In this detailed guide, we’re going to dive into everything you need to know about getting an FHA loan in Montana, especially if you’re looking for a way to buy a home with a small down payment, minimal to no closing costs, even if your credit isn’t perfect, your credit score’s on the lower side, or you’re carrying a high debt compared to your income.

Since 2022, the experts at Gustan Cho Associates have also offered their expertise in the beautiful state of Montana.

So, if you’re thinking about buying your first home, moving, or even planning your retirement in Montana, this article is designed to help you get familiar with the benefits and process of securing an FHA loan in the Treasure State. Whether you’re just starting out, looking for a new start, or seeking the perfect retirement spot, understanding how an FHA loan in Montana can work for you is important.

Why Montana?

Montana‘s population has been growing since late 2019 due to its majestic mountains, clean air, and better quality of life. The state offers many outdoor activities and is a haven for nature lovers. This surge in population has driven up home prices, but Montana still offers great value compared to many other states. Montana has various wildlife, including grizzly and black bears, bighorn sheep, wolves, bison, and beautiful birds like bald eagles and mountain bluebirds.

Bad Credit? You Can Still Qualify for an FHA Loan in Montana!

Contact us today to see how you can qualify for an FHA loan and start your journey to homeownership in Montana.

Is Montana a Good Place to Buy a Home?

Are you considering buying a home? You might find Montana intriguing. Known not just for its breathtaking landscapes but also as the top producer of talc in the world. Talc goes into many beauty products we use daily.

Once upon a time, the search for gold and silver turned parts of Montana into thriving communities, leaving behind a treasure trove of history to explore today. Those historic adventures make Montana not just a place to visit but a wonderful place to call home.

Additionally, if you’re considering financing options, you’ll be pleased to know that securing an FHA loan in Montana could be a viable route. This type of loan is popular among first-time homebuyers for its lower down payment requirements, making the dream of homeownership more accessible. So, from its scenic views to historical richness and favorable financing options like the FHA loan, Montana stands out as a fantastic location to purchase your next home.

Why Are Homes in Montana So Expensive?

Why do houses in Montana cost so much? Like many places, Montana’s home prices have shot up because many people want to buy homes, but there aren’t enough homes for sale. Even though prices are increasing, living in Montana can still be more affordable than in many other parts of the country.

If you’re thinking of buying a home here, considering an FHA loan in Montana could be a smart move. It’s a type of mortgage designed to help first-time homebuyers or those who might not have a huge down payment saved up. Locking in a 30-year fixed mortgage, especially with an FHA loan, can be a good way to protect yourself from rent increases and inflation, making your monthly housing costs more predictable.

Renting vs. Buying a Home in Montana

Homeownership is a great way to build wealth. When you own a home, your monthly payments build equity over time. In contrast, renting means you are subject to rent increases and do not build equity. With a fixed-rate mortgage, your payment stays the same (except for changes in taxes and insurance), helping you manage your budget better.

How to Buy a House in Montana If You Are Living in Another State

Are you looking to move to Montana, even if you’re currently living in another state? Montana has it all—breathtaking landscapes, a booming economy, low taxes, and homes that won’t break the bank. It’s no wonder folks from all corners are setting their sights here.

Need a hand navigating this big move? Gustan Cho Associates has got your back. They’re pros at juggling selling your old place with snapping up your dream home in Montana.

Considering an FHA loan in Montana? You must start your new gig and show pay stubs from the first two weeks. But if you’re eyeing a conventional or VA loan instead, things are a bit more relaxed. For starters, an offer letter for your soon-to-be job will do just fine, and you can follow up with those pay stubs within 60 days of settling in.

So, whether it’s the vast, open skies or the welcoming communities that have you longing for Montana, leaping doesn’t have to be complicated. We’re here to help make your Montana dream a reality.

Buying a Primary Home in Montana for Retirement

Montana is becoming a popular retirement destination due to its beauty and quality of life. Many homebuyers purchase a second home in Montana with plans to make it their primary residence upon retirement. Gustan Cho Associates offers various loan programs for buying second homes, including no-doc loans, stated-income loans, and asset depletion loans.

The Best Mortgage Program for Montana Homebuyers

Gustan Cho Associates is an expert in no-overlay lending. Our team is here to help you with FHA mortgage loans, which are popular due to their low down payment options and more lenient credit requirements. FHA loans were made to help people with lower credit scores get approved and prevent them from spending too much money each month.

Why Use an FHA Loan in Montana?

Considering an FHA loan in Montana can be a smart choice for many reasons, and here’s why it stands out against other mortgage options:

- Low Downpayment Options: If your credit score hits 580, you only need to put down 3.5%. This is a relief compared to other loans that might ask for more upfront.

- Low Credit Score Requirements: Got a credit score of 500? That’s okay! FHA loans are more understanding and allow you to qualify even with lower scores.

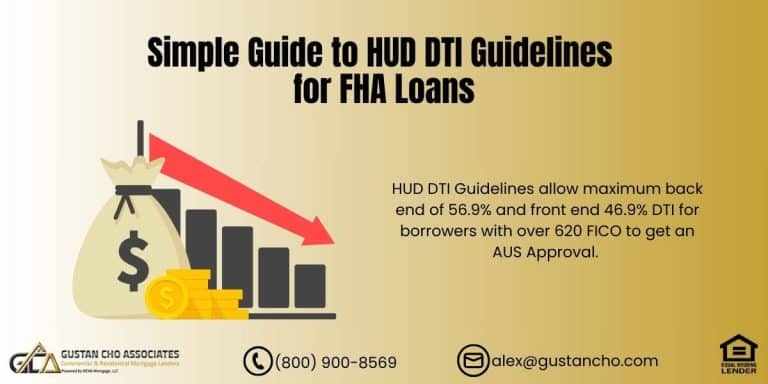

- Higher Debt-to-Income Ratios: With an FHA loan in Montana, you can breathe easier if you have other debts. They allow higher debt-to-income ratios than what you’d typically see with conventional loans. This means even if you’re carrying some debt, you might still be able to get your dream home.

- Lenient Guidelines: We all know life happens – a rough patch can lead to bankruptcy, foreclosure, or maybe just a couple of late payments. FHA loans in Montana are known for not holding those against you as much. They offer more lenient guidelines, which can be a big help.

Choosing an FHA loan in Montana can open doors for you, especially if you’re worried about your credit score or don’t have a huge chunk of money for a down payment. It’s designed to be more accessible and forgiving, making the dream of home ownership a reality for many.

Bad Credit in Montana? FHA Loans Make Homeownership Possible!

Contact us today to explore your options and get pre-approved for a home loan in Montana.

Common Myths about FHA Loans

There are plenty of myths floating around about FHA loans that aren’t true. Some folks think FHA loans don’t stack up against other types of mortgage programs, but that’s not accurate.

While it’s true that taking out an FHA loan in Montana means you’ll need to pay for mortgage insurance, these loans often come with lower interest rates compared to conventional loans.

This means that even after you factor in the cost of mortgage insurance, your monthly payment could still be lower than what you’d pay with another type of loan. It’s all about looking at the big picture and understanding the real benefits FHA loans offer, especially in places like Montana.

What Credit Score is Needed for an FHA Loan in Montana?

Montana, one of the most recent additions to our service area at Gustan Cho Associates, is renowned for its stunning landscapes and the strong sense of community among its people. We’re experts in assisting prospective homebuyers needing a better credit history. Qualifying for an FHA loan in Montana allows a FICO score as low as 500. It’s worth noting that more than 75% of our clients have previously faced rejections from other lending institutions. So, if you’ve been turned down for a home loan before, don’t worry. We’re here to help you secure an FHA loan in Montana.

FHA Loan in Montana with a 500 FICO Score

Montana, often called the Treasure State, is an incredible place to call home. This is attributed to its breathtaking landscapes and friendly neighborhoods. Helena serves as the state’s capital, while Billings is recognized as the largest city. Despite a relatively small population of about 1.1 million folks, Montana is known for offering a high-quality life. It also boosts cost-effective housing choices.

If you want to set down roots here and are worried that your credit score might hold you back, there’s good news. With Gustan Cho Associates, securing an FHA loan in Montana is possible. You can qualify even with credit scores around the 500 FICO mark. This means even if your credit isn’t perfect, you can still find a way to own your dream home in this beautiful state.

Mortgage Rates on FHA Loans in Montana

When looking into buying a house in Montana, you might hear a lot about FHA loans. These special kinds of loans are often praised because they usually have lower interest rates than traditional loans. The thing about an FHA loan in Montana is that it comes with mortgage insurance that is typically cheaper than what you’d pay with a conventional loan.

Specifically, the mortgage insurance rate for an FHA loan is about 0.85%. But, if you can make a down payment of 5% or more, this rate can drop to 0.8%. FHA loans are a great option for many homebuyers because they can help you save money.

Qualify for an FHA Loan in Montana Even with Bad Credit

At Gustan Cho Associates, we’re all about making FHA loans simple and accessible, even if your credit isn’t perfect. What sets us apart? We don’t add extra hurdles. We adhere strictly to the FHA’s guidelines without tacking on additional requirements. You must make a 3.5% down payment if your credit score is 580 or higher.

And why are more and more folks choosing Montana? It’s all about getting more bang for your buck – lower taxes, affordable homes, and a lifestyle that can’t be beaten. So, if you’re thinking of an FHA loan in Montana, we’re here to help you make that move without the stress of high credit expectations.

Applying for an FHA Loan in Montana

Getting an FHA loan in Montana is straightforward when you go through Gustan Cho Associates. Just call us at (800) 900-8569 or email us at alex@gustancho.com. Our friendly team is here to walk you through each step and clear up any questions. When you’re ready, you’ll just need to have a couple of things on hand:

- We need your Driver’s License so we can authenticate your identity.

- Your pay stubs from the last 30 days so we can see your current earnings.

- Your bank statements for the past 60 days to check your financial standing.

- The tax returns you filed in the last two years to give us a bigger picture of your financial history.

- And, if you have them, W2s or 1099s from the last two years to further support your application.

Getting an FHA loan in Montana doesn’t have to be complicated. We’re here to make sure your experience is as smooth as possible!

Bad Credit? Let’s Help You Qualify for an FHA Loan in Montana!

Reach out now to find out how we can help you secure the home of your dreams.

How to Qualify and Get Pre-Approved for an FHA Loan in Montana

Qualifying and getting pre-approved for an FHA loan in Montana starts when you send us your loan application and any necessary documents. Once we have your paperwork, we will check your credit by obtaining a report that pulls together information from the three main credit bureaus.

If everything looks good and you meet our requirements, we’ll send you a letter that says you’re pre-approved for an FHA loan in Montana. This is a big step in showing sellers you’re serious and ready to buy.

Now, if we notice any issues with your credit report or if any of the documents you provided need further clarification, don’t worry. We will be right there to advise you on what steps to take next to fix those issues. We are here to help you get across the finish line and qualify for your loan as smoothly and quickly as possible.

Boosting Your Credit to Qualify for an FHA Loan in Montana

If your credit score isn’t where it needs to be, we’re here to help you improve it. This process can include paying off existing debts, fixing any mistakes that might appear on your credit report, or starting new lines of credit responsibly. Our main goal is to assist you so that you can get approved for an FHA loan in Montana, making it possible for you and your family to buy the perfect home.

Ready to Find Your Home with an FHA Loan in Montana? Here’s What to Do Next

After getting your pre-approval letter for an FHA loan in Montana, it’s time to get into the exciting part – looking for your new home! Working closely with a real estate agent, you’ll enter Montana’s bustling real estate scene. It’s a hot market out here, and houses can get snapped up quickly, often leading to bidding wars. But don’t worry; we’re with you at every turn to make sure you navigate through these steps smoothly and land the home that’s just right for you.

Getting the Winning Bid on a Home Purchase Offer in Montana

In today’s competitive housing market, especially if you’re looking into an FHA loan in Montana, it’s not unusual to find yourself caught in the middle of a bidding war. But don’t worry; we’re here to guide you through making a compelling offer that can help you stand out. We aim to increase your chances of winning and securing the home you’ve set your heart on. Through simple, straightforward advice, we’ll assist you in understanding the nuances of making a strong purchase offer, ensuring you feel confident and informed every step.

The Mortgage Approval Process

After you’ve agreed to buy a house, the journey to getting your mortgage starts. We’ll get a professional to evaluate the house’s value, ensuring it’s fair, especially if you’re going for an FHA loan in Montana. This is an important step in the process.

Then, we’ll pass your file to our team of experts, who will look closely at all your paperwork. They might ask for a few more documents from you to ensure everything is right.

During this phase, we’re working hard to cross the T’s and dot the I’s. Once we’ve dotted all the I’s and everything checks out, you’ll be ready to move forward. We’ll let you know that you’re officially approved to close on your home, which means you’re one big step closer to holding the keys in your hand.

Clear to Close on an FHA Loan in Montana

Getting the green light for a clear to close on an FHA loan in Montana is a big moment. It means you’re all set to wrap up the buying process of your new home. The next step involves meeting with the title company to sign all the necessary paperwork. Once that’s done, the keys to your dream home are handed over to you. This step is particularly thrilling if you’re buying a home for the first time. It’s a simple path to becoming a homeowner, especially with the benefits of an FHA loan.

Can I Buy a House with an FHA Loan in Montana with Collections?

Yes, you can! Homebuyers can qualify for an FHA loan even if they have collections and charged-off accounts. You do not need to pay off these accounts to qualify. At Gustan Cho Associates, we understand that life happens, and we are here to help you get approved for an FHA loan despite past credit issues.

The Best FHA Mortgage Lenders in Montana for Low Credit Borrowers

Gustan Cho Associates is excited to offer our services in Montana. If you or someone you know is searching for an FHA loan in Montana, please get in touch with Alex Carlucci at (800) 900-8569. We are available seven days a week to answer your questions and help you through the mortgage process. Even if you have been turned down by other lenders, we can help.

Final Thoughts

Qualifying for an FHA loan in Montana is possible even with low credit scores, past collections, or high debt-to-income ratios. At Gustan Cho Associates, we are committed to helping you navigate the mortgage process and find the right loan for your needs. Whether buying your first home, relocating, or planning for retirement, we are here to assist you every step of the way. Contact us today to start your journey to homeownership in Montana.

FAQs: Bad Credit? Get an FHA Loan in Montana Today

- 1. What is an FHA loan, and how does it work in Montana? An FHA loan in Montana is a form of mortgage that the Federal Housing Administration insures. It is designed to assist homebuyers with low down payment savings and who may need better credit. It’s a popular choice for first-time homebuyers and those with lower credit scores.

- 2. Can I qualify for an FHA loan in Montana with bad credit? Absolutely! In Montana, you can be eligible for an FHA loan, even if you have a low credit score. Gustan Cho Associates can help you get approved, even if your FICO credit score is as low as 500.

- 3. What minimum credit score is needed for a Montana FHA loan? The lowest acceptable credit score for an FHA loan in Montana is 500 FICO. Having a higher score can facilitate the process and provide better terms.

- 4. How much down payment is required for an FHA loan in Montana? In Montana, if your credit score is 580 or higher, you can get an FHA loan with a down payment of just 3.5%. If your score is between 500 and 579, you will need a 10% down payment.

- 5. Can I get an FHA loan in Montana if I have collections or charged-off accounts? You can qualify for an FHA loan in Montana even if you have collections or charged-off accounts. You don’t need to pay these off to be eligible.

- 6. How do I apply for an FHA loan in Montana? Applying for an FHA loan in Montana is simple. Contact Gustan Cho Associates at (800) 900-8569 or email alex@gustancho.com. We will guide you through the process and help you gather the necessary documents.

- 7. Can I buy a home in Montana if I live in another state? Yes, you can buy a home in Montana even if you live in another state. Gustan Cho Associates can help you navigate the process, including using an employment offer letter for your new job in Montana.

- 8. Why are homes in Montana expensive, and how can an FHA loan help? Montana residences have a hefty price tag because of the abundant demand and scarce supply. With an FHA loan, potential homeowners can benefit from low down payment choices and less strict credit criteria, thus increasing access to homeownership.

- 9. Is it better to buy or rent a home in Montana? When you buy a home in Montana, you can build equity over time, making it a better option than renting. With a fixed-rate FHA loan, your monthly payments stay the same, unlike rent, which can increase.

- 10. What are the benefits of using an FHA loan in Montana? The benefits of using an FHA loan in Montana include low down payment options, lower credit score requirements, higher debt-to-income ratio allowances, and more lenient guidelines for past credit issues.

If you have any questions about an FHA loan in Montana, please call or text us at 800-900-8569. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about “Bad Credit? Get an FHA Loan in Montana Today” was updated on August 6th, 2024.

Bad Credit? FHA Loans in Montana Are Still Within Reach!

Contact us now to discuss how an FHA loan can help you qualify for homeownership in Montana.