This article will cover how to become a successful mortgage loan officer at Gustan Cho Associates. Starting a new career as a loan officer and How to become a successful mortgage loan officer.

This mortgage blog article on how to become s successful mortgage loan officer is geared toward those individuals thinking about starting a career as a loan officer.

This blog is geared toward educating loan officers to become the best of the best in the mortgage industry.

The Rewards of Becoming a Professional Loan Officer

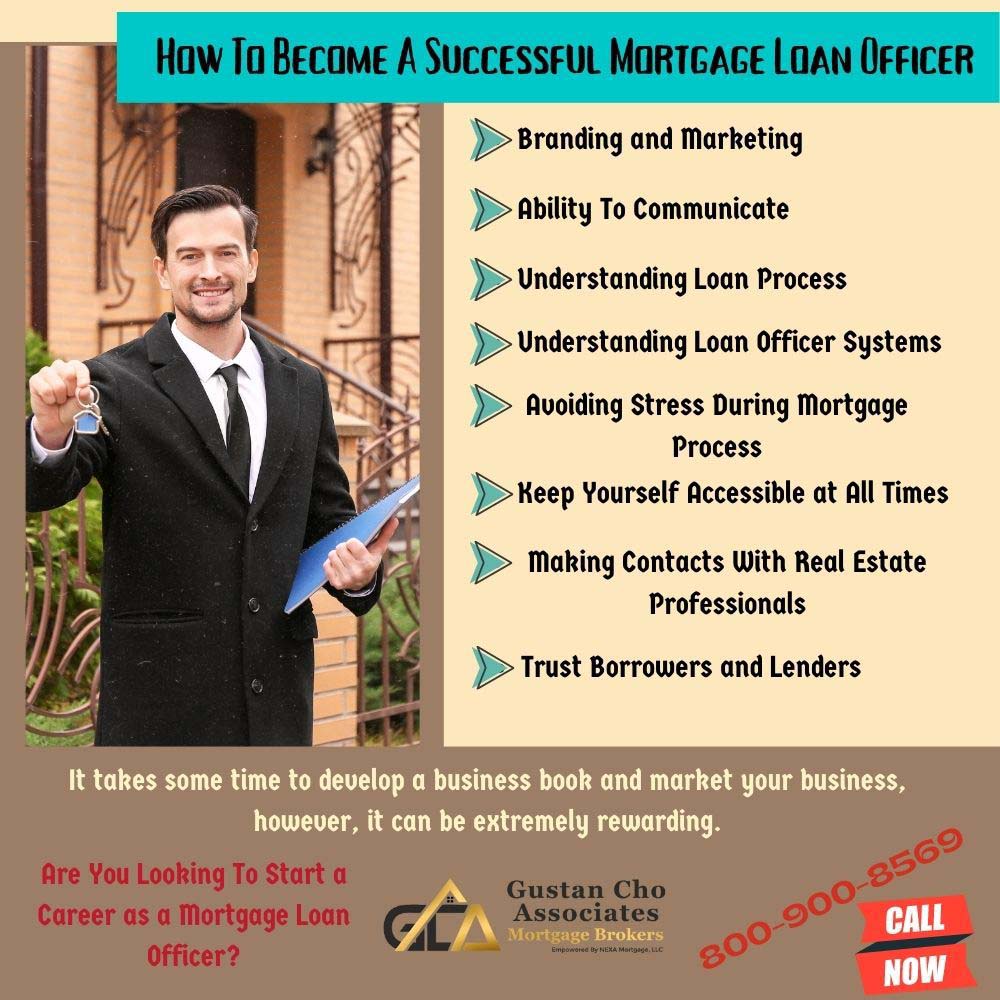

A career as a mortgage loan originator can be extremely rewarding. But it takes some time to develop a business book and market your business. Unlike other professions, becoming a mortgage loan officer is like owning a business.

Most mortgage loan officers are compensated on commissions; if they do not originate and close mortgage loans, they do not get paid.

Loan officers need to gain the confidence of their borrowers. Borrowers need to trust their mortgage loan originators. They must provide them with all their financial and personal information. In this article, we will discuss and cover how to become a successful mortgage loan officer.

Building Referral Network For Loan Officers

Mortgage borrowers do not just submit their financial information to loan officers. Still, they also need to provide a personal letter of explanation about their past issues, such as the following:

- periods of unemployment

- divorce, bankruptcy

- loss of business

- collection accounts

- sources of income

- irregular deposits

- reasons for foreclosures or short sale

- alimony

- child support

- other issues they may have had or are currently having

Documents Required By Borrowers And Understanding Mortgage Process

A loan officer will need the following documents by all borrowers:

- tax returns

- W-2s, paycheck stubs

- bank statements

- retirement accounts

- investment accounts

- child support paperwork

- divorce decree

- bankruptcy paperwork

Understanding Loan Officer Systems

Loan Officers will need the borrowers’ credit report and review the borrower’s payment history. Mortgage loan officers will need to review and analyze the borrower’s following documents carefully:

- bank statements

- withdrawals

- deposits of their bank statements

- obtain verification of employment

- verification of deposits

- verification of mortgage, and verification of rent

Trust Borrowers Give Loan Officers and Lenders

Financial information is every person’s most private and confidential information, but the mortgage loan officer needs access to every aspect of the borrower’s financial and personal information.

Loan originators need to be trusted and respected by borrowers for them to gain their confidence and for the borrower to hire them to represent them to become their mortgage loan officer.

The bottom line of becoming a successful mortgage loan officer is to command the confidence and respect of borrowers.

How To Become a Successful Mortgage Loan Officer and Servicing Clients

The key to becoming a successful mortgage loan officer is to treat your borrowers the way you want to be treated. Being a mortgage loan officer is unlike any other sales profession/ This holds true because you need access to your borrower’s financial and personal information.

I manage a team of licensed mortgage loan originators. Under my watch, all my mortgage loan originators must be available seven days a week for all their borrowers.

The trust mortgage borrowers give their loan officers deserves respect back to the borrower I am always available to my borrowers. It does not matter whether it is after work hours, evenings, weekends, or holidays.

How To Become a Successful Mortgage Loan Officer With Understanding Loan Process

The mortgage process is stressful process, and a lot of lives are at stake. The home buyer is counting on the mortgage loan officer to be able to close on their home loan on time. The need to understand what home buyers will be going through is important. Loan officers need to understand the process of the following:

- making plans on moving

- packing their belongings

- making arrangements with movers

- making arrangements to register their children in their new school districts

- ordering new utilities on their new homes and disconnecting utilities of their old home

- terminating the lease of their rental with their landlord, and the landlord may already have a new tenant to move in

On the home seller’s side, the seller may already have a new home under contract and relies on the buyer’s lender to ensure that their home closes without any issues and closes on time.

Understanding Families Is How To Become z Successful Mortgage Loan Officer

Loan Officers also need to understand what sellers go through during the home buying and selling. Again, like with the home buyer, the seller is packing their belongings.

Making arrangements with the utility companies. Sellers are terminating the enrollment and transferring school records for their children to their new school districts. Sellers are making arrangements with the moving companies.

A wrong move by the home buyers’ mortgage loan originator may pyramid the whole process into disaster and affect many people’s lives.

Ability To Communicate

Communication is key how to become a successful mortgage loan officer. Make sure that every phone call or email by not just for the borrower but the following people:

- home buyer’s realtor

- home sellers realtor

- buyers attorney

- sellers attorney

All the above questions do not go unanswered is the loan officer’s job.

Branding and Marketing Loan Officers and Lenders Name

A loan officer needs to brand their name. Most borrowers do not care about the mortgage company but only care about the individual mortgage loan officers.

The individual mortgage loan officer is the person they rely on and count on. Do not let them down.

Many loan officers avoid phone calls from their borrowers when things do not go right. That is the worst thing to do is avoid when there are issues with the mortgage process.

Helping Clients Understand the Complexity of the Home Loan Process

Borrowers understand the complexities of the mortgage application and approval process: If there are any hiccups or issues that arise during the mortgage process, that is the time for you to contact your borrower. Let them know the situation you are facing, and if you do not have any answers

Tell them that you are looking into solutions to fix the problem on hand and you will update them shortly. Always give your borrowers updates This holds especially true before a long weekend. Be available on the weekends, evenings, and be available during the days to take your borrower’s phone calls.

Remember, the borrower has trusted you and is counting on you, so do not make them down available at all times. Borrowers will understand and respect you if you are upfront with them. All issues can be correctable.

Explaining the Overall Mortgage Process

Examples of issues that can arise during the mortgage process too many to list, but all of the issues that I have run into during the mortgage process were all fixable. Some examples of issues that can arise during the mortgage process such as the following:

- is if the appraisal did not come in at value

- borrower changed jobs during the mortgage process

- the borrower is short of cash to close

- or the borrower’s homeowners insurance came out more than expected and the borrower no longer meets the minimum debt-to-income ratio requirements

Avoiding Stress During Mortgage Process

All of the above issues can be solved. An appraisal is not coming in at value. Normally in cases like these, we can do an appraisal rebuttal. Appraisal rebuttals are normally hard to overturn unless the home seller can provide strong comps.

In cases where the appraisal does not come in at value, the sellers normally reduce the purchase price to the appraised value. Or, the home buyer and home sellers can renegotiate the purchase price and come to a compromise.

Borrowers have changed jobs during the mortgage process: There are times when a borrower changes jobs during the mortgage process. In situations like these, the closing will get delayed until the mortgage borrower can provide 30 days of paycheck stubs before closing and verifying employment with the new employer can be done. Higher than expected debt-to-income ratios.

When a mortgage loan officer deals with a higher debt-to-income ratio borrower. There may be issues where the borrower’s debt-to-income ratios go higher during the mortgage process, such as when homeowners insurance comes in higher than expected.

This issue can be resolved by lowering the mortgage rates by paying points, paying down certain debts such as revolving accounts, or adding a non-occupant co-borrower to the mortgage loan. Again, this may delay the closing of the mortgage loan.

How To Become a Successful Mortgage Loan Officer and The Pre-Approval Stage

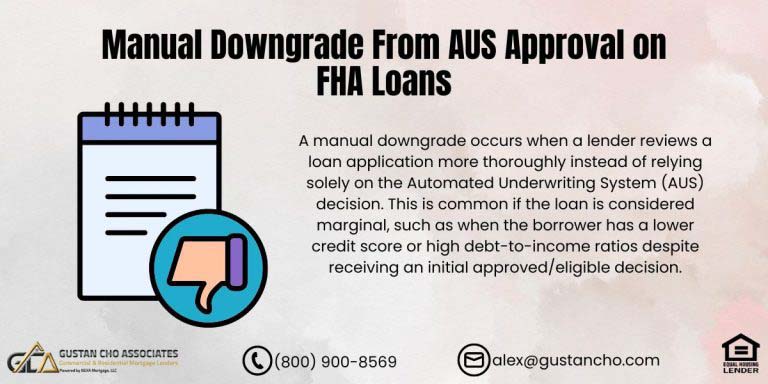

Most mortgage loan denials happen on the 11th hour, or there are delays in mortgage closings because the mortgage loan originator was not diligent when issuing the pre-approval.

Mortgage loan officers need to be extremely diligent when issuing a pre-approval letter. If the mortgage loan officer takes their time and is diligent in reviewing the following:

- all income docs

- thoroughly review the borrower’s credit reports

- make sure that foreclosure

- bankruptcies

- short sales dates have met the mandatory waiting period requirements

- make sure that there are no credit disputes on collections and derogatory credit items

- make sure that they have verification of employment on borrowers who have a part-time income or irregular wages

- borrower not just meets the mandatory lending guidelines but also meets the lender’s overlays requirements

There is no reason why the mortgage loan should not close and close on time.

Avoiding Last-Minute Mortgage Denials

The major reason for last-minute loan denials or major delays in the mortgage process is that the pre-approval was not solid. Take the extra time and ensure the pre-approval letter is solid before issuing it to your borrower.

If the mortgage file is complex, check with an underwriter on the case scenario before issuing the pre-approval letter.

Make sure you save the email correspondence you had with the underwriter on the file so you can refer back to it if the underwriter says something different during the mortgage process.

How To Become a Successful Mortgage Loan Officer Making Contacts With Real Estate Professionals

Every time you represent a home buyer as a mortgage loan originator, you will meet not just the home buyer (mortgage loan borrower).

Still, you will have contact with the home buyer’s realtor and your home buyer’s real estate attorney. As a mortgage loan originator, you often have contact with the seller’s real estate agent and the home seller’s attorneys.

Although you cannot disclose your borrower’s personal financial information. There are no law or ethics violations in introducing yourself as the home buyer’s mortgage loan officer and exchanging contact information.

Keep Yourself Accessible at All Times

By keeping yourself available to all parties involved: Make contact with them, and they will be appreciative and remember your name.

These real estate professionals are great future referral sources for you after your borrower has had their closing. Send everyone a thank you card and follow up with an email thanking them for being so cooperative.

Relay them to contact you if they have any questions on your area of expertise or have a question on a mortgage lending case scenario.

Are You Looking To Start a Career as a Mortgage Loan Officer?

Gustan Cho Associates is currently hiring remote mortgage loan officers nationwide. If you are a licensed mortgage loan officer looking for a new mortgage lender to work with that will provide marketing support and have no lender overlays, you have come to the right place.

We provide hard-working mortgage loan officers with borrowers who are qualified. No cold calling is necessary, and you do not have to worry about marketing. We have a full marketing staff and more people who need our services than we have loan officers.

Also, if you are a self-motivated individual planning on starting a new career as a loan officer, don’t hesitate to get in touch with us. We will guide you in getting your NMLS mortgage loan originator license and getting started.

Thanks for the information on what is required to become a mortgage loan officer, such as how it’s important to explain past issues and to make sure you treat borrowers well. If someone has these traits and qualifications, it would probably be a good idea to start looking online at loan officer jobs. While they do this, it might help to start narrowing them down based on the work that is being done, the location, and the company in order to find the best job for their skills and experience. Michael Gracz and Peter Bieda of Gustan Cho Associates has helped me tremendously and has offered me at job with the blessing of Massimo Ressa and Gustan Cho. Thank you Mike Gracz and Peter Bieda of Gustan Cho Associates at Loan Cabin Inc.

Hey Mr.Mike Gracz,

My name is Johnny Kim, I’m seeking for a career in Mortgage Loan Officer. Please Email me at johnnykim8609317@gmail.com ☺.

Johnny, you can email Mike at mike@loancabin.com or call and/or text him at 630-659-7644. What state are you in? Are you licensed and if so in what states? Do you have any experience?

Hi Mr. Gracz, I am interested in becoming a licensed Mortgage Loan Officer. I currently reside in South Carolina. I would love to talk with someone about the process of becoming licensed and obtaining a remote career as an MLO. My email is mwardlaw.86@gmail.com

Thanks in advance for any assistance or advice that you may be able to provide.

Ma’Randra W.

Ma’Randra. Are you licensed? If you are not licensed, I highly recommend David Reinholz of Loan Officer School. Visit their website at http://www.loanofficerschool.com and call the number on his website. David will explain to you on how to become licensed. Mention you were referred by Gustan Cho Associates and he will give you 25%. Once you have completed the necessary NMLS coursework and passed the national licensing NMLS exam, apply for your license. Once you get your license, please contact us and we can start the hiring process.

Hello Mr. Gracz and Mr. Cho,

I recently passed my NMLS test in CA and am Pending Approval for my NMLS license. I would love to work for your company, but I have no prior MLO experience. Please let me know if there is any way I could qualify to be able to work for your company. I can be reached at kevinsamii@yahoo.com anytime. Thanks!

Kevin S.

Kevin, congratulations. Unfortunately, we are not currently hiring remote loan officers without any experience. My advice is for you to seek employment at a local brick and mortar mortgage shop where you can physically go into the office and work with experienced loan officers, processors, and support staff. The mortgage business is so busy and we currently do not have the staff to train. Feel free to contact me anytime if you have any questions.

Thanks so much! I really appreciate the advice. I’m determined to work hard and gain as much knowledge as possible.

If you work at a brick and mortar, you will learn so much just by associating with other loan officers. Once you worked at a brick and mortar for a year or two, you can work at any company you like including ours as a remote loan officer. I have several thousand blogs and case scenario on my website. Learn how to navigate the search bar on http://www.gustancho.com and you will find any answers to any case scenario. It is like a cheat sheet. Again, the best of luck to you and your future. It is a very lucrative career. Chance to help folks and earn a lot of money.