This guide explains Fannie Mae second home guidelines, especially vacation properties. As of 2025, a minimum down payment of 10% is required by Fannie Mae and Freddie Mac.

Government loans cannot be used to purchase second homes or investment properties. Dale Elenteny of Gustan Cho Associates noted that the introduction of non-QM second home financing increases competition in this market.

Conventional and non-QM mortgages align with Fannie Mae’s guidelines, allowing the funding of second homes and investment properties.

Mortgage rates for primary and second homes are similar. In contrast, rates for investment properties are often higher due to the increased risk.

In summary, borrowers can finance second homes using conventional and non-QM loans. However, they should be aware of the different rate structures. The following sections will detail Fannie Mae second home guidelines.

Second Home Financing Eligibility Requirements

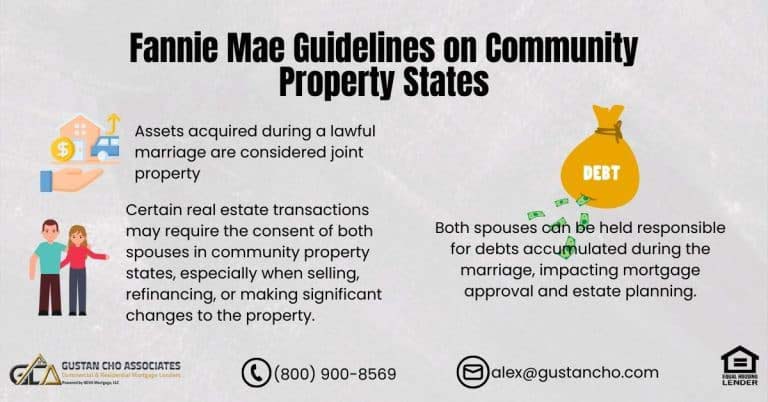

The rules for getting second-home financing through government loans, like FHA, USDA, and VA, are strict. These loans are meant only for primary residences that people live in and do not allow financing for second or investment homes. Fannie Mae and Freddie Mac are key organizations that set the rules for conventional loans and stress that government-backed loans should only be used for primary homes.

Fannie Mae and Freddie Mac are super important in the mortgage world because they set the rules for lenders. They want to make sure that government-backed loans actually help people get homes to live in rather than just being used for flipping houses as investments. This approach stabilizes the mortgage lending system and ensures these loans serve their intended purpose.

Ready to Buy a Second Home with a Conventional Loan?

Contact us today to learn how you can qualify for a second home purchase with a conventional loan.

Freddie Mac and Fannie Mae Versus Government-Backed Loans

Conventional loans offer financing options for both second homes and investment properties. The key difference lies in the interest rates, as second-home loans typically have significantly lower rates than investment property loans. Furthermore, the down payment requirements for second-home financing are notably lower than the conventional financing of investment properties, per Fannie Mae second home guidelines.

Second-home financing requires a 10% down payment. Investment home financing on a single-family home requires a 15% down payment. Mortgage rates on investment home financing are about 0.50% higher than second-home financing.

The Fannie Mae second home guidelines mandate a minimum Credit Score of 620 and adherence to all conventional mortgage lending criteria for all conventional mortgage loan programs. Non-QM loans provide financing options for primary residences, second homes, and investment properties, featuring full-doc and no-doc loan programs. Mortgage rates on non-QM loans are contingent upon credit scores and the down payment amount.

Fannie Mae Second Home Guidelines And Second Home Financing Requirements

Adhering to conventional mortgage lending criteria and providing a 10% down payment for a home acquisition doesn’t automatically assure eligibility for a second home mortgage loan, according to John Strange, a senior loan officer at Gustan Cho Associates. Strange explains that individuals can purchase a second home without selling their current residence by following the Fannie Mae second home guidelines, treating it as an owner-occupant property.

Fannie Mae Second Home Guidelines outline distinct regulations for financing second homes and corresponding requirements from Freddie Mac. According to these guidelines, the second home acquisition must be situated at a minimum distance of 100 miles from the buyer’s primary residence.

Securing a second residence nearby does not align with the standards set for second-home financing; rather, it qualifies solely for investment home financing. It is important to highlight that individuals seeking a second home benefit from more favorable terms, reduced interest rates, and less stringent down payment requirements when opting for second-home mortgage loans instead of investment home mortgage loans, following the Fannie Mae Second Home Guidelines.

Fannie Mae Second Home Guidelines Under 100 Miles From Primary Home

If you’re thinking about getting financing for a second home under Fannie Mae guidelines, there are a few things to keep in mind. First, the second home must be about 100 miles from your main house. It also needs to be either a waterfront or a resort area. This matters when it comes to whether or not you can get financing for that second home.

If your second home is close to where you live now, looks about the same size, and is in a similar neighborhood, it won’t be eligible for Fannie Mae’s second-home financing. It’s super important to know these rules if you’re thinking about getting funding for a second place so you can make sure everything fits the criteria.

Suppose you’re buying a beachfront house or a place in a resort area like Disney World in Orlando, and it’s near your main home. In that case, you’re in luck—it should qualify for a second home purchase!

Homebuyers of second and vacation homes second home financing with a national lender licensed in 48 states, including Puerto Rico, Washington, DC, and the U.S. Virgin Islands with no mortgage overlays, can contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.

We have a national reputation for being a one-stop mortgage shop due to being able to do commercial, business, and residential mortgage loans. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays to answer any of your questions.

FAQ – Fannie Mae Second Home Guidelines on Conventional Loans

Q: What are the Key Updates to Fannie Mae Second Home Guidelines for 2025?

A: The 2025 update to Fannie Mae Second Home Guidelines mandates a minimum down payment of 10% for individuals looking to purchase a second home. This emphasizes responsible lending practices and aligns with Freddie Mac’s requirements.

Q: Are Government Loans Allowed for Acquiring Second Homes or Investment Properties According to These Guidelines?

A: No, as emphasized by Fannie Mae and Freddie Mac, government loans such as FHA, USDA, and VA loans are not permissible for acquiring second homes or investment properties.

3. How do conventional and non-QM mortgages fit into these guidelines?

Conventional and non-QM mortgages provide flexible financing options that align with Fannie Mae Second Home Guidelines, allowing borrowers to secure funding for second homes and investment properties.

Q: Are Mortgage Rates for Primary Residences and Second Homes Similar?

A: Yes, mortgage rates for primary residences and second homes are generally comparable, which means individuals seeking to finance a second home can anticipate rates similar to those for their primary residence.

Q: How do Mortgage Rates for Investment Properties Differ from those for Primary and Second Homes?

A: Mortgage rates for investment properties are typically substantially higher than rates for both primary and second homes. This reflects the increased risk associated with financing properties intended for investment purposes.

Q: Why do non-QM loans have competitive rates in some cases?

A: Non-QM loans may have lower rates than conventional loans in certain situations, as Fannie Mae and Freddie Mac view second home financing as having a lower risk tolerance than financing for investment properties, resulting in lower second home mortgage rates.

Q: What is the Minimum Credit Score Required for Second Home Financing According to These Guidelines?

A: According to Fannie Mae Second Home Guidelines, a minimum credit score of 620 is required, and borrowers must adhere to all conventional mortgage lending criteria.

Q: Are There Any Location-Specific Requirements for Second Home Financing?

A: Yes, Fannie Mae guidelines require that the second home must be located at a minimum distance of 100 miles from the buyer’s primary residence. Additionally, the property must either be a waterfront property or situated in a resort area to meet Fannie Mae’s criteria.

Q: Can I Purchase a Second Home Without Selling My Current Residence?

A: Yes, individuals can purchase a second home without selling their current residence by following the Fannie Mae Second Home Guidelines, treating it as an owner-occupant property.

This article about Fannie Mae Second Home Guidelines on Conventional Loans was updated on April 25th, 2025.

Ready to Purchase Your Second Home? Understand Fannie Mae’s Guidelines

Contact us today to learn how you can qualify for a conventional loan and buy your dream second home.