Paying Rent Timely Will Help Get a Mortgage Approved

This guide covers how paying rent timely will help get a mortgage approved. Homebuyers who have little to no credit…

Call or Text: (800) 900-8569

Email Us: alex@gustancho.com

This guide covers how paying rent timely will help get a mortgage approved. Homebuyers who have little to no credit…

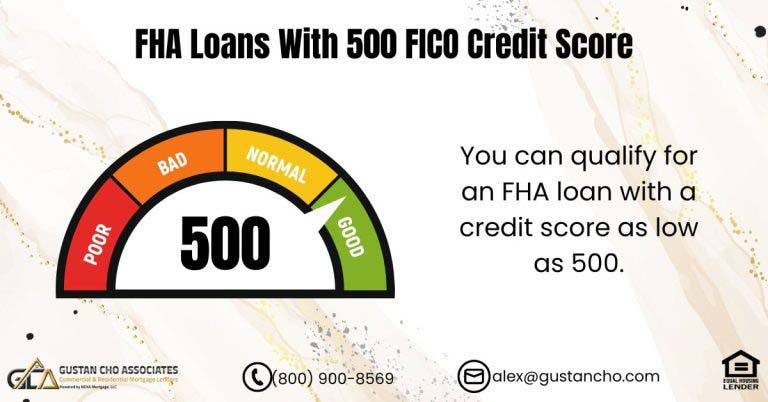

HUD, the parent of FHA, allows borrowers down to a 500 credit score to qualify for an FHA loan. However, for borrowers with under a 580 credit score, a 10% down payment is required.

Can an individual with a credit score of 500 be eligible for a VA loan? Absolutely. The Veterans Administration (VA)…

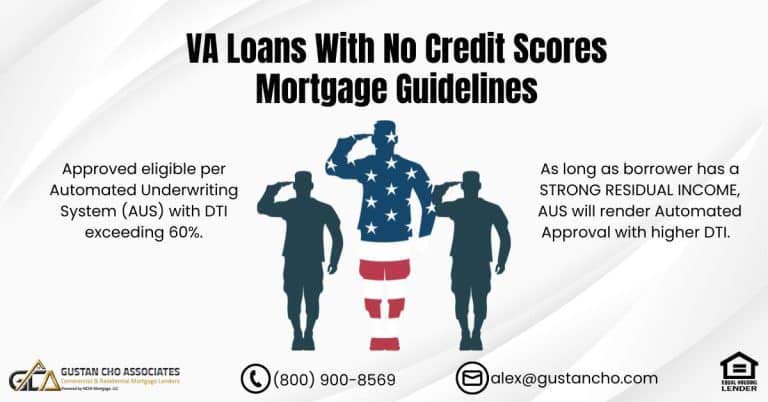

This blog post will discuss VA loans with no credit scores in detail and examine the DTI (Debt-to-Income) requirements. VA…

This article will delve into the mortgage guidelines for FHA DTI ratios on manual underwrites. The key distinction between manual…

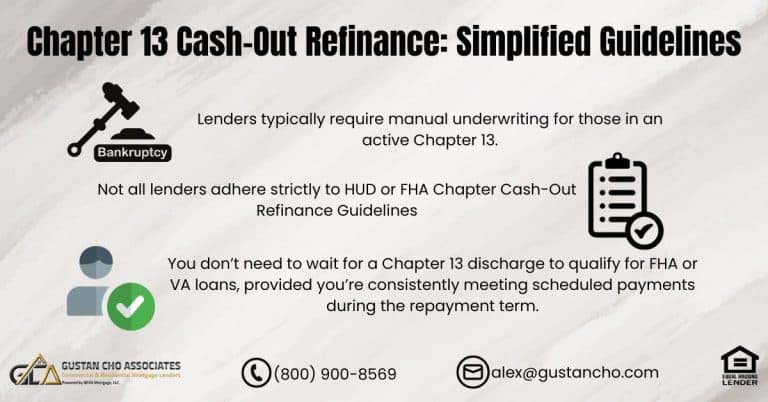

According to VA and HUD Chapter 13 cash-out refinance guidelines, homeowners may be eligible for a cash-out refinance on an…

In this blog, we will discuss and cover VA refer-eligible findings versus AUS approval guidelines. The United States Department of…

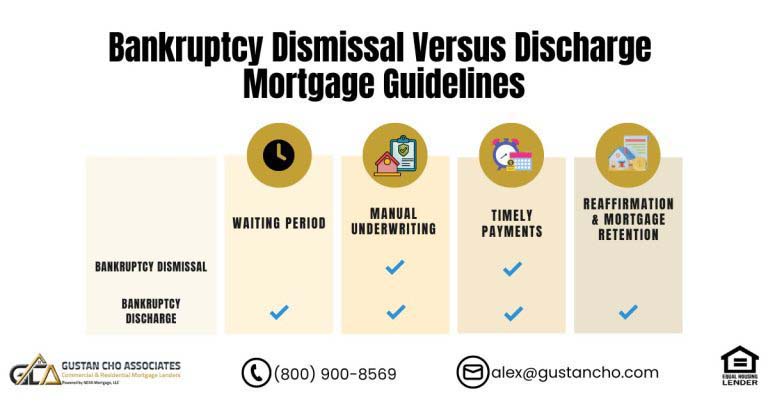

In this blog, we will cover and discuss the difference when qualifying for a mortgage after bankruptcy dismissal versus bankruptcy…

This guide covers manual underwriting versus automated approval. There are two types of Automated Underwriting Systems (AUS): Fannie Mae’s Automated…

Mortgage Underwriters will require one or more compensating factors for borrowers with higher debt to income ratio on manual underwrites to offset the risk of the higher DTI.

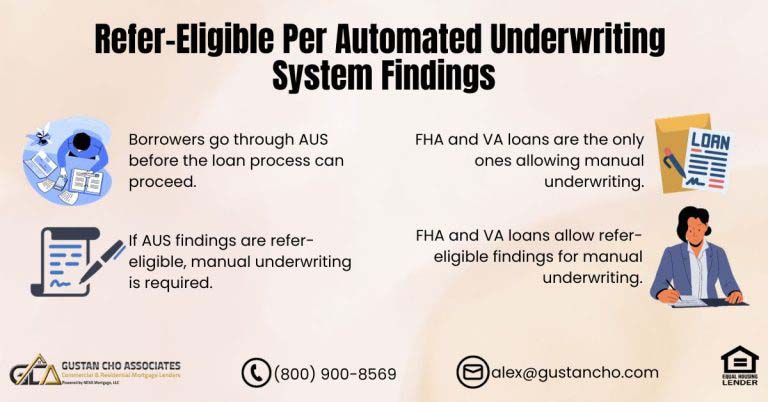

This article will cover and discuss refer-eligible per automated underwriting system findings. All mortgage loan applicants need to go through…

This guide covers solutions for no credit scores on mortgage loan approvals. There are cases where consumers do not have…

Not all Florida VA lenders have the same lending requirements on VA loans. Not all Florida VA lenders do manual…

This guide covers disabled Veterans benefits on VA loans. The Department of Veterans Affairs (VA) insures and guarantees VA Loans…