FHA Loans Chicago: Your 2024 Guide to Affordable Homeownership

Buying a home in Chicago can be daunting, especially with rising property values and high living costs. However, FHA loans have made homeownership more accessible and affordable for thousands of Chicago residents. Whether you’re a first-time buyer or simply looking for a better way to finance a home, FHA loans could be the key to your dream property in the Windy City.

Let’s dive into the benefits of FHA loans in Chicago, the requirements, and how to get started in 2024!

Why Choose an FHA Loans Chicago?

FHA loans, supported by the Federal Housing Administration, have gained popularity in expensive markets like Chicago. With their more accommodating requirements, minimal down payments, and elevated loan limits in six essential counties, FHA loans provide adaptability that resonates with a diverse group of buyers. This article will outline why FHA loans are an outstanding option for those looking to purchase homes in Chicago:

1. Higher Loan Limits

The FHA loan limit for single-family residences in the higher-cost areas around Chicago—such as Cook, Lake, Will, McHenry, DuPage, and Kane counties—has increased to $1,089,300 for 2024. This significant increase enables potential homeowners to buy properties in sought-after neighborhoods within Chicago or its suburban regions while remaining within FHA guidelines. This adjustment reflects the ongoing demand in these areas and makes homeownership more attainable.

2. Low Down Payment

FHA loans offer buyers a more accessible option than traditional loans, which typically demand a down payment of 20%. With an FHA loan, individuals can qualify with a down payment of 3.5%, provided their credit score meets the minimum requirement of 580 or higher. This flexibility can empower potential homeowners to take the next step toward owning a home. This low down payment can be a game-changer for buyers with limited savings who want to own property.

3. Lenient Credit Requirements

FHA loans were created to improve many individuals’ and families’ access to homeownership. They allow individuals to qualify with a credit score as low as 500 when they can provide a 10% down payment. Alternatively, if a borrower has a credit score of 580 or higher, they may qualify with just a 3.5% down payment. This flexibility in credit requirements gives many potential buyers, including those who have encountered past credit challenges, a valuable opportunity to achieve their homeownership dreams.

4. Higher Debt-to-Income (DTI) Ratios

FHA loans allow DTI ratios up to 56.9%, provided your credit score is 620 or higher. This flexibility can help buyers in high-cost areas qualify for homes even if they have other existing debts.

Looking for FHA Loans in Chicago with No Overlays? We Have You Covered!

Contact us today to get started on your FHA loan application with no overlays.

How FHA Loans Make Homeownership Accessible in Chicago

With around 35% of Chicago-area home loans being FHA-backed, it’s clear that FHA loans offer significant advantages to local buyers. Here’s what makes FHA loans such a strong option:

- Accessible Interest Rates: FHA loans often provide competitive rates, which can mean significant savings over the life of your loan.

- Credit-Rebuilding Opportunities: FHA loans offer a viable option for borrowers with lower credit scores, providing a chance to rebuild credit through responsible homeownership.

- Multi-Unit Property Eligibility: In the vibrant housing landscape of Chicago, FHA loans provide an excellent opportunity for buyers, enabling them to purchase properties with up to four units while only requiring a down payment of 3.5%. This arrangement allows homeowners to occupy one unit and rent out the remaining ones, effectively helping to offset mortgage costs.

Understanding the 2024 FHA Loans Chicago Requirements

Getting approved for an FHA loan is straightforward but requires a solid understanding of FHA guidelines. Here are the main requirements:

- Down Payment

- If you have a credit score of 580 or above, you need a 3.5% downpayment.

- If your credit score is between 500-579, you need a 10% down payment.

- Employment and Income History

- FHA guidelines recommend steady employment for at least two years. If you’ve recently changed jobs after a gap, you’ll need 30 days at the new job to qualify if the gap was six months or less. Longer gaps may require additional employment time.

- Credit Score

- 580 and above: Qualify with 3.5% down.

- 500-579: Qualify with 10% down.

- Below 500: Generally not eligible for FHA loans.

- Debt-to-Income (DTI) Ratios

- Front-End DTI (housing costs): Up to 46.9% of gross monthly income.

- Back-End DTI (total monthly debt): Up to 56.9% for borrowers with higher credit.

The Six High-Cost Counties Surrounding Chicago and Why They Matter

FHA’s high-cost limits apply to Cook, Lake, Will, McHenry, DuPage, and Kane counties, allowing for more competitive home purchases in pricier Chicago neighborhoods. Buyers can secure FHA financing for properties without needing additional cash reserves. This increased limit is an advantage whether you’re buying in the city or a nearby suburb.

What are the Properties You Can Purchase with an FHA Loan in Chicago?

One of the greatest features of FHA loans is the variety of property types that qualify. Here’s a look at your options:

- Single-Family Homes: Traditional single-family homes are ideal for many buyers, offering privacy and stability. With FHA loans, you can secure financing with just 3.5% down (credit score 580+).

- Multi-Unit Properties (Two to Four Units): FHA loans allow you to purchase multi-unit properties (up to four units). Live in one and rent out the others to offset your mortgage. This is popular in Chicago, where rental income can help with monthly payments.

- Condos: You can buy a condo in an FHA-approved complex. Condos offer lower maintenance and can include access to shared facilities like pools or fitness centers.

- Manufactured Homes: Manufactured homes qualify for FHA financing if they meet HUD guidelines, including being built after 1976 and permanently affixed to a foundation.

Step-by-Step Process for FHA Loan Approval in Chicago

- Get Pre-Approved: Getting pre-approved not only clarifies your budget but also signals to sellers that you are a committed buyer. A lender such as Gustan Cho Associates can assist you in navigating the FHA loan pre-approval process, ensuring no unnecessary complications.

- Find Your Home: With pre-approval in hand, work with a realtor to find a home within FHA loan limits and your budget. The higher limits in Chicago’s collar counties make finding property in desirable areas easier.

- Appraisal and Inspection: FHA loans require an appraisal to check that the property meets basic safety and quality standards. The lender will also assess the home’s market value to make sure it matches these requirements.

- Underwriting: During underwriting, your lender verifies your income, assets, and credit history. Providing accurate documentation upfront can speed up this process.

- Closing: Once everything is approved, the next step is closing, during which the final documents will be signed, and you’ll receive the keys to your new home. Typically, the closing process takes around 30 to 45 days, although it can differ based on various factors.

Ready to Secure an FHA Loan in Chicago with No Overlays? Let’s Make It Easy!

Reach out today to find out how we can help you secure your FHA loan in Chicago.

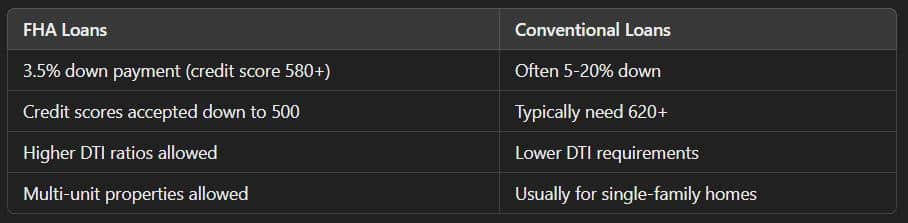

How FHA Loans Compare to Conventional Loans in Chicago

FHA loans offer significant advantages over conventional loans for borrowers with limited savings or past credit issues. Here’s a side-by-side comparison:

FHA Loan Programs with No Overlays

At Gustan Cho Associates, we specialize in FHA loans with no additional overlays. This means we adhere strictly to FHA guidelines without imposing additional requirements. Our approach includes:

- No extra credit score requirements

- No additional DTI ratio restrictions

- Flexible policies on collections and charge-offs

With Gustan Cho Associates, you can qualify for an FHA loan in Chicago even with a complex financial history.

Why Work with Gustan Cho Associates for FHA Loans in Chicago?

Choosing the right lender is important for a successful FHA loan process. With Gustan Cho Associates, you benefit from a team that understands Chicago’s market and specializes in FHA loans with no overlays. This means:

- There are no additional requirements beyond FHA guidelines.

- Flexible credit and DTI policies that accommodate your unique financial situation.

- Guidance for credit rebuilding and other support programs that can strengthen your loan application.

Ready to Take the Next Step? Contact Us Today!

If you want to purchase or refinance a home in Chicago with an FHA loan, Gustan Cho Associates can guide you through every step. Our specialists can answer your questions, provide a quote, and get you pre-approved for an FHA loan.

Contact Us Today!

Call 800-900-8569 or email alex@gustancho.com to speak with an FHA loan specialist. We’re available seven days a week to support your mortgage needs.

Frequently Asked Questions About FHA Loans Chicago:

Q: What are FHA Loans, and How do They Help Homebuyers in Chicago?

A: FHA loans are government-backed loans that make homeownership easier by requiring lower down payments and offering more flexible credit requirements. For buyers in Chicago, FHA loans provide affordable options to buy homes in pricier areas, like Cook or DuPage counties.

Q: What Minimum Credit Score is Required to Qualify for FHA Loans in Chicago?

A: To qualify for a 3.5% down payment on FHA loans in Chicago, you need a credit score of at least 580. If your score is between 500-579, you can still qualify, but you’ll need to make a 10% down payment.

Q: How Much Can I Borrow with FHA Loans in Chicago?

A: In 2024, the loan limit for FHA loans in high-cost areas of Chicago, like Cook and Lake counties, is up to $1,089,300 for single-family homes. This allows buyers to purchase homes in higher-cost areas without exceeding FHA limits.

Q: Are FHA Loans in Chicago Only for First-Time Homebuyers?

A: No, FHA loans in Chicago aren’t just for first-time buyers. Anyone who meets the requirements can apply, whether it’s their first home or not. Due to the low down payment, these loans are also popular with first-time buyers.

Q: Can I Buy a Multi-Unit Property with FHA Loans in Chicago?

A: Absolutely! FHA loans allow you to purchase properties with as many as four units. This option is fantastic in Chicago since you can occupy one unit while leasing out the others to assist with your mortgage payments.

Q: Do FHA Loans in Chicago Have Higher Loan Limits Than Other Parts of Illinois?

A: Yes, FHA loan limits are higher in the six counties surrounding Chicago due to the higher cost of living. This makes buying in more expensive neighborhoods in the Chicago area easier.

Q: What Down Payment is Required for FHA Loans in Chicago?

A: FHA Loans Chicago requires a 3.5% downpayment if your credit score is 580 or above. If your score is between 500 and 579, a 10% down payment is required.

Q: Can I Get FHA loans in Chicago with Past Credit Issues?

A: Yes, FHA loans help people who have had credit problems. Even with a low credit score, you may still qualify if you meet certain down payment requirements. These loans also offer a chance to improve your credit score by being a responsible homeowner.

Q: Can I Include a Co-Borrower on FHA Loans in Chicago?

A: Yes, FHA loans allow you to have a non-occupant co-borrower, like a family member, who doesn’t live in the home but helps you qualify for the loan. This is especially helpful for buyers who may need extra income to qualify.

Q: How do FHA Loans in Chicago Compare to Conventional Loans?

A: FHA loans in Chicago offer more flexibility with credit scores and down payments than conventional loans, making them ideal for those with lower credit or limited funds. Conventional loans usually require higher credit scores and larger down payments.

This blog about “FHA Loans Chicago For Bad Credit With No Lender Overlays” was updated on November 7th, 2024.

Get the Best FHA Loan in Chicago with No Overlays – Let’s Get You Approved!

Contact us now to explore your FHA loan options and get pre-approved for your home purchase.