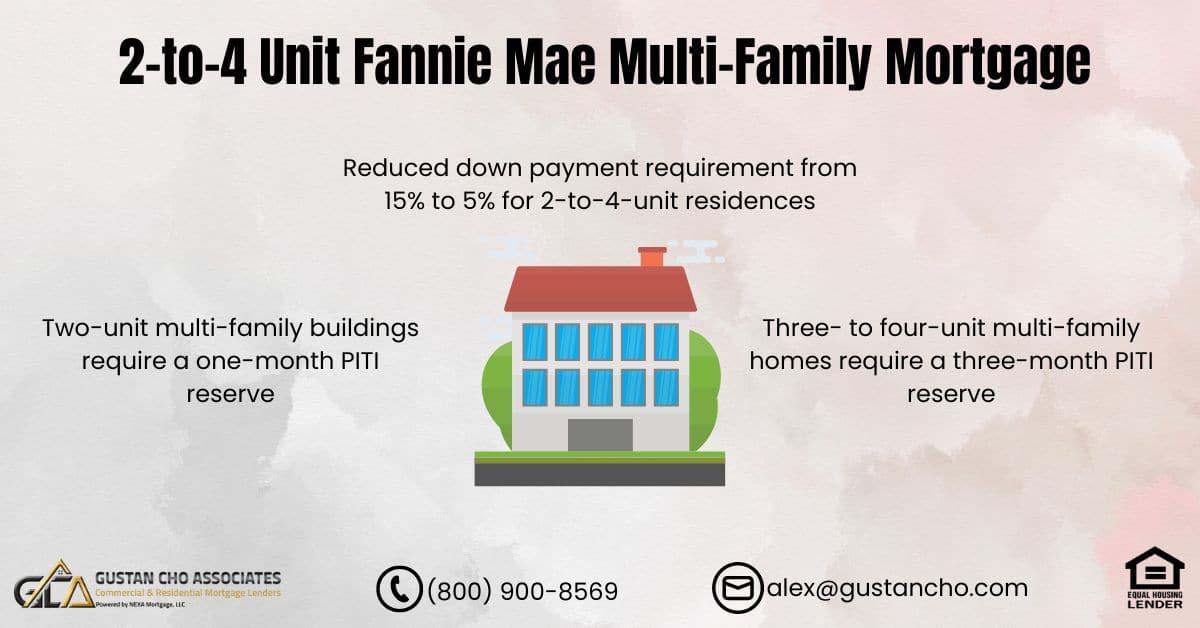

This manual addresses the modifications in down payment and self-sufficiency for multi-family properties designated as owner-occupant primary residences by the Fannie Mae Multi-Family Mortgage Guidelines. The Fannie Mae Multi-Family Mortgage Guidelines for 2-to-4-unit residences reduce the down payment obligations for owner-occupant borrowers, decreasing it from 15% to 5%.

Two-to-four-unit multi-family investment properties do not apply for Fannie Mae 5% down payment on multi-family conventional loans and require a 25% down payment.

The down payment requirements for Fannie Mae Multi-Family Mortgages are specifically reduced for owner-occupant borrowers. A down payment of 25% is mandatory for two-to-four-unit borrowers investing in homes. It’s important to note that Fannie Mae’s guidelines for a 5% down payment on multi-family primary owner-occupant homes do not satisfy the self-sufficiency test requirement.

Fannie Mae Rolls Out The 5% Down 2-to-4 Unit Multi-Family Conventional Loan Program.

Prospective homeowners can acquire both owner-occupied and investment multi-family residences using conventional loans. Fannie Mae Multi-Family mortgage loans apply to any residentially zoned two-to-four-unit multi-family property. These conventional loans are often referred to as conforming loans.

Conventional loans are called conforming loans because Fannie Mae only buys mortgage loans that conform to Fannie Mae agency guidelines that are secured by real estate.

Fannie Mae Multi-Family Mortgage does not extend financing eligibility to properties such as timeshares, motorhomes, houseboats, boat slips, cabanas, mobile homes, and residences lacking a fixed concrete foundation. Distinctions in down payment and reserve requirements exist within the Fannie Mae Multi-Family Mortgage Guidelines for two-unit homes compared to three- and four-unit multi-family homes.

Invest in multi-family living with just 5% down!

Apply now for a 2-to-4 unit conventional loan and secure your future today!

Can You Purchase a Two-to-Four Unit Multi-Family Home With Conventional Loans

Yes, you can purchase a two-to-four-unit multi-family home. These types of properties are called duplexes, triplexes, and fourplexes.

Hire a real estate agent with experience in multi-family properties. They can help you find suitable properties, negotiate the purchase, and guide you through the process.

Investing in a multi-family residence can be a strategic financial move, enabling you to generate rental income from various units. Assess your budget and explore financing alternatives, including collaborating with a mortgage broker or lender to investigate loan options tailored for multi-family properties, such as the Fannie Mae Multi-Family Mortgage.

Fannie Mae Repeal The 15% to 25% Down Payment Two-to-Four Unit Multi-Family Home Loans

Homebuyers interested in two-to-four-unit multi-family homes are now relieved from the previous down payment constraints. Conventional loans no longer mandate a 15% down payment for two units or a 25% down payment for three-to-four-unit multi-family homes. Instead, buyers can secure a two-to-four-unit multi-family mortgage with a 5% down payment.

Research potential neighborhoods and consider property values, rental demand, and proximity to amenities and public transportation.

Additionally, there is no longer a residual income requirement for loans on two-to-four-unit multi-family homes. While the Department of Housing and Urban Development (HUD), the parent of FHA, still mandates a 3.5% down payment for multi-family home loans, a self-sufficiency test is now only required for three to four-unit multi-family homes on FHA loans.

Fannie Mae Introduces The 5-Percent Down Payment Option on Multi-Family Homes

Fannie Mae introduced the 5 percent down option for homebuyers of multi-family homes. The 15% down payment Fannie Mae guidelines on two units and the 25% down payment on three-to-four-unit multi-family homes for owner-occupant homes are no longer in effect starting November 18, 2023.

Conduct a thorough inspection of the property to identify any potential issues. This includes examining the condition of each unit, the building’s structure, and its systems (plumbing, electrical, HVAC).

Fannie Mae Multi-Family Mortgage Guidelines on the down payment and reserve requirements were higher on two-to-four-unit multi-family investment properties than primary owner-occupant multi-family homes. Many homebuyers of multi-family homes could not qualify for conventional loans unless they put in a 15% down payment.

5% Down Payment on Two-to-Four Unit Multi-Family Conventional Loans

Homebuyers can qualify for two-to-four-unit multi-family homes with a 5% down payment and no self-sufficiency test on conventional loans. Understand local zoning regulations and any legal requirements related to multi-family properties.

Some areas may have specific rules governing the use of these properties. Explore financing options for multi-family properties.

Remember that buying a multi-family property involves more complexities than purchasing a single-family home. Thorough research and due diligence are crucial to making a successful investment. The following paragraphs will discuss the updated Fannie Mae’s multi-family mortgage guidelines. Fannie Mae’s 5% down payment option is only for owner-occupant primary multi-family homes.

Mortgage Guidelines on Owner-Occupancy Requirements for Multi-Family Homes

With owner-occupant, homeowners can live in one of the units, rent the other, and receive rental income. Any residentially zoned property with up to four units can qualify for owner-occupant conventional loans. Fannie Mae Multi-Family Mortgage Guidelines on the down payment are much higher than FHA’s 3.5% down payment requirement.

Owner-occupant and investment multi-family properties can be great investments due to their appreciation of potential and instant cash flow.

Multi-family unit homes require reserves depending on owner-occupancy or the property being an investment home. Two-unit multi-family buildings require a one-month PITI reserve. Three- to four-unit multi-unit family homes require a three-month PITI reserve. Investment multi-family homes require six months of PITI. PITI stands for principal, interest, tax, and insurance.

Start Your Process Towards Buying A Home

Apply Online And Get recommendations From Loan Experts

Reserve Requirements on Two-to-Four Unit Fannie Mae Multi-Unit Mortgage Loans

Gustan Cho Associates has dozens of wholesale lenders with no overlays on government and conventional loans. Gustan Cho Associates follows Fannie Mae and Freddie Mac’s Automated Underwriting System findings. We have zero lender overlays on government and conventional loans.

Fannie Mae Multi-Family Guidelines used to require a 15% down payment on two-unit owner-occupant homes with one month of PITI reserve.

Three four-unit owner-occupant primary homes require a 20% down payment with three months of reserves. Investment properties require a 25% down payment with six months of PITI reserves. This blog will discuss Fannie Mae’s Agency Guidelines and requirements. Effective November 18th, the Fannie Mae multi-family down payment guidelines on conventional loans have changed to 5%.

Purchasing Multi-Unit Properties as an Investment

Multi-family properties are becoming increasingly popular. Homebuyers who need an owner-occupant home and want a great investment can purchase multi-family homes. This also holds true for first-time homebuyers and those without a family. After one year, homeowners with a multi-family property can be eligible for another owner-occupant property if they buy a single-family home.

Buying a multi-family home is an excellent investment. Two-to-four unit buildings cost less per unit than buying a condo, townhouse, or single-family home.

They can exit the multi-family owner-occupant unit and rent it out. Becoming a first-time landlord is ideal with an owner-occupant multi-family home because managing multiple tenants in one location and living on the same property is easier. Down payment requirements differ based on owner-occupant versus investment homes.

Fannie Mae 5% Down 2-To-4 Unit Multi-Family Mortgage Loans

Fannie Mae Multi-Family Mortgage Down Payment Guidelines vary based on whether the property is intended for owner-occupancy or investment purposes. Additionally, loan-to-value limits differ depending on the type of refinancing. Below are the fundamental Fannie Mae Multi-Family Mortgage Guidelines regarding down payment and loan-to-value:

For conventional loans on owner-occupied two-unit properties, a 15% down payment is required.

VA loans provide 100% financing, eliminating the need for a down payment on multi-family homes. The maximum loan value for owner-occupied homes with up to 2 units is 85% LTV or a 15% down payment; for 2 to 4-unit multi-family homes, an 80% LTV or a 20% down payment is necessary.

Conventional loans require a 15% down payment on two unit buildings and 20% down payment on three to four unit multi-family unit homes versus HUD’s 3.5% down payment requirement on two-to-four unit homes.

Gustan Cho Associates facilitates a 5% down payment option for multi-family home financing. For more information, contact Gustan Cho Associates at alex@gustancho.com or 800-900-8569. For a quicker response, feel free to text us.

Fannie Mae Announced 5% Down Payment Multi-Family Home Loans

FHA and VA loans are the two government loan programs allowing multi-family home financing. However, all government-backed mortgage loans are for owner-occupant homes only. Fannie Mae multi-family mortgage guidelines allow owner-occupant and investment property multi-family home financing.

If you want to finance two-to-four unit multi-family properties, you cannot use FHA and VA loans. Conventional and non-QM loans allow for investment home multi-family home financing.

Unlike FHA loans, Fannie Mae Multi-Family Mortgage Guidelines allow investment property financing on two-to-four-unit multi-family homes. Property down payment requirements on 2 to 4-unit investment homes require a 25% down payment or 75% LTV.

Fannie Mae Multi-Family Mortgage Guidelines on Refinancing

Refinance Conventional Guidelines on 2-unit properties for rate and term refinancing loan to value is 85% LTV. Rate and term refinance guidelines on conventional loans for primary three- to four-unit multi-family homes are 80% LTV.

Multi-Family homeowners can do a cash-out refinance. On cash-out refinance mortgage loans on two-to-four unit multi-family homes, the loan-to-value is lower than rate and term refinance.

The owner-occupant loan-to-value on primary multi-family homes on a cash-out refinance loan is lower than the loan-to-value cash-out refinance on investment multi-unit homes. Owner-occupant cash-out refinance on 2 to 4 units is capped at 75% LTV. Cash-Out refinance loan to value on investment 2 to 4 unit properties is capped at 70% LTV.

Fannie Mae Multi-Family Mortgage on Refinancing

Apply Online And Get recommendations From Loan Experts

How To Manage Two-To-Four Unit Multi-Family Homes

Consider how you will manage the property, especially if you are not planning to live in one of the units. Property management may involve handling tenant issues, maintenance, and other responsibilities. Evaluate the potential rental income from each unit to ensure it aligns with your investment goals.

Consider market rents in the area and factor in potential vacancy rates. Calculate the potential return on investment to determine if the property aligns with your financial goals.

This includes considering not only rental income but also property appreciation over time. Seek advice from legal and financial professionals specializing in real estate transactions. They can help ensure you understand all the purchase’s legal and financial aspects.

Lowered Down Payment on Multi-Family Homes on Conventional Loans

Borrowers of two- to four-unit properties need to meet all FANNIE MAE Multi-Unit Family Guidelines. Conventional loans have a minimum credit score requirement of 620 FICO. There are reserve requirements for multi-family homes.

The minimum reserve requirement for two-unit owner-occupant primary residence homes is one month of PITI. Reserve requirements on three- to four-unit owner-occupant multi-family homes are three months of PITI.

Reserve requirements on two-to-four-unit multi-family investment homes are six months of PITI. Reserve requirements by mortgage lenders mean one month of PITI.

PITI is principal, interest, tax, and insurance. When a lender requires three months of reserves, the lender requires the borrower to have three months of principal, interest, tax, and principal savings. FHA requires one-month reserves on two-unit homes and three-month reserves on three- to four-unit homes. Debt-to-income ratios on multi-family home financing cannot be greater than 50%.

Gustan Cho Associates, powered by NEXA Mortgage, are mortgage brokers licensed in 48 states, including Washington, DC, and Puerto Rico, with over 210 wholesale mortgage lenders.

Using the Potential Rental Income on Multi-Family Homes

Potential rental income can be used as qualified income on multi-family properties. Fannie Mae and Freddie Mac allow up to 75% of potential rental income to be used as qualified income. The home appraiser determines the potential rental income. Potential rental income can be used even though the units are vacant. HUD, the parent of FHA, allows up to 85% of potential rental income to be used as qualified income.

Over 80% of our homebuyers at Gustan Cho Associates are borrowers who could not qualify at other mortgage companies due to a last-minute mortgage loan denial or the lender having overlays.

At Gustan Cho Associates, we have no lender overlays on government and conventional loans. We go off the agency mortgage guidelines. Homebuyers seeking pre-qualification for a two-to-four-unit multi-family home should contact us at Gustan Cho Associates.

The team at Gustan Cho Associates is an expert on two- to four-unit multi-family owner-occupied and investment homes. Contact us at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.

FAQ for UPDATED 2-to-4 Unit Fannie Mae Multi-Family Mortgage

What modifications are addressed in the manual regarding down payment and self-sufficiency for multi-family properties designated as owner-occupant primary residences by Fannie Mae Multi-Family Mortgage Guidelines?

The manual discusses down payment and self-sufficiency changes for owner-occupant primary residences within the Fannie Mae Multi-Family Mortgage Guidelines. Specifically, it highlights a reduction in the down payment requirement from 15% to 5% for 2-to-4-unit residences.

Do the Fannie Mae Multi-Family Mortgage Guidelines apply to two-to-four-unit investment properties as well?

No, the 5% down payment option mentioned in the Fannie Mae Multi-Family Mortgage Guidelines is specifically for owner-occupant borrowers. Investment properties in the two-to-four-unit category still require a 25% down payment.

Is the 5% down payment option applicable to all multi-family homes, including three-to-four-unit properties?

Yes, the 5% down payment option introduced by Fannie Mae applies to two-to-four-unit multi-family homes, regardless of the number of units.

When did Fannie Mae roll out the 5% down payment option for 2-to-4 unit multi-family conventional loans?

Fannie Mae introduced the 5% down payment option on November 18, 2023, repealing the previous down payment constraints of 15% for two-unit and 25% for three-to-four-unit multi-family homes.

Can conventional loans be used to purchase two-to-four-unit multi-family homes for investment purposes?

Yes, conventional loans, including Fannie Mae Multi-Family Mortgage, can be used for both owner-occupied and investment multi-family residences. However, the down payment requirements differ, with a 5% down payment option available for owner-occupant homes.

Is the self-sufficiency test required for Fannie Mae’s 5% down payment option on multi-family primary owner-occupant homes?

No, it’s important to note that Fannie Mae’s guidelines for a 5% down payment on multi-family primary owner-occupant homes do not satisfy the self-sufficiency test requirement.

What types of properties are not eligible for financing under Fannie Mae Multi-Family Mortgage Guidelines?

Fannie Mae does not extend financing eligibility to properties such as timeshares, motorhomes, houseboats, boat slips, cabanas, mobile homes, and residences lacking a fixed concrete foundation.

What reserve requirements exist for two-to-four-unit multi-family homes under Fannie Mae Multi-Family Mortgage Guidelines?

Two-unit multi-family buildings require a one-month PITI reserve, while three- to four-unit multi-family homes require a three-month PITI reserve. Investment multi-family homes necessitate six months of PITI.

When did Fannie Mae repeal the 15% to 25% down payment requirement for two-to-four-unit multi-family home loans?

Effective November 18th, Fannie Mae repealed the previous down payment requirements of 15% for two units and 25% for three-to-four-unit multi-family homes. Now, buyers can secure a two-to-four-unit multi-family mortgage with a 5% down payment.

Can potential rental income be used as qualified income for multi-family properties under Fannie Mae Multi-Family Mortgage Guidelines?

Yes, Fannie Mae and Freddie Mac allow up to 75% of potential rental income to be used as qualified income. The home appraiser determines the potential rental income, and it can be utilized even if the units are vacant.