How Loan Officers Qualify Borrowers And Issue Pre-Approvals

This Article Is About How Loan Officers Qualify Borrowers And Issue Pre-Approvals. Understanding how loan officers qualify borrowers is crucial in the…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This Article Is About How Loan Officers Qualify Borrowers And Issue Pre-Approvals. Understanding how loan officers qualify borrowers is crucial in the…

This guide covers credit score guidelines versus overlays by mortgage lenders. There are two types of credit score requirements to…

In this blog post, we’ll discuss qualifying for FHA loans with top North Carolina FHA lenders for bad credit. It’s…

This blog is about overlays in underwriting on government and conventional loans. The mortgage industry went through a major overhaul…

This guide covers getting a home loan approved after denied by a bank for your mortgage. There should be no…

This blog will cover the FHA Total Scorecard and how it works. The United States Department of Housing and Urban…

HUD, the parent of FHA, allows borrowers down to a 500 credit score to qualify for an FHA loan. However, for borrowers with under a 580 credit score, a 10% down payment is required.

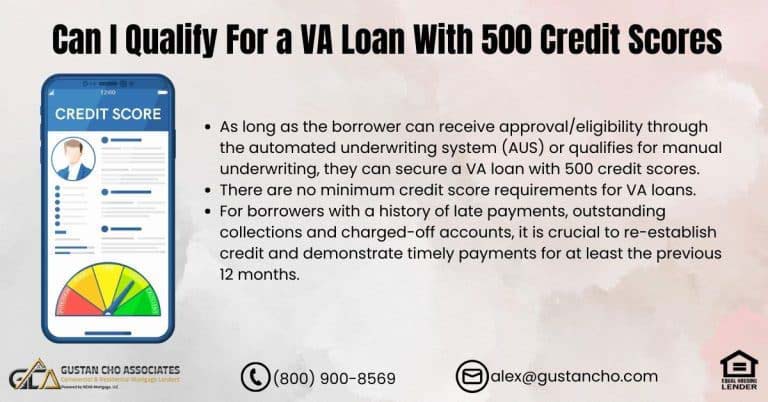

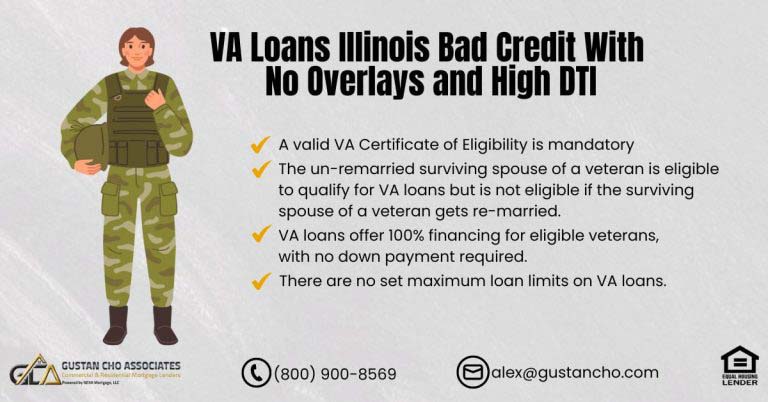

Gustan Cho Associates has no lender overlays on VA loans. VA loans do not have a minimum credit score requirement nor a maximum debt to income ratio cap as long as the borrower can get an approve/eligible per automated underwriting system.

This guide covers HUD guidelines versus lender overlays on FHA loans. There have been notable changes for HUD guidelines versus…

This guide covers preparing for a VA loan with a lender with no overlays. Preparing for a VA loan with…

Can an individual with a credit score of 500 be eligible for a VA loan? Absolutely. The Veterans Administration (VA)…

This guide covers avoiding home loan denial during the mortgage process. We will go deeply in giving our viewers tips…

This guide covers VA credit agency guidelines versus lender overlays on VA loans. Understanding VA Credit Score Agency Guidelines is…

This guide covers overlays on debt-to-income ratio on FHA loans. Homebuyers who got issued pre-approval from a mortgage loan originator…

This guide covers lender overlays on credit tradelines by mortgage underwriters. Do all mortgage companies have lender overlays on credit…

This article covers getting a VA loan denial due to overlays and qualifying with a different lender. In this article,…

This article Is about qualifying for VA loans Illinois bad credit with no overlays and high debt-to-income ratio. VA loans…

In this blog, we will cover and discuss mortgage loan programs with no overlays and closing in 30 days. The…

This guide covers how lender overlays prevent mortgages for homebuyers. The Federal Reserve Board announced that almost a third of…

This guide covers the DTI overlays lenders require on government and conventional loans. DTI overlays are imposed on home mortgage…

This guide covers mortgage approval with bad credit and late payments. Many consumers have had a period in their lives….

This blog covers the best Arizona mortgage lenders for bad credit with low FICO credit scores. It is an important…