How High Interest Rates Affect Housing Market

This guide covers how skyrocketing interest rates affect housing prices going into 2025. When it comes to the current housing…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers how skyrocketing interest rates affect housing prices going into 2025. When it comes to the current housing…

This guide covers the mortgage markets and interest rates. The mortgage markets and interest rates have seen volatile trends in…

Breaking News: The Implications of the ISM Non-Manufacturing Index for the Economy and Housing Sector in 2024. The ISM Non-Manufacturing…

2024 Guide to Low Credit Score Pricing Adjustments: Understanding Your Options to Save on Your Mortgage Ready to buy or…

Understanding Discount Points: Your Key to Big Savings on Your Mortgage When exploring your mortgage options, “discount points” often pop…

This guide covers FHA versus conventional mortgage rates on purchase and refinances transactions. One of the most common questions the…

This article covers the mortgage rate lock process and how to decide when to lock in a mortgage. You cannot…

This Article Is About How Credit Scores Affect Mortgage Rates When Locking Loan Mortgage Rates have dropped 0.25% after the…

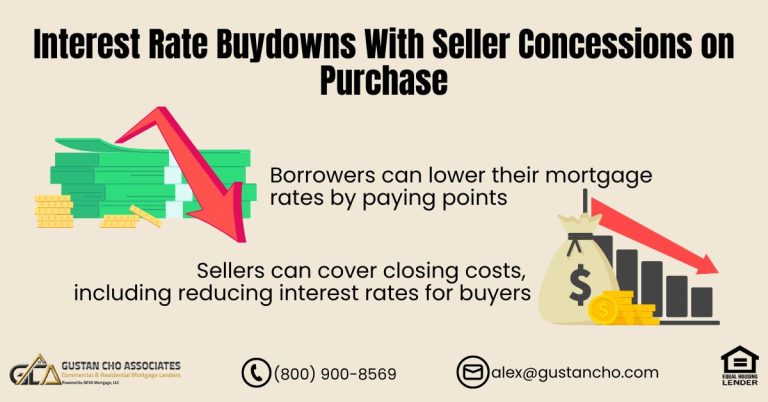

In general, borrowers buy down mortgage rates to get a lower rate on their home loans. However, there are instances where borrowers need to buy down rates due to loan level pricing adjustments due to lower credit scores

This guide covers the volatility of mortgage rates during the Covid-19 pandemic. Mortgage Rates During The COVID-19 Pandemic is two-fold….

This guide covers comparison of mortgage rates on purchase and refinance loans. Mortgage rates have been steadily going up to…

This guide covers buying an investment property using a conventional loan. Buying an investment property using a conventional loan with…

This guide covers credit scores and mortgage rates versus pricing adjustments. Credit scores and mortgage rates go side by side….

This guide covers qualifying for the lowest FHA mortgage rates on FHA loans. Qualifying for the lowest FHA mortgage rates…

Lenders base each borrower’s credit scores as well as other risk factors when determining mortgage rates. The higher the risk of a borrower, the higher the rate. It is best for each borrower to maximize their credit scores and other layered risks to get the best mortgage rates.

This guide covers understanding FHA mortgage rates on purchase and refinance transactions. FHA loans are the most popular mortgage program…

This ARTICLE On 15 Year Versus 30 Year Fixed Rate Mortgages On Loan Programs. All residential mortgage loan programs have…

Homeowners should explore how much money they can save with today’s historic low mortgage rates to refinance their home loans.

In this blog, we will cover what a 3-2-1 buydown mortgage is. We will also discuss the differences between a…

This guide covers how to get the best mortgage rates on a home loan. How to get the best mortgage…

When saving money buying a house, remember one key thing, low rates with FICO credit scores. This article will cover…

This guide covers interest rate buydowns with seller concessions on purchases. Interest Rate Buydowns are when borrowers pay DISCOUNT POINTSto…