Health Insurance Special Enrollment Rules You Must Know

If you missed open enrollment or your life just changed, you don’t have to wait a whole year to get…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

If you missed open enrollment or your life just changed, you don’t have to wait a whole year to get…

How to Cancel PMI on Conventional Loans in 2025: Step-by-Step Guide to Save Money Private Mortgage Insurance (PMI) is one…

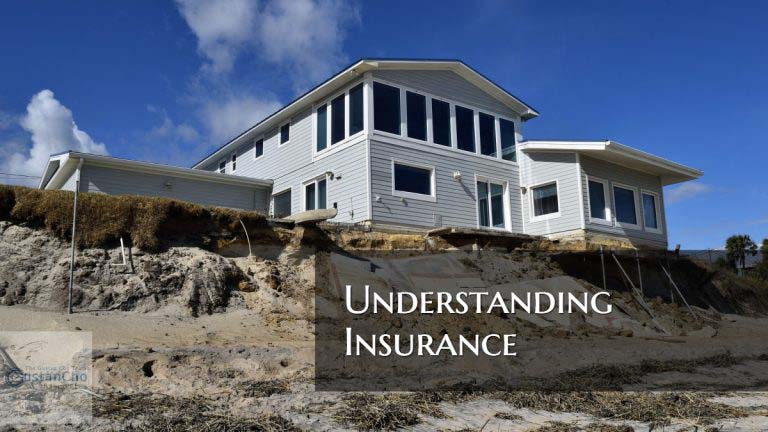

This guide covers understanding insurance protection for consumers and homeowners. Good morning open enrollment blog for day 1 of the…

With mortgage payments often being one of the largest monthly expenses, owning a home comes with big financial responsibilities. Life’s…

This BLOG On Insurance Claim By Policyholders Often Yields An Increase Of Premium Was UPDATED On January 3rd, 2025. Filing…

This guide covers travel insurance. In the following paragraphs, we will cover A Little TIDBIT About “Travel Insurance”. So, here…

Understanding PMI on Conventional Loans: Your Essential Guide for 2024 When you’re looking to buy a home or refinance one,…

Refinancing your mortgage is a smart way to lower your housing costs and save money over time. For FHA homeowners,…

In this article, we will discuss and cover the Types of Insurance For Different Kinds of Athletes. From the time…

Breaking News: Lower FHA Mortgage Insurance Premiums in 2024—What It Means for Your Mortgage Are you thinking about buying a…

This guide covers what is PMI on conventional loans. What Is PMI? One of the most common questions I often…

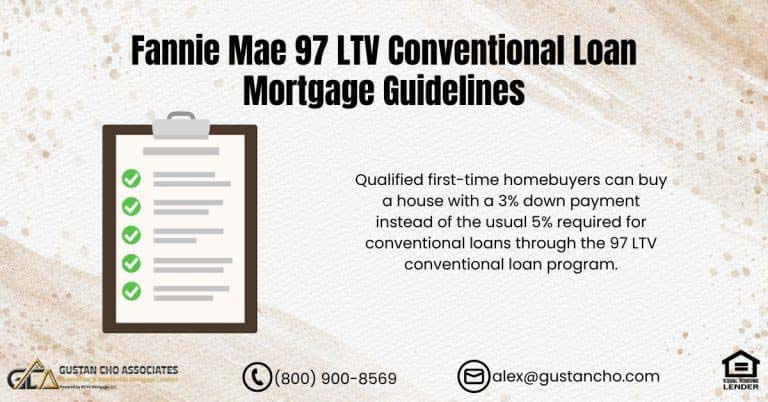

This guide covers the 97 LTV conventional loan mortgage guidelines for first-time homebuyers. Fannie Mae and Freddie Mac 97 LTV…

This guide covers FHA MIP versus conventional PMI for mortgage borrowers. Mortgage Insurance is mandatory on all FHA loans and…

This guide covers eliminating FHA mortgage insurance premium by refinancing FNMA. Borrowers taking out an FHA insurance mortgage loan, besides…

Homeowners With FHA Loans Should Consider A Conventional Refinance Loan While Mortgage Rates Are At Historic Lows And Avoid Paying FHA MIP. Mortgage rates are at historic lows and many home values have skyrocketed in the past several years. Many homeowners with FHA loans can benefit by refinancing to a conventional mortgage and avoid paying LPMI.

This guide covers the first payment after closing for mortgage loan borrowers. One of the most common questions new homebuyers…

This guide covers buying home with no private mortgage insurance with 80-10-10 mortgage loans. Any conventional mortgage loan with less…

In this guide, we will cover what is lender-paid mortgage insurance on conventional loans. Lender-paid mortgage insurance is also referred…

In this guide, we will cover being prepared for hurricanes in Florida. Homeowners and renters in Florida’s biggest fear is…

This BLOG On FHA Lowers Mortgage Insurance Premium Was UPDATED On November 24th, 2018 This blog is a rewrite and updated…