Debt Settlement Versus Bankruptcy: A Guide for Mortgage Borrowers in 2024

If you’re juggling debt and trying to figure out your next step, the decision between debt settlement versus bankruptcy can feel overwhelming. Both options can help you take control of your financial future, but they also have long-term effects on your credit, financial stability, and ability to qualify for a mortgage.

In this updated guide for 2024, we’ll break down what you need to know about debt settlement and bankruptcy, how they impact your ability to buy or refinance a home, and why choosing the right path is crucial for your future.

Debt Settlement: What is it?

Debt settlement involves working with your creditors to reduce the total amount of debt you owe. This option is usually for people who have fallen behind on payments due to financial issues like losing a job, medical expenses, or unexpected costs.

Here’s how it works:

- You (or a debt settlement agency) engage in negotiations with creditors to settle for a one-time payment that is lower than the total amount due.

- Creditors agree to consider the debt “settled” once the payment is made.

While this can lower your debt, it comes with risks:

- Credit Impact: Debt settlement significantly lowers your credit score because it shows creditors you didn’t fulfill the original agreement.

- Tax Consequences: Debt that has been forgiven could be regarded as taxable income.

- Potential Scams: Beware of debt settlement firms that require advance payments or offer guarantees that seem overly optimistic.

Debt Settlement vs. Bankruptcy: What’s the Best Path to Homeownership?

Contact us today to learn how these options can impact your mortgage approval.

What Is Bankruptcy?

Bankruptcy is a legal procedure that assists individuals or companies in eliminating or restructuring their debts according to federal regulations. It’s often seen as a last resort but can provide a clean slate for those facing overwhelming financial burdens.

Chapter 7 Bankruptcy

- Chapter 7 is also called “liquidation bankruptcy.” It helps people eliminate most unsecured debts, like credit card bills and medical costs.

- You may need to sell non-exempt assets to pay creditors.

- Mortgage Impact: Depending on the loan type and lender guidelines, you can qualify for a mortgage two to four years after discharge.

Chapter 13 Bankruptcy

- Chapter 13 is a type of bankruptcy designed to help you reorganize your financial obligations. Often called a “reorganization bankruptcy,” it enables you to repay your debts through a plan that receives court approval. Generally, this repayment plan spans three to five years.

- This option is ideal for people with a steady income who want to keep their assets, like a home.

- Mortgage Impact: With trustee approval, you can qualify for an FHA or VA loan while in an active repayment plan (after 12 months of on-time payments).

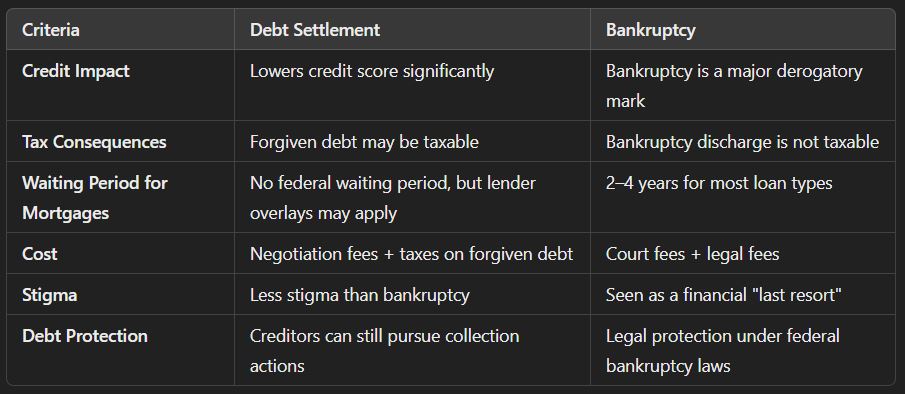

Debt Settlement Versus Bankruptcy: Key Differences

How Debt Settlement Impacts Mortgage Qualification

After a debt settlement, qualifying for a mortgage is possible, but there are hurdles you need to overcome. Lenders often treat debt settlement similarly to bankruptcy, as both indicate financial hardship.

Here are the key factors lenders consider:

- Waiting Periods: While federal guidelines don’t mandate a waiting period, many lenders require 12-24 months of credit reestablishment before approving a mortgage.

- Credit Score: Expect your credit score to take a significant hit. You’ll need to rebuild your credit to qualify for competitive rates.

- Down Payment: Lenders might request a bigger down payment (20-25%) to mitigate the perceived risk.

- Cash Reserves: You’ll need to show strong financial stability, often by providing proof of several months’ worth of mortgage payments in savings.

Pro Tip:

Focus on rebuilding your credit to increase your likelihood of mortgage approval. Make payments on time, maintain low balances on credit cards, and consider adding favorable credit accounts, such as a secured credit card.

How Bankruptcy Impacts Mortgage Qualification

Bankruptcy has more defined rules for mortgage qualification, which can make the path clearer for borrowers.

Chapter 7 Bankruptcy

- Waiting Periods:

- FHA Loans: 2 years after discharge

- VA Loans: 2 years after discharge

- Conventional Loans: 4 years after discharge

- USDA Loans: 3 years after discharge

- Non-QM Loans: Some lenders offer mortgages one day after discharge, but these require a significant down payment (30% or more).

Chapter 13 Bankruptcy

- While in Repayment Plan:

- FHA and VA Loans: Eligible after 12 months of on-time payments with trustee approval.

- After Discharge:

- There is no waiting period for FHA and VA loans.

- Conventional Loans: 2 years after discharge.

Choosing Between Debt Settlement Versus Bankruptcy

Making the right choice depends on your financial situation, future goals, and how quickly you want to recover.

Debt Settlement May Be Right If:

- Your total debt is relatively low.

- You can make a single large payment.

- You want to avoid the stigma of bankruptcy.

Bankruptcy May Be Right If:

- You have an overwhelming debt with no realistic way to repay it.

- You need immediate legal protection from creditors.

- You want a fresh financial start with clear guidelines for recovery.

Real-Life Example:

- Debt Settlement: John had $50,000 in credit card debt and negotiated it down to $25,000 through settlement. While this reduced his debt, his credit score dropped by 150 points. He had to wait two years and save for a 25% down payment before qualifying for a mortgage.

- Bankruptcy: James filed for Chapter 7 bankruptcy after losing her job and was debt-free within six months. Two years later, he qualified for an FHA loan with a 3.5% down payment and a credit score 680.

Rebuilding Credit After Debt Settlement or Bankruptcy

Recovering from debt settlement or bankruptcy takes time, but with the right steps, you can rebuild your financial health and qualify for a mortgage sooner.

Steps to Rebuild Credit:

- Check Your Credit Report: Ensure all debts included in your bankruptcy or settlement are marked correctly.

- Open a Secured Credit Card: Use it for small purchases and pay the balance in full each month.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit.

- Avoid New Debt: Focus on managing your current obligations before taking on more debt.

Not Sure Whether Debt Settlement or Bankruptcy is Right for You? Let’s Talk About Your Mortgage Options!

Reach out now to discuss how we can help you qualify for a mortgage, no matter which route you’ve taken.

Mortgage Options After Debt Settlement or Bankruptcy

For borrowers recovering from financial hardships, there are several mortgage options available.

FHA Loans

- Adaptable credit criteria and minimal down payment choices (3.5%).

- Ideal for borrowers recovering from bankruptcy or debt settlement.

VA Loans

- Available to eligible veterans and active-duty service members.

- No down payment is required, and there are lenient credit guidelines.

Non-QM Loans

- No waiting period after bankruptcy or debt settlement.

- Higher down payment and interest rates apply.

Tips for Mortgage Approval in 2024

- Work with a Lender Who Understands Your Situation: Choose a mortgage lender with no overlays and experience helping borrowers with past financial hardships.

- Provide a Letter of Explanation: Be transparent about the situation that resulted in your financial difficulties and the actions you’ve taken to improve your situation.

- Show Stable Income: Demonstrating steady employment and income will reassure lenders of your ability to make payments.

Debt Settlement Versus Bankruptcy: Which Is Better?

For mortgage purposes, bankruptcy is often viewed more favorably than debt settlement because it provides a clear resolution to financial issues under federal law. However, the best choice depends on your individual circumstances.

Final Thoughts

Whether you choose debt settlement or bankruptcy, know that recovery is possible. With time, discipline, and the right guidance, you can rebuild your credit and achieve your dream of homeownership.

Ready to take the next step? Contact Gustan Cho Associates to learn how we can help you qualify for a mortgage after debt settlement or bankruptcy. Call us at 800-900-8569 or email us at gcho@gustancho.com. We’re here to help, 7 days a week!

Related> Is Debt Settlement Worse Than Bankruptcy?

Frequently Asked Questions About Debt Settlement Versus Bankruptcy:

Q: What’s the Difference Between Debt Settlement Versus Bankruptcy?

A: Debt settlement is when you negotiate with creditors to pay less than you owe. At the same time, bankruptcy is a legal process to eliminate or reorganize debt under federal laws. Both impact your credit and mortgage eligibility differently.

Q: Which is Better for Buying a House: Debt Settlement Versus Bankruptcy?

A: Mortgage lenders often view bankruptcy more favorably because it provides a clear resolution to debt. In contrast, debt settlement can raise concerns about financial stability.

Q: How Long Do I Wait for a Mortgage After Debt Settlement Versus Bankruptcy?

A: After debt settlement, waiting periods vary by lender, typically 12-24 months. After bankruptcy, FHA and VA loans require a 2-year wait for Chapter 7 and no wait after Chapter 13 discharge with trustee approval.

Q: Does Debt Settlement Versus Bankruptcy Hurt My Credit More?

A: Both hurt your credit, but debt settlement often has a smaller initial impact than bankruptcy. However, bankruptcy may allow faster recovery in the long term.

Q: Can I Qualify for a Mortgage During a Chapter 13 Bankruptcy?

A: With trustee approval, you can qualify for an FHA or VA loan after 12 months of on-time payments while in a Chapter 13 repayment plan.

Q: Do I Have to Pay Taxes on Forgiven Debt in a Settlement?

A: Yes, forgiven debt is often considered taxable income. Before choosing debt settlement, consult a tax advisor to understand the implications.

Q: Why Do Lenders View Debt Settlement as Worse Than Bankruptcy?

A: Lenders see bankruptcy as a finalized solution backed by federal laws. In contrast, debt settlement doesn’t offer the same long-term protection and stability.

Q: Can I Rebuild My Credit After Debt Settlement Versus Bankruptcy?

A: Yes, you can rebuild credit by paying bills on time, using secured credit cards, keeping credit utilization low, and avoiding new debt.

Q: What Mortgage Options are Available After Debt Settlement Versus Bankruptcy?

A: FHA, VA, and non-QM loans are popular choices. Non-QM loans typically do not have a waiting period but demand larger down payments and come with higher interest rates.

Q: How Do I Decide Between Debt Settlement Versus Bankruptcy?

A: If you’re dealing with manageable debt and can reach a settlement, debt settlement could be a viable solution. However, bankruptcy might be a more suitable choice if you require legal protection and a fresh beginning. It’s important to always seek advice from a financial advisor or attorney to make an informed decision.

This blog about “Debt Settlement Versus Bankruptcy Mortgage Guidelines” was updated on November 15th, 2024.

Looking to Buy a Home After Debt Settlement or Bankruptcy? Let’s Find the Right Mortgage for You!

Reach out now to see how we can help you get approved for a home loan.