This guide covers HUD FHA 203k loans manual underwriting guidelines on renovation loans. HUD FHA 203k loans manual underwriting guidelines allow manual underwriting on FHA loans. Most lenders do not allow manual underwriting on FHA 203k loans . Lenders can have higher lending requirements above and beyond the minimum agency mortgage guidelines of HUD.

Lenders do not have to offer specialty FHA loan programs even though HUD insures the loan program. There are two different types of FHA 203k loans: FHA 203k loans streamline renovation and the full standard FHA 203k loans.

The FHA 203k streamline renovation loan has a maximum renovation budget of up to $35,000. There is no maximum budget on the full FHA 203k standard renovation loan. Many lenders offer FHA 203k loan programs but not through manual underwrite although HUD FHA 203K loans manual underwriting guidelines insures renovation loans through automated underwriting system and manual underwriting.

HUD Manual Underwriting Versus Automated Underwriting System Guidelines on FHA Loans

There are instances when AUS approved FHA loans need to be downgraded to manual underwriting. Borrowers in an active current Chapter 13 Bankruptcy repayment plan or borrowers discharged from Chapter 13 Bankruptcy without a two year seasoning from the discharged date cannot get an approve/eligible. You need a 2-year seasoning from the discharged date to be eligible for an approve/eligible per automated underwriting system.

HUD Chapter 13 Bankruptcy guidelines require 12 months have been completed with timely payments to Trustee to qualify for FHA loans unless the process goes through manual underwriting.

There is no waiting period after Chapter 13 Bankruptcy discharge date to qualify for FHA loans. Anyone who has less than two years seasoning of their Chapter 13 Bankruptcy discharge needs to be manually underwritten. HUD FHA 203K loans manual underwriting guidelines allow for borrowers in a Chapter 13 repayment or with a recent Chapter 13 discharge. To qualify for FHA 203k loans with manual underwriting, make sure to consult with mortgage than one mortgage lender. Not all mortgage lenders offer the rate and terms on FHA 203k loans.

Looking to Buy or Renovate with an FHA 203k Loan? We Can Help with Manual Underwriting!

Contact us today to learn how we can guide you through the manual underwriting process and get you pre-approved for your renovation loan.Cases Where Manual Underwriting Is Required

There are many reasons the AUS (Automated Underwriting System) will not give an approve/eligible findings report. Some of the most common reasons are the following:

- bankruptcy within the past two years

- late payments on a mortgage account

- Housing events such as foreclosures, short-sales, or deed-in-lieu on credit

- decline in income

If borrowers Automated Underwriting System (AUS) report comes back with refer/eligible findings, FHA loan can still be insured by HUD. We can still close that loan!! However, it must pass manual underwriting guidelines. Manual underwriting guidelines require timely payments of all monthly payments for the past two years.

What Is Manual Underwriting

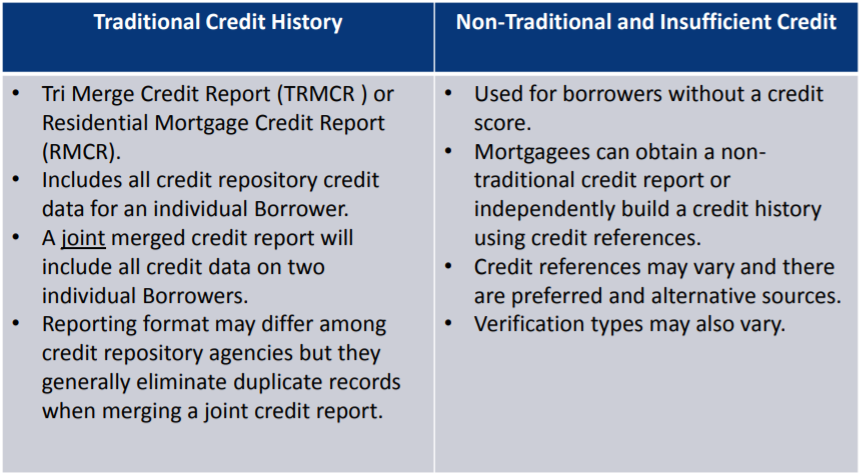

What items are looked at during manual underwriting? To determine creditworthiness for manual underwriting, underwriters will analyze and go over the following factors:

- Credit history of the TRI-MERGE credit report

- Number of credit tradelines and payment history

- Liabilities

- Debts

- Rental Payments

- Mortgage Payments

- Debt-to-income Ratios

- Credit Score

The underwriter is responsible to manually underwrite in compliance to HUD agency mortgage guidelines. Underwriters must determine the borrower has the ability to repay the new loan and the new mortgage will not cause financial hardship. Layered risk factors is evaluated and compared to the number of compensating factors. Each manual underwriting borrowers is underwritten and reviewed as a separate and unique transaction. No two manual underwritten file is the same.

What Types of Renovations Can Be Done With FHA 203k Loans

As more and more lenders add overlays to their mortgage products, less and fewer companies participate in manual underwriting. The good news is the team at Gustan Cho Associates are experts in manual underwriting. What are some common renovations?

- Adding complete additions to your property

- Upgrading kitchens and bathrooms, or any other room

- Roofing, gutters, downspouts

- Redoing Plumbing work

- Landscaping improvements

- Accessibility options for the disabled

- Energy Efficient Improvements

Gustan Cho Associates has the ability to manually underwrite FHA 203k loans. Finding a company who does both automated underwriting approved and manual underwriting FHA 203k loans can be a challenging. Reach out to the Gustan Cho Associates for making the dream home ownership a reality! Gustan Cho Associates has a national reputation for being able to do mortgage loans other lenders cannot do.

Who is Eligible For HUD FHA 203K Loans Manual Underwriting Guidelines

The FHA 203K program allows you to make your new home your DREAM home before you even move it. You have the ability to finance up to six payments into your loan amount if you cannot live in the home while the renovations are being completed. You should see some of the before and after photos of an FHA 203k loan. Borrowers have the ability to do amazing renovations.

Once the real estate purchase offer is accepted by the seller, the home buyer will reach out to a HUD 203K Consultant. Use this link to find an FHUD Housing Consultant in the area near the proposed home purchase. Get qualified and pre-approved for an FHA 203k loan with a HUD-approved mortgage lender for either a FHA 203k streamline or Standard Full HUD FHA 203k loan. Homebuyers or homeowners who are planning on renovating their home purchase or existing home with an FHA loan. There are the steps borrowers need to go through on FHA 203k loans. Borrowers need to choose a contractor. Borrowers may want to research more than one reputable contractor.

Once homeowner have selected the contractors they would like to use, they will set up a meeting with HUD 203k consultant and the contractor. They will coordinate each project and finalize the estimate for the renovations.

Complete the first appraisal during the process, there will be one appraisal before the project and another appraisal after the projects and verify completion. Once the lender has received the first appraisal the mortgage process will be very similar to a regular mortgage process. Homeowners will want to keep in contact with their lender, contractor, and HUD 203k consultant. Homeowners would want to confirm all inspections and payments are happening at the appropriate time. After all, projects are completed, the second appraisal will be ordered. Once received, the home is yours and all projects are completed!!! Reach out to the Renovation Pros from the Gustan Cho Associates!

Need an FHA 203k Loan with Manual Underwriting? We’ve Got You Covered!

Contact us now to explore how manual underwriting can work for you and get pre-approved for your home renovation project.HUD Cash-Out Mortgage Guidelines During and After Chapter 13 Bankruptcy

Homeowners with equity in their homes can do a cash-out refinance a mortgage on FHA manual underwriting refinances during and after Chapter 13 Bankruptcy. However, if borrowers do an FHA cash-out refinance mortgage during a Chapter 13 Bankruptcy repayment plan, the trustee may require that the Chapter 13 bankruptcy debtors be paid with the proceeds. This is not the case with doing an FHA cash-out refinance after Chapter 13 bankruptcy discharge date. Any bankruptcy discharge seasoned less than 2 years need to be manually underwritten. Borrowers can do a cash-out refinance on manually underwritten FHA loan at Gustan Cho Associates.

Choosing FHA 203k Manual Underwriting Lender With No Overlays

Peter Arcuri is the author of this blog on HUD FHA 203K loans manual underwriting guidelines. Peter Arcuri is also a contributing editor of Gustan Cho Associates Google Mortgage News. Peter Arcuri has a national reputation of being able to do mortgages other lenders cannot do due to being represented by a national lender with no overlays on government and conventional loans.

Keep in mind and remember the homeowners (the borrower) is in control. Make sure to get multiple quote and take your time on who the best contractor for the job is. Make sure the contractor gets the work done on time.

Peter Arcuri is an expert with HUD FHA 203K loans manual underwriting guidelines and is available 7 days a week, evenings, weekends, and holidays. Peter is the National Development Business Manager at Gustan Cho Associates and an expert in all government and conventional loan programs. Please reach out to Peter Arcuri at (800) 900-8569. The Team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

FAQs: HUD FHA 203k Loans Manual Underwriting Guidelines

-

1. What are HUD FHA 203k loans manual underwriting guidelines? HUD FHA 203k loan manual underwriting guidelines allow for the manual underwriting of renovation loans. This means that even if a loan doesn’t get automated approval, the lender can still approve it through manual review.

-

2. Why do some lenders not offer FHA 203k loans with manual underwriting? Many lenders choose not to offer FHA 203k loans with manual underwriting because they have stricter internal guidelines or overlays, even though HUD FHA 203k loans’ manual underwriting guidelines permit it.

-

3. What types of renovations can I do with an FHA 203k loan? With an FHA 203k loan, you can renovate kitchens and bathrooms, add rooms, repair roofing, upgrade plumbing, and more. The HUD FHA 203k loans manual underwriting guidelines cover minor and major renovations.

-

4. Can I get an FHA 203k loan if I’m in a Chapter 13 Bankruptcy? If you are in an active Chapter 13 Bankruptcy repayment plan or recently discharged, HUD FHA 203k loans manual underwriting guidelines allow for manual underwriting of your loan.

-

5. What’s the difference between FHA 203k streamline and standard loans? The FHA 203k streamline loan is for renovations up to $35,000, while the standard loan has no renovation budget limit. According to HUD FHA 203k loans manual underwriting guidelines, both can be manually underwritten.

-

6. What happens if my FHA 203k loan doesn’t get automated approval? Suppose your loan doesn’t get automated approval. It can still be processed through manual underwriting if it meets HUD FHA 203k loans manual underwriting guidelines.

-

7. How can I ensure my FHA 203k loan is approved through manual underwriting? Make sure your credit history, income, and debts are well-documented. HUD FHA 203k loans manual underwriting guidelines will review your financial situation more thoroughly than automated systems.

-

8. Is there a waiting period after Chapter 13 Bankruptcy for FHA 203k loans? There’s no waiting period after Chapter 13 Bankruptcy discharge for FHA 203k loans if you go through manual underwriting. This is allowed under HUD FHA 203k loans manual underwriting guidelines.

-

9. Can I choose my contractor for an FHA 203k renovation? Certainly, you have the freedom to select your contractor; however, they must receive approval from your lender and satisfy the criteria outlined in the HUD FHA 203k loans manual underwriting guidelines.

-

10. What are the benefits of working with a lender that follows HUD FHA 203k loan manual underwriting guidelines? Working with such a lender gives you a better chance of loan approval if your financial situation doesn’t fit automated criteria. This flexibility is key to accessing renovation financing through HUD FHA 203k loans manual underwriting guidelines.