This blog delves into the significance of non-traditional credit in mortgage qualification process, particularly focusing on scenarios where borrowers lack conventional credit scores. A prevalent situation arises with recent college graduates with no credit history. This absence of credit scores is common among individuals who have recently completed their college education. Despite the absence of traditional credit scores, it’s important to note that recent college graduates remain eligible to meet the qualifications for a mortgage without needing a credit history.

Considering non-traditional credit in mortgage is very important, acknowledging that certain borrowers, such as recent college graduates, might not conform to conventional credit score criteria. The blog highlights the accessibility of non-traditional credit in mortgage for individuals without credit scores, emphasizing the inclusivity of the process for those embarking on their post-college journey. This recognition of non-traditional credit underscores the evolving landscape of mortgage lending, accommodating diverse financial backgrounds and acknowledging the unique circumstances of borrowers who may not fit the traditional credit mold.

When borrowers lack traditional credit scores, their files may be subject to a manual underwrite. In such cases, mortgage underwriters often necessitate the inclusion of non-traditional credit tradelines. These tradelines pertain to creditors whose information is not reported across all three credit bureaus. In the ensuing paragraphs, we will delve into the significance of non-traditional credit in the mortgage qualification process, exploring how it plays a crucial role in assessing the creditworthiness of individuals without conventional credit scores. Understanding the dynamics of non-traditional credit becomes imperative in facilitating a comprehensive evaluation for mortgage approval in instances where traditional credit metrics are absent.

The Reason Why Some Mortgage Loan Applicants Have No Credit Scores

Certain individuals may find themselves without credit scores in mortgage applications. This scenario is particularly common among recent college graduates or individuals who have undergone financial setbacks, such as bankruptcy or foreclosure, without subsequently rebuilding or establishing new credit. In these cases, the absence of credit scores stems from the lack of credit tradelines reporting to the three major credit bureaus.

Non-traditional credit in mortgage applications is prevalent when applicants, often recent graduates or those with a history of bankruptcy or foreclosure, fail to rebuild or establish new credit post-financial setbacks. The absence of credit scores in these instances is attributed to the absence of reported credit tradelines on the three major credit bureaus. This underscores the importance of considering alternative credit evaluation methods for these applicants in the mortgage approval process.

Qualifying For An FHA Loan With No Credit Scores

There are many consumers with no credit scores. They do not have a credit score from the three credit reporting agencies. They do not have a credit score because they have no active creditors reporting their payment history to the credit bureaus. Many folks who have filed for bankruptcy want nothing to do with credit. Therefore, they do not want to re-establish credit with any creditors.

No Credit Score? You Can Still Qualify for an FHA Loan!

Contact us today to learn how we can help you get approved with alternative credit documentation.

Why Consumers Do Not Have a Credit Score

People pay for everything they buy with cash. This includes food, clothes, home improvement tools, and even big items like cars and appliances. Not rebuilding credit after bankruptcy can hurt consumers when they try to buy a house, get insurance, or need to borrow money. Insurance companies set insurance rates based on a person’s credit score.

Importance of Credit Scores In Pricing Mortgage Rates

The higher the credit score the lower the insurance premium. It is common for recent college graduates not to have a credit score because they were dependent on their parents while they were in college.

The good news is people with no credit scores can still qualify for a mortgage without credit score. It needs to be a manual underwrite. Mortgage underwriters still need to review the past credit history and payment history of the borrower. This is done by requiring non-traditional credit tradelines. Non-traditional credit tradelines are credit tradelines that do not report to the three credit bureaus.

What Are Non-Traditional Credit Tradelines

Non-traditional credit tradelines are creditors that do not report to the three credit bureaus. Examples of non-traditional creditors are insurance companies, utility companies, cellular companies, gym memberships, cable and internet providers, and other creditors that do not report to the three credit bureaus.

Are Credit-Tradelines Required To Get Mortgage Approval?

When applying for FHA loans, numerous lenders will demand that borrowers possess a minimum of three established credit tradelines, each with a history of at least 12 months. It’s important to note that this requirement is a lender overlay and not part of the HUD guidelines. In fact, HUD allows borrowers with no active credit tradelines to qualify for FHA loans. This flexibility enables mortgage underwriters to assess credit risk effectively by reviewing the borrowers’ prior credit history. Additionally, non-traditional credit options are permitted for those lacking traditional credit tradelines, providing more avenues for approval.

Verification Of Mortgage And Rental Verification: Mortgage And Rental History

Mortgage/Rental History:

Mortgage/Rental History is very important. Verification of mortgage and/or verification of rent are strong non-traditional credit tradelines. There are many instances where the Automated Underwriting System will require verification of rent and/or verification of mortgage for borrowers with credit scores under 620.

How Can Rental Verification Be Valid To Be Used By Lenders

Rental and/or mortgage verification can only be proven if the borrower has paid their housing payment with a check and/or bank wire or online. The borrower needs to provide a history of 12 months of timely payments via canceled checks, online payments, or bank wire. Gustan Cho Associates allows borrowers who are living rent-free with families to be exempt from verification of rent. It will be exempt as long as the rent-free status can be documented and the reason for living rent-free is to save money so they can save for a home.

Traditional Versus Non-Traditional Credit In Mortgage Qualification Process

Non-traditional credit in mortgage refers to credit tradelines that are not commonly reported on credit bureaus. For a credit account to be recognized as a tradeline, the consumer must have a track record of consistent monthly payments over the past 12 months. Examples of traditional credit tradelines include student loans, auto loans, revolving accounts, credit cards, installment accounts, and mortgages.

In order to qualify as a credit tradeline, a one-year seasoning period is necessary. This implies that the consumer must have a documented history of making payments to the creditor for at least 12 months or more. It should be emphasized that the act of acquiring a secured credit card and making a few payments without fulfilling the 12-month seasoning requirement does not qualify as a credit tradeline when it comes to non-traditional credit in mortgage.

No Credit Score? Don’t Let That Stop You from Owning a Home

Contact us today to discuss how we can help you move forward with homeownership.

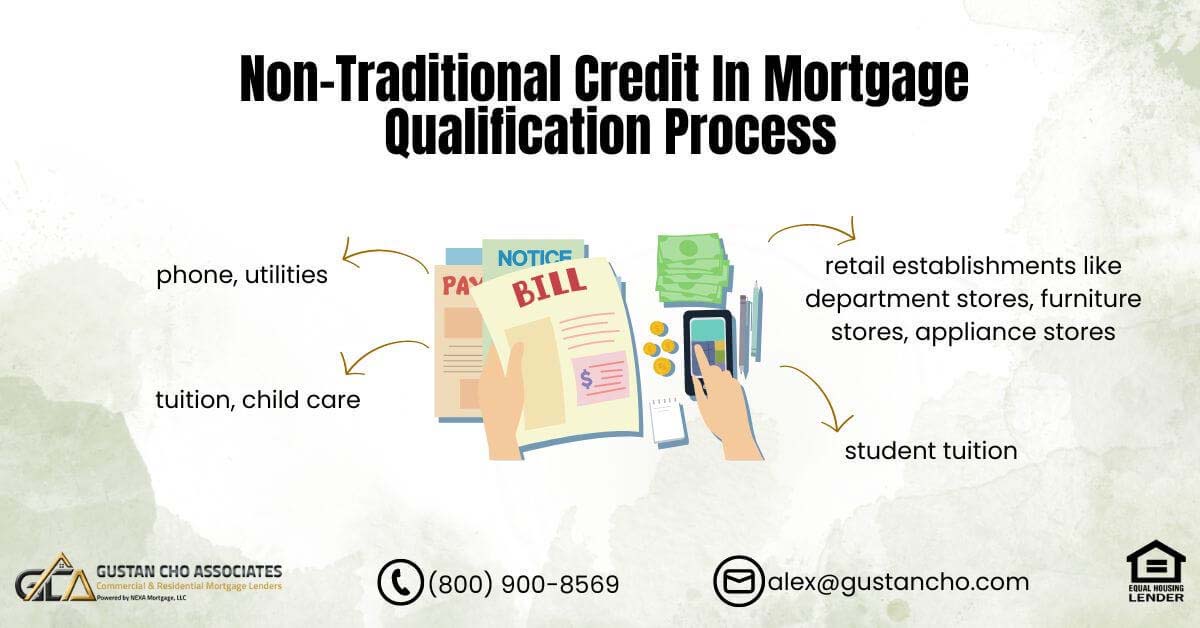

Typical Non-Traditional Credit Tradelines

Examples of non-traditional credit tradelines are creditors who do not report on the credit bureaus.

Here are some examples:

- Cell Phone

- Utility Bills

- Insurance bills

- Cable TV

- Rental Verification

- Mortgage Verification

- Internet monthly payments

- Any other creditors that do not report on credit bureaus

In order to be considered non-traditional credit tradelines, the consumer needs to have made at least 12 monthly payments to the creditor. If the consumer opened up an account and made payments for a few months, it does not count as a non-traditional credit tradeline.

Non-Traditional Credit In Mortgage Qualification Process For Borrowers With No Credit

To qualify for a mortgage using non-traditional credit, you need to use a Non-Traditional Credit Report (NTMCR). If you can’t get an NTMCR, you must verify non-traditional credit directly. You can use non-traditional credit when borrowers lack the usual credit accounts shown on a traditional credit report or to add to an insufficient number of credit accounts.

Cases Where Non-Traditional Credit In Mortgage Qualification Process Cannot Be Used

There are instances where non-traditional credit in the mortgage qualification process cannot be used.

Here are the instances where it cannot be used:

- To Offset derogatory credit tradelines

- To create a new credit report for mortgage borrowers without a verifiable credit payment history

- Enhancement of poor payment history of the borrower

- Non-Traditional Credit Tradelines must have three credit references

- Verification Of Rent is the best form of non-traditional credit that a borrower can provide

Insurance payments such as medical, life, automobile, and renters insurance coverage that is not payroll deducted can be used as non-traditional credit tradelines.

Forms Of Non-Traditional Credit That Can Be Used

Non-traditional credit can play a role in mortgage applications. This includes payments made for childcare and eldercare, which can count as non-traditional credit. These payments should go to businesses that provide services like tuition for students, department stores, furniture stores, appliance stores, and rent-to-own stores for furniture and appliances. By recognizing these payments as valid credit sources, mortgage lenders acknowledge people’s financial responsibilities in supporting their dependents’ education and care.

Another aspect of non-traditional credit involves paying medical bills that insurance does not cover. While this is not typical in traditional credit assessments, including these payments can provide a fuller picture of a borrower’s creditworthiness. Considering these payments highlights the various financial commitments people handle beyond standard credit options when applying for a mortgage.

Have Non-Traditional Credit? You Can Still Qualify for a Mortgage!

Reach out now to learn how we can help you get approved!

How Non-Traditional Credit In Mortgage Qualification Process Work

Non-traditional credit in the mortgage qualification process involves documenting a history of regular savings through non-payroll deducted deposits over a period of 12 months. This means that consistent deposits, which contribute to an increasing account balance, are essential. Additionally, having Non-Sufficient Funds (NSF) in your account can be detrimental and may jeopardize your mortgage application.

Example of Non-Traditional Credit Tradelines

Other examples of non-traditional credit

- Auto Leases

- Personal loans from non-company individuals can work if there is a written payment agreement with repayment terms and supported by canceled checks to verify payments

Non-Traditional Credit References need to include 12 months of payment history with the following terms:

- No history of late payment on rental payments

- No more than one thirty-day late payment on any other tradelines

- No collections other than medical collections in the past 12 months

Insufficient Non-Traditional Credit In Mortgage Qualification Process

Credit requirements for borrowers with insufficient credit are tougher than those with standard three-credit traditional credit tradelines. Here are the credit requirements for borrowers with non-traditional credit tradelines:

- Credit history of timely monthly payments during the prior 12 months.

- No more than one 30-day late payments

- No collection accounts were filed in the past 12 months other than medical collections

- Front-end debt to income ratios not to exceed 31% DTI and a back-end DTI not to exceed 43% DTI

- DTI can be extended to 50% with compensating factors

- Two months’ reserves from borrowers’ own funds required

- Reserves cannot be gifted

Home Buyers who do not meet credit tradeline requirements from other lenders can contact us at Gustan Cho Associates at 800-900-8569 or text for a faster response. Gustan Cho Associates is a national mortgage company licensed in multiple states with no lender overlays on government and conventional loans. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays. Or email us at gcho@gustancho.com.

FAQs About Non-Traditional Credit In Mortgage Qualification Process

Q: What is the Significance of Non-Traditional Credit in the Mortgage Qualification Process?

A: Non-traditional credit in mortgage is crucial in helping individuals, especially recent college graduates or those with financial setbacks, qualify for a mortgage when they lack traditional credit scores. It allows mortgage lenders to assess the creditworthiness of applicants without relying solely on conventional credit metrics.

Q: Who Typically Lacks Traditional Credit Scores in Mortgage Applications?

A: Individuals who have recently graduated from college or those who have experienced financial setbacks like bankruptcy or foreclosure without rebuilding their credit are often the ones without traditional credit scores.

Q: How can Recent College Graduates or Those with No Credit Scores Qualify for an FHA Loan?

A: While they may not have traditional credit scores, they can still qualify for an FHA loan through a manual underwrite process, which requires non-traditional credit tradelines in mortgage. Mortgage underwriters review their past credit and payment history to assess their creditworthiness.

Q: What are Non-Traditional Credit Tradelines in Mortgage, and Why are They Important?

A: Non-traditional credit tradelines in mortgage refer to creditors that do not report to the three major credit bureaus. They are essential for evaluating the creditworthiness of individuals without conventional credit scores, helping them qualify for mortgages.

Q: What Types of Creditors are Considered Non-Traditional Credit Tradelines?

A: Examples of non-traditional creditors include insurance companies, utility companies, cellular companies, gym memberships, cable and internet providers, and others that do not report to the major credit bureaus.

Q: How Can Individuals Document Non-Traditional Credit in the Mortgage Qualification Process?

A: Non-traditional credit can be documented through a Non-Traditional Credit Report (NTMCR) or by providing evidence of timely payments to non-reporting creditors, such as canceled checks, online payments, or bank wire transfers.

Q: Can Non-Traditional Credit in Mortgage be Used to Offset Derogatory Credit Tradelines or Create a New Credit Report for Borrowers Without a Credit Payment History?

A: No, non-traditional credit in mortgage cannot be used for such purposes. It is primarily used to supplement an insufficient amount of credit tradelines.

Q: What are Some Examples of Non-Traditional Credit References that can be Used in the Mortgage Qualification Process?

A: Non-traditional credit references can include payments made to care providers, retail establishments, rent-to-own stores, and medical expenses not covered by insurance.

Q: What are the Credit Requirements for Borrowers with Non-Traditional Credit Tradelines?

A: Borrowers with non-traditional credit tradelines must demonstrate a history of timely monthly payments over the past 12 months, with no more than one 30-day late payment and no recent collection accounts, except for medical collections.

This blog about “Non-Traditional Credit In Mortgage Qualification Process” was updated on April 22nd, 2025.

Using Non-Traditional Credit to Qualify for a Mortgage? We Can Help!

Contact us now for guidance on using non-traditional credit to qualify for a home loan.

Looking for a VA loan I have a rated disability of 10%