In this blog, we will discuss and extensively cover everything you need to know about the loan estimate. The Loan Estimate, also known by mortgage industry professionals borrowers as the GFE, was created by the United States Department of Housing and Urban Development in 2010. The Good Faith Estimate is being replaced by the newly created Consumer Financial Protection Bureau, CFPB, Loan Estimate. The CFPB’s New LE will also be replacing the Truth In Lending form ( Regulation Z ). In the following paragraphs, we will cover everything you need to know about the Loan Estimate.

What Is The Loan Estimate During The Mortgage Process?

The Good Faith Estimate was extremely confusing and difficult to understand and was flawed from the first day it was launched. The CFPB’s New Loan Estimate, when first previewed, seemed like it was a major improvement over the 2010 GFE. Mortgage loan originators need to get used to the new Loan Estimate form. The CFPB New Loan Estimate also seems to have its flaws and loan officers needs to learn the procedures to the document. In this article, we will discuss and cover how the Loan Estimate Replaced the Good Faith Estimate.

What Is The Main Purpose For The CFPB’s Loan Estimate

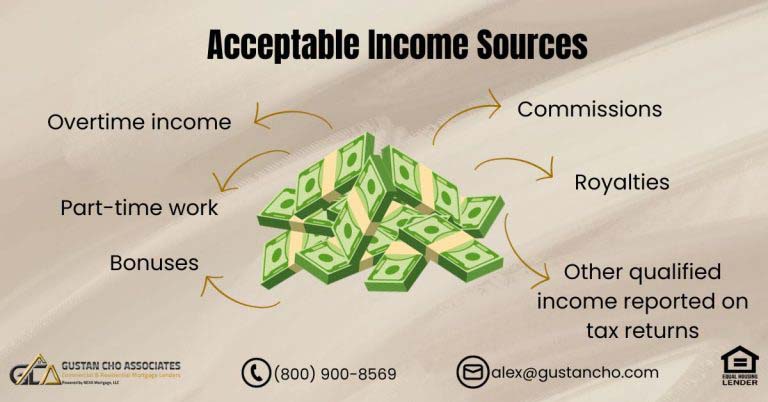

The loan estimate will include your interest rate, closing costs, monthly payments, and mortgage program. This document is designed to help consumers shop for a home and understand the financial obligation associated with the transaction.

The loan estimate is designed to easily display the ins and outs of your mortgage loan. It was created and launched to replace the old Good Faith Estimate to make it easier to understand by the consumer.

The mortgage industry seems like it is overloaded with rules and regulations and there seems to be no end. Why change a system that is already working with new forms and new regulations? Mortgage regulators are creating new laws and changes to mortgage regulations to protect consumers but many in the industry think otherwise.

Speak With Our Loan Officer for Getting Mortgage Loans

Understanding The Costs Listed on the Loan Estimate

Many mortgage industry experts believe that with new changes such as the new Loan Estimate creates more confusion to consumers. They also believe it creates more work to mortgage companies and lenders which translates to higher fees to consumers. The CFPB is now making it mandatory and requiring that title insurance fees do not reflect any discounts.

Title Insurance Fee Disclosures

The amount of the title premium for the mortgage lender’s title insurance coverage needs to be disclosed without any price adjustment to the premium that may be made for the simultaneous purchase of an owner’s title insurance policy. What this means is that instead of disclosing the simultaneous issue policy rate borrowers get when purchasing a house, borrowers will be viewing the general scheduled rate. This rate is much higher.

If buying a house getting a home loan, borrowers will be receiving the simultaneous issue rate every time. Most owners title policy is paid for by the home seller.

For example, a loan amount of $400,000, a simultaneous fee issue of $700 will be disclosed with the old system. With the new CFPB’s LE, lenders will be required to give the general schedule quote of a rate of $1,400, although borrowers will not be paying the higher rate. A simultaneous issue rate is normally provided systematically to home buyers when there is an owners policy and the lender’s policy.

How Is The Owner’s Title Policy Disclosed on the Loan Estimate?

The owner’s title policy needs to be disclosed on the New CFPB’s Loan Estimate. With the old HUD’s Good Faith Estimate, it also required this fee to be disclosed.. This new law is labeled as ridiculous by many mortgage professionals. This because mortgage loan originators need to explain to their borrowers that they are quoting a bogus fee of $1,400 when they are actually paying $700. The reason the higher fee is listed is due to government regulations by the CFPB.

How To Shop For a Mortgage?

If you have been shopping for a mortgage loan recently, you may have noticed the cost of your loan is higher than a loan you may have closed in the past. It seems like everywhere you turn in the year 2024, prices are skyrocketing. I know I feel a noticeable difference when I go to the gas pump, grocery store, and dare to look at the costs of airfare. Unfortunately, the same is true for many fees collected in the mortgage process. In this blog we will detail how to read a loan estimate and break down some basic mortgage fees.

Comparing The Old GFE To The New Loan Estimate

If it’s been a while since you have applied for a mortgage, you may remember the good faith estimate (GFE) and the truth in lending disclosures (TILA) that you signed with your initial paperwork and signed again on your closing day. In 2015, a new disclosure was created called the loan estimate (LE). This is an important document that breaks down all key components of your mortgage loan.

What Is Included in the Loan Estimate?

A loan estimate is also a document that will look the same no matter which mortgage company you choose. This is done on purpose so you can easily compare lenders to make sure you are getting the best deal available. After a mortgage lender receives a full application, they are required to send you a loan estimate within three business days (please ask us what a full application consists done. Once you receive the loan estimate, you should be able to compare the offer side-by-side in an easy to read format. Contact us to get the best deal for you home purchase, Click Here

Page One of the Loan Estimate

This three-page document will be divided into sections. Below we will break out how to read each section. Page 1 of the loan estimate is a summary of your loan. This section will include your loan program, loan amount, term of your loan, and specify your estimated monthly payment. The first page will show you what date your lender sent you the loan estimate, loan program, interest rate, estimated monthly payment, and a total cash to close figure. At this stage in the game, the cash to close figure will be an estimate.

Disclosing The Mortgage Rate on the Loan Estimate

The first page of the loan estimate will also show if your rate is locked or floating. In today’s current mortgage market, rates are changing every moment of the day. If you are comfortable with your monthly payment, we strongly encourage you to lock your rate in before this amount may increase. We often hear clients mix up the terms “floating rate” versus “adjustable rate”. If your rate is floating, this simply means you have not locked in your rate and you are still at the mercy of the market. An adjustable rate is different from floating. An adjustable rate will eventually change based on market conditions. An adjustable rate must still be locked in. For more information on rate locks, please contact our team to speak with a licensed loan officer in your state.

Page Two of the Loan Estimate

Page 2 of the loan estimate is your breakdown of total closing costs. This second page is the most important page of your entire mortgage disclosure package. When comparing quotes from different lenders, this page is what you need to look at to compare lenders. Page 2 of the loan estimate will show you origination costs, services you can and cannot shop for, taxes and government fees, prepaid items, initial escrow deposit, and any other closing costs that may be associated with your mortgage loan.

Comparing Fees From Multiple Lenders

Reading page 2 of the loan estimate will easily allow you to compare quotes from multiple lenders. The origination charges are really the only area where the lender has control over what you will be charged. Other services you cannot shop for include the appraisal, credit report fees, and any agency mortgage insurance. Services you can shop for include title work. If you are completing a refinance transaction, you may choose any title company that has the proper certifications. If this is a purchase transaction, in most states, the seller will pick the title company which gives you very little control over title fees.

Who Prepares The Loan Estimate

Most title companies are reasonably close in total costs, so don’t let the fact the seller is in control of this bother you too much. Depending on the area of the country where you are purchasing or refinancing a home, government taxes and recording fees will vary. Some areas of the country such as Florida have incredibly high real estate transfer taxes. This is one way to offset the fact that the state does not have a state income tax. Other states such as Montana have incredibly low transfer taxes. This is an area you will have no control over.

Qualify for purchasing or refinancing a home, click here

Pre-Paid Items on the Loan Estimate

The section for prepaids will include paying your homeowners insurance premium 12 full months at closing as well as any per diem interest required. Since you will also make an initial deposit into your escrow account, your lender must verify you have enough money in your escrow account to properly pay your property taxes and homeowners insurance next year when they are due. They are also legally obligated to keep a two-month buffer in the account at all times.

What Is Disclosed on Loan Estimate

When viewing your loan estimate, it is important to go over key details with your licensed loan officer. If you feel your current lender is charging you fees that are too high, please call Gustan Cho Associates to review your quote. Our team is currently licensed in 48 states and are highly competitive in today’s rate environment. We would love to save you money and earn your business. So we can go over your quote together and verify if our team can save you money!

Page Three of the Loan Estimate

Page 3 of your loan estimate can also be confusing. This section gives you additional information about your mortgage loan. In the comparison section, the loan estimate will show exactly how much principal you will have paid off in five years as well as total payments made within the first five years. You will also see your annual percentage rate or APR. This is the cost over the loan term expressed as a percentage.

What Is The APR on The Loan Estimate

Please keep in mind, your APR is not your interest rate (your monthly payments are based off your interest rate, not the APR). You will also see a section called total interest percentage or TIP. This is the amount of interest you will pay over the loan term as a percentage of your loan amount. There is also a section that goes over appraisal, assumption, homeowners’ insurance, late payment, and servicing requirements. The section for the appraisal will reiterate that the property's value must be a certain value and that the lender is required to send you a copy of the appraisal. Depending on the loan program you select, your loan may be assumable.

Are VA and FHA Loans Assumable?

Typically, all FHA and VA mortgages can be assumed by someone purchasing your home. For more information on assuming a mortgage loan, please reach out to our team today. The brief section for homeowners’ insurance will reiterate that you must have proper homeowners’ insurance coverage on the property for the entire time the home has a lien against it. If for some reason you cancel your homeowner’s insurance policy, your lender will put forced place insurance on the property.

What Do Lenders Consider a Late Payment?

Your loan estimate will have a brief description of the late payment policy on your mortgage. Every mortgage payment is always due on the first of the month. As long as you pay before the 15th of the month, you are technically not considered late. After that you will be charged a late fee of 4% or 5% of the principal and interest portion depending on which loan program you select.

How To Read a Mortgage Loan Estimate

If a lender plans on servicing your loan, your payments will be made directly to them. Many lenders intend to transfer the servicing rates of your loan, nothing will change as far as the interest rate and key components of your mortgage but who you make your payments will change.

Loan Estimate Requirements

We understand the three pages of a loan estimate are packed with vital information. It is important to understand all aspects of your mortgage loan so there are no surprises down the road. We all remember the real estate crash of 2008, where many borrowers were utilizing an adjustable-rate mortgage and were still in shock when their payment skyrocketed. Adjustable-rate mortgages are starting to make a comeback due to the economy and global markets.

Rate Adjustment on Loan Estimate

If your payment is going to change because of a rate adjustment, this information will be detailed in your loan estimate. Your load officer should be able to answer any and every question you have surrounding the information provided on a loan estimate. If they are unable to do so, you may want to find a different Mortgage team.

Borrower Paid Versus Lender Paid Origination Compensation on Loan Estimate

Depending on your credit score, there are situations where a mortgage broker must put your file through borrower paid compensation. This means as the borrower, you will be paying the compensation for your lender. Borrower paid compensation is a way to have origination fees do not count against the fair qualifying mortgage threshold. We don’t expect you to understand these terms in full. Just know, with lower credit score lending, and today’s current market conditions, many times you will need to use borrower paid compensation to close a mortgage transaction.

Loan Estimate Requirements

There are requirements you must meet on loan amount and total fees to legally close a mortgage loan. We suggest you reach out to your license loan officer to discuss if your file must be closed with lender paid or borrower paid compensation. This can significantly change the cash to close requirement on your loan. For example, if you have a credit score below 600, you are more than likely going to need to utilize borrower paid compensation. We strongly recommend you set your offer up to receive some seller paid closing costs to offset the borrower paid compensation costs.

Understanding The Loan Estimate

If you are working with an experienced real estate agent, they will know how to properly set up your offer in these scenarios. The team of loan officers at Gustan Cho Associates can also point you in the right direction. However, our mortgage team cannot assist you with your real estate contract. But we can work alongside your realtor to make sure the deal is properly structured. We have become experts and borrower paid compensation because we do not have lender overlays and are able to help many clients with lower credit scores compared to your large mortgage banks.

In some cases, the mortgage industry gets a bad reputation because of practices that happened prior to 2008. The federal government has stepped in to regulate mortgage compensation and disclosure requirements.

As a mortgage broker, we are required to send you all the proper documentation discussing what you will be paying in rates and fees. Your licensed loan officer will make sure you understand all details surrounding your mortgage loan. Are highly skilled team takes pride in educating our clients on every step of the mortgage process. We want to make sure you know all the ins and outs of your mortgage loan and that there are no surprises. This will help create a smooth process and set you up for long term success owning a home!

This guide on everything you need to know about the loan estimate was updated on January 9th, 2024.