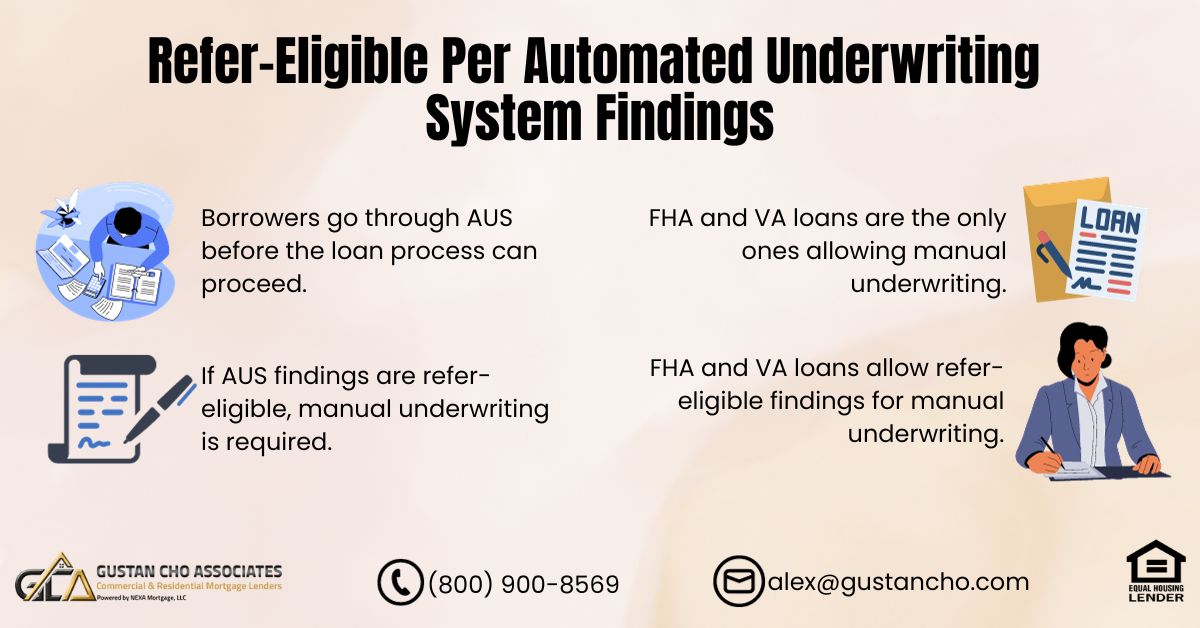

This article will cover and discuss refer-eligible per automated underwriting system findings. All mortgage loan applicants need to go through the automated underwriting system (AUS) before the loan process can proceed. If the findings on the automated underwriting system render an approve/eligible, that means the AUS approves the borrower. There are three decisions the automated underwriting system will render:

The Three Automated Findings from AUS

The automated underwriting system has three different types of findings. Approve/eligible per automated underwriting system: Approve/eligible per AUS means the file has an automated approval and is ready. The second type of AUS findings is a refer-eligible per automated underwriting system: Refer-eligible means the automated underwriting system finds the mortgage loan applicant eligible but cannot render an automated underwriting system approval and needs to be manually underwritten. Refer with Caution: Refer with caution means the file has been denied, and the borrower does not qualify for a mortgage. FHA and VA loans are the only two mortgage programs that allow manual underwriting. In later paragraphs, We will explore how manual underwriting works in this blog.

Speak With Our Loan Officer for Getting Mortgage Loans

Understanding Refer-Eligible Per Automated Underwriting System

Refer-Eligible Per Automated Underwriting System indicates that the Automated Underwriting System cannot provide approval based on automated findings. If the borrower receives refer-eligible findings from the automated underwriting system, they qualify for a manual underwrite. Manual underwriting involves additional scrutiny and analysis by a mortgage underwriter.

Lender Overlays on Refer-Eligible Per Automated Underwriting System Findings

Borrowers with refer-eligible outcomes in automated underwriting system findings may face challenges in obtaining approval from most banks or mortgage companies. In cases where a mortgage loan file is flagged as refer-eligible per the automated underwriting system, manual underwriting becomes an alternative option. Manual underwriting follows specific guidelines, but it’s important to note that not all lenders engage in this process. During manual underwriting, underwriters assess compensating factors, which are positive elements that favor the borrowers.

Importance of Compensating Factors on Manual Underwriting

An example of a compensating factor is the payment shock. Payment shock is how underwriters determine the factor of what they are paying for rent currently to what the new housing payment will be when they close on their home purchase.

Other examples of compensating factors a borrower can have are larger down payments. A larger down payment on a home purchase shows that the home buyer has skin in the game.

A larger down payment means the lender has less risk because the borrower has skin in the game. Most homeowners will do everything possible not to default on their mortgage if they have a lot of equity in their homes. One month’s reserves are required on all manual underwriting. However, if the borrower has three or more months in reserves, lenders will consider that a strong compensating factor.

Speak With Our Loan Officer for Getting Mortgage Loans

Refer-Eligible Per Automated Underwriting System: Reserves

Reserves are one-month P.I.T.I. P.I.T.I. stands for principal, interest, taxes, and insurance. Mortgage lenders like to see at least three months of reserves from home buyers which is a great compensating factor. Reserves do not have to be cash. Asset accounts are reserves such as the following:

- IRA accounts

- 401k Accounts

- Securities Accounts

- Other types of liquid investment accounts can go toward reserves

Refer-Eligible Per Automated Underwriting System Versus Approve Eligible Per AUS

As long as borrowers meet the minimum federal mortgage guidelines, borrowers should get an approve eligible per Automated Underwriting System. Let’s take a case scenario on an FHA loan. Borrower should get an approve eligible but gets a refer eligible per Automated Underwriting System, so the file needs to be manual underwriting. The minimum FHA mortgage lending guideline for borrowers is a 580 credit score to qualify for a 3.5% down payment FHA home purchase mortgage loan. The maximum debt-to-income ratio required for borrowers with credit scores under 620 may be lowered to a 43% debt-to-income ratio if the AUS sees the borrower has layered risk due to lower credit scores.

Talk To Our Loan Officer FHA Loans, Click Here

Gift Fund Guidelines on Refer-Eligible Per Automated Underwriting System Findings

HUD permits using 100% gifted funds for the down payment when purchasing a home. FHA does not mandate a specific minimum number of active credit tradelines, although having seasoned credit tradelines is viewed positively and regarded as a compensating factor.

Verification of rent is typically required when the mortgage loan borrower has credit scores below 600 or under specific conditions outlined by the Automated Underwriting System (AUS).

While meeting these requirements usually results in an approve-eligible status per automated findings for FHA mortgage loan applicants, it is not guaranteed. In some instances, applicants meeting all federal minimum mortgage lending guidelines may receive a refer-eligible status from the Automated Underwriting System due to perceived multiple layers of risk associated with the borrower.

Is It Possible To Get a Refer-Eligible Per Automated Underwriting System Converted To an Approve Eligible?

Certainly, the response to this inquiry is affirmative. This practice is a routine occurrence. Seasoned mortgage loan originators routinely examine whether they receive a refer-eligible outcome from automated findings, aiming to restructure the details to attain an approve-eligible result. The loan officer’s initial step involves a meticulous review of the automated findings, pinpointing the reasons for receiving a refer-eligible status rather than an approve-eligible one.

Automated Underwriting System Decides Conditions on Gift Funds and Other Risk Factors

In numerous instances, when dealing with mortgage applicants who only marginally satisfy the federally mandated mortgage lending criteria, automated findings often disfavor the use of gifted funds for the down payment when purchasing a home.

Simply eliminating the gift funds and utilizing the borrower’s funds has the potential to transform a refer-eligible status into an approve-eligible one.

Another scenario where a refer-eligible outcome can be converted to approve-eligible is incorporating additional assets into the borrower’s application. The automated system views reserves as significant compensating factors, especially when the borrower barely meets the obligatory minimum guidelines. Increasing the amount of assets can shift the finding from refer-eligible to approve-eligible.

Click Here For Finding Refer-Eligible To Approve-Eligible

FHA and VA Loans Allow Refer-Eligible Per Automated Underwriting System Findings For Manual Underwriting

Individuals in this category will receive a referral eligibility based on the Automated Underwriting System (AUS). Direct lenders, such as myself, proficient in manual underwriting, can process these files. It’s important to note that not all lenders are equipped to handle manual underwriting.

It is crucial to ensure that a mortgage lender can conduct manual underwriting, especially for individuals with a Chapter 13 Bankruptcy discharge.

In situations where the automated system findings are rigid and unyielding on referral eligibility, the only avenue to secure approval for a home loan through manual underwriting is to obtain a referral eligibility per the Automated Underwriting System, ensuring it is not marked as “refer/caution.”

How To Start The Pre-Approval Mortgage Process

Homebuyers must qualify for a mortgage company licensed in 48 states with over 160 wholesale lenders. We have a national reputation for having dozens of wholesale lending relationships with lenders with no overlays. If you have any questions about getting pre-approved and qualified for a mortgage, contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. We have no overlays on FHA, VA, USDA, and Conventional loans. We are also experts in non-QM and alternative lending programs. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

FAQs about Refer-Eligible Per Automated Underwriting System Findings

What is an Automated Underwriting System (AUS)? An Automated Underwriting System (AUS) is a computerized program used by mortgage lenders to assess a borrower’s creditworthiness and determine if they qualify for a mortgage loan.

What are the three types of findings from the AUS? The AUS provides three types of findings:

- Approve/Eligible: This means the borrower has received automated approval and is ready to proceed with the loan process.

- Refer-Eligible: This indicates that while the borrower is eligible for a mortgage, the AUS cannot provide automated approval, and manual underwriting may be necessary.

- Refer with Caution: This finding suggests that the borrower does not qualify for a mortgage and has been denied.

What does “Refer-Eligible Per Automated Underwriting System” mean? “Refer-Eligible Per Automated Underwriting System” signifies that the AUS cannot provide approval based on automated findings. Borrowers with this outcome may qualify for manual underwriting.

How do lenders handle refer-eligible outcomes from the AUS? Lenders may have overlays on refer-eligible outcomes, making it challenging for borrowers to obtain approval. Manual underwriting, where a mortgage underwriter assesses the application manually, becomes an alternative option.

What are compensating factors in manual underwriting? Compensating factors are positive elements that favor borrowers during manual underwriting. These may include larger down payments, payment shock considerations, and reserves, among others.

How are reserves evaluated in manual underwriting? Reserves are crucial in manual underwriting, typically equivalent to one month’s PITI (Principal, Interest, Taxes, and Insurance). Having at least three months of reserves, including assets like IRA or 401(k) accounts, strengthens the borrower’s application.

Can a refer-eligible outcome be converted to approve-eligible? Yes, it’s possible to convert a refer-eligible outcome to approve-eligible. Mortgage originators often review the reasons for the refer-eligible status and may adjust details such as using gifted funds or incorporating additional assets to meet the criteria.

Which loans allow refer-eligible outcomes for manual underwriting? FHA and VA loans are among the few mortgage programs that permit refer-eligible outcomes for manual underwriting. Not all lenders are equipped to handle manual underwriting, so finding a lender experienced in this process is essential.

How can borrowers start the pre-approval mortgage process? To begin the pre-approval mortgage process, borrowers can contact licensed mortgage companies like Gustan Cho Associates. They provide services in 48 states and offer various loan programs with no overlays, including FHA, VA, USDA, and conventional loans.

This blog about Refer-Eligible Per Automated Underwriting System Findings was updated on January 29th, 2024.

Need to refi to pay off outstanding tax debt, rehab and then sell. Home has been in family for 50yrs. Currently in Ch 13 BK Adversary. Need loan commitment in writing by 8/17/2021.