This guide covers the mortgage process of first-time home buyer loan programs. First-time home buyers have dominated the housing market for the last 10 years. All trends show this streak is likely to continue. Many first-time homebuyers are leery to enter the housing market due to misconceptions of the mortgage process.

Many renters still think they need to save a 20% down payment to buy a house. That is not the case! There are many programs in 2024 that only require a 3% or 3.5% down payment.

We can also help eligible first-time homebuyers with down payment assistance mortgage programs where there is no down payment requirement. We will discuss those later in this blog. While money issues are the main roadblock in obtaining homeownership, it should not defer home buyers from starting the process. In the following paragraphs, we will cover first-time home buyer loan programs.

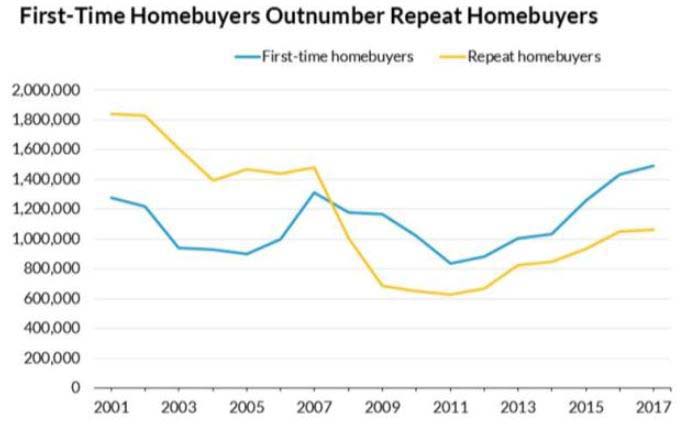

Historical Trends of Renters Versus Home Buyers

Take a look at the trends of first-time home buyers vs repeat home buyers over the past 15 plus years. There is a noticeable dramatic change during the financial crisis of 2008. The number of first-time homebuyers is at an all-time high!

Graph credit to (Source: eMBS, Federal Housing Administration, Urban Institute) from: First Time Home Buyers Dominate Mortgage Markets. With that in mind, how does a first time home buyer start the process? The answer is simple! Contact the Gustan Cho Associates at 262-716-8151 or text for a faster response. Or email us at gcho@gustancho.com. The team at Gustan Cho Associates is available 7 days a week!

Documents Required To Start Mortgage Process

Mortgage Borrowers will be instructed to gather the following information:

- Last 60 Days Bank Statements – to source down payment

- Last 30 Days Pay Stubs

- Last Two Years W2’S

- Last Two Years Tax Returns

- Driver’s License

- Social Security Card

Mortgage Applicants will then fill out an online application. Either myself or one of my highly skilled licensed loan officers will pull borrowers credit and complete the loan application. We offer a full TBD underwriting approval. For more on this unique process please read our TBD UNDERWRITING PROCESS Blog. Once approved you can shop for your first home!

Most Popular First-Time Home Buyer Loan Programs

What are some first-time home buyer loan programs? FHA loans is very popular amongst first-time homebuyers. They have competitive interest rates and offer a secure low-down-payment option. Good Neighbor Next Door Program offered by the HUD, provides significant discounts on HUD-owned homes in revitalization areas for eligible teachers, law enforcement officers, firefighters, and emergency medical technicians.

FHA loans offer low down payment requirements (as low as 3.5% of the purchase price) and more lenient credit score requirements. FHA loans are popular among first-time buyers.

FHA loans are federally insured loans through the U.S. Department of Housing and Urban Development (HUD). Only require a 580 or higher credit score to put down 3.5% down payment. We are experts in FHA guidelines and can answer any questions you may have.

Speak With Our Loan Officer for Getting Mortgage Loans

What Are First-Time Home Buyer Loan Programs

First-time homebuyer loan programs are designed to assist individuals in purchasing their first home. First-time homeowner interest rates, down payment assistance, and reduced closing costs help make homeownership more affordable for first-time buyers. Here are some common types of first-time homebuyer loan programs:

FHA 203(k) Loans

FHA 203k loans allow first-time buyers to finance the purchase of a home and the cost of necessary repairs or renovations in a single mortgage. There are two types of FHA 203K loan programs: Streamline which the maximum loan amount is $35,000 and the full FHA 203k loan program which a gut and rehab loan is allowed.

To take advantage of these programs, it’s essential to research and understand each program’s specific requirements and qualifications.

Eligibility criteria can vary based on income, credit score, and location. Additionally, it’s crucial to work with a knowledgeable lender or housing counselor to navigate the application process and find the best program for your needs.

USDA First-Time Home Buyer Loan Programs

USDA home loans is one of three government-backed loans that is available for homebuyers in designated rural areas with no down payment requirement. USDA loans offers loans to eligible rural and suburban homebuyers with low to moderate incomes. USDA loans require no down payment.

VA Loans

VA Loan – As someone who served this great country you can use your VA benefits to buy your first home. You can buy a home with ZERO down payment and a lower funding fee (financed into your loan) for first use.

VA loans are for qualifying veterans or active-duty service members. These loans require no down payment and have competitive interest rates.

VA loans is a great option for a low housing payment as VA loans do not carry any private mortgage insurance (PMI). Usually, come with lower interest rates compared to conventional financing. VA loans do not have a minimum credit score requirement and can approve higher debt-to-income (DTI) ratios than most mortgage products. Click here to get free quote related to VA Loans

Fannie Mae HomeReady First-Time Home Buyer Loan Programs

Conventional loans with down payment assistance first-time home buyer loan programs: Some lenders and state agencies offer conventional loans with down payment assistance first-time home buyer loan programs. Down payment assistance programs help borrowers with down payments.

Conventional financing also has low down payment options geared to first-time home buyers. This is to compete against the FHA 3.5% down payment product.

These require a 620 minimum credit score and will cap you at a 50% maximum back end DTI to qualify. This program comes with lower mortgage insurance requirements. This is a great program put out by Fannie Mae, please see HOMEREADY BLOG for more information

Freddie Mac HomeOne First-Time Home Buyer Loan Programs

Freddie Mac HomeOne first-time home buyer loan programs is Freddie Mac’s answer to Fannie Mae’s HomeReady program. Another program that requires at least one borrower must be a first time home buyer. Our HOMEONE BLOG dives into the requirements for a first-time home buyer. Homebuyers can also use gift funds. Available for single-family homes, townhomes, and condos! HomePath Ready Buyer Program: Fannie Mae’s HomePath program offers closing cost assistance to first-time buyers who complete an online homeownership education course. The HomePath mortgage program no longer exist but the HomePath properties are still available.

Down Payment Assistance First-Time Home Buyer Loan Programs

State and Local Down Payment Assistance Programs – Programs are not always available, but when they are they can be a great tool for first-time homebuyers. State and Local Programs: Many states and local governments have their first-time homebuyer programs.

Down payment assitance loan programs may offer grants, loans, or tax incentives to make homeownership more accessible. Most of these programs are usually Geared for first-time homebuyers. Keep in mind nothing in this world is free.

Down payment assistance loan programs usually cost home buyers more over the life of the loan. The majority of the time they have higher interest rates and restrict homeowners from selling / refinancing their home without paying the assistance money back. There are forgivable and non-forgivable down payment assistance loan programs. Speak With Our Loan Officer for Getting Mortgage Loans

Getting Pre-Approved For First-Time Home Buyer Loan Programs

If you’re reading this, you’re more than likely a first time home buyer! The majority of our clients are also first-time home buyers. Many of our first-time homebuyers take advantage of our first-time home buyer loan programs. We are always here to help, you may qualify today, or you may need some guidance on how to qualify. We have helped clients for over 12 months pointing them in the direction to qualify, and once they close they are happy as can be. Call us anytime 7 days a week for any mortgage-related questions. The team at Gustan Cho Associates are experts in helping first-time homebuyers. We are a groupd of highly skilled loan officers who can help you with buying your next home. We deal with one-off situations every single day, and we have seen it all, check out our reviews/ success stories and contact us today! This guide on first-time home buyer loan programs was updated on January 16th, 2024.