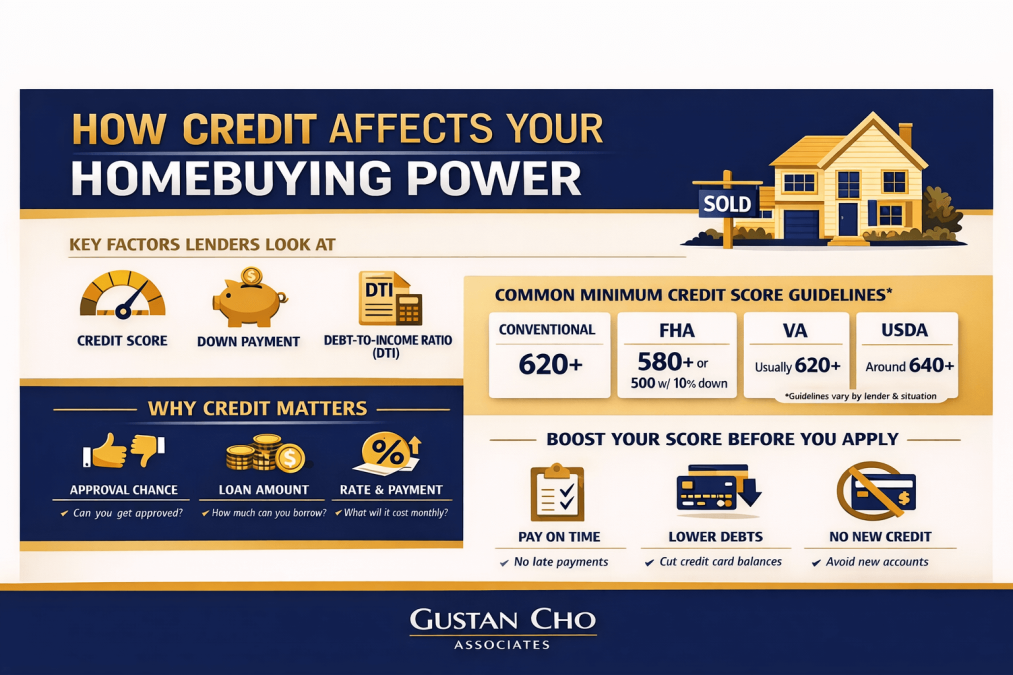

Your credit score affects three things that matter most when you buy or refinance a home:

- Whether you get approved

- How much can you borrow

- What your rate and monthly payment look like

But your credit score isn’t the only piece of the puzzle. Lenders also look at your down payment, debt-to-income ratio (DTI), cash reserves, and your recent payment history.

At Gustan Cho Associates, we help borrowers with excellent credit and those rebuilding, without adding extra restrictions when the loan program allows it.

What Credit Score Do You Need?

Here are the typical minimums by loan type (exact requirements vary by lender and automated underwriting results):

- Conventional: often 620+

- FHA: 580+ with 3.5% down (and 500–579 may qualify with 10% down)

- VA: no official minimum from VA, but many lenders look for 620+

- USDA: often easier with stronger scores; many lenders prefer 640+ for automated approval

Why Your Credit Score Matters So Much

Your score helps lenders measure risk. In plain English:

- Higher score = more options + lower costs

- Lower score = fewer options + higher costs (but approval can still be possible)

Even minor improvements can help—especially if you’re moving from one pricing tier to the next.

Before You Apply: 3 Simple Moves That Help Fast

If you’re 30–90 days away from applying, these steps usually make the biggest difference:

- Pay every account on time (even one late payment can hurt)

- Lower credit card balances (aim to keep usage under 30%, lower is better)

- Avoid new credit (new accounts/inquiries can reduce your score temporarily)

Credit changes don’t always show instantly, so starting early matters.

See How Your Credit Affects Your Mortgage Approval

Your credit score plays a big role in qualifying for a home loan. At Gustan Cho Associates, we help borrowers with perfect or challenged credit achieve homeownership.

Introduction: How Your Credit Impacts Your Homebuying Process

Buying your first home marks a huge financial step. Age and experience matter, but in 2026, your credit score is even more important. With 30-year fixed mortgage rates near 6.4% thanks to market changes, a smart score can help you secure the house you want without blowing your budget. Your credit will determine whether you get a loan in the first place, the rates you pay, and even how much you can borrow. Let’s break down the score’s role in the mortgage process and explore easy, practical steps to improve your credit before you buy.

Understanding Credit Scores

Your credit score helps lenders decide if you will repay your borrowed money. Please consider the score a single, quick grade to show your trust in them. It’s a three-digit number usually between 300 and 850 and comes from the history you build every month. While mortgage lenders mostly use the FICO score, many also consider the Vantage Score, so either can matter. The higher the number, the safer lenders feel.

How Credit Score Can Change Your Payment

Mortgage pricing can change when your credit score moves into a different pricing tier—but rates also depend on the market, down payment, loan type, and other factors. To keep this simple and “apples-to-apples,” here’s one example:

Example Assumptions:

- Loan amount: $400,000

- Term: 30-year fixed

- Payment shown: principal & interest only

- Not included: property taxes, homeowners’ insurance, HOA dues, mortgage insurance (PMI/MIP), points, lender credits, or APR differences

- Property type: single-family primary residence

- Rates shown: sample rates only (your actual rate depends on current pricing and full loan profile)

Why this matters: Even a small rate change can add up over time. A higher credit score often helps you qualify for better pricing and may reduce monthly mortgage insurance costs when applicable.

Best practice: Don’t rely on generic charts for your exact payment. If you want a real number, get a personalized quote based on your credit score, down payment, and debt-to-income ratio.

Credit Score Requirements For Mortgage Approval

The credit score you need depends on which loan program you’re using—and sometimes on lender “overlays” (extra rules some lenders add). Think of it this way: there’s the program baseline, and then there’s what lenders commonly prefer to make approval easier.

Conventional Loans

- Common minimum: 620+

- Best pricing typically starts: around 720+

- Low down payment options: some conventional programs allow as little as 3% down (eligibility depends on the program, income, and AUS findings).

- PMI can cost less with higher credit scores: stronger credit often reduces the monthly PMI when putting down less than 20%.

FHA Loans

- 580+ usually allows 3.5% down

- 500–579 may qualify with 10% down

- FHA is often a strong option for borrowers rebuilding credit, as long as the rest of the file supports approval.

VA Loans

- Program baseline: VA does not set an official minimum credit score.

- Common lender practice: many lenders look for ~620+, but approvals can vary based on the whole file and AUS findings.

USDA Loans

- Program baseline: USDA does not publish a universal minimum credit score.

- Common lender practice: many lenders prefer ~640+ because it often helps with automated approval through GUS.

Bottom line: A credit score is important, but it’s not the only factor. Your recent payment history, debt-to-income ratio, down payment, and reserves can also affect whether you’re approved and what terms you receive.

How Credit Affects Mortgage Interest Rates

When shopping for a mortgage, your credit score is one of the biggest pieces of the puzzle. A small change in the score can change your interest rate, which means real money saved—or spent—over the life of the loan. Let’s look at how it shakes out for a 30-year mortgage in 2026.

Some lenders may approve lower numbers if the rest of your financial picture is solid. However, 2026 could see even stricter criteria in the mortgage market, so the smartest move is to aim for scores well above the floor.

Doing that not only boosts your chances of approval, but it can also spare you higher rates, costs, and hassle. If your credit score sits in the elite range of 760 to 850, you’ll likely see an annual percentage rate (APR) of about 6.15%. Drop into the 700 to 759 range, and that rate can jump to 6.35%. Going lower, the score of 680 to 699 averages 6.45%, 660 to 679 gets 6.50%, 640 to 659 is 6.60%, and the 620 to 639 bracket thumps you with approximately 6.70%. Rates can also shift based on where you live and the loan’s size.

The Role of Credit in Loan Amounts and Qualification

Your credit score is like a financial report card — it doesn’t just decide if you get a yes, it also tells the bank how much money you can borrow and the rules that come with it. Banks look at that score next to what you earn, how long you’ve been with your job, and your debt-to-income ratio, which is best kept below 36 percent.

If your score is high, it can offset a slight dip in another area, making it more likely that you’ll get pre-approved.

Strong credit often opens the door to larger loans, which says to lenders that you’re someone who pays bills on time. If your score is low, the bank might offer you a smaller loan or ask you to add more cash. For instance, if the number is below a certain point, you may have to buy private mortgage insurance if your down payment is less than 20 percent, which adds to your monthly payment.

Quick Steps to Boost Your Credit for a Mortgage

Want a better mortgage rate? Start working on your credit score 6 to 12 months before you apply. Begin by getting your free copy of the credit report from Equifax, Experian, and TransUnion.

Look for mistakes—fixing just one error can lift your score now. You get one free report from each agency every 12 months.

After you have the reports, focus on lowering your debt. Pay the highest-interest cards first to keep your credit cards below 30 percent of the max limit. This move lowers your credit utilization and debt-to-income ratio, two factors lenders watch closely. Next, build strong habits: pay every bill on time, avoid opening new credit lines, and keep a mix of accounts, like a credit card and an installment loan. Check out credit-builder loans or a secured card if your credit file is thin.

Common Credit Mistakes to Avoid When You’re Buying a Home

Please don’t mess up your mortgage before you even get it. Shutting your credit account for a car, student loan, or furniture deal seems harmless, but a new inquiry record makes your score dip a few points. When your score drops, lenders think you’re taking on risky new debt even if you never purchased a thing.

On the other hand, putting a big charge on one or two credit cards bumps your credit-utilization ratio up. That move drags your score even lower.

A forgotten minimum payment for any card, medical bill, or subscription could ruin the mortgage deal you’ve waited for. And if you co-sign on a new student loan, boost a car payment, or pile on any other charge before the deed goes through, the extra debt makes your back-end ratio sky-high—loan denied! No big financial move is ever harmless, from when your realtor hands you the first digital pre-approval to the moment the pen hits the closing disclosure. Stay calm and stay on the plan.

How Higher Credit Scores Yields Lower Mortgage Rates

In 2026 and beyond, your credit score still makes or breaks the whole homebuying deal, deciding what rates you see, how big a loan the bank writes, and how much of a payment you can afford. John Strange, a senior mortgage loan originator says the following about how borrowers can save tens of thousands of dollars over the course of the loan if they have higher credit scores.

When you know what makes the score tick and what breaks it, you can fix, boost, and protect the one number that decides your mortgage every step of the process.

Listen, even a few extra clicks to get that extra discount on furniture or clothes can cost you hundreds of dollars a month in interest and thousands of dollars over a decade. Whether buying your first home or changing your loan, getting your credit score to shine is the smartest first investment step. Money and mortgage strategies aren’t one-size-fits-all, so talk with your loan officer or credit union rep for the boost that fits your money style.

Bad Credit? We Can Still Help

Even with collections, late payments, or low scores, we offer mortgage programs with no lender overlays.

How Your Credit Impacts Your Homebuying Process: Factors Determining The Qualification Of Borrowers

There are three main areas of concern when getting preapproved for a mortgage.

- Credit score

- Debt-to-income

- Down payment (and reserves).

Debt-to-Income Ratio (DTI): What Underwriters Actually Look At

Your debt-to-income ratio (DTI) is one of the biggest factors in how much home you can afford. DTI compares your monthly debt payments to your gross monthly income. It’s not a “pass/fail” number by itself—most approvals depend on automated underwriting (AUS) and the strength of your overall file.

What is DTI?

DTI is your monthly debts ÷ your monthly income.

Front-End vs. Back-End DTI

- Front-end DTI: your new housing payment only (principal, interest, taxes, insurance, HOA if any)

- Back-end DTI: your housing payment plus all other monthly debts (car, credit cards, student loans, personal loans, etc.)

Most lenders focus primarily on back-end DTI because it reflects your total monthly obligations.

Typical DTI Ranges

DTI limits can change based on credit score, down payment, reserves, loan type, and AUS findings.

- FHA: can allow higher DTIs when AUS approves and the file is strong (some approvals reach the mid–high 50% range)

- VA: often allows higher DTIs than other programs when residual income and the overall file support it

- Conventional: tends to be tighter, and many AUS approvals land below the high-40% range, though caps vary by case and findings.

- USDA: often follows lower target ratios (commonly discussed as 31% front / 43% back), but outcomes still depend on the whole file and the lender’s process

Important: These are common ranges—not guarantees. AUS findings and lender overlays can tighten or loosen what’s possible.

What Can Offset a Higher DTI?

Even if your DTI is on the higher side, these factors can improve approval odds:

- Higher credit scores

- Lower credit card balances (lower utilization)

- Bigger down payment

- Cash reserves (months of payments in the bank)

- Stable job/income history

- Lower payment shock (new payment not dramatically higher than current rent)

- Strong compensating factors (especially on manual underwrites)

Best Next Step

If you want an accurate price range, don’t guess your DTI from online calculators—income and debts are treated differently depending on the loan program. A quick review of your income type, monthly obligations, and credit report will give you a realistic target payment and approval path.

Credit Score Requirements for Mortgage Approval

The credit score you need depends on which loan program you’re using—and sometimes on lender “overlays” (extra rules some lenders add). Think of it this way: there’s the program baseline, and then there’s what lenders commonly prefer to make approval easier.

Conventional Loans

- Common minimum: 620+

- Best pricing typically starts: around 720+

- Low down payment options: some conventional programs allow as little as 3% down (eligibility depends on the program, income, and AUS findings).

- PMI can cost less with higher credit scores: stronger credit often reduces the monthly PMI when putting down less than 20%.

FHA Loans

- 580+ usually allows 3.5% down

- 500–579 may qualify with 10% down

- FHA is often a strong option for borrowers rebuilding credit, as long as the rest of the file supports approval.

VA Loans

- Program baseline: VA does not set an official minimum credit score.

- Common lender practice: many lenders look for ~620+, but approvals can vary based on the whole file and AUS findings.

USDA Loans

- Program baseline: USDA does not publish a universal minimum credit score.

- Common lender practice: many lenders prefer ~640+ because it often helps with automated approval through GUS.

Bottom line: A credit score is important, but it’s not the only factor. Your recent payment history, debt-to-income ratio, down payment, and reserves can also affect whether you’re approved and what terms you receive.

How Your Credit Impacts Your Homebuying Process and Mortgage Rates

Credit score is a major factor, but pricing also depends on LTV, occupancy, loan type, points, and market conditions. Mortgage rates are based on credit score thresholds. The amount of interest will be broken down into 20-point buckets. Below is an example AND not factual, REACH OUT TO A LICENSED LOAN OFFICER FOR AN EXACT QUOTE.

- 620-639 – 7.75%

- 640-659 – 7.50%

- 660-679 – 7.25%

- 680 -699 – 7.0%

- 700 – 719 – 6.75%

- 720-739 – 6.50%

- 740-759 – 6.25%

- 760 and above – 6.0%

In the (hypothetical) example above, your rate could be 1.75% lower based on a higher credit score. Based on a loan amount of $300,000, the savings will add up quickly:

How Your Credit Impacts Your Homebuying Process and Interest Expense Over The Term of The Loan

The total interest paid on a 30-year fixed mortgage at 5.25% is $296,380, and the total interest paid on a 30-year fixed mortgage at 4% is $215,608. A higher credit score in this example could save you $80,772! We hope you now see your credit score’s impact on your mortgage loan. Borrowers with higher credit scores will get lower interest rates. Lower interest means tens of thousands of dollars in savings over the loan’s term.

Loan-Level Pricing Adjustments (LLPAs) Explained in Plain English

LLPA stands for Loan-Level Pricing Adjustments. It’s a pricing system used on many conventional loans (typically those backed by Fannie Mae or Freddie Mac). Think of LLPAs as risk-based adjustments that can affect your pricing.

LLPAs are not set by one lender—they’re based on market and investor pricing rules that most conventional lenders follow.

What Can Trigger LLPAs?

Common factors include:

- Credit score

- Down payment / loan-to-value (LTV)

- Loan purpose (purchase vs. refinance, cash-out vs. rate-and-term)

- Occupancy (primary home vs. second home vs. investment)

- Property type (single-family vs. condo, number of units)

- Loan size and product type

Why This Matters

Two borrowers can have the same credit score and still receive different pricing if their down payment, occupancy, or loan purpose differs.

Important Note

LLPAs can show up in different ways—such as rate changes, points, or lender credits—depending on how you choose to structure your mortgage.

Best next step: Get a quote based on your full scenario (credit score, down payment, occupancy, loan type) so you’re comparing apples to apples.

First-Time Homebuyer and Low Down Payment Options (What’s Common vs. What’s Possible)

Low down payment conventional loans are real—but the rules aren’t “one-size-fits-all.” The minimum down payment depends on the specific program, your occupancy (primary, second home, or investment), and your automated underwriting (AUS) results.

First-Time Homebuyer (standard definition):

Many programs define a first-time homebuyer as someone who has not owned a home in the past 3 years. Some programs also include certain exceptions (such as a spouse who hasn’t owned or other exceptional cases).

Conventional Down Payment Rules (Typical, Not Absolute)

- Some conventional programs allow as little as 3% down for a primary residence.

- These programs are often tied to eligibility requirements, such as:

- first-time homebuyer status, or

- income limits, or

- completion of a homebuyer education course, depending on the program.

- 5% down is common for many repeat buyers on a primary residence, but it’s not a universal rule. Your minimum can vary based on:

- credit score and overall file strength,

- property type (single-family vs. condo),

- AUS findings,

- and the lender/investor guidelines.

Bottom line: If you’ve owned a home recently, you may still have low down payment options—but the best minimum down payment depends on the program you qualify for, not just whether you’re “first-time” or “repeat.”

Don’t Let Credit Challenges Stop You

Whether you’re rebuilding or improving, we’ll guide you through the process so you can buy your dream home with confidence.

How Your Credit Impacts Your Homebuying Process: Importance of Maximizing Credit Scores Before Applying For a Mortgage

Gustan Cho Associates cannot stress enough the importance of your credit score. Since we are experts in lower credit score mortgage lending, we have seen virtually every credit profile.

We help clients with credit scores in the 800s and down to the 500s. It is very easy to damage your credit score. As you may know, repairing your credit score can be difficult and time-consuming.

If your credit profile is imperfect, we encourage you to contact our mortgage experts. While we don’t recommend a credit repair agency, we may be able to point you in the right direction to raise your credit score in a reasonable timeframe. We have helped numerous clients raise their credit scores to qualify for the mortgage program that suits them best.

Frequently Asked Questions About How Your Credit Impacts Your Homebuying Process

What Credit Score Do I Need to Buy a House?

It depends on the loan type and lender, but many buyers aim for:

- Conventional: often 620+ (stronger scores typically get better pricing)

- FHA: 580+ for 3.5% down, and 500–579 may qualify with 10% down

- VA/USDA: program rules don’t always set a single minimum score, but lenders often have common “preferred” ranges.

Does Checking My Credit Score Lower it?

No—checking your own score or pulling your own credit report is a “soft inquiry,” which does not hurt your score. Score drops usually come from hard inquiries when you apply for new credit.

How Much Does a Mortgage Credit Inquiry Affect My Score?

A mortgage application can cause a small, temporary score decrease because it’s typically a hard inquiry. The size of the change varies by credit profile and tends to fade over time.

How Can I Raise My Credit Score Fast Before Buying a House?

Focus on the steps that usually move the needle the most:

- Pay every bill on time

- Pay down credit card balances (lower utilization)

- Try not to open any new credit accounts right before you apply

- Check your credit reports for errors and dispute inaccuracies

Should I Pay Off Collections Before Applying for a Mortgage?

Not always. Collections can be treated differently depending on the loan type (medical or non-medical), the amount, and what AUS says. Before paying anything off, it’s smart to review your scenario—because paying a collection the wrong way or at the wrong time can sometimes change your score.

What Credit Score Gets the Best Mortgage Rates?

In general, borrowers with higher scores tend to qualify for the best pricing. Many rate comparisons commonly cite top-tier pricing around 760+, depending on the lender and the rest of the file (down payment, DTI, reserves, etc.).

Starting The Mortgage Process With a Mortgage Company Licensed In Multiple States With No Overlays

Gustan Cho Associates are made up of mortgage professionals who take pride in their work. Our team is committed to offering fast and reliable service. You must have a trustworthy mortgage team in today’s competitive housing market. Our seasoned loan officers are available seven days a week to help you with your qualifications. Any mortgage-related questions can be directed to Alex Carlucci at (800) 900-8569 or email mike@gustancho.com. We would love the opportunity to help you and your family realize the dream of homeownership and make it a reality.

This article about “How Your Credit Impacts Your Homebuying Process in 2026” was updated on February 27th, 2026.

Take Control of Your Credit and Your Future

Your homebuying journey starts with understanding your credit. With our flexible programs, the path to approval is closer than you think.