Starting New Career as MLO in 2025: Step-by-Step Guide to Success

If you’ve been thinking about starting a new career as an MLO — Mortgage Loan Officer — you’re in the right place. This career can be both rewarding and flexible, offering the chance to help people achieve their dream of homeownership while building your own income potential.

At Gustan Cho Associates, we’ve trained and hired loan officers nationwide, including many from completely different careers. Whether fresh out of school, in a midlife career change, or looking for more freedom and income, becoming an MLO might be your perfect next move.

This guide will walk you through everything you need to know — from licensing and training to what the job is really like, how MLOs get paid, and how to start strong.

Why Starting a New Career as an MLO Could Be Your Best Decision

Mortgage Loan Officers are the bridge between homebuyers and lenders. When someone wants to buy a house or refinance, the MLO guides them through the process, collects paperwork, and helps them get approved.

What makes this career stand out?

- Unlimited income potential – Most MLOs are paid commission, so your effort directly impacts your earnings.

- Flexibility – Many work remotely or set their own schedules.

- Helping people – You’re literally changing lives by helping clients buy homes.

- Variety – No two borrowers or loan files are ever the same.

At Gustan Cho Associates, we specialize in working with borrowers whom other lenders turn away. That means our loan officers learn to solve challenging scenarios, making them more valuable in the industry.

Start Your MLO Career With Expert Lender Support

Get training, tools, and mentorship to succeed as a new mortgage loan officer.

Step 1: Get Licensed Through the NMLS

The first step in starting a new career as an MLO is getting your license through the Nationwide Multistate Licensing System (NMLS).

Here’s how it works:

- Create an NMLS account – Register and get your NMLS ID number. This will be your permanent license ID.

- Complete the 20-hour pre-licensing course, which is Available online or in classrooms. Topics include federal laws, ethics, and mortgage basics.

- Pass the national NMLS exam. It’s 125 questions and 3 hours long, and you need a score of 75% or higher.

- Submit to a background check. You must complete a background check that includes fingerprinting and a credit check.

- Apply for state licenses – You’ll need a separate license for each state where you want to originate loans.

Pro Tip: Many new MLOs take a prep course before the NMLS exam to boost their chances of passing on the first try.

Step 2: Choose Where You’ll Work – Bank, Broker, or Mortgage Banker

After obtaining your license, it is important to secure a company to sponsor you when starting a new career as an MLO. Your choice will significantly influence your work environment, compensation structure, and the variety of loans you can provide.

Working for a Bank

Working for a federally chartered bank typically does not require special licensing. However, these banks often have a limited range of loan products and adhere to stricter lending regulations. While there is a consistent stream of in-house clients, the work environment can be less flexible than that of other lending institutions.

Working for a Mortgage Broker When Starting a New Career as an MLO

Working as a mortgage broker involves collaborating with various wholesale lenders, providing clients with a broader range of loan options. However, being licensed in each state where you operate is important. Additionally, while the role offers diverse lending choices, brokers are responsible for generating their own leads to attract potential clients.

Working for a Mortgage Banker

A mortgage banker is a company that lends its own money for home loans. They can also help you find other loan options if needed. This enables them to provide competitive rates and various loan options to cater to their clients’ needs.

Often provides training and leads, like Gustan Cho Associates, which has no lender overlays and hires nationwide.

Step 3: Training and Support Matter More Than You Think

Training is critical when starting a new career as an MLO. Knowing guidelines, software, and sales techniques can make or break your first year.

At Gustan Cho Associates, every new recruit works closely with senior loan officers. We:

- Provide borrowers so you can start closing loans immediately — no cold calling is needed.

- Offer marketing support to help you build your personal brand.

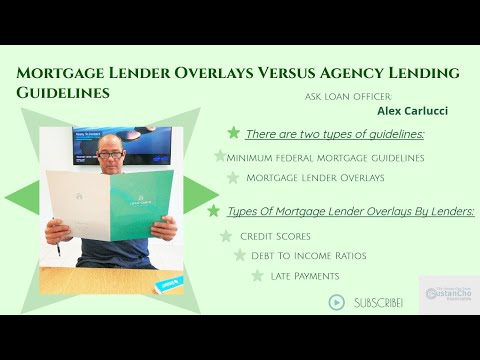

- Teach you to handle complex borrower situations, including low credit scores and high debt-to-income ratios.

Launch Your Career in Mortgage Lending

Work with a lender that invests in your growth from day one.

What an MLO Really Does Day-to-Day

Many people think loan officers “fill out forms.” In reality, the job is about problem-solving, communication, and building trust.

Daily tasks include:

- Talking with clients to understand their goals.

- Reviewing credit reports and financial documents.

- Matching clients with the right loan programs.

- Working with real estate agents, attorneys, and appraisers.

- Keeping clients updated and comfortable during the process.

Because no two borrowers are the same, you’ll always be learning — especially if you work somewhere like Gustan Cho Associates, where unique cases are the norm.

Income Potential When Starting a New Career as an MLO

One of the biggest draws is income potential. Most MLOs earn a commission based on the loan amount. A typical range is 75 to 150 basis points (0.75% to 1.5%) per loan.

Example: On a $300,000 loan at 1% commission, you’d earn $3,000. Close just 3–4 loans a month, and you can see how income can skyrocket.

Note: Your income depends on your work ethic, market conditions, and your company’s support system.

Pros and Cons of Becoming an MLO

Pros

- High earning potential.

- Flexible schedule.

- Rewarding work helping people achieve homeownership.

- Constantly learning new things.

Cons

- Commission-based income can fluctuate.

- Requires self-motivation and discipline.

- Must keep up with changing mortgage guidelines.

How to Succeed When Starting a New Career as an MLO

- Get excellent training – Don’t just learn the basics; master them.

- Work with a strong company – Choose a lender with wide loan options and support.

- Build relationships – Realtors, attorneys, and past clients are your referral goldmine.

- Stay updated – Guidelines and market conditions change often.

- Focus on customer service – Happy clients bring repeat business and referrals.

Why Gustan Cho Associates Is a Great Place to Start

At Gustan Cho Associates, we:

- We have no lender overlays, so we go strictly by agency guidelines.

- Offer FHA, VA, USDA, Conventional, Jumbo, Non-QM, and more.

- Provide leads to new loan officers so you can start closing fast.

- Having a national footprint allows you to grow your career beyond one market.

We hire both experienced loan officers and motivated beginners ready to commit to learning.

Final Thoughts: Your MLO Career Starts Now

If you’re serious about starting a new career as an MLO, the opportunities are wide open in 2025. The housing market continues to evolve, and skilled loan officers are in demand.

If you get the right licenses, some training, and solid support from your company, you can create a career that gives you financial freedom and feels great because you’re helping people.

Ready to get started? Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on starting a new career as an MLP, please contact us at 800-900-8569, text us for a faster response, or email us at alex@gustancho.com.

Don’t Just Get Licensed — Get Supported

Join a mortgage lender that provides the resources and guidance you need to thrive.

Frequently Asked Questions About Starting a New Career as an MLO:

Q: What Does Starting a New Career as an MLO Mean?

A: It means you’re beginning work as a Mortgage Loan Officer, helping people get home loans from start to finish.

Q: Do I Need a License to Start a New Career as an MLO?

A: Yes. You must get an NMLS license by taking classes, passing a test, and passing a background check.

Q: How Long Does it Take to Start a New Career as an MLO?

A: Most people can get licensed in 4–8 weeks if they take the course, pass the exam, and complete the paperwork quickly.

Q: How Much Does Starting a New Career as an MLO Cost?

A: The required class usually costs between $200 and $500, plus fees for the test, fingerprints, and background check.

Q: Can I Work from Home When Starting a New Career as an MLO?

A: Yes. Many MLOs work remotely, primarily if they work for mortgage brokers or companies that allow virtual work.

Q: How Much Can I Earn When Starting a New Career as an MLO?

A: Most MLOs are paid commission. Your income depends on how many loans you close, but it can grow fast if you work hard.

Q: Do I Need Sales Experience to Start a New Career as an MLO?

A: No. Sales experience helps, but good communication skills and the willingness to learn are just as important.

Q: Will I Get Training When Starting a New Career as an MLO?

A: Yes. At places like Gustan Cho Associates, new MLOs get hands-on training and even leads so you can start closing loans right away.

Q: Is Starting a New Career as an MLO Hard?

A: It can be at first because you’re learning rules, paperwork, and loan programs, but it gets easier with practice and support.

Q: Where Can I Apply to Start a New Career as an MLO?

A: You can apply directly with mortgage companies like Gustan Cho Associates, which hires and trains new loan officers nationwide.

This article about “Starting a New Career as an MLO with Mortgage Lender Support” was updated on August 14th, 2025.

Fast-Track Your MLO Success

Get the backing of an experienced lender while building your book of business.

whats acceptable credit issues and whats not. its really annoying its such a grey area. i have an offer contingent on credit check. and the lady helping me fill out the paper work. is not helpful at all. i need to know if i shouldn’t get my hopes up!!!

You need a minimum credit score of 580 FICO to qualify for a 3.5% down payment FHA home purchase loan. You can have outstanding collection accounts. Medical collections and charge offs do not count in the calculations of debt to income ratios. Non medical collection accounts with aggregate unpaid balances of over $2,000, 5% of the outstanding unpaid balance will be used as a monthly debt payment in the calculations of the borrower’s debt to income ratios even though the borrower does not have to make that monthly debt payment. If the outstanding unpaid collection balance is too high, you can enter into a written payment agreement and whatever the agree monthly payment agreement is, that figure will be used as the monthly debt payment in the debt to income ratio calculations. Hope this help. Call me or email me if you have any further questions.

Gustan Cho

Directors Financial Group

http://www.gustancho.com

262-716-8151

So if I’m a brand new MLO, recently licensed, I can start with this company no problem?

Lol. Like your style. Maybe. Need to talk to you first and interview you. If you and I are a good fit, then we can proceed the hiring process with our company.

I know this post is kind of old, hoping that it is still actively looked at. I will be retiring from the military and looking to make a career change. What would you recommend to make myself more marketable. Right now I am working towards my degree in business management thinking of switching to accounting or finance. After researching becoming a MLO I think it would be a great fit for me.

You can start now before you finishing your degree. Get your NMLS 20 course and take the NMLS exam and get licensed.

Greetings! I am looking into changing careers. I am seriously thinking about studying and getting my license to become a MLO. I have a Bachelor’s in Business Administration and a Master’s in Organizational Leadership (both obtained online). I am and have been working in government for the past 12 years. I am a bit of an introvert but am very driven, disciplined, and a fast learner. I would like to work from home after obtaining my license. Especially with COVID and having a baby. Do you think this is possible to become a MLO in GA working remotely being a novice?

It is possible to work as a remote loan officer. However, if you have no experience, I strongly recommend that you start with a local brick and mortar mortgage broker. After about a year or two, you can work remotely at any company. I highly recommend David Reinholtz at http://www.loanofficerschool.com. They have the best 20 hour NMLS online course and practice study materials for you to pass your exam the first time around. The very best to you and your new career.

Gustan,

I absolutely appreciate your article and responses to queries. Like finding a needle in a haystack about what to actually do after you pass you exam and have no mortgage experience. I am in Las Vegas, any recommendations for picking and best way to contact a brick and mortar location? I am also a Realtor and my broker is fine with me doing both jobs, however Im assuming that would be another hurdle/concern for many employers. I do already have numerous potential clients.

Thank you in advance for any incite.

Give my friend John Grimaldi a call on his cell at 973-618-9833. John runs a branch in Nevada and is well connected in Las Vegas as well the whole state. He will talk to you and may give you an opportunity.

Hi I’ve been a cosmetologist for over 25 years and I’m looking for a career change. I’m very interested in getting my MLO and since I’ll be new at this I realize that I cannot work remotely as of yet. I’m located on the Va/NC border do you have any offices here? I’m very motivated and ready to begin a new journey.

Tracy, you can train and start working remotely if you have a company to train you. If you are a go-getter and willing to learn and give it 110%, I will hire you and take you on our team. You first need to get your NMLS license. I highly recommend you contact David Reinholtz. Visit his website http://www.loanofficerschool.com and call the toll free number. Tell him Gustan Cho of Gustan Cho Associates and Capital Lending Network, Inc. referred you. He will give you a discount. David has the best online training and best practice exams for you to pass your NMLS exam on the first try. Once you have passed your 125 question federal NMLS exam, apply for your NC and Virginia state NMLS license. Once you get approved for your state licenses, contact me and lets get you onboarded and get you trained and started. Our North Carolina and Virginia company NMLS licenses are pending so it may be perfect timing for both of us. Post any other questions you have on this comment section and I will answer all of them for you. The best of luck to you and your endevours. W

Gustan,

Thanks for taking the time to provide us with this write up. I recently just passed the NMLS MLO exam here in Ventura County California. I am looking for a way to get my foot in the door in this field. Wondering if you might have any leads about work opportunities here? I am from this area and recently just moved back after being based out east working as crew member on superyachts for a few years, so I am coming from an unrelated field.

The best way to learn this business is to work for a local brick and mortar mortgage broker where you can go in to the office everyday. Or a national lender with a structured training program. Let me know if you cannot find one. I will help you. Starting out as a remote loan officer without any experience is extremely difficult with us because we do not have someone to train newer loan officers at this time.

Greetings,

My name is Ruben and I am a full-time agent in the Long Beach area for Southern California. I am currently taking the 20-hour SAFE course to obtain my MLO.

I don’t want to spend too much time within the actual loan process but I’d like to be legally compensated for the value that I add. Am I able to hang my loan license with your office and receive compensation for the loans that I bring in? I plan on staying with the same RE broker so no changes on that end.

http://gustancho.com/can-realtors-be-loan-officers

Ruben,

As long as you are Licensed, we can compensate you. You can refer your buyers and other borrowers and we can assign a Licensed mortgage loan officer to handle all of your leads exclusively. You and the loan officer will split the commission.

Thank you for the quick response.

I’m currently researching different mortgage companies to work with. What is the split rate between licensed agents and the MLO? So far the most attractive split I have been offered is 1% but I have had some bad experiences with that company. What are some of the things that set your company apart from other lenders? It’s ost important for me to make sure my clients get the best service, rates, and lowest fees.

Sincerely,

All self generated comp for LOs are 125 basis points. Corporate provided leads are 75 basis points. Therefore, you would bet 50 basis points and the loan officer that does all the work would make 75 basis points. Our rates are super competitive and we are 100% transparent. Loan officers can be on a higher comp plan but then your rates will not be competitive. Loan officers can be on a much higher comp plan but then they are pricing themselves out of the market. We are licensed in multiple states and our goal is to get licensed in most of the 50 states. Feel free to try other companies out so you get a feel on how they operate. If you are a real go getter, you will always have an open door with us.

Gustan Cho NMLS 873293

National Managing Director

Gustan Cho Associates | Loan Cabin Inc.

Corporate NMLS 165732

Direct (800) 900-8569

Cell (262) 716-8151 Text For Faster Response

Website http://www.gustancho.com

Corporate Offices 1910 S. Highland Avenue, Suite 300 | Lombard, Illinois 60148

Equal Housing Lender

I recently passed the national SAFE test. I’m confused on the next step. You say to get your license – but every state I’ve seen requires you to have a “sponsoring entity” in other words a company to hire you. Buuuuuut mortgage companies are saying get the license first. It seems like a catch-22. How can I get a license without getting hired first??

You need to get licensed first before you can apply to mortgage companies. There are certain states that do require sponsorship like California and Georgia. Other states you can get licensed without sponsorship like Illinois.

I am a 15 year vet of the luxury vehicle business and used to the hustle. Looking for a career change, I am very interested in becoming an LO and started looking into getting licensed to show initiative to potential employers ahead of time. I am in Colorado, but from what I see, it looks like sponsorship is required for the MLO exam to get my license. Can you please confirm and advise what might be the best route for me?

You can need to get your 20 hour NMLS CE courses done and pass your 125 question federal NMLS exam and get your license. I recommend you contact David Reinholtz at http://www.loanofficerschool.com. David will guide you to the right way in getting licensed.

I have passed my NMLS exam and I am completing my MU4. What are the things that they look at when they are going over your credit report? Do I need a specific score or something? That’s what’s holding me back from submitting my application.

What state are you applying to? Depends on the state. California and Illinois are very lenient on collections and charged-off accounts. Georgia and Texas are very strict.

Hi Gustan,

I am currently in the real estate business and recently just started studying for my MLO Exam. I am currently in the Philadelphia and I have been looking at job postings online and they all require at least 2 years of experience to be a MLO. How do you get your foot in the door if it’s hard to find companies that will hire or train you? And how do you find companies? Do you have any offices or recommendations in the Philadelphia area?

Hi,

I’m currently a MLO licensed in CA and have joined a mortgage broker. I am considering to switch a company. Does your company cover in CA?

We are licensed in California. Please reach out to us at gcho@gustancho.com.

Great article, may I post it to some LO groups I’m in? There are a lot of folks new to the industry that this will help.

I’m brand new, licensed and coming from a marketing and consulting background. I’m a go getter and motivated to get business. I was sad to see you’re not in MC, I like your approach!

We applied in North Carolina. Our North Carolina license in now pending.

In NC. Fumble fingers on tiny keyboard.

Hi Gustan Cho,

I am a realtor and I would like to also get MLO license. I reside in California Bay Area. So once I get license, is there a way I can get the job without experience? I am also Notary Loan signing agent and I am very familiar with all the loan documents and a little bit about the FHA, VA, and Conventional. Do you hire new MLO? Thank you.

We only hire brand new MLO without experience only if they complete a post MLO training course. I can refer you to http://www.loanofficerschool.com. Contact them and ask for Dave Valdez.

Hello,

I currently work in the healthcare field. I am looking to change careers. I have been wanting to get out of healthcare for a few years now. I am not happy working in healthcare and it shows. My friend is an MLO and really enjoys it. He said his bank is hiring and I could get a job. I am just struggling to make the decision. It’s a big one. What steps should I take or things to research before making this choice. Not sure how long the job will be available .

Talk to as many loan officers as you can.

Are you in Florida or Colorado?

Also, should an MLO set themselves up with an LLC?

I passed my MLO exam in November 2021. I am also a licensed realtor in the state of Georgia. I have a bachelors degree in business management and worked as a finance manager for a large automotive corporation. They downsized during Covid and my job was eliminated. I’m excited to start my new chapter as an MLO, but everything I look at says experience required. I’m in Georgia and need a I need a sponsor, any suggestions on what I can do to get a sponsor?

Please reach out to us at gcho@gustancho.com.

Hey Gustan,

I am currently working at a Credit Union in Kansas City as a new MLO or Jr. MLO. Not required to be licensed to work here but I plan to get my license in the near future. In your opinion where/what would be the best training material to acquire?

Contact David Reinholtz at Loan Officer School at http://www.loanofficerschool.com and tell him Gustan Cho referred you and he will get you a discount. Once you pass the test contact me and I will go over career opportunities with you with our organization.