This guide covers FHA Guidelines on Manufactured Home Loans. FHA Guidelines on manufactured home loans are released. HUD, the parent of FHA loans, sets all the agency guidelines on Manufactured Homes and FHA loans. More and more homebuyers are interested in buying manufactured homes.

Technology has come a long way. Dale Elenteny, a senior loan officer at Gustan Cho Associates, says the following about manufactured homes:

Manufactured homes can be nicer than stick built homes. In many instances, you do not know the property is a manufactured home. However, many lenders have issues with financing manufactured homes and have lender overlays on FHA loans.

Manufactured homes often surpass stick-built homes in terms of quality. Investing in manufactured homes allows you to acquire spacious and well-appointed residences for your budget.

Individuals considering the purchase of manufactured homes are advised to acquaint themselves with the FHA Guidelines on Manufactured Home Loans before engaging in a real estate home purchase agreement.

The United States Department of Housing and Urban Development, commonly known as HUD, oversees the authority. HUD functions as the parent organization of the Federal Housing Administration (FHA), which, although not a lending institution, operates as a government agency.

Speak With Our Loan Officer for Getting Mortgage Loans

What Are Manufactured Homes

The question of “What are manufactured homes, and why should homebuyers consider them?” is frequently raised at Gustan Cho Associates. Opting for manufactured homes is a prudent choice for those seeking an affordable, prompt, and environmentally conscious approach to realizing their dream home.

Manufactured homes, also referred to as modular homes or mobile homes, are prefabricated houses constructed in factories and then transported and assembled on-site. In comparison to traditional site-built homes, manufactured homes boast numerous advantages, including lower costs, quicker construction timelines, superior quality, increased customization options, and a reduced environmental footprint.

This blog post aims to explain the nature of the FHA guidelines on manufactured home loans, highlight their distinctions from other housing options, and underscore prospective home buyers’ benefits.

How Are Manufactured Homes Built

Manufactured homes are constructed in sections or modules in a controlled factory environment and then delivered and installed on a permanent foundation on a piece of land. In the United States or other countries, these buildings’ construction adheres to either the national building code established by the HUD or the Department of Housing and Urban Development or the regulations set by local authorities.

John Strange, a senior loan officer at Gustan Cho Associates, explains how manufactured homes are built as follows:

Manufactured homes can range from single-wide to multi-section units and from basic to luxurious designs. They can have different styles, sizes, layouts, and features depending on the preferences and needs of the buyers. Some manufactured homes can even be customized with additions or alterations after installation.

Manufactured homes stand apart from various prefabricated housing options like panelized homes or kit homes, which arrive in components and are constructed on-site either by contractors or homeowners. Additionally, they distinguish themselves from mobile homes or trailers, being smaller and less permanent structures designed for relocation from one place to another.

How Do Manufactured Homes Differ From Site-Built Homes?

Manufactured homes differ from site-built homes in several ways, such as cost. Manufactured homes are generally cheaper than site-built homes because they use standardized materials and processes, require less labor and waste, and benefit from economies of scale.

According to ManufacturedHomes.com, the average cost of manufactured homes is significantly less than stick-built on-site built homes:

The average cost of a manufactured home in 2020 was $55 per square foot, compared to $114 per square foot for a site-built home. Manufactured homes differ from stick-built homes in the time it takes to build.

Constructed homes are quicker to assemble than homes built on-site, as they are not subject to weather-related interruptions, material shortages, or contractor scheduling conflicts. The construction of a site-built home may take weeks or months, in contrast to the months or years required for completion.

Do You want to get home loan or want to Speak With Our Loan Officer for Getting Mortgage Loans? Click Here

Quality and Customization of Manufactured Versus Stick-Built Homes

Quality. Manufactured homes are built with high-quality materials and equipment in a controlled environment that ensures consistency and accuracy. They undergo rigorous inspections and testing before leaving the factory and after installation. They also comply with strict safety and energy efficiency standards HUD or local authorities set.

Customization of manufactured homes offers more customization options than site-built homes. This is because they can be designed and modified according to the buyer’s specifications. Buyers can choose from various floor plans, styles, colors, finishes, appliances, and amenities for their manufactured home.

Upon installation, individuals have the option to incorporate additional features such as porches, decks, garages, or sunrooms into their manufactured homes. These homes exhibit a lower environmental impact compared to site-built homes, attributed to their reduced use of materials and energy, diminished waste and emissions, and minimized land disturbance and erosion.

Additionally, manufactured homes are equipped with superior insulation and ventilation systems, resulting in decreased heating and cooling expenses and enhanced indoor air quality.

Role of Federal Housing Administration

In this segment, we will explore the function of HUD, the overseeing entity the FHA guidelines on manufactured home loans.

FHA operates as a governmental agency falling under the purview of HUD. The primary responsibility of the Federal Housing Administration is to provide insurance for FHA loans initiated and financed by banks and private lenders adhering to HUD Guidelines.

In instances of borrower default or foreclosure, HUD steps in to insure the lenders. To qualify for HUD insurance, lenders must have followed FHA Guidelines during the loan origination process. Additionally, HUD extends its insurance coverage to manufactured home loans under the HUD Title 1 Loan program.

FHA Guidelines On Manufactured Home Loans Requirements

This section will discuss the fundamental prerequisites outlined in the FHA guidelines for manufactured home loans. HUD classifies manufactured homes due to their construction off-site.

For a manufactured home to qualify for FHA financing, it must have been built on or after June 15, 1976, and bear a certified red HUD label. Every dwelling constructed post that date is required to display a label, and once affixed, the label cannot be replaced if tampered with or removed.

Notably, double-wide manufactured homes exhibit two labels, one on each exterior of the transportable sections, and there is a minimum size requirement of 400 square feet for financing eligibility of a manufactured home.

Foundation Requirement With FHA Guidelines On Manufactured Home Loans

Manufactured homes are categorized as real estate in some states, while in others, they are designated as personal properties. FHA has established its own set of guidelines for loans on manufactured homes. The forthcoming section will examine these guidelines.

To meet FHA criteria, a manufactured home must be situated at or above the 100-year flood level in both its specific location and the surrounding area. Additionally, the home should possess a crawl space or basement equipped with adequate ventilation.

Permanent installation of utilities within the home is essential, covering water and sewage systems. Newly installed homes must come with a one-year warranty from the manufacturer to comply with FHA requirements.

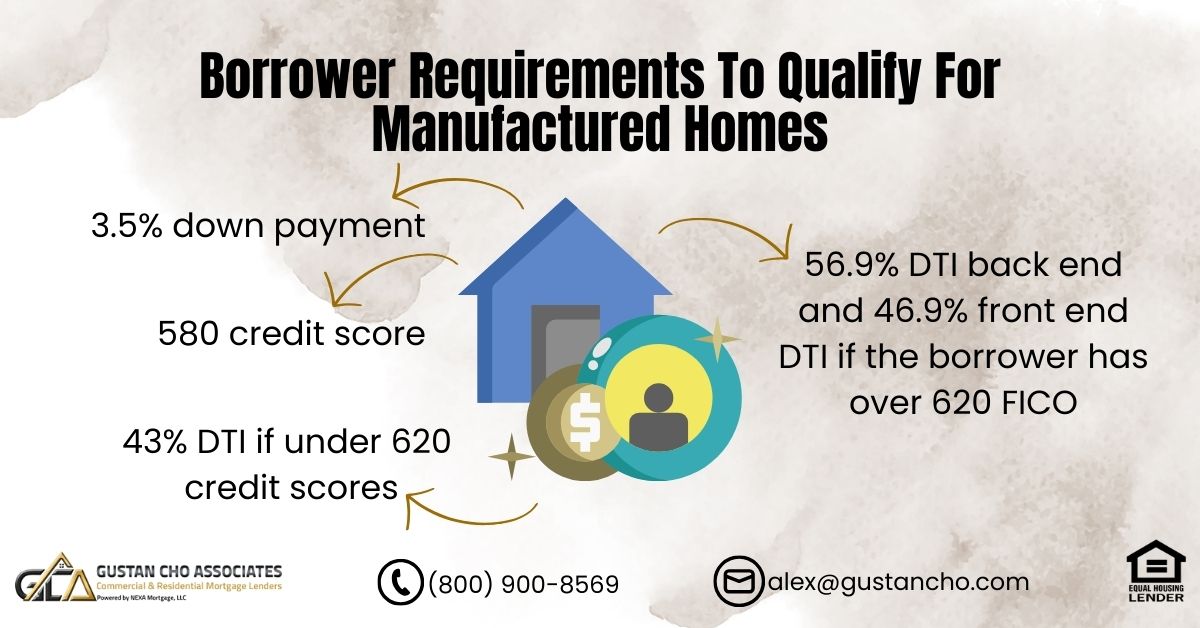

Borrower Requirements To Qualify For Manufactured Homes

This section will cover the borrower requirements for FHA guidelines on manufactured home loans. Minimum down payment 3.5% down payment. Minimum 580 credit scores. Debt-to-income ratio 43% DTI if under 620 credit scores. Debt to income ratio requirements is 56.9% DTI back end and 46.9% front end DTI if the borrower has over 620 FICO.

HUD does not require you to pay off the outstanding collection or charge-off accounts to qualify for manufactured home loans—non-occupied co-borrowers are allowed with manufactured home loans with FHA.

FHA guidelines on manufactured home loans permit single and double-wide manufactured homes to qualify for FHA financing. It is essential that the home is permanently affixed to a concrete foundation slab, basement, or crawl space.

In order to be eligible for FHA financing, the manufactured home must not be movable. Down payments can be gifted by family members.

Gustan Cho Associates imposes no lender overlays on FHA, VA, USDA, and Conventional loans. The Gustan Cho Associates Mortgage Group specializes in originating loans for manufactured homes.

If you are interested to qualify for manufactured home loan contact us

What Are the Benefits of Buying a Manufactured Home?

Buying a manufactured home has many benefits for home buyers, such as saving you money on your home purchase and maintenance. You can buy a manufactured home for a fraction of the cost of a site-built home without compromising quality or comfort.

You can also save on property taxes, insurance premiums, and utility bills because manufactured homes are more affordable, durable, and efficient than site-built homes.

It helps you save time on your home construction and move-in. You can have your manufactured home delivered and installed on your land within weeks or months after placing your order, compared to waiting for months or years for a site-built home to be completed. You can also skip the hassle and stress of dealing with contractors, permits, and inspections that come with building a site-built home.

It gives you more flexibility in choosing your home design and location. You can customize your manufactured home according to your preferences and needs, from the floor plan to the fixtures. You can also choose where you want to live, whether in a rural or urban area, in a manufactured home community, or on your land. It helps you reduce your environmental footprint and live more sustainably.

Tips for Buying and Maintaining a Manufactured Home

You have the option to experience the benefits of residing in a manufactured home constructed using environmentally conscious materials and practices, resulting in reduced resource and energy consumption, as well as decreased pollution and waste generation. Enhance the eco-friendliness of your manufactured home by choosing green features like solar panels, rainwater harvesting, or composting toilets.

When considering the purchase of a manufactured home, adhere to some guidelines to secure the most favorable deal and ensure long-lasting enjoyment of your residence. Here are some recommendations for both purchasing and maintaining a manufactured home.

Do Your Research

Before heading to dealerships or inspecting properties, conduct online research to compare various models, manufacturers, prices, and features. Utilize websites to explore numerous floor plans and reviews. Additionally, assess the reputation and ratings of dealers and lenders by visiting platforms such as the Consumer Financial Protection Bureau or Better Business Bureau.

Negotiate the Price

Feel free to negotiate with the dealer and inquire about discounts or incentives. Similar to cars, manufactured homes come with a built-in profit margin and holdback, allowing you to negotiate for a lower price or more favorable terms. Take the time to explore different options, obtaining quotes from various dealers and lenders to identify the most attractive offer.

Inspect the Manufactured Home

Before finalizing any agreement or depositing, carefully examine the property and search for flaws or damages. You can hire a professional inspector or do it yourself with a checklist. You should also check the home’s warranty and service agreement and ensure you understand what is covered and what is not.

Maintaining Manufactured Homes

Once you move into your manufactured home, you should take good care of it and perform regular maintenance tasks to keep it in good condition and prevent any problems.

Maintenance tasks include checking and repairing the roof, skirting, siding, windows, and doors. Cleaning and replacing the air filters, vents, and ducts. Testing and replacing the smoke detectors, carbon monoxide detectors, and fire extinguishers. Winterizing the pipes, faucets, and water heater.Leveling the home and adjusting the piers and anchors.

Speak With Our Loan Officer for Getting Mortgage Loans

Qualify For Manufactured Homes With Overlays

Prefabricated homes, also known as manufactured homes, are constructed in factories and then transported and assembled on-site. They provide a cost-effective, quicker, higher quality, customizable, and eco-friendly alternative to traditionally built homes.

These homes present numerous advantages for individuals seeking an affordable, speedy, and environmentally conscious way to realize their dream home. Feel free to reach out to us for additional information and assistance in finding the most suitable manufactured home for your requirements.

The popularity of manufactured homes is on the rise nationwide, leading to an increasing demand for loans tailored to these homes. This trend is fueled by the realization among homebuyers that manufactured homes offer a practical solution, especially for first-time buyers and those with budget constraints.

Over 80% of our borrowers are folks who are either going through a major stressful mortgage process or getting a last-minute loan denial by another lender. The only reason for a last-minute loan denial or stress during the mortgage loan process is that the loan officers did not properly qualify the borrower.

If you have any other questions about the FHA guidelines on manufactured home loans, please get in touch with us at Gustan Cho Associates at 800-900-8569 or text for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.

FAQ – FHA Guidelines on Manufactured Home Loans

What are FHA Guidelines on Manufactured Home Loans? FHA Guidelines on Manufactured Home Loans are the criteria set by the Federal Housing Administration (FHA) for financing manufactured homes. These guidelines provide the requirements and standards that borrowers and manufactured homes must meet to qualify for FHA-backed loans.

Who sets the FHA Guidelines on Manufactured Home Loans? The FHA Guidelines on Manufactured Home Loans are established by the Department of Housing and Urban Development (HUD), which oversees the Federal Housing Administration (FHA).

Why should homebuyers consider manufactured homes? Manufactured homes offer an affordable, prompt, and environmentally conscious option for those looking to own a home. They often surpass traditional site-built homes in terms of quality, cost-effectiveness, customization options, and construction timelines.

How are manufactured homes built? Manufactured homes are prefabricated in controlled factory environments, then transported and assembled on-site.

What are the differences between manufactured homes and site-built homes? Manufactured homes are generally more cost-effective and quicker to build than site-built homes. They offer more customization options, higher energy efficiency, and reduced environmental impact. Site-built homes, on the other hand, can be more expensive and time-consuming to construct.

What role does the Federal Housing Administration (FHA) play in manufactured home loans? The FHA provides insurance for FHA loans initiated by banks and private lenders that adhere to HUD Guidelines. In cases of borrower default or foreclosure, HUD steps in to insure the lenders. FHA insurance also extends to manufactured home loans under the HUD Title 1 Loan program.

What are the requirements for manufactured homes to qualify for FHA financing? To qualify for FHA financing, a manufactured home must have been built on or after June 15, 1976, and bear a certified red HUD label. It should be permanently affixed to a foundation, and utilities must be installed within the home. There is also a minimum size requirement of 400 square feet.

What are the borrower requirements for FHA guidelines on manufactured home loans? Borrowers must meet certain criteria, including a minimum down payment of 3.5%, a minimum credit score of 580 (or higher DTI requirements if credit scores are below 620), and specific debt-to-income ratios. Non-occupied co-borrowers are allowed, and down payments can be gifted by family members.

What are the benefits of buying a manufactured home? Buying a manufactured home offers cost savings, reduced property taxes, insurance premiums, and utility bills. It also saves time on construction, provides customization options, and reduces the environmental footprint.

What tips are recommended for buying and maintaining a manufactured home? Research different models, negotiate prices, inspect the home, and understand warranties before buying. For maintenance, regularly check and repair various components, winterize, and level the home.

Speak With Our Loan Officer for Getting Mortgage Loans

This article about FHA Guidelines on Manufactured Home Loans was updated on February 2nd, 2024.