Freddie Mac CHOICERenovation Mortgage: Your Key to Transforming a House into Your Dream Home in 2024

If you dream of buying a home and turning it into your dream space—or renovating your current home to better suit your needs—the Freddie Mac CHOICERenovation® mortgage could be your ultimate solution.

Renovation lending is becoming increasingly popular as the coronavirus pandemic has triggered a surge in remodeling. This groundbreaking program enables you to merge the expenses of buying or refinancing a home with renovation costs into a single, convenient loan. Whether upgrading an outdated kitchen, adding square footage, or tackling repairs, CHOICERenovation gives you the tools to achieve your goals.

In this article, we’ll explore what makes Freddie Mac CHOICERenovation one of the best renovation financing options for 2024. We’ll also discuss its advantages, qualifications, updated guidelines, and why this loan could be the perfect fit for your next project.

Why Choose Freddie Mac CHOICERenovation?

There are many ways to pay for home renovations: personal loans, credit cards, home equity lines of credit (HELOCs), cash-out refinancing, and FHA 203(k) loans. But Freddie Mac CHOICERenovation stands out with unique benefits tailored to modern homeowners:

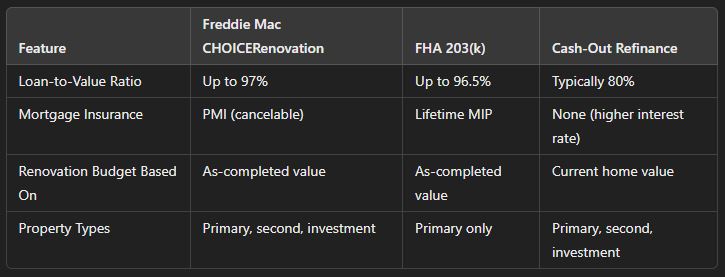

- One Loan, One Payment: Unlike juggling multiple loans or credit cards, CHOICERenovation combines the home purchase or refinance and renovation costs into a single loan. This means one application, one closing, and one monthly payment.

- No Long-Term Mortgage Insurance: Unlike FHA 203(k) loans, CHOICERenovation doesn’t require lifetime mortgage insurance. Even if private mortgage insurance (PMI) is required, it can be canceled once your loan-to-value (LTV) ratio drops below 80%.

- Lower Interest Rates: Freddie Mac CHOICERenovation loans often have lower interest rates than personal loans, home equity loans, or credit cards. This makes them a cost-effective way to fund significant home improvements.

- Flexibility for Various Property Types: Whether you’re renovating a primary residence, a second home, or even an investment property, CHOICERenovation has options for you.

- Larger Loan Amounts: Your loan amount is based on the improved value of your home after renovations, not just its current market value. This gives you more borrowing power.

- No Re-Qualification Required: Unlike many construction loans, once your loan closes, you don’t have to re-qualify after renovations are complete.

This product can also be combined with other Freddie Mac products, such as FREDDIE MAC HOME POSSIBLE, FREDDIE MAC HOMEONE, and FREDDIE MAC SUPER CONFORMING.

Ready to Renovate Your Home? The Freddie Mac CHOICERenovation Mortgage Makes It Easy!

Contact us today to learn how you can use this flexible loan to create your dream home.

Updated for 2024: Key Features and Guidelines

As of 2024, Freddie Mac CHOICERenovation continues to evolve, making it even more borrower-friendly. Here are the latest updates and key features:

Eligible Properties

CHOICERenovation is available for:

- 1-4 unit primary residences

- 1-unit second homes

- 1-unit investment properties

- Manufactured homes

- Condominiums

Maximum Loan-to-Value (LTV) Ratios

The loan-to-value (LTV) ratio assesses the amount you are eligible to borrow in relation to the value of your property:

- 1-unit primary homes: Up to 97% (first-time buyers) or 95%

- 2-unit primary homes: 85%

- 3-4 unit primary homes: 80%

- Second homes: 90%

- Investment properties: 85%

- Manufactured homes: 90%

Debt-to-Income (DTI) Ratio

- Maximum DTI: 50% for highly qualified borrowers

- Typical DTI: 43% for most applicants

- All applications must pass Freddie Mac’s automated underwriting system (AUS). Manual underwriting is not an option for CHOICERenovation loans. Please see our AUS BLOG for more information.

How Much Can You Renovate?

The maximum renovation cost is capped at 75% of the “as-completed” appraised value of the home. For example:

- If your home’s appraised value after renovations is $400,000, you can finance up to $300,000 in renovation costs.

- For purchases, the cap is the lesser of:

- The purchase price plus renovation costs

- The “as-completed” appraised value.

The total loan amount must also fall within your area’s conforming loan limits, which range from $726,200 in most areas to $1,089,300 in high-cost locations.

Renovation Timeline and Requirements

Renovations must begin as soon as possible after your loan closes. All projects must be completed within 365 days. If you encounter delays, Freddie Mac may grant an extension, but you’ll need to provide a detailed explanation to your lender.

What You’ll Need to Provide:

- A clear renovation plan with costs

- A licensed contractor or builder

- Proof of permits, if required by local authorities

Looking to Buy and Renovate? The Freddie Mac CHOICERenovation Mortgage Can Help!

Reach out now to explore how this mortgage can simplify your home buying and renovation process.

How CHOICERenovation Compares to Other Options

Is Freddie Mac CHOICERenovation Right for You?

This loan is ideal if:

- You want to modernize an older home.

- You’re a first-time homebuyer looking for a low down payment option.

- You’re refinancing and want to include renovation costs.

- You own an investment property and want to increase its value.

How to Qualify for CHOICERenovation

The qualification procedure is simple, but collaborating with a knowledgeable lender can significantly impact the outcome. Here’s what you will require:

- Credit Score: While Freddie Mac doesn’t set a specific minimum, most lenders require at least 620.

- Down Payment: As little as 3% for first-time buyers using HomeOne® or Home Possible® programs.

- Income Documentation: Proof of stable income through W-2s, tax returns, or pay stubs.

- Renovation Plan: A comprehensive outline that describes the range and expenses of your project.

CHOICERenovation for 2024: New Updates and Alternatives

Freddie Mac recently introduced the CHOICEReno eXPressSM mortgage for smaller-scale projects. This streamlined option is perfect for borrowers who need less extensive renovations. It offers simplified approval processes and faster funding, making it a great alternative for minor upgrades.

Why Work with Gustan Cho Associates?

Managing a renovation loan can seem daunting, but the professionals at Gustan Cho Associates focus on making the experience straightforward and hassle-free. Our experts, with vast experience in renovation financing, are ready to support you during every step. Whether you’re a new homebuyer or an experienced homeowner, we’ll help you discover the most suitable mortgage option for your requirements.

Ready to Get Started?

Your dream home is just a few clicks away. With Freddie Mac CHOICERenovation, you can finance the perfect home and the improvements you’ve always wanted—all with one loan. Don’t wait to start your renovation journey.

Contact us today to see if you qualify in just minutes! Call Gustan Cho Associates at 800-900-8569, text us for a faster response, or email us at alex@gustancho.com. We’re here to help seven days a week and have offered FANNIE MAE HOMESTYLE and FHA 203 K renovation mortgages for years.

Frequently Asked Questions About Freddie Mac CHOICERenovation:

Q: What is the Freddie Mac CHOICERenovation Mortgage?

A: The Freddie Mac CHOICERenovation mortgage lets you combine the cost of buying or refinancing a home with renovation expenses into one single loan. It’s a simple way to upgrade your home without taking out multiple loans.

Q: Who Can Use Freddie Mac CHOICERenovation?

A: This program is available for first-time homebuyers, homeowners looking to refinance, and even investors. It works for primary residences, second homes, investment properties, and manufactured homes.

Q: How Much Can I Borrow With Freddie Mac CHOICERenovation?

A: Your loan amount is based on the home’s “as-completed” appraised value after renovations. Renovation costs can be up to 75% of this value, but your total loan must stay within conforming loan limits.

Q: What Makes Freddie Mac CHOICERenovation Better Than Other Renovation Loans?

A: CHOICERenovation stands out because it doesn’t require long-term mortgage insurance, offers lower interest rates than credit cards or personal loans, and lets you cancel PMI once you reach 80% LTV. Plus, there’s no need to re-qualify after renovations.

Q: What Types of Renovations Can I Do With Freddie Mac CHOICERenovation?

A: This loan can be used for various projects, including remodeling kitchens, adding bedrooms, making structural repairs, or even installing energy-efficient upgrades.

Q: What’s the Maximum Loan-to-Value (LTV) Ratio for Freddie Mac CHOICERenovation?

A: The maximum LTV varies based on the property type. For example, primary residences can go up to 97% for first-time buyers, while second homes go up to 90%.

Q: How Long Do I Have to Complete Renovations?

A: Renovations must be finished within 365 days of closing. If delays happen, you can request an extension from Freddie Mac, but you’ll need to explain the reasons to your lender.

Q: What if I Don’t Have Perfect Credit? Can I Still Qualify?

A: Most lenders need a minimum credit score of 620 for the Freddie Mac CHOICERenovation program. Approval relies on automated underwriting systems (AUS), meaning that manual underwriting is not available.

Q: Can I Use Freddie Mac CHOICERenovation for Small Projects?

A: Yes, you might also consider the new CHOICEReno eXPressSM mortgage for smaller renovations. It’s designed for less extensive projects with faster approval and funding.

Q: How Do I Apply for a Freddie Mac CHOICERenovation Mortgage?

A: Start by working with an experienced lender like Gustan Cho Associates. They’ll guide you through the process, help you create a renovation plan, and get you prequalified for the loan. Call 800-900-8569 or email alex@gustancho.com to get started today!

This blog about “Freddie Mac CHOICERenovation Mortgage Guidelines” was updated on November 27th, 2024.

Want to Renovate a New Home? Get a Freddie Mac CHOICERenovation Mortgage!

Reach out today to learn how we can help you secure the funds you need.