This blog will cover overlays with FHA loans compared to HUD agency guidelines. FHA loans are the most popular home loan program in the United States. The U.S. Department of Housing and Urban Development (HUD) is the Federal Housing Administration (FHA) parent. FHA is not a lender. HUD is a large federal agency that administers the FHA-insured mortgage program. HUD sets all the agency mortgage guidelines on FHA loans.

Are FHA and HUD the Same Thing?

HUD is the parent of FHA. Because of the government guarantee by HUD, private lenders aggressively originate and fund FHA loans. HUD has nothing to do with the origination, processing, underwriting, closing, funding, or servicing of FHA loans. In the following paragraphs, we will cover overlays with FHA loans by mortgage lenders.

FHA loans benefit first-time homebuyers, borrowers with no credit scores, borrowers with bad credit, homebuyers with credit scores down to 500 FICO, homebuyers with collections and charged-off accounts, and homebuyers who cannot qualify for other mortgage loan programs. FHA loans have more lenient mortgage guidelines than other mortgage loan programs.

What Is The Role of HUD?

HUD, the parent of FHA, is a government agency that insures FHA loans originated by lenders in the event borrowers default on their FHA loans and the lender takes a loss.

FHA loans are loans that the Federal Housing Administration insures. The Federal Housing Administration will insure lenders against defaults if they are FHA-approved lenders and follow FHA guidelines. In this article, we will discuss and cover Lender Overlays Versus Agency Guidelines on FHA loans. Click here apply for mortgage loans

FHA Loans Are The Most Popular Loan Program In The United States

FHA loans are an extremely popular mortgage loan vehicle for first-time homebuyers for those with prior bad credit. HUD has lenient guidelines for consumers who have filed for bankruptcy and had a foreclosure in the past with prior bad credit, low credit scores, and high debt-to-income ratios.

Outstanding collections and charged-off accounts do not have to be paid to qualify for FHA loans. You can qualify for an FHA loan after bankruptcy and foreclosure with a waiting period. Homebuyers in the Chapter 13 Bankruptcy repayment plan can qualify for an FHA loan one year after filing. There is no waiting period requirement after the Chapter 13 Bankruptcy discharge date.

FHA Loans For Bad Credit

HUD allows borrowers with unpaid collections, charge-offs, judgments, and tax liens to be able to qualify for a home loan with a 3.5% down payment:

- The minimum credit score of 580 FICO

- Under 580 scores require a 10% down payment

HUD allows a mortgage loan applicant to add non-occupant co-borrowers to meet minimum income qualification requirements. Front end 46.9% and back end 56.9% debt to income ratios for approve/eligible per AUS FINDINGS on borrowers with 620 credit scores higher. Borrowers with credit scores under 580 FICO can qualify for FHA Loans with automated underwriting system approval with a 10% down payment.

Basic HUD Agency Mortgage Guidelines on FHA Loans

There are hundreds, if not thousands, of HUD guidelines and sub-guidelines. However, we will concentrate on the main FHA mortgage lending guidelines for FHA loans.

In this section, we will cover the basic HUD guidelines to meet eligibility for FHA loans. The minimum down payment requirement to qualify for FHA loans is 3.5% on real estate purchase transactions.

Mortgage Insurance Premium on FHA Loans

FHA loans require mortgage insurance premiums on all of their loan programs. This blog will cover the 30-year fixed-rate FHA mortgage loan since it is the most popular.

On a 30-year fixed-rate FHA loan, there is a mandatory upfront mortgage insurance premium of 1.75% of the loan amount. There is a lifetime annual FHA mortgage insurance premium. The annual mortgage insurance premium of 0.85%% of the mortgage loan balance amount for the life of a 30-year fixed rate FHA loan.

HUD Guidelines on Debt-to-Income Ratio on FHA Loans

One of the reasons why FHA loans are so popular is its generous lenient guidelines on FHA loans. The maximum debt-to-income ratio cap on FHA loans is 46.9%/56.9% on automated underwriting system-approved borrowers.

Debt-to-income ratio caps on manual underwriting can be as high as 40% front-end and 50% back-end debt-to-income ratio with two compensating factors.

HUD Guidelines on The Minimum Credit Score Requirements on FHA Loans

The minimum credit score requirement to qualify for an FHA loan is 500 FICO. A 10% down payment is required for those with credit scores between 500 and 579 FICO. 3.5% down payment for credit scores of over 580 FICO.

- The mandatory 3-year waiting period after the recorded date of a foreclosure and deed in lieu

- The mandatory 3-year waiting period after a short sale to qualify for a residential FHA mortgage loan

- The mandatory 2-year waiting period after the discharge date of a personal Chapter 7 bankruptcy

- No waiting period after the Chapter 13 Bankruptcy discharge date to qualify for FHA loans with Gustan Cho Associates

Borrowers can qualify for FHA loans one year into a Chapter 13 Bankruptcy repayment plan. Need approval of Chapter 13 Bankruptcy Trustee. Open collections and charge-offs are okay. Apply for FHA Loans , click here

How Does Overlays With FHA Loans Work?

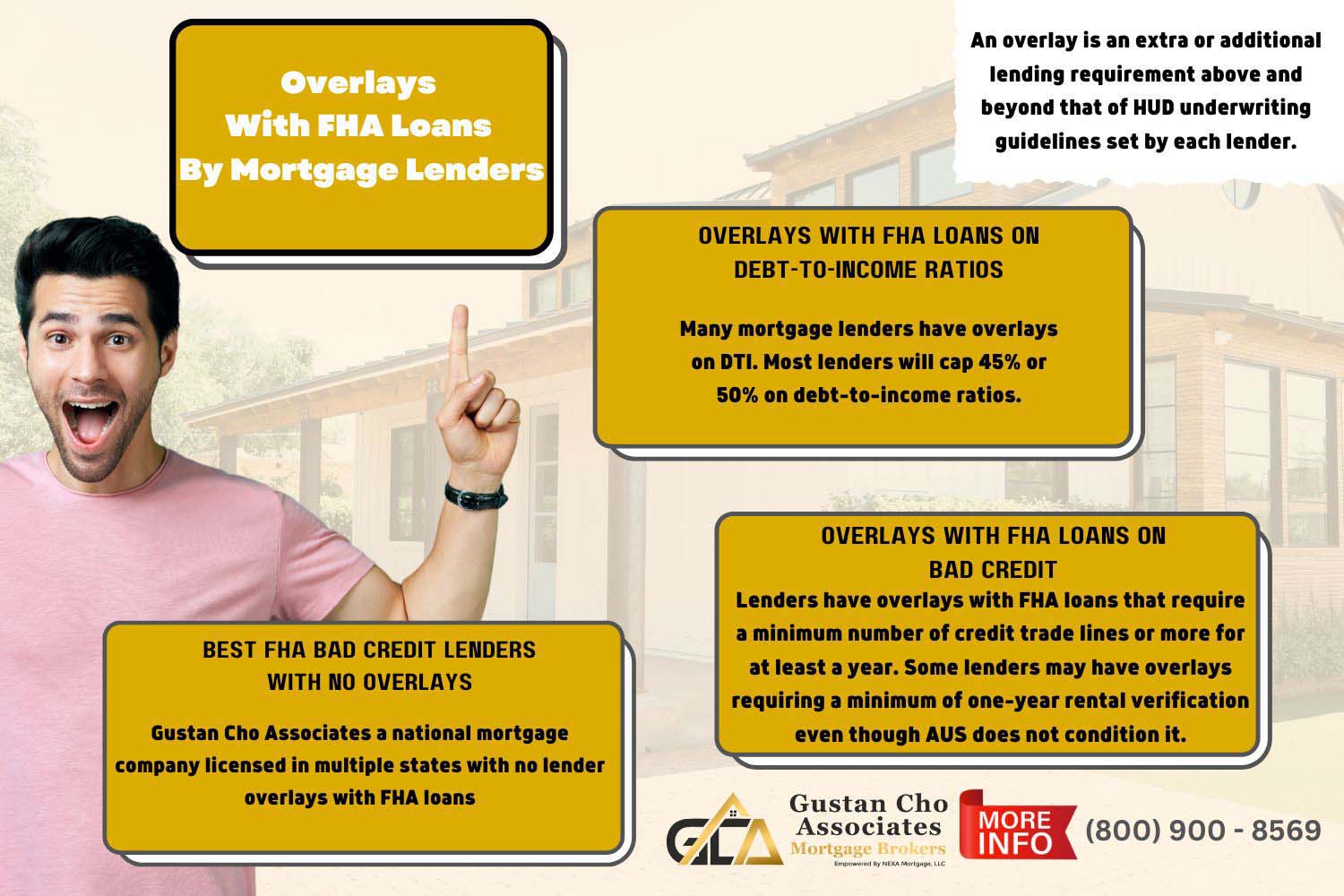

Just because you have an Approved Eligible from Fannie Mae’s Automated Underwriting System for an FHA mortgage loan does not guarantee that you will get mortgage approval from an FHA mortgage lender. Many lenders have mortgage underwriting overlay With FHA loans. An overlay is an extra or additional lending requirement above and beyond that of HUD underwriting guidelines set by each lender.

For example, just because the minimum credit score to qualify for FHA loans is 580 FICO does not guarantee mortgage approvals. Many lenders have credit score overlays on FHA loans. The majority of lenders require credit scores of 620 or higher. This holds true even though FHA only requires 580. And some even have overlays of credit scores of 640 FICO or higher. Gustan Cho Associates has no overlays with FHA loans.

Overlays With FHA Loans on Debt-To-Income Ratios

Another overlay with FHA loans that mortgage lenders might have is lower debt-to-income ratios. Although HUD guidelines on the front-end debt-to-income ratio are 46.9%, the back-end debt-to-income ratio is 56.9%.

Many mortgage lenders have overlays on DTI. Most lenders will cap 45% or 50% on debt-to-income ratios. A lot of lenders will also cap front-end DTI to 31%. Front-end DTI is the housing ratio (P.I.T.I.).

Overlays With FHA Loans on Bad Credit

Some lenders have overlays requiring that borrowers have no late payments after a bankruptcy or foreclosure. Late Payments after bankruptcy, foreclosure, deed in-lieu-of foreclosure, and short sale are not HUD Guidelines but overlay with FHA loans by individual lenders.

Other lenders have overlays with FHA loans that require a minimum number of credit trade lines or more for at least a year. Some lenders may have overlays requiring a minimum of one-year rental verification even though AUS does not condition it.

Best FHA Bad Credit Lenders With No Overlays

Homebuyers looking to get qualified for FHA loans with a national mortgage company licensed in multiple states with no lender overlays with FHA loans, contact the team at Gustan Cho Associates at 800-900-8569 or text for a faster response. Or email us at gcho@gustancho.com.

Gustan Cho Associates is a mortgage broker licensed in 48 states with a national reputation of being able to do mortgage loans other lenders cannot do. Over 75% of our borrowers are folks who could not qualify at other lenders due to overlays, stress, last-minute loan denial, or not having the mortgage products. At Gustan Cho Associates, we only market mortgage loans that exist and are possible at competitive rates. Besides government and conventional loans with no lender overlays, we offer hundreds of non-prime mortgage programs including non-QM and non-prime mortgages.

Gustan Cho Associates team is available seven days a week, evenings, weekends, and holidays. Gustan Cho Associates is a dba of NEXA Mortgage, is licensed in 48 states, and has a lending partnership with over 190 wholesale lenders. Our viewers can subscribe to our daily mortgage and real estate newsletter at www.gustancho.com.

The Blog on overlays with FHA loans was updated on December 7th, 2022. Click hereto apply for FHA Bad Credit Lender with no overlays

Related> FHA Loans With No Lender Overlays

Related> FHA Lenders With No Overlays In California