in the event borrowers default on their VA loans.

The Veterans Administration is not a lender. The VA does not originate, process, underwriter, or fund VA loans. The role of the Veterans Administration is to insure lenders in the event borrowers default and/or foreclose on their VA loans.

What Is The Role of the United States Department of Veterans Administration

The responsibility of the Veterans Administration is to partially insure Wisconsin VA mortgage lenders who have originated loans for borrowers who meet the VA guidelines and have defaulted and/or foreclosed on their VA loans.

In order for the Veterans Administration to guarantee Wisconsin VA mortgage lenders on defaulted VA loans, Wisconsin VA mortgage lenders need to meet the minimum VA agency mortgage guidelines.

If Wisconsin VA mortgage lenders do not have borrowers meet every aspect of the minimum VA agency guidelines, the loan is not insurable. Not every Wisconsin VA mortgage lenders have the same guidelines and lending requirements on VA loans. We will explain why in the next paragraph.

Lender Overlays Imposed By Wisconsin VA Mortgage Lenders

In the previous paragraph, we discuss how all Wisconsin VA mortgage lenders have to have their borrowers meet the minimum agency mortgage guidelines. Many borrowers have been turned down by Wisconsin VA mortgage lenders for one reason or another. Many borrowers get conflicting reports from various Wisconsin VA mortgage lenders and often get confused. The fact of the matter is every Wisconsin VA mortgage lenders can have different lending requirements on VA loans.

No Overlays. No Stress. Just VA Loans.

Low credit? High DTI? We’ve got you covered.

Example of Credit Score Lender Overlays

One lender may require a 620 credit score while other Wisconsin VA mortgage lenders may require a 640 credit score. Yet other Wisconsin VA mortgage lenders like Gustan Cho Associates have no minimum credit score requirements and can get borrowers with credit scores down to 500 approved for VA loans.

All Wisconsin VA mortgage lenders need to have their borrowers meet the minimum agency guidelines of the Veterans Administration.

However, Wisconsin VA mortgage lenders can have higher lending requirements above and beyond the minimum agency guidelines of the Veterans Administration.

Wisconsin VA Mortgage Lenders With VA Overlays on VA Loans

The higher lending standards required by Wisconsin VA mortgage lenders that are above and beyond the Veterans Administration are called VA lender overlays.

There are no minimum credit score requirements on VA loans. Many Wisconsin VA mortgage lenders have lender overlays on credit scores.

Most Wisconsin VA mortgage lenders will set a minimum credit score requirement on VA loans such as 620, 640, and 660. Over 80% of our borrowers at Gustan Cho Associates are folks who could not qualify at other mortgage companies due to lender overlays. As long as the borrower meets the minimum credit score requirements on VA loans, you can rest assured that Gustan Cho Associates will approve you and not just close the loan but close it on time.

Types of Lenders Overlays Imposed By Wisconsin VA Mortgage Lenders

Wisconsin VA mortgage lenders can have lender overlays on anything they feel is too much risk for them. Here are typical lender overlays by Wisconsin VA mortgage lenders on VA loans:

- Lenders can require a specific minimum credit score when the VA does not mandate a minimum credit score.

- Overlays on debt to income ratios when VA loans do not have a maximum debt to income ratio cap.

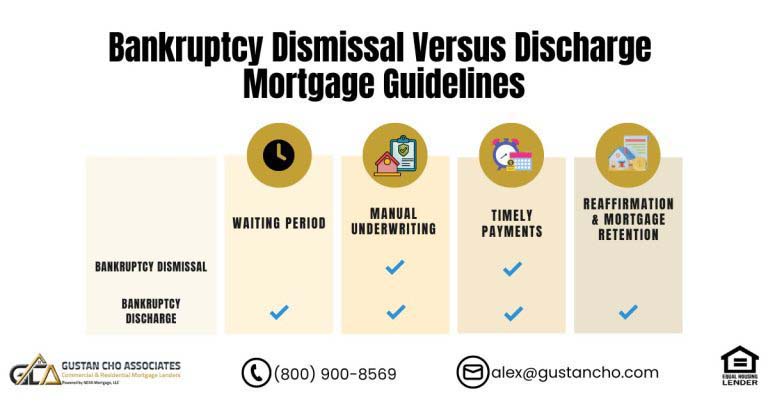

- Wisconsin VA mortgage lenders can require they will not approve borrowers in an active Chapter 13 Bankruptcy repayment plan when VA allows borrowers to qualify for a VA loan during Chapter 13 with trustee approval via manual underwrite and the Chapter 13 does not need to be discharged.

- Lenders can require one year to two-year waiting period after the Chapter 13 Bankruptcy discharge date when the Veterans Administration does not have a waiting period after the Chapter 13 discharge date with a manual underwriting.

- Many Wisconsin VA mortgage lenders can require borrowers to pay outstanding collections and/or charged-off accounts when the VA does not require unpaid collections and charged-off accounts to qualify for a VA loan.

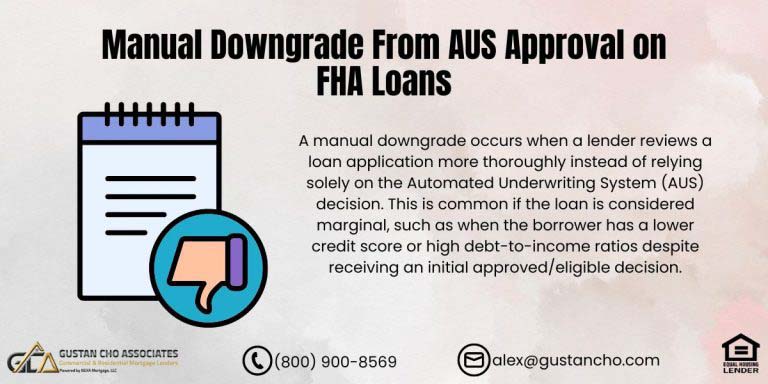

- Some Wisconsin VA mortgage lenders will not allow manual underwriting on VA loans.

- Many Wisconsin VA mortgage lenders will not allow manufactured homes, one-time close VA construction loans, and other niches VA mortgage loan programs.

- Not too many Wisconsin VA mortgage lenders will approve VA loans with credit scores down to 500 FICO.

Wisconsin VA Mortgage Lenders Overview

For veterans and active-duty military in Wisconsin, purchasing a home marks a key achievement. The VA home loan program rewards military service by making homeownership affordable.

With zero down payment, no mortgage insurance, and lenient credit standards, VA loans stand out. The downside? Many Wisconsin VA mortgage lenders layer on their own stricter rules—known as lender overlays—making it tougher to qualify.

Gustan Cho Associates eliminates these overlays, delivering VA loans that follow VA rules only while providing competitive rates. Find Wisconsin VA mortgage lenders who impose zero overlays and offer great rates. Gustan Cho Associates helps veterans secure loans when other lenders decline.

What Exactly Are Lender Overlays?

The VA sets the groundwork for loan requirements, but individual lenders often add tougher rules. These extra rules are called overlays, and they can prevent qualified veterans from securing the loan they’ve earned.

Typical Overlays on VA Loans

- Higher credit score demands—Many lenders want 620 to 640 or higher, even though the VA has no minimum score.

- Tighter debt-to-income (DTI) limits can shut out veterans with certain monthly obligations.

- Extra cash reserves that the VA doesn’t require.

- Denials for past credit problems, even when the VA allows for a bankruptcy, foreclosure, or a few late payments.

- At Gustan Cho Associates, we stick to VA rules only—no extra overlays.

- If you meet the VA’s qualifications, you can get the loan.

Why Pick Gustan Cho Associates in Wisconsin?

- No Lender Overlays: We approve you based only on the VA’s rules. If you qualify with them, you’ll qualify with us.

- Great VA Mortgage Rates: With a network of over 280 wholesale lenders, Wisconsin veterans get some of the lowest VA mortgage rates.

- Speedy, Straightforward Process: Our team excels at getting VA loans approved when others can’t.

- We fast-track underwriting so you can see “clear to close” in record time.

- Trusted Nationwide: Gustan Cho Associates has successfully guided veterans across the U.S.

- We’re honored to assist Wisconsin heroes who have faced multiple “no” answers.

VA Loan Advantages in Wisconsin

- 100% Financing: VA loans let veterans borrow the total purchase price—no down payment needed.

- No Monthly PMI:While FHA and conventional loans charge monthly mortgage insurance, VA loans don’t, which saves veterans serious cash every month.

- Credit Flexibility: VA loans accept lower scores and can overlook past bankruptcies or foreclosures.

- Lower Interest Rates: Because the federal government backs VA loans, we can offer interest rates that often beat conventional loan terms.

How to Qualify for a VA Loan in Wisconsin

Basic Eligibility Steps

- You must be a qualified veteran, currently serving, in the National Guard, or a reservist.

- Bring a valid Certificate of Eligibility (COE).

- You must use the home as your main residence.

Financial Guidelines

- The VA does not set a minimum credit score.

- Debt-to-income limits are flexible; we look mainly at the borrower’s leftover monthly income.

- There’s no set cap on loan amounts; we focus on what the borrower’s income and credit can support.

Denied Elsewhere? We Can Help

We’re known nationwide for helping veterans qualify for mortgages.

Gustan Cho Associates: Your VA Lending Partner in Wisconsin

Many Wisconsin vets don’t know that Gustan Cho Associates exists to make lending simple and fast, with no overlays. We’ll probably say yes if a bank or a different lender has turned you away because of credit, DTI, or other guidelines.

Our purpose is clear: We help vets buy homes using the benefits they earned in the service.

FAQs – Wisconsin VA Mortgage Lenders

What Sets Gustan Cho Associates Apart From Other Wisconsin VA Lenders?

We give you VA loans with no extras. The only rules we use are the VA’s. If the VA gives you the green light, we can usually finish your loan.

Is a Down Payment Required for VA loans in Wisconsin?

No way. VA loans let you finance the whole price, so you don’t have to bring cash for a down payment.

Can I Get Approved With Bad Credit?

Yes, you can. The VA does not require a minimum credit score. Gustan Cho Associates has helped many veterans with scores below 600 get approved.

Do VA loans Have PMI?

VA loans have no monthly PMI, which lowers your monthly payment.

How Soon After Bankruptcy or Foreclosure Can I Get a VA Loan?

You can typically get a VA loan two years after bankruptcy and two years after foreclosure, as long as your current credit and repayment history look good.

What is Residual Income, and Why Does VA Care?

Residual income is the money you have left after your big bills are paid. VA uses this number to ensure you have enough monthly money to cover living costs without being stretched too thin.

Can I Use a VA Loan to Buy a Second Home or An Investment Property in Wisconsin?

No, VA loans are only for your home as your primary residence.

What is The VA Funding Fee?

The funding fee is a one-time charge that helps fund the VA loan program. You can add it to your loan amount, and most disabled veterans do not have to pay it.

How Do VA Mortgage Rates Compare in Wisconsin?

VA mortgage rates are usually lower than those for FHA or conventional loans. Since we tap into wholesale pricing, lenders like Gustan Cho Associates offer even better deals.

Can Gustan Cho Associates Close VA Loans Faster Than the Competition?

Absolutely. We focus solely on VA loans and do not have extra rules that delay the process. Most of our VA loans close in 30 days or less.

Final Thoughts

If you’re a veteran or active duty service member in Wisconsin, don’t let extra lender rules hold you back from owning a home. Gustan Cho Associates provides VA loans without overlays and offers some of the sharpest rates on the market.

We’ve built a national name for getting mortgages approved when others can’t or won’t. While others say “no,” we keep saying “yes.”

Ready to make it happen? Call Gustan Cho Associates today to learn how much home you can buy using the VA benefits you earned.

Wisconsin VA Mortgage Lenders Who Are Experts in VA Loans For Bad Credit and Borrowers with Credit/Income Issues

Again, over 80% of our borrowers at Gustan Cho Associates are homebuyers who could not qualify at other lenders. A large percentage of our borrowers are folks who could not qualify for a VA loan at other Wisconsin VA mortgage lenders. When you get issued a pre-approval from Gustan Cho Associates, you will not just close, but will close on time.

If you need to qualify for a VA loan in Wisconsin, please contact us at gcho@gustancho.com or call us at 800-900-8569. Gustan Cho Associates has a national reputation of being able to do loans other lenders cannot do.

Text us for a faster response. The team at Gustan Cho Associates does not believe in banker hours. The team at Gustan Cho Associates is available 7 days a week, in the evenings, on weekends, and on holidays.

Your VA Benefits, Fully Unlocked

Don’t let strict rules hold you back—we approve loans other lenders can’t.