This guide covers how lender overlays prevent mortgages for homebuyers. The Federal Reserve Board announced that almost a third of commercial and residential mortgage lenders loosen lending overlays in the 3rd Quarter. They expect lenders loosen lending overlays even more on the 4th Quarter. Lenders loosen lending overlays have sparked a sharp increase in mortgage applications nationwide. Most of our borrowers see first hand how lender overlays prevent mortgages. Over 80% of our borrowers are folks who could not qualify at other lenders due to lender overlays:

The reason why one lender denies and another approves is due to how lender overlays prevent mortgages for buyers. Loosening overlays by lenders enable homebuyers to purchase homes otherwise they would not have qualified.

Mortgage rates are at an 18 month high and conventional mortgage rates have crossed the 7.5% mark last week. There are no signs of a housing slowdown with higher rates. However, rates have started to drop due to the 10-year treasuries going from 5.0% to under 4.0%. With the combination of loosening of lenders loosen overlays with strong demand in the housing market, the housing market and housing prices are expected to be stronger than ever.

How Lender Overlays Prevent Mortgages: What Are Lender Overlays

Lender overlays refer to additional criteria or requirements that a mortgage lender imposes on top of the standard guidelines set by government agencies (such as the Federal Housing Administration, Fannie Mae, or Freddie Mac). These overlays can vary from one lender to another and are used as risk management tools to protect the lender from potential defaults or losses.

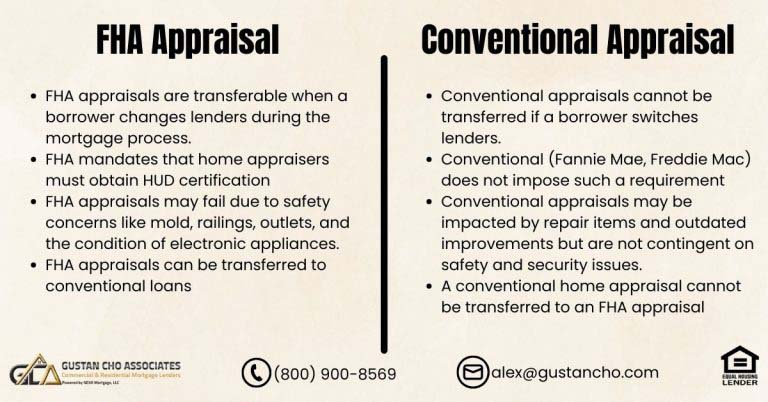

Lenders may have additional property condition requirements or appraisal standards beyond what government agencies mandate. If a property doesn’t meet these criteria, the lender may refuse to approve the loan.

Lender overlays can sometimes prevent mortgage approvals for borrowers. While government agencies may have minimum credit score requirements for certain loan programs, lenders can set their own, higher credit score standards as overlays. If a borrower’s credit score falls below the lender’s threshold, even if it meets the government agency’s minimum, the loan application may be denied. These overlays are not inherently negative, as they can help lenders manage risk and maintain a healthy portfolio. In the following paragraphs, we will cover how lender overlays prevent mortgages.

Struggling Housing and Mortgage Markets

The strong economy under the Trump Presidency with good economic and international news day after day, home buying and refinance mortgage applications skyrocketed when Trump was President. Those days are now gone but we can only hope things will get better for the mortgage and real estate industry.

Lenders are on high alert and worry about another housing crisis around the corner due to high inflation, skyrocketing home prices, political unrest and corruption, and surging home prices.

In this article, we will cover and discuss how lender overlays prevent mortgages for homebuyers. Lenders may impose reserve requirements, which refer to the amount of cash or liquid assets a borrower must have after closing. If a borrower cannot meet the lender’s reserve requirements, their loan may be denied.

Get Mortgage Loans For Home, Click Here

Lenders Realize How Lender Overlays Prevent Mortgages

More and more lenders are realizing how lender overlays prevent mortgages for home buyers. With higher mortgage rates, the refinance is drying up where much small mom and pop refinance shop are closing their doors and trying to concentrate on the purchase markets. Most national lenders have loosened lending overlays are guidelines. Lenders may have stricter guidelines regarding a borrower’s credit history, including how recent any derogatory marks (such as bankruptcies or foreclosures) can be. Even if the borrower meets the government agency’s guidelines, the lender may deny the loan based on these additional criteria.

What Overlays Are Being Imposed By Mortgage Companies

It is a fact how lender overlays prevent mortgages. Overlays are when a lender imposes additional mortgage lending requirements on top of the minimum FHA, VA, USDA, Freddie Mac, and Fannie Mae Guidelines. For example, to qualify for a 3.5% down payment FHA loan, HUD, the parent of FHA, requires a minimum credit score of 580. However, a particular lender may set a lending overlay of a minimum credit score of 620 to 640. Many lenders have overlays on credit scores and refuse to take any mortgage loan applicant with credit scores under 640. Same with collection accounts. HUD does not require a mortgage loan applicant to pay off collection accounts with unsatisfied balances.

Why Lenders Impose Overlays on Collections and Charged-Off Accounts

However, a lender may require borrowers to pay off any collection accounts with balances: Lenders may require to bring it to a zero balance as part of their overlays. This is because they might be afraid that the collection account will turn into a judgment. Majority of lenders have overlays and are realizing how lender overlays prevent mortgages on purchase transactions.

More and more lenders are eliminating some of their mortgage overlays. Gustan Cho Associates Mortgage Group have zero overlays on government and conventional loans.

Not too many mortgage lenders have zero mortgage lending overlays. However, if you get denied at one lender, you can go to a different lender and get approved. I expect lenders loosening their lending overlays more and more as time goes on because they now realize how lender overlays prevent mortgages.

Credit Score Lending Overlays

As mentioned above, the minimum credit score needed to qualify for a 3.5% down payment home purchase mortgage loan is 580. However, most banks and lenders have lending overlays on FHA loans that require minimum credit scores of 620 to 640. While some government-backed loans allow for low down payments, lenders may require borrowers to make a higher down payment as an overlay. If a borrower cannot meet the higher down payment requirement, their loan application may be denied.

HUD guidelines require borrowers with under a 580 credit score and down to 500 FICO a 10% down payment versus a 3.5% down payment for borrowers with a 580 credit score and higher.

Many 640 credit score lenders have loosened their lending overlays to 620 credit scores. Others have lowered their minimum credit score requirements to 600. If credit scores are lower than 600 and no lender will take you due to their lending overlays, please contact us at Gustan Cho Associates. We have zero overlays and just go off the DU FINDINGS or LP FINDINGS.

How Lender Overlays Prevent Mortgages: Debt-to-Income Ratio Mortgage Overlays

Lenders often impose stricter debt-to-income (DTI) ratio limits as overlays. If a borrower’s DTI exceeds the lender’s threshold, even if it complies with standard guidelines, the lender may deny the mortgage application. Besides credit score lending overlays, another popular lending overlays set by lenders are the debt to income ratio overlays. For FHA loans, the maximum front end debt to income ratios allowed to be approve/eligible per DU FINDINGS is 46.9% and the maximum back end debt to income ratio allowed is 56.9% DTI.

Majority of lenders have lender overlays on DTI. Even if you meet HUD guidelines and get an AUS approval, the lender may cap the debt-to-income ratio due to their lender overlays.

Most FHA lenders do not want to see a 45% debt-to-income ratio. There are some that will allow up to 50% debt-to-income ratio for the back end. However, more and more lenders are eliminating the debt-to-income ratio overlays and will just go off DU FINDING. A few national lenders recently removed their debt-to-income ratio 50% maximum lending overlays and now will just go off DU FINDINGS. Borrowers will find more and more lenders removing their debt-to-income ratio overlays on FHA LOANS.

Talk To Our Lender about DTI Ratio, Click Here

How Lender Overlays Prevent Mortgages on Collection Accounts

HUD guidelines allow for a mortgage applicant to get a home loan with unsatisfied collection accounts without having them pay for it in full. However, many lenders, especially banks and credit unions, require that all collection accounts be paid in full as part of their own internal mortgage overlays.

Most lenders that have overlays on collection accounts still do not budge on this overlay. The reason being is because they are afraid an unsatisfied collection account can turn into a judgment.

You do not have to pay outstanding collections and charge-off accounts. How lender overlays prevent mortgages is most lenders want borrowers to pay off outstanding collections as part of their overlays. Borrowers who get denied by a lender due to unpaid collection accounts, please contact us at 800-900-8569 or text us for faster response. We have no overlays on government and conventional loans and just go by is DU FINDINGS.

How Lender Overlays Prevent Mortgages: Lender With No Overlays

We all now know how lender overlays prevent mortgages. Lender overlays can create challenges for borrowers, especially if they don’t meet the specific criteria set by a particular lender. Borrowers are encouraged to shop around and consider multiple lenders to find one whose overlays align with their financial situation. Borrowers who have gotten denied for a mortgage loan in the past couple of years from lender due to mortgage lending overlays may try them back. Many mortgage lenders have loosened their lending overlays. If you still do not qualify due to their overlays, please contact us at Gustan Cho Associates Mortgage Group at 1-800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com. Viewers can visit GCA Forum where it is the most active mortgage forum in the United States.