This guide covers VA lender overlays- What Veterans need to know in 2025. Veteran homebuyers who are looking for lenders with no VA lender overlays came to the right place. VA lender overlays are additional mortgage guidelines on VA loans that individual mortgage lenders set that is above and beyond the VA agency guidelines. Lenders do not have to approve a borrower for a VA loan with just the minimum VA minimum guidelines. John Strange, a senior mortgage loan officer at Gustan Cho Associates said the following about VA lender overlays:

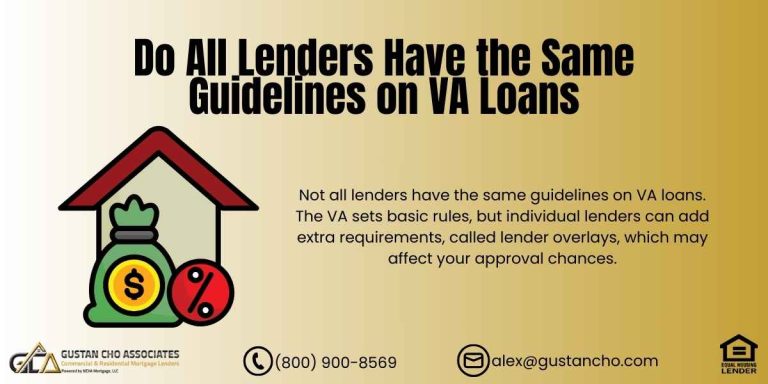

Lenders can have higher credit and income standards on VA home loans they originate and fund. The additional guidelines that each individual mortgage lender sets is called VA lender overlays.

Most mortgage lenders will have lender overlays on VA loans. The smaller the mortgage banking company the more overlays the lender will have. Chicago and its surrounding suburbs have one of the biggest population of Veterans in the country. A substantial amount of Chicagoans are Veterans of the U.S. Military. Gustan Cho Associates are experts in originating and funding VA home loans in Chicago and other major cities with no VA lender overlays. Veteran homebuyers who are looking and shopping for lenders with no VA lender overlays have come to the right place. In this article, we will discuss and cover VA lender overlays-what veterans need to know in 2025.

More On VA Loans With No VA Lender Overlays And The Department Of Veteran Affairs

The United States Department of Veteran Affairs is in charge of VA Loans. The Veterans Administration or VA is not a mortgage lender.

The following lists the role and function of the U.S. Veterans Administration:

- The Veterans Administration is not a mortgage lender.

- The function and role of VA when it comes to home loans is to insure and guaranty VA mortgages.

- Private mortgage lenders are who originate and close on VA insured loans and not the Department of Veterans Affairs.

- VA insures and guarantees VA home loans originated and funded by private lenders in the event the loans they have originated and funded defaults and goes into foreclosure and the lender loses money.

- Mortgage lenders are more than eager and willing to finance VA mortgage loans due to the guarantee of the government.

- Mortgage lenders are able to offer VA mortgages with no money down by veterans at phenomenal lower mortgage interest rates than conventional loans due to the guarantee by the United States Department of Veteran Affairs.

- VA home loans do not require mortgage insurance premium due to the guarantee of the Veterans Administration

- VA does mandate residual income requirement.

- The U.S. Department of Veteran Affairs has extremely lenient mortgage lending guidelines on VA loans.

- Most mortgage lenders have VA lender overlays.

- Gustan Cho Associates has no lender overlays on VA loans.

- The only requirement is a borrower needs a 580 FICO .

- There is no debt-to-income ratio requirement on VA mortgage loans.

- Most lenders will have a debt to income ratio caps set at 41% to 50% DTI on VA loans.

However, this is not a VA loan requirement BUT a lender requirement and part of their VA lender overlays.

VA Loan Denied? It Might Be the Overlay

Find out how lender overlays work — and how to get approved without them.

What Are VA Mortgages?

VA mortgages are the best mortgage loans that anyone can have. VA home loans are very easy to qualify for and have countless benefits. Unfortunately, not everyone can qualify for VA mortgages. The United States Government only rewards them to Veterans of the United States Armed Services who served in the U.S. Military and has a valid Certificate of Eligibility. A Certificate of Eligibility is also called a COE and this COE is the VA loan eligibility for Veterans with honorable discharges. The VA does not have a maximum loan limit on VA loans.

Key Points On VA Loans Versus VA Lender Overlays

Here Are The Mechanics Of VA Loans:

- Home loans for veterans are only for active duty, retired, disabled veterans with an honorable discharge of the U.S. Military with a COE or eligible spouses of deceased veterans.

- No down payment requirement.

- U.S. Department of Veterans Affairs guarantees 100% Financing.

- There is no down payment required from the homebuyer.

- No closing costs required by the veteran as long as the Veteran home buyer can get a sellers concession and/or lender credit for closing costs.

- This type of loans offers the lowest mortgage interest rates out of any mortgage loan program in the country for American veterans.

- Mortgage lenders feels safe on VA loans because of the government guarantee.

Low risk means low rates and the government guarantee on VA loans means low risk.

How Do Veterans Qualify For VA Loans?

Home Buyers who are a Veteran of the United States Armed Services and know that they have an entitlement for a VA Home Loan, and loan officer from a bank or mortgage company can help qualify for a VA Loan. Veteran Borrowers who are shopping for a Lender With No VA Lender Overlay, please contact us at Gustan Cho Associates at 800-900-8569 or email us at gcho@gustancho.com with any questions on the following:

- High-debt-to-income ratio

- 580 Credit Scores

- Bad Credit

- Late Payments

- Outstanding Collection Accounts

- Outstanding Charge Off Accounts

- Bankruptcy

- Foreclosure

- Deed In Lieu Of Foreclosure

- Short Sale

- Deferred Student Loans

VA mortgages are one of the easiest mortgage programs you can qualify for. If you are a Veteran and are told that you do not qualify for a VA mortgage but qualify for an FHA Loan, it is because the lender you consulted with has VA lender overlays. Gustan Cho Associates has no VA lender overlays.

VA Lender Overlays: What Veterans Need to Know in 2025

Explore VA lender overlays in 2025. Please find out how they affect veterans, why lenders use them, and how to secure a VA loan without these obstacles.

What Are VA Lender Overlays?

VA home loans are among the best benefits for veterans, active-duty service members, and some service member spouses. Backed by the VA, they let you buy a home without a down payment, have lower interest rates, and skip costly mortgage insurance. Still, after you meet all the official VA rules, you might get a “no.” That’s where VA lender overlays come in. Even in 2025, these extra lender rules are the biggest reason veterans get turned down for VA loans. Knowing what overlays are and how to get around them can turn a possible denial into a loan approval.

What Are VA Lender Overlays?

The U.S. Department of Veterans Affairs makes basic eligibility rules for VA home loans.

These Rules Say:

- The VA does not set a minimum credit score.

- The VA does not set a maximum debt-to-income (DTI) ratio.

- No down payment is needed if the home appraises for the purchase price.

Private lenders fund loans, and they may add extra rules, which are called overlays.

- Take Credit Score: The VA does not require a specific score, but a lender may ask for at least 620, 630, or even 640.

- A veteran with a score of 580 who meets all other VA rules can still be denied because of that lender’s overlay.

Why Do Lenders Add Overlays?

Risk Management and Investor Requirements

Lenders set overlays to protect their business and the investors who purchase the loans. VA guarantees a part of the loan if a veteran defaults, but lenders want to avoid defaults whenever possible.

Common Reasons for Overlays

- Credit Score Concern: Lenders often consider lower credit scores a sign that a borrower may not repay the loan.

- Debt-To-Income Limits: The VA does not cap DTI.

- However, lenders usually set a cap anyway (usually between 41 and 50 percent).

- Bankruptcy or Foreclosure Wait Times: Some lenders enforce stricter waiting periods than VA guidelines.

- Employment Record: Many lenders want a documented history of steady work for two years, even when VA guidelines allow for shorter gaps.

Common VA Lender Overlays in 2025

Minimum Credit Score Overlays

- Although VA does not set a required score, many lenders demand a minimum of 620–640.

- Borrowers below this range may need to search for a lender who strictly follows VA guidelines.

Debt-to-Income (DTI) Ratio Overlays

- VA measures repayment ability mostly on residual income, not a fixed DTI.

- Lenders often cap DTI at 41% or 50%, which can disqualify some otherwise eligible veterans.

Collections and Charge-Offs

- VA does not insist that all collection accounts be settled.

- Several lenders enforce a rule requiring complete payment of all collections before granting a loan.

Employment and Income Overlays

- VA permits short periods of unemployment as long as the borrower is re-employed.

- Lenders with overlays might insist on two years of continuous work to sign off on the application.

Waiting Periods After Bankruptcy or Foreclosure

VA guidelines say you can get approved two years after a Chapter 7 bankruptcy or a foreclosure. However, some lenders add extra waiting time and may require you to wait 3 to 4 years instead.

Know the Difference Between VA Rules and Lender Rules

We explain overlays and how veterans can still qualify even if told “no.”

How to Avoid VA Lender Overlays

Work With a Lender With No Overlays

To sidestep extra waiting periods, look for a lender who sticks to VA rules only. Some banks and credit unions add their strings. You can find specialized VA lenders who check only what the VA says and nothing more.

Compare Multiple Lenders

Don’t settle for the first answer. If one lender says no, ask others. The next lender may say yes, with no extra waiting time. A little effort can help you get the home you want sooner.

Ask the Right Questions

If you’re applying, make sure to check:

- What’s your minimum credit score to qualify?

- Will you allow a maximum DTI ratio?

- Must I pay off all collections before closing?

- Is two years of continuous employment history a must?

Why Choosing the Right VA Lender Matters

Lenders can vary widely. Some big banks promote VA loans, but then apply so many extra rules that only a few veterans get approved. On the other hand, mortgage brokers often work with several wholesale lenders. They can match veterans to those with no extra rules.

That matters because the VA loan program exists to make home buying simpler for those who have served. Extra rules can water down that purpose. When you team up with a lender that respects the program, you lock in the mortgage you’ve earned without needless hurdles.

FAQs About VA Lender Overlays

What Are VA Lender Overlays?

They are extra requirements that lenders add to the VA loan rules. For example, a lender may ask for a higher credit score or a lower DTI ratio than the VA requires.

Does the VA Require a Minimum Credit Score?

No, the VA itself does not mandate a minimum credit score. However, most lenders will ask for a score of 620 or higher anyway.

Can I Get a VA Loan With a 580 Credit Score?

Yes, but only if you find a lender with **no overlays**. Many lenders want a 620 score or higher, but a few will still consider you with a 580.

Do I Have To Pay Off Collections For a VA Loan?

Not for the VA itself. Their rules don’t say you must clear collections. Still, many lenders who add overlays want you to pay them first.

What is The Maximum DTI Ratio For VA Loans?

The VA does not set a maximum DTI. Instead, it focuses on residual income to see if you can cover costs. Lenders with overlays, however, might say DTI can’t exceed 41% to 50%.

How Long After Bankruptcy Can I Get a VA Loan?

The VA says you can apply two years after a Chapter 7 bankruptcy. Lenders with overlays might make you wait a few extra months to a year.

Why Do Lenders Add Overlays To VA Loans?

Lenders do overlays to lower their risk and meet rules set by the companies that buy the loans.

Can Overlays Be Different From One Lender To Another?

Yes, every lender can pick their overlays. Some might have a long list of extra rules, while others only stick to the VA rules.

How Do I Avoid VA Lender Overlays?

Look for lenders that say “no overlays” up front, and consider using VA loan specialists or mortgage brokers familiar with the VA program.

Will Overlays Apply To All VA Loans in 2025?

Not necessarily. Overlays are extra rules that some lenders add to VA guidelines. If you want to avoid them, it’s best to shop around. Some lenders stick strictly to VA rules. Compare offers to see who does the least extra.

Veterans: Don’t Let Lender Overlays Stop You

Many lenders add extra rules on top of VA guidelines. Learn how to avoid denials.