The FHA W-2 Income Only Mortgage Lending Guidelines provide a pathway for borrowers to qualify for an FHA loan based solely on W-2 income, without the requirement of submitting income tax returns. Conventional and FHA loans stand out as the most widely used among the various mortgage loan programs available today.

It is important to note that FHA loans cater to a diverse range of borrowers and are not exclusively designed for those with poor credit.

The Department of Housing and Urban Development (HUD), the parent organization of FHA, has established flexible lending guidelines, accommodating borrowers with prior adverse credit history, higher debt-to-income ratios, and credit scores as low as 500 FICO. FHA loans emerge as a preferred choice for first-time homebuyers, individuals with credit scores as low as 500 FICO, and those with limited or no credit history. This article aims to delve into and elucidate the FHA W-2 Income Only Mortgage Lending Guidelines.

Homebuyers Who Will Benefit From FHA Loans

Here are some excellent advantages of FHA loans for prospective homebuyers. HUD permits the use of gifted funds for the down payment when purchasing a home. Additionally, the option to include non-occupant co-borrowers in the loan is available for situations where the borrower does not satisfy the maximum debt-to-income ratio requirements.

HUD also cap front-end debt-to-income ratios up to 46.9% and back-end debt-to-income ratio up to 56.9% DTI to get an automated underwriting system (AUS) approval. To qualify for a 3.5% down payment home purchase FHA loan, the borrower needs a 580 credit score.

Homebuyers with a FICO score below 580 and a credit score as low as 500 are eligible for an FHA loan, provided they make a 10% down payment. There is no restriction on the number of non-occupant co-borrowers who can be included in the application. However, these co-borrowers must have a familial connection to the borrower through either marriage or blood. Individuals without such a relationship are not eligible to be co-borrowers. If homebuyers choose non-occupant co-borrowers unrelated by blood or marriage, the down payment requirement increases from 3.5% to 10%.

Qualify With Just Your W-2s

FHA allows borrowers to apply without providing income tax returns.

W2 Income Only Wage-Earners

Numerous employees earning W-2 income avail themselves of tax deductions when filing their income tax returns. This practice stems from the fact that they have a lower tax liability. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about FHA W2 income only mortgage loans:

Incorporating substantial deductions into their tax returns counterbalances the qualified income that borrowers can leverage when seeking approval for a mortgage.

This situation may otherwise fail to qualify for a home loan. The Department of Housing and Urban Development (HUD) oversees the Federal Housing Administration (FHA). HUD has recently authorized borrowers to be eligible for W-2 income-only loans, eliminating the necessity for income tax returns to qualify for an FHA Loan.

W-2 Income-Only Loans

Loans exclusively based on W-2 income are currently accessible for individuals with substantial write-offs on their tax returns. Unlike traditional loan programs, this particular one eliminates the need for borrowers to submit federal income tax returns, relying solely on W-2 income for qualification.

It is important to note that specific rules apply, and not all borrowers may meet the criteria for the W-2 Income Only Mortgage.

Nevertheless, this loan program is gaining popularity, offering an opportunity for individuals previously ineligible for home loans due to significant write-offs on their tax returns. Eligibility is contingent upon satisfying HUD’s W-2 Income Only lending guidelines.

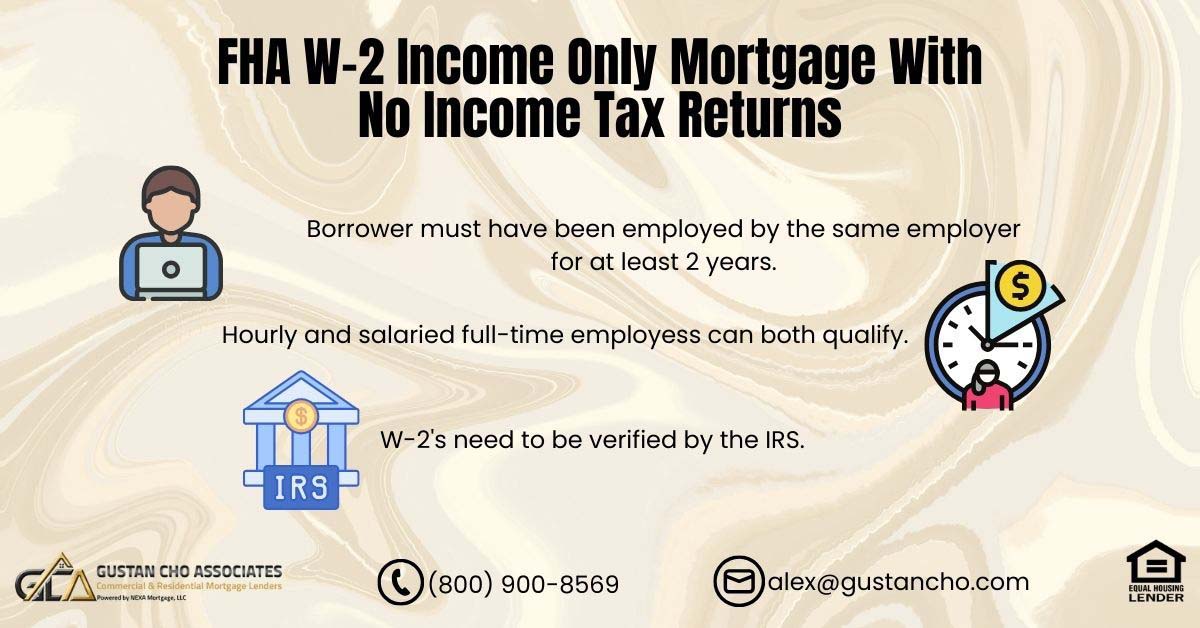

Requirements To Qualify For W-2 Income Only Program

To be eligible for the FHA W-2 Income Only Mortgage Program, borrowers need to adhere to the mortgage lending guidelines outlined below. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates says the following about FHA W2 income only mortgage loans:

Eligibility requires a minimum of two years of continuous employment with the same employer for both hourly and salaried full-time employees.

To verify income, applicants must provide 30 days of paycheck stubs and two years’ worth of W-2s. The W-2s must undergo validation by the Internal Revenue Service (IRS).

W-2 Income Wage Earners With Additional 1099 Income

Individuals who have extra sources of income through 1099 earnings or own real estate are ineligible. There are situations in which having 1099 income may necessitate the submission of tax returns.

Those who earn additional income as 1099 wage earners will be assessed on a case-by-case basis. If a borrower is applying for the W-2 Income Only Mortgage Program, Income Tax Returns cannot be submitted.

Can I qualify for FHA with just my W-2s?

Yes—HUD guidelines allow approval without tax returns.

W-2 Income Wage Earners Showing 25% or more of the W-2 Income Is Commission Income

If a borrower demonstrates that 25% or more of their W-2 income comprises commission income, they will be deemed ineligible. The FHA W-2 Income Only Mortgage program does not allow qualification with non-occupant co-borrowers.

Only applicants with Approve/Eligible status based on Automated Underwriting System findings are eligible for this program. Manual Underwriting FHA Loans cannot be considered for the W-2 income-only program.

Non-Eligible Borrowers For FHA W-2 Income Only Mortgage Program

Not every borrower can qualify for the FHA W-2 Income Only Mortgage Loan Program. Below are the ineligible borrowers for the FHA W-2 Income Only Mortgage Loan Program:

- Self Employed Borrowers are ineligible

- Borrowers who have income reported their schedule K-1 of their income tax returns are not eligible.

- This holds true no matter how small or large the percentage of the ownership is

- Borrowers with a commission income of 25% or more percent on their W-2 income are not eligible.

- Borrowers who receive any rental income will be excluded from qualifying for the FHA W-2 Only Income Mortgage program.

- Borrowers who earn temporary income or have inconsistent or periodic employment, such as seasonal, unemployment, and contract, will not qualify.

Borrowers who have income earned from any foreign entity, corporation, or government entity and are compensated via foreign currency will not qualify.

FHA W-2 Income Only Mortgage: Wage-Earners Employed By Family Members

Employees working for a family member as their employer will be ineligible for qualification. Likewise, individuals employed by a non-arms-length transaction party, such as the lender’s employees, will not meet the requirements of this program. Borrowers receiving dividends, interest income, and capital gains will also be disqualified.

Those with other non-taxable or non-employment income, which is reported on their 1099 forms used to qualify for their mortgages, such as social security income, pension income, and other income, will not be eligible.

Borrowers who rely on tip income, as indicated on their IRS Form 4137, but this income has not been reported by their employer on their W-2s, will not be eligible for qualification. The automated findings necessitate the submission of tax returns; thus, tax returns will be mandatory.

FHA W-2 Income Only Mortgage With No Income Tax Returns

See how to qualify for an FHA W-2 income-only mortgage without IRS tax returns in 2025. Get the latest eligibility steps, program perks, and tips from Gustan Cho Associates for a quick closing.

FHA Loans Made Easy for W-2 Workers

For many hopeful homebuyers, digging up multiple years of tax returns trips up the mortgage journey. Suppose you earn a regular W-2 paycheck and have a solid job history. In that case, there’s good news. The FHA W-2 income-only mortgage lets you skip tax returns completely.

Rather than stress about the IRS docs, you focus only on your clean W-2, making this a turbo-boost to your buying power. Gustan Cho Associates knows the ins and outs of this program.

We shine the spotlight on W-2 earners who have faced roadblocks elsewhere. The FHA W-2 income-only mortgage gives you a hassle-free road to closing with less fuss, zero NTP1 docs, and no waiting for those pesky tax years.

What Is an FHA W-2 Income-Only Mortgage?

An FHA W-2 Income-Only Mortgage simplifies home buying by letting you prove your income through your W-2 forms and recent pay stubs. Unlike standard FHA loans that require full tax returns, this program skips those lengthy documents, letting an underwriter focus on steady pay from your job.

Looking at W-2 amounts, they ignore the big reductions your tax returns may show from business deductions, medical expenses, and losses. The result is an updated view that captures your real paycheck, not your adjusted gross income.

The pluses are clear for you—no tax returns, fewer papers to gather, and the chance to get approved even after taking sizable deductions on your returns. Even with this lighter process, you still get FHA’s usual benefits, like easier credit score rules, low cash-down options, and attractive market rates.

Why FHA W-2 Income Only Mortgage Matter

Most wage earners tackle complex 1040s with business expense records, extra freelance income, and itemized deductions. While these tax moves drop what the IRS sees as income, they also creep up the strain on mortgage underwriters used to full docs. The FHA W-2 Income-Only program, however, flips the focus. Lenders grab W-2 earnings and the most recent pay stub, rewarding the steady W-2 earner and wiping away headaches from tax shortcuts. You won’t get penalized for file deductions that crunch your income on standard docs, and home buying stays on the table.

FHA W-2 Income Only Mortgage Guidelines for 2025

To get approved under this program, you need a two-year track record of W-2 earnings from the same employer or positions in the same field. Lenders will check a couple of recent pay stubs and your last two years of W-2s.

A minimum credit score of 580 gets you the standard 3.5% down payment. If your score is at least 500, you must pay 10% down, but you can still qualify.

FHA keeps its debt-to-income ratio limits on the higher side, capping the number at 56.9% if an underwriter runs an automated review. The program is open to primary residences with up to four units. The paperwork is pretty light—usually just W-2s, pay stubs, and maybe a job-verification form. You won’t need to hand over tax returns.

Who Should Think About This Loan?

The W-2-only FHA loan is a strong choice for people with steady paychecks, including nurses, teachers, store workers, union members, and government employees. It also suits borrowers with tricky tax returns that shrink the qualifying income, even if the W-2 number stays steady. First-time buyers especially like the straightforward approval steps and the low down payment.

FHA W-2 Income Only vs. Regular FHA Loan

When you apply for a regular FHA loan, you must share W-2s, recent pay stubs, and all your federal tax returns. This can slow everything down if your adjusted gross income looks lower because of tax write-offs. The FHA W-2 income-only loan skips those tax returns and looks only at your regular wages. The result? A cleaner, faster mortgage process for anyone paid with a W-2.

FHA W-2 Income Only Loan Perks

This loan type comes with several perks. First, you get faster approval because underwriters skip the tax returns and focus only on pay stub income. If your credit isn’t the greatest, don’t worry; FHA guidelines still favor you. Not using deductions or losses makes your income on paper look better and helps you qualify. You still enjoy all the regular FHA goodies like a low down payment, gift funds for the down payment or closing costs, and attractive interest rates.

Who helps borrowers with W-2 only FHA loans?

Gustan Cho Associates specializes in FHA W-2 only approvals nationwide.

Steps to Qualify for an FHA W-2 Income-Only Mortgage

Start by checking your credit score to confirm you meet FHA guidelines. Then, verify you have consecutive two-year W-2 income from your job.

Gather your most recent W-2s, plus the latest couple of pay stubs, because that’s all the income documentation you’ll need. You should get a pre-approval from a trusted lender.

At Gustan Cho Associates, we often provide same-day pre-approvals without extra lender guidelines that can slow things down. As soon as you have that pre-approval, you can start house-hunting. Since the paperwork is simple, you can usually close quickly than with a standard FHA loan.

Common FAQs About FHA W-2 Income-Only Mortgages

Do I Need Tax Returns For FHA W-2 Income-Only Loans?

No tax returns are needed—just your W-2s and the most recent pay stubs.

Can I Qualify With Multiple W-2 Jobs?

- Yes, as long as you’ve worked at each job for at least two years, or if they’re in the same field.

What If I Changed Jobs Recently?

- That’s fine as long as your new job is in the same line of work.

Are Self-Employed Borrowers Eligible?

- No, this loan is only for W-2 employees.

Can I Use Overtime or Bonus Income?

- Yes, as long as you can show a two-year history, it’s likely to keep coming.

Does the FHA W-2 Program Only Let You Do Manual Underwriting?

- If the automated system flags it, manual underwriting is an option if you have compensating factors.

How Much Of a Down Payment Do I Need?

- If your credit score is 580 or above, the down payment is 3.5 percent.

- If your score is between 500 and 579, you’ll need 10 percent.

Can I Purchase a Multi-Unit Dwelling?

- Yes, FHA will finance one to four-unit primary residences.

Can I Use Gift Money?

- Absolutely.

- You can have the entire down payment gifted.

How Quickly Can I Close?

- Loads of borrowers close in 30 days or less since the paperwork is easy to manage.

Apply Now For FHA W-2 Income Only Mortgage Loan

The FHA W-2 income-only loan that skips income tax returns is a smart option for W-2 employees who want to simplify the loan process. This program cuts down on paperwork and opens the door for people who might not qualify under strict requirements.

Contact us at 800-900-8569 or head to [Gustan Cho Associates] to kick off your FHA W-2 income-only mortgage application. We’re here to help you every step of the way!

At Gustan Cho Associates, we deliver FHA W-2 income-only loans with no lender overlays. This means fewer extra rules and a greater chance for you to get the green light. If you work for a company and get a W-2, we’ll work to get you a fast, easy, and stress-free closing.

Who Offers FHA W-2 Income Only Mortgage Loan Programs

Gustan Cho Associates offers FHA W-2 Income Only Mortgage Programs. W-2 Income Only Loans are also offered on VA and Conventional loans. W-2 Income Only mortgage loans are available with both FHA and VA and Conventional loans. Both Fannie Mae and Freddie Mac offer W-2 Income.

Submitting income tax returns for underwriting purposes is strictly prohibited. Any attempt to submit income tax returns to underwriting will result in automatic disqualification from the qualification process.

Only Conventional loans with higher debt-to-income ratios due to a lot of write-offs on income tax returns need to know more about both the Conventional, VA, FHA W-2 Income Only Mortgage Loan Programs, please us at Gustan Cho Associates at 800-900-8569 or text for faster response. Or email us at alex@gustancho.com. Gustan Cho Associates is a national five-star mortgage company licensed in multiple states. The Team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays to take your call or email inquiries. Gustan Cho Associates Mortgage Group aims to close all our loans in 21 days or less.

We Approve Loans Other Lenders Deny

With no overlays, we make FHA mortgages possible nationwide.

FAQ: FHA W-2 Income Only Mortgage With No Income Tax Returns

What is The FHA W-2 Income Only Mortgage Lending Guidelines Article About?

- This article provides information on the FHA W-2 Income Only Mortgage Lending Guidelines, which allow borrowers to qualify for an FHA loan based solely on their W-2 income, without the need to submit income tax returns.

- It highlights the advantages of FHA loans and eligibility criteria.

Who Can Benefit From FHA Loans?

- FHA loans benefit first-time homebuyers, individuals with credit scores as low as 500 FICO, and those with limited or no credit history.

- Borrowers can use gifted funds for down payments, include non-occupant co-borrowers, and have flexible debt-to-income ratios.

How Do Credit Scores Affect FHA Loan Eligibility?

- To qualify for a 3.5% down payment FHA loan, borrowers need a minimum credit score of 580.

- Those with credit scores below 580 but at least 500 can qualify with a 10% down payment.

Can Non-Occupant Co-Borrowers Be Included in The FHA Loan Application?

- Yes, non-occupant co-borrowers can be included in the application, provided they have a familial connection to the borrower through marriage or blood.

- Otherwise, the down payment requirement increases from 3.5% to 10%.

What Are W-2 Income-Only Loans, And Who Can Benefit From Them?

- W-2 income-only loans are mortgage programs that rely solely on W-2 income for qualification, eliminating the need for income tax returns.

- These loans are designed for individuals with substantial write-offs on their tax returns.

What Are The Requirements to Qualify For The W-2 Income Only Mortgage Program?

- Eligibility for this program requires a minimum of two years of continuous employment with the same employer, verification through paycheck stubs, and two years’ worth of W-2s validated by the IRS.

Are Borrowers With Additional 1099 Income or Commission Income Eligible For This Program?

- Borrowers with additional 1099 income or commission income of 25% or more of their W-2 income are not eligible for the W-2 Income Only Mortgage Program.

Who is Not Eligible For The FHA W-2 Income Only Mortgage Program?

- Self-employed borrowers have income reported on Schedule K-1, earn rental income, have inconsistent employment, receive income from foreign entities, or work for family members or non-arms-length transaction parties are not eligible for this program.

Can Borrowers Submit Income Tax Returns For Underwriting Purposes?

- No, submitting income tax returns for underwriting is strictly prohibited.

- Attempting to do so will result in automatic disqualification from the qualification process.

This blog about FHA W-2 Income Only Mortgage With No Income Tax Returns was updated on September 10, 2025.

FHA Flexibility for Hardworking Borrowers

Even with no tax returns filed, you may still qualify.