VA loans residual income requirements and guidelines state borrowers can qualify for VA loans with a high debt-to-income ratio as long as they have a high VA residual income. The U.S. Veterans Administration, commonly called the VA, is the federal agency governing VA loans. Dale Elenteny, a senior loan officer who has helped hundreds of veterans with credit scores down to 500 FICO qualify and get approved for VA loans explains the role of the Veterans Administration:

The Veterans Administration is not a lender. The responsibility is not to originate, process, underwrite, and fund VA loans. Private lenders designated and approved by the VA originate, process, underwrite, and fund VA loans.

Lenders can offer 100% with no mortgage insurance at competitive low mortgage rates on VA loans due to the government guarantee against loss or foreclosure on VA loans. VA loans have no maximum debt-to-income ratio cap on VA loans. We go off the automated underwriting system (AUS) findings. It is possible for borrowers with over a 60% debt-to-income ratio to get an approve/eligible per automated underwriting system as long as they have sufficient residual income.

What Is VA Loans Residual Income?

What is the VA loans residual income? VA loans residual income is the discretionary monthly income the borrower has left over after paying all the monthly mortgage payments and all other household bills. The monthly residual income required on VA loans depends on the county and state, the loan amount, and the household size. This article will discuss the importance of VA loans residual income requirements.

VA loans residual income test is very important because it determines borrowers’ residual income after paying all their minimum monthly bills, including the proposed mortgage payment.

VA loans have lenient mortgage guidelines. There is no maximum debt-to-income ratio on VA loans. Gustan Cho Associates have approved and closed VA loans with over 60% debt-to-income ratio. As long as you have strong residual income on VA loans, you can get an approve/eligible per the automated underwriting system on VA loans. VA Home Loans is the best loan program for owner-occupant home buyers.

VA Loan Approval Starts With Residual Income—Do You Qualify?

Check Your VA Residual Income Now! Apply Now And Get recommendations From Loan ExpertsWhat Does The VA Provide For Veterans?

One frequently asked question at Gustan Cho Associates is, what does the VA provide for veterans? The U.S. Department is a giant federal agency. The Veterans Administration’s main role and priority is to provide a wide variety of benefits to every veteran of the U.S. Armed Services. Tim Cho, an active duty veteran and staff sergeant of the U.S. Army, advises the role of the Veterans Administration as follows:

Some of the benefits available to veterans are disability benefits which include monetary awards, disability benefits, pension veterans, the management of all VA hospital and medical benefits, the Veteran Readiness program, employment, burial, and last but not least, administering VA home loans.

One of the main roles of the VA is to create and launch VA agency mortgage guidelines for VA loans. Veterans Affairs is in charge of administering the VA loan guarantee program on VA loans.

What Role Does The Veteran Administration Play In a VA Loan?

Another frequently asked question is, what role does the Veterans Administration play in a VA loan? In general, the role of the VA is to provide benefits to active duty, retired veterans, and spouses of eligible deceased veterans in various fields.

VA is not a lender. The Veterans Administration is a federal mortgage insurance to private lenders and financial institutions who originate, process, close, and service VA home loans.

One of the most important roles of the VA is the administration of financing housing to eligible veterans and surviving spouses of eligible deceased veterans. The main role of the VA with VA loans is to guarantee lenders who originate, process, underwrite, close, and service VA home loans. In this blog, we will discuss VA loans and the VA residual income guidelines.

How Does The Veteran Administration Insure Private Lenders on VA Loans?

The Veterans Administration acts as a large mortgage insurer for private lenders. The VA insures and partially guarantees lenders against losses sustained by homeowners who default and foreclose on the VA loans. Lenders can offer 100% financing, with lenient lending requirements, at competitive rates on VA loans, advises Sonny Walton, a dually realtor and loan officer at Gustan Cho Associates:

As long as the lender has followed VA agency lending guidelines on VA loans, the VA will step in and partially guarantee the loss sustained by the lender on the VA loan.

However, not all borrowers can qualify for VA Loans. VA Mortgages are for eligible active-duty, retired, or surviving spouses. To qualify for VA Loans, borrowers need a valid Certificate of Eligibility from the VA. Our loan officers can help with the paperwork to obtain the COE. VA Loans are for primary owner-occupant one to four-unit homes only. VA does not allow for second homes and investment property financing.

What Is A VA Loan and How Does It Work?

As mentioned in the previous paragraph, VA loans are the best home mortgage program in the nation. There is no other home mortgage program than VA loans. The U.S. government created VA loans to reward the brave men and women of the U.S. Armed Services who served this country voluntarily. The U.S. government wants to reward our servicemen and women by making it possible to make the dream of homeownership a reality with no down payment and no mortgage insurance at better rates than conventional loans.

What Is Special About VA Loans Versus Other Mortgage Options?

VA agency guidelines are more lenient than any other government or conventional loans. Not all members who served in the U.S. Military can qualify for VA loans. Only eligible active or retired United States Armed Services members who have earned a certificate of eligibility (COE) qualify for VA loans. VA loans are the only home mortgage program that does not have a minimum credit score requirement. VA does not have a maximum debt-to-income ratio cap as long as the borrower has an approve/eligible per automated underwriting system (AUS).

VA Loan Requirements For 500 Credit Score Homebuyers

The key to getting an approve/eligible per automated underwriting system on VA loans with credit scores down to 500 FICO is to have been timely on all monthly payments in the past 12 months. 24 months of timely payments are required on manual underwrites. When researching mortgage lenders, make sure the lender has no lender overlays on VA loans, advises Ethel Matthews, a dually licensed realtor and loan officer at Gustan Cho Associates:

Overlays are additional mortgage lending requirements implemented by individual lenders above and beyond the VA. This is why most lenders require minimum DTI requirements, such as 41% to 50%. Gustan Cho Associates is a national mortgage company licensed in multiple states with no overlays on VA Loans.

The trick in getting an approve/eligible per automated underwriting system with a high debt-to-income ratio is to have a high residual income. Borrowers with strong residual income can get an approve/eligible per AUS with a debt-to-income ratio over 60% DTI. Gustan Cho Associates is a five-star national mortgage company licensed in multiple states with no lender overlays on VA loans.

VA Loan Eligibility Requirements To Qualify For Pre-Approval

This section will discuss and cover the many benefits of VA loans versus other home mortgage programs. The main benefits of VA loans are 100% financing which means no down payment on a home purchase. There are no closing costs with seller concessions or lender credit. VA loans have lower mortgage rates than conventional loans—no annual mortgage insurance premium. Dale Elenteny explains the many benefits of VA loans as follows:

No minimum credit score requirements. No maximum debt-to-income ratio requirements. Upfront VA funding fee can be rolled into the VA Loan Balance. As of January 2020, there are no more maximum loan limit caps on VA loans. The maximum loan limit was $548,250 until the maximum cap on VA loans was removed.

Before eliminating the maximum VA loan limit, for purchases over $647,680, buyers needed to put 25% on the overage of the $647,680—very lenient credit guidelines. Borrowers can qualify for VA Loans 2 years after bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale. Borrowers passing the VA residual income test can exceed DTI by over 60%. In this blog, we will discuss the importance of the VA residual income test for borrowers with high debt-to-income ratios.

Buying With a VA Loan? Know Your Residual Income Requirement

Start Your VA Loan Application With Confidence!How Can I Qualify For VA Loans With High Debt-To-Income Ratios

VA loans do not have a maximum debt-to-income ratio cap as long as the borrower can get an approve/eligible per automated underwriting system (AUS). As long as the borrower has sufficient residual income, the automated underwriting system will render an approve/eligible per AUS. There are no maximum debt-to-income ratio caps on VA loans, says Mike Gracz of Gustan Cho Associates, Inc.

The Department of Veterans Affairs (VA) has no maximum debt-to-income ratio requirements. Most lenders have additional mortgage guidelines on VA loans called lender overlays.

We have approved and closed countless borrowers with credit scores in the 500s and debt-to-income ratios higher than 60%. However, an approved/eligible per automated underwriting system is required, and borrowers must meet the VA residual income test.

What Does VA Loans Residual Income Mean?

Many folks get VA residual income confused with debt-to-income ratios. VA residual income is consumers’ leftover money after paying all the monthly minimum payments, including the proposed housing payments. Residual income on the VA loans test needs to be met by borrowers. The minimum residual income depends on the number of family members.

How Do You Calculate Residual Income on VA Loans?

Another frequently asked question on VA loans is how to calculate VA residual income. Residual income on a VA loan is very simple. Residual income is left over after all the borrower’s expenses have been paid. VA residual income is calculated by deducting all monthly debt payments that make up your debt-to-income ratio. Alex Carlucci of Gustan Cho Associates is one of our top loan experts on VA loans.

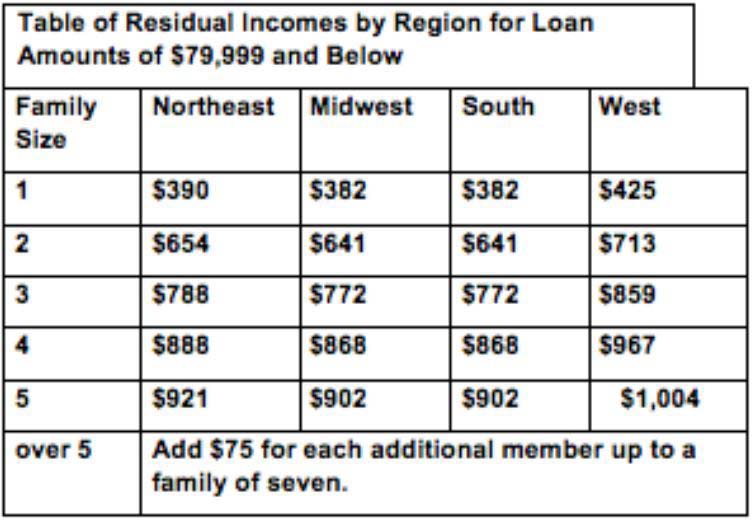

VA Residual Income Chart By Region For Loan Amounts of $79,999 and Below

Here is the Residual Income Chart:

VA Loans Residual Income Table By Broken Down By Region

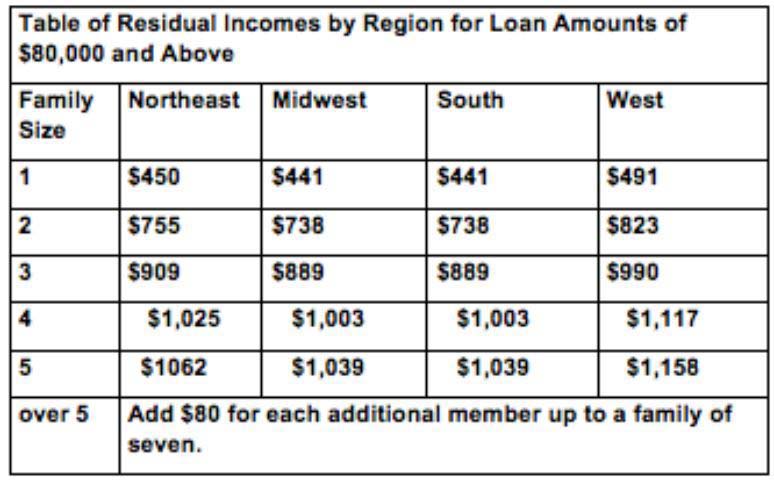

For borrowers with a higher than $80,000 household income, the following chart explains the VA Residual Income Requirements:

Do All Lenders Have Different Requirements for VA Loans?

Over 80% of our borrowers at Gustan Cho Associates are folks who either got a last-minute mortgage denial or could not qualify for a VA loan due to the lender’s lender overlays. As long as borrowers get an approve/eligible per the automated underwriting system (AUS), we are ready to approve and close the loan. We do not just close your VA Loans; rest assured that we will close them on time.

What Does VA Loans Residual Income Mean?

For Borrowers, VA loans have debt-to-income restrictions that are pretty straightforward, but they also require a veteran to pass the residual income formula. Many people ask, what is residual income? John Strange, a top-producing loan officer at Gustan Cho Associates, explains VA loans residual income as follows:

Residual income helps lenders determine how much money veterans have each month after paying all their bills, including living expenses, the sum of all monthly debts, the new mortgage, and any other veteran expenses.

If you are applying for a VA loan with another lender, I challenge you to ask your loan officer how residual income is calculated. Unfortunately, many loan officers in the industry cannot explain how residual income works concerning a VA loan.

What Happens If VA Residual Income or DTI Does Not Meet The Requirements?

They may issue you a pre-qualification letter based on your debt to income, and then once you start the process, you may not pass the residual income qualifications. This will instantly kill your VA loan, and you may lose your earnest money and out-of-pocket expenses such as appraisal and inspection. This is why coming to the experts at Gustan Cho Associates is important. The team at Gustan Cho Associates will walk you through the process. Call us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Gustan Cho Mortgage Group offers the TBD underwrite. Part of that is verifying borrowers’ residual income. By now, I’m sure you are asking what residual income is.

The Role of DTI To Residual Income For VA Loans

In layman’s terms, residual income is the amount of money left over after paying all your required monthly capital costs. This is also known as disposable income. Residual income is an important component of obtaining a loan. It is very similar to a back and debt-to-income ratio but is calculated differently based on the size of your family and the region you live in. Certain items, such as the size of the home, can come into effect in this calculation. This calculation is used in conjunction with other credit risk indicators, such as the following:

- loan-to-value

- reserve accounts

- credit score

- the overall credit profile of borrowers

- debt to income requirements

Passing VA Loans Residual Income Guidelines Requirements

Residual income calculations are something veteran borrowers must pass to obtain VA loans. VA loans do allow for higher debt-to-income ratios compared to conventional financing. But with debt-to-income ratios above 41%, the veteran must pass the residual income requirements by around 20%. Sonny Walton, a dually licensed realtor and loan officer at Gustan Cho Associates, explains VA loans residual income:

The VA residual income analysis helps determine the borrower’s ability to pay all of their debts, have general living expenses where they do not have to struggle financially and be able to pay their mortgage payment.

As you can see, residual income requirements are the highest in the Western region. So for this example, we will use a VA loan in California with a family size of 5 and a debt-to-income ratio of 55%. Since the debt to income is above 41%, you must aim for 20% above the requirement. Veteran borrowers will need to have $1390 in residual income. If the borrower had a lower debt-to-income ratio for the same scenario, they would need $1158 in residual income.

What Is Included in Residual Income on VA Loans?

Let’s go over one more example from the Midwest region for a veteran buying a home in Illinois with a family size of 2 and a debt-to-income ratio of 47%. The Veteran is buying a home for $200,000. It has a total mortgage payment of $1700, including taxes and insurance. Dale Elenteny of Gustan Cho Associates says the following about VA loans residual income guidelines:

Residual income is a very important factor for lenders on VA loans. Residual income on VA loans helps lenders decide whether or not the borrower has enough money and reserves for the ability to repay their new VA home loan.

The veteran must have a residual income of 20% above the requirement of $889 due to the debt-to-income ratio. In this case, that amount is $1067. Remember, the family size is two, husband and wife. Residual income, unlike debt-to-income ratios, is calculated by net income. Once again debt to income ratios are calculated from gross income, and residual income is based on take-home pay.

Veterans’ take-home pay = $4500 a month

Veterans Debts:

- Mortgage = $1700 (includes principal, interest, taxes, and insurance)

- Car payment = $300

- Credit Cards = $50

- Personal Loan =$50

DTI = 46.7% Residual income = $2190

- (the maintenance expense was calculated off a home of 2000 square feet in this example)

- In this scenario, the veteran does pass the residual income requirement

Maintenance expenses are based on the size of the home and added to the residual income calculations. As stated above, ask the loan officer if they can explain this. Chances are they are not aware of how residual income affects each VA loan.

VA Loan Denied Over DTI? Residual Income Could Save Your Approval

Strong residual income can override a high debt-to-income ratio. See If You Qualify for VA Loan Approval Based on Residual Income!VA Loans For Bad Credit And Low Credit Scores

The U.S. Department of Veteran Affairs does not have a minimum credit score requirement or maximum debt-to-income ratio caps. Why do most VA lenders require a 620 or 640 credit score? John Strange explains Gustan Cho Associates’s no lender overlays policy on VA loans as follows:

Why do most lenders have a debt-to-income ratio cap of 45% to 50% on VA Loans? This is not because of VA Guidelines but because most VA Lenders have mortgage overlays on VA loans. Gustan Cho Associates has zero lender overlays on VA loans.

Gustan Cho Associates has a national reputation for helping veteran home buyers with higher debt-to-income ratios and credit scores under 600 secure VA Home Loans. Many of our Gustan Cho Associates borrowers are veteran home buyers in a Chapter 13 Bankruptcy Repayment Plan or recently had their Chapter 13 Bankruptcy discharged. There is no waiting period to qualify for VA Home Loans after Chapter 13 Bankruptcy discharge. Gustan Cho Associates Mortgage Group are experts in VA and FHA Manual Underwriting.

Best Mortgage Lenders For Bad Credit With No Overlays on VA Loans

Borrowers don’t want to find themselves in a panic situation right before closing is supposed to happen. Another lender has denied 80% of our clients or has not gotten the correct information from their loan officers. That’s why contacting the experts at Gustan Cho Associates for your VA mortgage needs is important. Each family has a different story, requiring an extraordinary residual income. As you can see, this is another aspect that clouds the qualifications for a VA loan. Contact us at Gustan Cho Associates to get your TBD pre-approval started!

How To Apply For a VA Loan With a Lender With No Overlays with the Best Rates

Borrowers needing to qualify for VA loans with a national five-star mortgage company licensed in multiple states with no overlays, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays. Gustan Cho Associates are commercial and residential mortgage brokers with zero overlays on VA loans. We go off the automated underwriting system, and no additional lending requirement is above and beyond the minimum agency VA guidelines.

To our clients who were referred by Gustan Cho Associates and Capital Lending Network, Inc.

I hope this email finds you well. It’s been awhile since your discharge, and I hope by now your life has changed dramatically and your credit score is soaring!

A couple months back I introduced you to my personal injury practice. I wanted to take this opportunity to let you know about some of Miller & Miller’s other areas of expertise, so that if you do need other legal help, you know where to turn.

On a general note, I have been in business for over 25 years. In that time, I have met a lot of great, and not-so-great, attorneys. If you had a good experience with me, I want to encourage you to use me as a resource for other assistance. I have great relationships with family law attorneys, criminal attorneys, you name it. And you can trust that I will refer you to someone with the same core values of exceptional customer service, competent representation, and compassionate advice that we live by here at Miller & Miller.

Debt Satisfaction in State Court

If you noticed that some of your debts were still appearing on CCAP or elsewhere, that absolutely needs to get taken care of to further raise your score. Give us a call to discuss the particular debt, and whether our services might be needed to produce the proper paperwork to get that debt OFF your credit report for good! It shouldn’t be there!

Social Security Disability, Worker’s Compensation

On a specific note, over the years my bankruptcy practice has branched out into several other areas of representation, of which personal injury is just one. We also help people with worker’s compensation and social security disability cases. These issues can also come up during or shortly after a bankruptcy, so I made it my business to deliver aggressive representation in these areas so that nothing hinders my clients’ paths to complete financial recovery.

Debt Negotiation, Student Loan Debt

I have also have built successful practices in debt negotiation and student loan assistance. Some debts are difficult to discharge in bankruptcy, but not only have I succeeded in doing so, I have also found remedies that have not required bankruptcy at all. These can certainly be utilized when you have already filed a bankruptcy, and are left with non-dischargeable debts. Again, nothing should be standing in the way of your financial recovery. Let me assist you with anything that is slowing down your progress. You’d be amazed what experience and background knowledge can do with seemingly un-eraseable debts.

Simply hit reply to this email, and tell me a little about your situation. Or call me at 414-622-1443. I’d love to chat with you and make sure whatever is giving you trouble now, doesn’t continue to do so.

Best,

James L. Miller

Attorney at Law

Based on loan amount not income limit, “VA Residual Income Table By Broken Down By Region

Borrowers with higher than $80,000 household income, the following chart explains the VA Residual Income Requirements:”