Mortgage After Bankruptcy: Your 2026 Guide to Homeownership

This guide covers the minimum lending requirements with getting approved for a mortgage after bankruptcy. Bankruptcy is a federal law…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers the minimum lending requirements with getting approved for a mortgage after bankruptcy. Bankruptcy is a federal law…

As per the Fannie Mae Bankruptcy Guidelines for conventional loans, borrowers must follow a mandatory waiting period after filing for…

According to VA and HUD Chapter 13 cash-out refinance guidelines, homeowners may be eligible for a cash-out refinance on an…

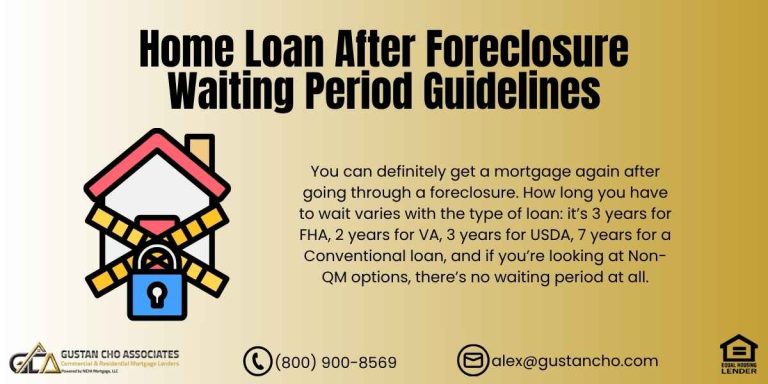

Quick Answer: Mortgage Loan After Foreclosure Yes—you can get a mortgage loan after foreclosure, often sooner than you think. Eligibility…

Quick Answer Yes—getting a home loan after multiple foreclosures is still possible. The key is the most recent foreclosure date…

Quick Answer: Yes, you may qualify for an FHA or VA mortgage while you’re still in an active Chapter 13…

When Is Rental Verification Required? (Quick Answer for Borrowers) If you’re buying a home, you may be wondering when is…

Buying a home in Alaska while you’re in a Chapter 13 repayment plan is possible — but only if you…

Understanding the FHA Bankruptcy Waiting Period The FHA Bankruptcy Waiting Period determines how long a borrower must wait after filing…

Home Loan After Foreclosure: 2026 Waiting Period Guidelines and Options Losing a home to foreclosure can feel like the end…

Mortgage After Short Sale Waiting Period: How Soon Can You Repurchase a Home? If you went through a short sale…

In this blog, we will discuss and cover the bankruptcy mortgage guidelines on government and conventional loans. All mortgage loan…

In this blog, we will cover and discuss qualifying for FHA jumbo loans while in Chapter 13 Bankruptcy repayment plan….

In this article, we will cover and discuss the FHA Chapter 13 Guidelines in Wyoming to buy a home or…

The bankruptcy manual underwriting guidelines on FHA and VA loans are covered in this guide, which focuses on the exclusive…

Many people search for the reasons for foreclosures because they want clear answers. This guide explains, in plain language, why…

In this blog, we will cover and discuss USDA loan after Chapter 7 Bankruptcy mortgage guidelines for first-time homebuyers. USDA…

From Setback to Comeback A deed-in-lieu of foreclosure is one of the toughest financial decisions a homeowner can face. You…

Non-QM Loan Waiting Period Guidelines: Buy a Home Sooner After Bankruptcy or Foreclosure Life happens. Job loss, medical bills, divorce,…

Starting Fresh: Mortgage After Bankruptcy in New Hampshire Filing for bankruptcy is never easy. It can feel like the end…

This guide covers Fannie Mae guidelines mortgage after short sale and deed-in-lieu of foreclosure. Fannie Mae guidelines mortgage after short…

This guide covers the frequently asked question on what is a sheriffs sale and how does it work. A sheriffs…