In this blog, we will discuss and cover duplex mortgage loans down payment guidelines. A duplex is a two-unit multi-unit residential housing unit. HUD, the parent of FHA, allows homebuyers to qualify for a 3.5% home purchase FHA loan on an owner-occupant one to four-unit home. The owner needs to occupy one of the units and can rent out the remaining units when they purchase a one to four-unit multi-family home.

Chicago Multi-Family Homes

In Chicago, it is often called two flats when there is an apartment on the first floor and another apartment on the second floor. The owner often lives in one of the units and rents out the other unit. Two flats in Chicago often have basements. Many Chicago two flats have basement apartments that have been remodeled without proper building permits but the duplex owner still collects the rent. The City of Chicago is aware of this but does not enforce the building code. Mortgage lenders who originate duplex mortgage loans will not count rental income from illegal basement apartments.

Do You Have to Put 20% Down on a House in Chicago?

No, you do not have to put 20% down on a house in Chicago. Various loan options allow for lower down payments depending on your qualifications. For example, conventional loans can require as little as 3% to 5% down, although putting down less than 20% typically means you’ll need private mortgage insurance (PMI).

FHA loans, supported by the Federal Housing Administration, necessitate a minimum down payment of 3.5% for individuals with a credit score of 580 or higher.

Meanwhile, individuals with lower scores might be required to put down 10%. VA loans for qualifying veterans and active-duty service members frequently do not necessitate a down payment. Additionally, USDA loans for homebuyers in rural and suburban areas may not require a down payment.

Additionally, first-time homebuyer programs in Illinois offer down payment assistance, sometimes reducing the requirement to as little as 1%. These programs can be a valuable resource for those looking to enter the housing market without a substantial initial investment. It’s advisable to consult with a lender to explore these options and determine what you qualify for based on your financial situation and credit history.

Ready to Buy a Duplex? Let Us Help You Secure the Perfect Mortgage Loan!

Contact us today to learn about your mortgage options and get pre-approved for a duplex loan.

3.5% Down Payment FHA Versus 15% Down Payment Conventional On Multi-Family Homes

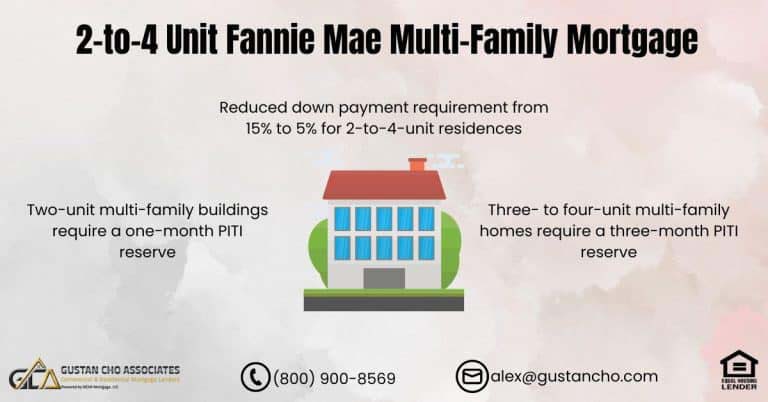

A duplex or 2 flats is an excellent choice for those homebuyers who eventually want to be property investors or first-time homebuyers who want a lot of property for their money. A duplex home buyer can qualify for a 3.5% down payment duplex mortgage loan. This only holds true if the duplex is an owner-occupied residence. Duplex mortgage loans have higher FHA loan limits than single-family loans.

Rental Income on Multi-Family Homes

Rental income for the additional unit can be used for income qualification. HUD has higher FHA loan limits on two to four-unit FHA loans. One of the units of the duplex must be owner-occupied and the second unit can be rented. The appraisal of the 2 units needs to include 1007, which is the schedule of market rents. From the schedule of market rent for the rental unit, 85% of the market rent can be used towards rental income in qualifying borrowers’ debt to income ratios on FHA Loans. Conventional Guidelines only allow 75% of the potential income to be used.

Using Vacant Apartment Income On 2 To 4 Unit Properties

Buyers of multi-unit properties can use 85% of potential rental income on FHA Loans and 75% of potential rental income on Conventional loans:

- Correct, 85% of rental income

- I just checked HUD’s website, and the loan limit for a 2-unit is $468,150

- The duplex home buyer also needs expanded homeowners insurance to include 6 months rental loss insurance

For conventional duplex mortgage loans, a 15% down payment is required for owner-occupied duplex properties.

Can I Purchase A Single Family Owner Occupied Home After Duplex Mortgage Loans?

Home Buyers can qualify for another owner-occupied home after they have lived in a duplex for at least a year. They can rent out the primary unit of your duplex. Homeowners can only have one owner-occupied home. But there are exceptions to the rule where if they purchased an owner-occupied home but want to move out of there and purchase another owner-occupied home.

Exceptions to this rule are if you get a job transfer that is beyond commuting distance or if they need to either upgrade home because family is expanding. Or downsize home because kids are now grown and are off to college. Buying a single-family home after purchasing an owner-occupied duplex qualifies for upgrading to a larger single-family home.

Looking to Buy a Duplex? We Offer Flexible Financing Options!

Reach out now to explore your mortgage options and get started with your duplex loan.

Non-QM Duplex Mortgage Loans

Home Buyers who need to qualify for duplex mortgage loans with a mortgage company licensed in multiple states with no mortgage overlays on government and conventional loans can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

Gustan Cho Associates has no lender overlays on government and conventional loans. Gustan Cho Associates has a national reputation of being a one-stop mortgage shop. This is due to offering non-QM and alternative mortgage loan programs. We have partnerships with over 160 non-QM wholesale mortgage lenders.

Gustan Cho Associates has every mortgage loan program available in today’s market. This includes owner-occupant homes, second homes, and investment properties. Some of our popular non-QM loan programs include 12-month bank statement mortgages, non-QM mortgages one day out of bankruptcy and foreclosure, asset-depletion mortgages, P and L no-doc stated income mortgages, and fix and flip mortgages.

FAQs: Duplex Mortgage Loans Down Payment Guidelines

- 1. What is a duplex? A duplex is a two-unit, multi-unit residential housing unit. It allows the owner to occupy one unit while renting out the other.

- 2. What are the down payment requirements for an FHA loan on a duplex? If the property is owner-occupied, homebuyers can qualify for a 3.5% down payment. The owner must live in one of the units and can rent out the other.

- 3. Are there different terms for duplexes in Chicago? Yes, in Chicago, duplexes are often called “two flats,” with an apartment on each floor. Many two flats also have basements that are sometimes rented out, though only sometimes legally.

- 4. Do you need to put 20% down on a house in Chicago? Different loan options offer the opportunity for reduced down payments. For instance, conventional loans necessitate only 3% to 5% down. In comparison, FHA loans mandate a minimum of 3.5% down for individuals with a credit score of 580 or above.

- 5. What are the benefits of purchasing a duplex? Purchasing a duplex allows homebuyers to live in one unit and rent out the other, potentially helping cover mortgage payments. It’s also a good option for those interested in property investment.

- 6. Can rental income from a duplex be used for loan qualification? Yes, rental income from the additional unit can be used to qualify for income. HUD allows 85% of the market rent for FHA loans, while conventional guidelines allow 75%.

- 7. What are the down payment requirements for conventional duplex loans? For conventional duplex mortgage loans, a 15% down payment is required for owner-occupied duplex properties.

- 8. Can I purchase a single-family, owner-occupied home after owning a duplex? Yes, you can qualify for another owner-occupied home after living in a duplex for at least a year. You can rent out the primary unit of your duplex. Still, certain exceptions apply when purchasing a new owner-occupied home.

- 9. What are Non-QM duplex mortgage loans? Non-QM (Non-Qualified Mortgage) loans are available for those needing to meet traditional mortgage qualifications. These include 12-month bank statement mortgages and P&L no-doc stated income mortgages. Contact Gustan Cho Associates for more information.

If you have any questions about Duplex Mortgage Loans Down Payment Guidelines or you need to qualify for loans with a lender with no overlays, please contact us at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about Duplex Mortgage Loans Down Payment Guidelines was updated on June 10th, 2024.

Buying a Duplex? Let’s Find the Best Mortgage Loan for You!

Contact us today to learn about the best loan options for duplexes and get started with your home purchase.