When does an automated underwriting system approved file get downgraded to a VA manual underwrite downgrade on VA loans happen? If you are following Gustan Cho Associates, you know we are experts in VA mortgage guidelines. We do our best to help as many of our Nation’s veterans as possible.

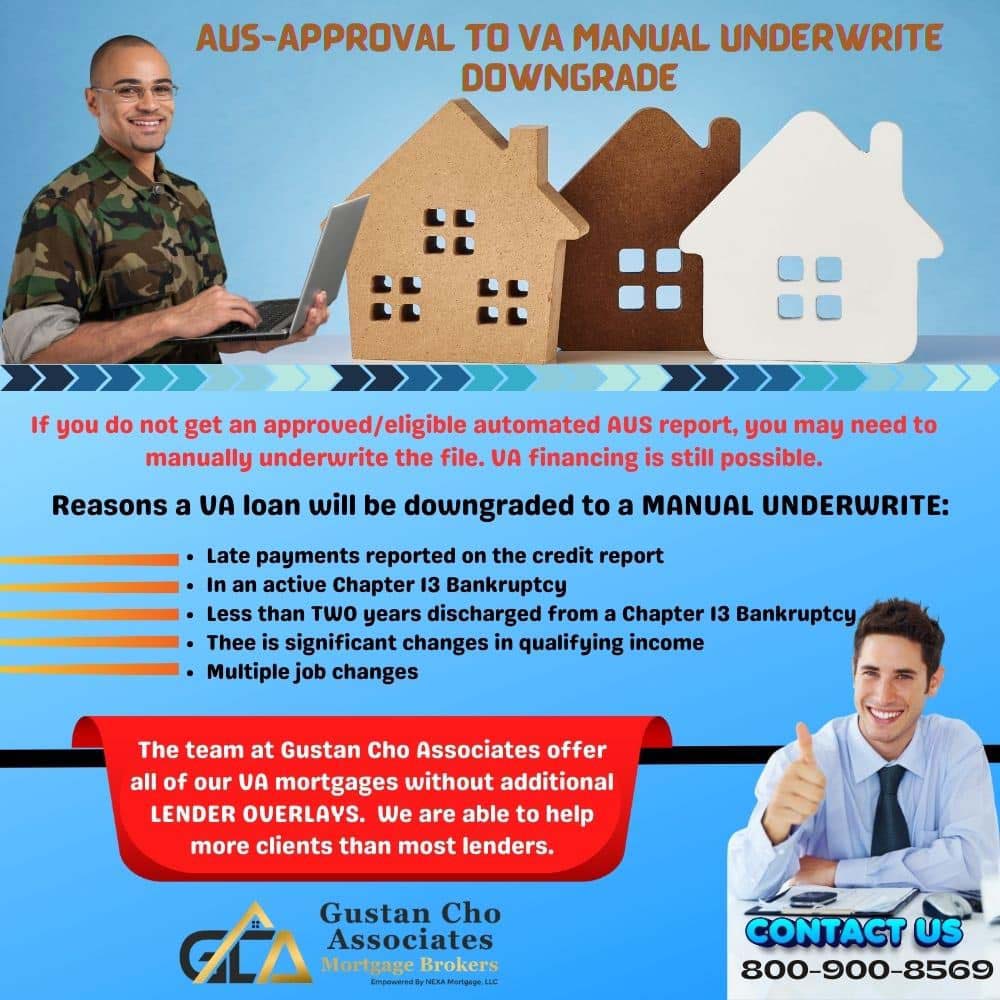

The team at Gustan Cho Associates offer all of our VA mortgages without additional LENDER OVERLAYS. We are able to help more clients than most lenders.

In the following paragraphs, we will detail a few VA options we have, that set us apart from our competition. We will also discuss when a VA loan needs to be manually underwritten, and how to apply for a VA loan with Gustan Cho Associates. In this article, we will discuss and cover when does AUS-approved VA loans get a VA manual underwrite downgrade on VA loans happen.

Understanding AUS Approval to VA Manual Underwrite Downgrades

When applying for a VA home loan, the approval process can take different paths based on the applicant’s financial profile. One such path involves the shift from Automated Underwriting System (AUS) approval to a manual underwrite downgrade. This article explains what triggers such a downgrade, what it means for potential borrowers, and how it impacts the VA loan process.

AUS Didn’t Approve? VA Manual Underwriting Can Still Get You Approved!

Don’t give up! If the AUS system says “refer,” we’ll downgrade to manual and keep your home loan moving. Get Help With Your VA Manual Underwrite Now!

What is AUS?

Lenders use the Automated Underwriting System (AUS) tool to quickly evaluate a loan application based on algorithms and historical data. The AUS assesses credit risk and eligibility by reviewing the applicant’s credit scores, debt ratios, employment information, and other financial details. The most commonly used AUS tools for VA loans are the Loan Prospector (LP) and Desktop Underwriter (DU).

Triggers for AUS to Manual Underwrite Downgrade

Several factors can trigger a downgrade from AUS approval to manual underwriting, including:

Inconsistent income: If the borrower has irregular or inconsistent income, the AUS might not adequately assess future earnings’ stability.

- Recent employment changes: A recent switch in jobs or career paths, especially if the new job is in a different industry, can lead to a downgrade.

- Low credit scores: While VA loans do not have a set minimum credit score, very low scores or limited credit history can result in further scrutiny.

- High debt-to-income (DTI) ratios: An AUS might approve a borrower with a high DTI ratio. However, a manual review could be required to further assess financial stability.

- Previous bankruptcies or foreclosures: These can also flag an application for manual review, depending on how recent and under what circumstances they occurred.

The Manual Underwriting Process

When a VA loan application is downgraded to manual underwriting, it undergoes a more detailed and personalized review by a loan underwriter. This process involves:

- Thorough evaluation of documentation: The underwriter will meticulously review all submitted financial documents, including bank statements, pay stubs, employment history, and tax returns.

- Assessment of compensating factors: Manual underwriters look for compensating factors that might mitigate the risks indicated by the AUS. These can include a larger down payment, significant savings, or a history of making rent payments equal to or above the proposed mortgage payments.

- Verification of employment: Underwriters may directly contact employers to verify employment and salary.

Impact on the Loan Process

A downgrade to manual underwriting generally means a longer processing time for the VA loan application. More interaction is required between the borrower and the lender to gather additional documentation and clarifications. However, it does not necessarily mean the loan will be denied. Manual underwriting allows for a more nuanced decision-making process, where human judgment plays a critical role in evaluating the borrower’s ability to repay the loan.

Preparation for Potential Borrowers

For those applying for a VA loan, it is beneficial to prepare for the possibility of a manual underwrite downgrade by:

- Ensuring accuracy in all submitted financial documents.

- Maintaining a stable employment record.

- Building a strong credit history and working on improving credit scores.

- Reducing debts to lower the DTI ratio.

- Saving for a substantial down payment, even if not required, can serve as a strong compensating factor.

Expert Lenders on AUS-Approved VA Loans Downgraded To a VA Manual Underwrite Downgrade

Not only do we offer our VA mortgage loans without any additional lender overlays, but we also offer a few specialty VA for gauge programs. We have a one-time close new construction VA mortgage, a VA renovation loan, and offer manually underwritten VA mortgages.

Gustan Cho Associates offers a one-time FHA and VA close construction mortgage loan program. A “one time close” is a great option for our veterans who are looking to build a new property. This mortgage loan allows you to qualify one time for the loan

Some construction mortgages force borrowers to qualify to start the construction and qualify again once the home is complete for the final mortgage. With the VA products we offer, you simply qualify at the beginning, and you are set for the life of the loan. Please see this article for more information. This is important during times like this when millions of Americans are losing their job. If you started this process and then lost your job, you may not qualify for the home once it is completed. That is why only needing to qualify for the loan once is a major advantage.

From AUS Refer to VA Manual Underwrite—We’ve Got You Covered

AUS isn’t the end—it’s just a bump in the road. Talk to a Lender Who Knows How to Manually Approve VA Loans

AUS-Approval To VA Manual Underwrite Downgrade on Renovation Loans

We also offer a VA RENOVATION LOAN. A renovation loan can be a great tool to increase the equity position in your property. Whether you are buying or refinancing, most homes can use a little elbow grease to be more desirable. A new bathroom or a renovated kitchen can dramatically increase the value of your property. This loan product allows up to $50,000 for renovations without a down payment. Please call Alex on (800) 900-8569 for more information on what renovations are permitted.

When Does Is a VA Manual Underwrite Downgrade Required on VA Mortgages

When does a VA mortgage require a manual underwrite? Downgrading to a manual underwrite can be incredibly confusing for veterans and individuals who are not in the mortgage industry.

What exactly does a manual underwrite mean? If you do not get an automated underwriting system on a VA loan and get a refer/eligible per automated underwriting system, VA allows you to do a manual underwrite.

If you do not get an approved/eligible automated AUS report, you may need to manually underwrite the file. If the automated underwriting system says refer/eligible, then you may downgrade to a manual underwrite. In short, an automated AUS approval is the ultimate goal but if the findings are refer/eligible. VA financing is still possible. Please see our AUS BLOG for more information.

Typical Case Scenarios When Underwriters Downgrade To Manual Underwrite

Reasons a VA loan will be downgraded to a MANUAL UNDERWRITE:

- Late payments reported on the credit report

- In an active Chapter 13 Bankruptcy

- Less than TWO years discharged from a Chapter 13 Bankruptcy

- Thee is significant changes in qualifying income

- Multiple job changes

Applying For a Manual Underwrite VA Mortgage

How to apply for a VA loan with Gustan Cho Associates: First, you will need to gather the following information:

- Last 60 Days Bank Statements – to source money for escrows

- Last 30 Days Pay Stubs

- Last Two Years W2’S

- Last Two Years Tax Returns

- Driver’s License

- Certificate of Eligibility

VA Manual Underwrite Pre-Approval Mortgage Process

Then contact Alex on (800) 900-8569. You and Mike will have a one-on-one VA mortgage consultation. You will go over your qualifications in detail. From there you will be paired with a licensed loan officer in your state and start the pre-approval process.

Gustan Cho Associates are experts on manual underwriting on VA loans with no lender overlays. We have a national reputation for being able to do mortgage loans other lenders cannot do.

Once you send in the documentation and complete an online application, your loan officer will get you pre-approved OR put you on a custom financial plan to qualify as soon as possible.

VA Loan Denied by AUS? Manual Underwriting Is Still an Option

We specialize in manually underwriting VA loans that deserve a second look. Start Your VA Manual Underwrite Today!

Shopping For a House After Getting Pre-Approved

Once you have a pre-approval letter, you can start the house shopping process. We encourage you to continue to follow our website for changes in order to the mortgage industry.

The COVID-19 coronavirus outbreak has created some abrupt changes in mortgage lending. While most lenders have raised credit score requirements on VA loans, Gustan Cho Associates have not.

Please reach out to us even if you have been turned down for a VA loan in the past. You can call us at 800-900-8569 or text us for a faster response. You can also email us at alex@gustancho.com. We look forward to hearing from you. The team at Gustan Cho Associates is seven days a week, evenings, weekends, and holidays.

Frequently Asked Questions (FAQs)

- What is an AUS approval in the context of VA loans?

AUS (Automated Underwriting System) approval refers to a computerized process used by lenders to evaluate VA loan applications based on credit, income, and other financial data. It provides quick preliminary loan approval decisions. - Why might a VA loan application be downgraded from AUS to manual underwriting?

A downgrade can occur due to factors like inconsistent income, recent employment changes, low credit scores, high debt-to-income ratios, or previous financial hardships like bankruptcies or foreclosures that require more detailed analysis. - What happens during the manual underwriting process?

In manual underwriting, a human underwriter reviews the borrower’s financial details more thoroughly, including employment verification, financial statements, and credit history, to assess the risk and ability to repay the loan. - How does a manual underwrite impact the loan approval time?

Manual underwriting typically extends the loan approval process because it involves a more detailed and personalized assessment requiring additional documentation and verification. - After a downgrade to manual underwriting, can you still get approved for a VA loan?

Yes, being downgraded to manual underwriting does not mean denial. Approval is still possible for borrowers who demonstrate sufficient compensating factors, such as a substantial down payment or consistent employment history. - What are compensating factors in manual underwriting?

Compensating factors are positive aspects of a borrower’s financial profile that offset risks indicated by their financial situation. Examples include substantial savings, a history of making comparable rent payments, or a low debt-to-income ratio. - How can I avoid a manual underwrite downgrade?

To minimize the chances of a downgrade, ensure your income and employment are stable and well-documented, maintain a healthy credit score, and reduce your debt-to-income ratio. Accurate and complete application information is also crucial. - Can I predict if my VA loan will require manual underwriting?

While it’s hard to predict with certainty, knowing the common triggers—such as recent job changes, high debt levels, or past credit issues—can give you an idea of the potential for a manual review.

Turn Your VA AUS Refer Into a Manual Approval

If your file got downgraded, don’t panic—we help borrowers every day. Request a Free VA Manual Underwrite Consultation Now!