In this blog, we will cover and discuss mortgage loan programs with no overlays and closing in 30 days. The majority of mortgage lenders have their own overlays. There are not too many lenders who have mortgage loan programs with no overlays. Stay in close contact with your lender and respond promptly to additional information or documentation requests. Working with an experienced agent can help coordinate the various aspects of the home-buying process and ensure things progress smoothly.

Choose a responsive title company and appraiser: The title company and appraiser can impact the closing timeline, so choose reputable professionals who can work efficiently.

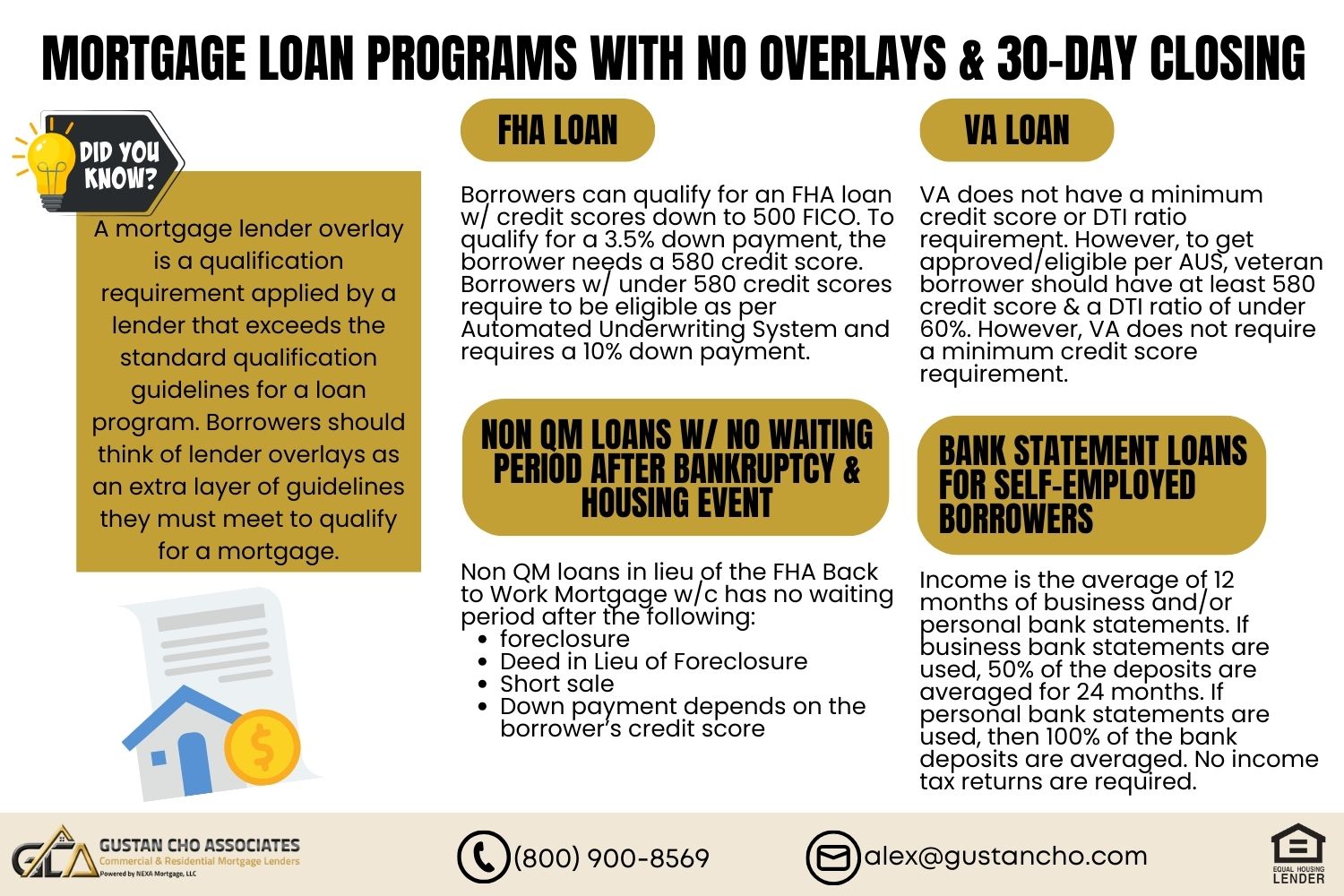

Lender overlays are additional mortgage guidelines imposed by lenders that are above and beyond the minimum agency guidelines of FHA, VA, USDA, Fannie Mae, and Freddie Mac. The team at Gustan Cho Associates is a mortgage company licensed in multiple states with no mortgage lender overlays on government and conventional loans. We are licensed to originate FHA, VA, USDA, and conventional residential mortgage loans. Our team at Gustan Cho Associates works with dozens of realtor referral partners nationwide. In the following paragraphs, we will discuss and cover no mortgage lender overlays approvals on FHA and VA loans.

Get Qualified Today For a Home Loan With Bad Credit

What Are Lender Overlays on Government and Conventional Loans

Lenders can impose lender overlays on just about anything. For example, HUD, the parent of FHA, requires a 580 credit score for a 3.5% down payment FHA loan. Many lenders will require a 620 or 640 credit score for borrowers even though HUD Agency Guidelines only require a 580 credit score. There are so many lender overlays one lender may have but not another lender. Just because a borrower cannot qualify for a mortgage at one lender does not mean they cannot qualify for a mortgage at another lender.

Fannie Mae Mortgage Loan Programs on Conventional Loans

Fannie Mae and Freddie Mac are the two mortgage giants that set mortgage agency guidelines on conventional loans. Conventional loans are not backed by a government agency. Fannie Mae or Freddie Mac backs conventional loans and often has competitive interest rates and terms. With a strong credit profile and a straightforward application, a 30-day closing is achievable. FHA loans are known for lenient credit and income requirements compared to conventional loans.

Government-Backed Mortgage Loans

Some lenders offer FHA loans with minimal overlays, making it possible for borrowers with lower credit scores to qualify. VA loans are for veterans with certificates of eligibility (COE), active-duty service members, spouses of deceased veterans, and their families. VA loans typically have no overlays, and lenders often strive for a fast closing process.

Prepare your documentation in advance: Gather all the required income documents, such as W2s, 1099s, income tax returns, bank statements, pay stubs, and other paperwork, and promptly provide them to the lender.

USDA loans are for buyers with low-to-moderate incomes buying a house in a rural area designated by the U.S. Department of Agriculture. Some lenders offer USDA loans with minimal overlays to facilitate a smooth closing. To achieve a 30-day closing, working with a lender specializing in quick turnarounds is important. It has experience handling loans without excessive overlays. Here are some tips to help expedite the closing process:

Finding a Lender With Mortgage Loan Programs With No Overlays

Gustan Cho Associates has no lender overlays on government and conventional loans. Each lender can have its own lender overlays. One lender may have lender overlays on credit scores but not a debt-to-income ratio and a different lender can have overlays on DTI but not credit scores. No all lenders have the same mortgage lending requirements:

All lenders need to have borrowers meet the minimum agency guidelines of HUD, VA, USDA, FANNIE MAE, and Freddie Mac. However, lenders can have higher lending standards called lender overlays.

There are a few lenders that claim they have zero overlays. Remember that while a 30-day closing is desirable, it may only sometimes be achievable due to factors beyond your control, such as market conditions or unexpected delays. Therefore, working closely with your lender and real estate professionals is essential to navigate the process as smoothly as possible.

Why Do Mortgage Lenders Have Overlays?

However, completely zero overlays are non-existent. In this section, we have completed a list of common lender overlays that lenders who claim they have zero overlays still question. DU approval must reflect a maximum debt-to-income ratio, DTI, of 56.9% back-end and 46.9% front-end debt-to-income ratio for borrowers to get an approve/eligible per AUS on FHA loans.

Overlays are individual mortgage lender’s lending requirements that is above and beyond the minimum agency guidelines of HUD, VA, USDA, Fannie Mae, or Freddie Mac. No two mortgage companies have the exact same overlays.

Exceptions to exceed the maximum debt-to-income ratio of 46.9% front end and 56.9% back-end is not allowed since this is the minimum agency mortgage guidelines from HUD. Most mortgage lenders will have lower front-end and back-end debt-to-income ratio caps as part of their lender overlays. Over 80% of our borrowers at Gustan Cho Associates are borrowers who could not qualify at other lenders due to the mortgage company’s overlays.

Get Approved Today For a Home Mortgage

Automated Findings of the AUS

The automated underwriting system (AUS) can approve maximum debt-to-income ratios of up to 46.9% front-end and 56.9% back-end on FHA loans. Lenders with no lender overlay just go off the automated underwriting system findings and have no other overlays. However, lenders with lender overlay may cap debt-to-income ratios on both front-end and back-end debt-to-income ratios. Mortgage underwriters may request a letter of explanation on how they intend on paying their mortgage and monthly payments with no hardship.

The Borrower’s Ability to Repay

Mortgage underwriters will analyze and be concerned with the borrower’s ability to repay their new housing payment. The submission package must provide evidence of documented strengths to offset any borrowers’ deficiencies (This helps me give me ammo to potentially get around any hurdles). Low payment shock is considered a great compensating factor.

If the borrower’s new housing payment is the same as the rent payments they have been paying, there is a zero percent payment shock.

Any payment shock of 5% or under is considered a strong compensating factor. This is because the borrower is used to paying a monthly housing payment and the new mortgage payment will be no payment shock. Verification of rent by providing 12 months of canceled checks or management VOR.

Manual Underwriting on FHA and VA Loans

FHA and VA loans are the only two mortgage loan programs that allow manual underwriting. In general, verification of rent is required on all manual underwriting. However, at Gustan Cho Associates rental verification can be waived if the borrower is living rent-free with family members.

The owner of the property needs to sign a form that is provided by the lender stating the borrower is living rent-free temporarily to save funds to purchase a home.

Mortgage underwriters can downgrade an automated underwriting system-approved borrower to a manual underwrite because they see many-layered risks. This is the underwriter’s discretion. Lenders with no lender overlays will not downgrade an automated underwriting system borrower to a manual underwrite.

Gustan Cho Associates Are Experts on Manual Underwriting

Living Rent-Free With Family Members

If the borrower has lived with a family member rent-free or paid cash for rent, the borrower is to provide a signed budget letter (I have had some success when documenting less than 12 months on this provided we have a strong LOE’s budget letter, etc). Follow DU for acceptable credit documentation. Collections/Charge-offs less than 24 months and greater than $5000 will be reviewed on a case-by-case basis and the requirement for payoff is at the underwriter’s discretion with lenders who have overlays.

Adding Non-Occupant Co-Borrowers

Non-occupant co-borrowers or co-signers are permitted as long as they are immediate family members; proof of relationship is required. Other blood relatives (aunts, uncles, cousins, etc) will be permitted and the occupant borrower DTI cannot exceed 50%. Borrower income derived solely from commissions must have 3 months of PITI reserves over and above the required investment. Borrowers that are currently in a payment arrangement with IRS have an established payment arrangement in place for 3 months and provide evidence of payments made.

Over 80% of Our Borrowers Are Folks Who Could Not Qualify at Other Lenders

Do All Lenders Have Different Lending Requirements?

The answer to do all mortgage lenders have different lending requirements on the same loan program is YES. Not all mortgage lenders have the same lending requirements for government and conventional loans. There are many mortgage lenders that change their overlays mortgage loan program guidelines with little notice.

Mortgage lenders can have any lender overlays. One lender may have overlays on minimum credit score requirements while another lender does not but may have overlays on debt-to-income ratios.

There are many mortgage lenders claiming they have no overlays and that as long as the borrower had approve/eligible from Fannie Mae’s Automated Underwriting System, the deal will get done. However, during the underwriting process, the mortgage application got suspended due to lenders coming up with lender overlays.

Why Do Loans Get Suspended or Denied During the Mortgage Process?

Home loans often get suspended during the mortgage process because the lender implemented rental verification overlays. Verification of rent is not required on AUS-approved borrowers but a lender can require it even though it is not conditioned on the Automated Underwriting System Findings.

A mortgage lender can downgrade a borrower with an approve/eligible per automated underwriting system findings to a manual underwrite as a lender overlay due to the underwriter discretion of seeing the borrower being high risk.

There are times when borrowers can not provide rental verification because the home they were currently living in is under foreclosure. The home can be under the wife’s name and not the husband’s. Ultimately, the underwriting department can approve the mortgage loan without requiring rental verification or giving a pass to their lender overlays.

What Is a Clear To Close?

If the mortgage loan originator offers special mortgage loan programs with no overlays where benefits such as not having to pay off open collections, 580 credit scores, and high debt-to-income ratios, I strongly recommend that borrowers aggressively work in getting a clear to close and not procrastinate in submitting required documents.

A clear to close is when the mortgage underwriter has reviewed all conditions of the borrower and believes the borrower meets all agency guidelines and the lender’s overlays on the mortgage loan program the borrower applied.

Gustan Cho Associates has mortgage loan programs with no overlays. We just go off AUS Findings. Gustan Cho Associates are experts in originating and funding non-QM loans such as bank statement loans, asset-depletion mortgages, one-day out of bankruptcy and foreclosure, non-QM jumbo loans with lower credit scores, and a variety of loans for real estate investors.

Best Types of Lenders With No Overlays and Lenient Mortgage Guidelines

Gustan Cho Associates are mortgage brokers licensed in 48 states with no overlays on government and conventional loans and has the ability to broker non-QM and specialty mortgage loans. Gustan Cho Associates gets daily inquiries from realtors throughout the country about the specialty products we have to offer their home buyers.

Many realtors have requested that I write a blog about the mortgage loan program loan programs we have available and the services

Gustan Cho Associates provides. In this article, we will discuss and cover the personal service Gustan Cho Associates can offer with the various mortgage programs we have to offer. We have a national reputation for being able to do loans other mortgage companies cannot do.

We Are The Best Lender For Bad Credit

Best Mortgage Broker With Mortgage Loan Programs With No Overlays

Gustan Cho Associates has no mortgage lender overlays on government and conventional loans. We are available 7 days a week. Gustan Cho Associates is a lender licensed in multiple states. Borrowers can apply online 24/7 at Gustan Cho Associates. The team at Gustan Cho Associates is available seven days a week:

All of our mortgage pre-approvals are full loan commitments issued by our mortgage underwriters. The team at Gustan Cho Associates only go off the automated findings of the Automated Underwriting System.

Gustan Cho Associates and all of our subsidiary lending partners and affiliate lenders have no lender overlays. Over 80% of our borrowers are folks who either get denied by other lenders due to the lender overlays or are stressed during their mortgage process with their current lender. Most of our borrowers close their home loans in 30 days or less.

Mortgage Loan Programs With No Overlays on FHA Loans

Gustan Cho Associates has mortgage loan programs with no overlays on FHA loans. Borrowers can qualify for an FHA loan with credit scores down to 500 FICO. To qualify for a 3.5% down payment home purchase FHA loan, the borrower needs a 580 credit score.

Borrowers with under 580 credit scores require to approve/eligible per Automated Underwriting System and a 10% down payment. Manual underwriting is available for borrowers who meet manual underwriting agency guidelines.

Debt-to-income ratios up to 46.9% front-end and 56.9% back-end. Non-occupied co-borrowers are allowed on FHA loans. Up to 6% seller’s concession allowed on FHA loans to cover buyer’s closing costs and escrows. Open collections, late payments, bank overdrafts, and charged-off accounts are allowed.

Can I Qualify For an FHA Loan With Judgments?

Borrowers with judgments and tax liens are eligible to qualify for FHA loans if they have a written payment agreement and have made three timely payments. Borrowers who have prior bad credit are allowed as long as the borrower has been timely on all of their payments for the past 12 months. Collections and charged-off accounts do not have to be repaid. Homebuyers can qualify for FHA loans after meeting the two-year waiting period after the Chapter 7 Bankruptcy discharge date. Homebuyers can qualify for an FHA loan after a housing event. There year waiting period after foreclosure, deed-in-lieu of Foreclosure, and short sales.

Can I Qualify For Mortgage After Bankruptcy and Foreclosure?

To qualify for government and conventional loans, borrowers need to meet the agency guidelines of Fannie Mae and Freddie Mac lending on waiting period requirements. There are mortgage loan programs one day out of bankruptcy and foreclosure. There is no waiting period after bankruptcy and foreclosure on non-QM loans. Mortgage borrowers can qualify with our new NON-QM loan program. No waiting period out of housing events with non-QM loans one day out of bankruptcy and foreclosure.

Get Approved Today For Mortgage After Bankruptcy

HUD Guidelines on FHA Loans During and After Chapter 13 Bankruptcy

Borrowers can qualify for a home purchase or refinance FHA or VA mortgage loan during a Chapter 13 Bankruptcy repayment plan with a manual underwrite. Manual underwrites are available for borrowers in an active Chapter 13 Bankruptcy repayment plan with trustee approval:

- No waiting period after the Chapter 13 Bankruptcy discharge date

- 100% gifts allowed on a home purchase by a family member

- 24-hour mortgage loan underwrites and mortgage approvals

- Closings in 14 days if it is a rush file

- Most closings are in 30 days or less

- No waiting period for borrowers with a short sale

- This holds true as long as they were current on their loan until the day of the short sale and evidenced by HUD.

Homeowners with equity in their homes can qualify for an FHA or VA cash-out refinance mortgage loans and do a Chapter 13 Bankruptcy buyout before the term of their Chapter 13 Bankruptcy repayment plan.

Mortgage Loan Programs With No Overlays on VA Loans

VA does not have a minimum credit score or debt-to-income ratio requirement. However, to get approve/eligible per AUS, Veteran borrowers should have at least a 580 credit score and a debt-to-income ratio under 60% DTI. However, VA does not require a minimum credit score requirement. Residual Income and Reserves are great compensating factors for VA loans for Veteran Borrowers with less-than-perfect credit and higher debt-to-income ratios. Outstanding collections and charge-offs do not have to be paid to qualify for VA loans at Gustan Cho Associates.

Can I Qualify For a Mortgage During and After Chapter 13 Bankruptcy

FHA and VA Loans After Chapter 13 Bankruptcy

Most FHA and VA lenders require a one-year to two-year waiting period after a Chapter 13 Bankruptcy discharge for them to qualify for FHA And VA loans. Gustan Cho Associates does not have any waiting period requirement after a Chapter 13 Bankruptcy discharge date. Home Buyers can qualify for FHA and VA loans during and after Chapter 13 Bankruptcy with no waiting period requirements. Any mortgage loan underwriting with less than 2 years of seasoning after a Chapter 13 Bankruptcy discharge is done via manual underwriting. We close all manual underwrites in 30 days or less.

Apply For a Mortgage During Chapter 13 Bankruptcy Repayment Plan

What Are NON-QM Loans and Bank Statement Mortgage Loans

HUD has discontinued the FHA Back to Work Extenuating Circumstance due to an economic event mortgage program. Borrowers who have had a prior bankruptcy, foreclosure, deed in lieu of foreclosure, and short sale used to be able to qualify after one year of a Chapter 7 Bankruptcy or Housing Event.

The Ill-Fated Back-to-Work Mortgage

The waiting period was shortened to a one-year waiting period after Chapter 7 Bankruptcy or a housing event as long as the cause of the Chapter 7 Bankruptcy, foreclosure, deed-in-lieu of foreclosure, or short sale was caused by the borrower being unemployed, or underemployed. The unemployment needed to have affected the borrower’s household income by at least 20% for at least six months prior to their initiation of the bankruptcy, foreclosure, deed in lieu of foreclosure, or short sale. This program turned out to be a total flop. The back to work mortgage program no longer exists. Borrowers who have recovered from bankruptcy or foreclosure can now qualify for a non-QM loan one day out of bankruptcy and foreclosure with a 30% down payment.

NON-QM Loans With No Waiting Period After Bankruptcy and Housing Event

Gustan Cho Associates now has NON-QM loans in lieu of the FHA back to work mortgage which has no waiting period after the following:

- Foreclosure

- Deed-in-lieu of foreclosure

- Short Sale

- There is a one-year waiting period after a Chapter 7 Bankruptcy discharge date

- 10% to 30% down payment

- Down payment on non-QM loans depends on the borrower’s credit score

Bank Statement Loans For Self-Employed Borrowers

Besides having a national reputation for our mortgage loan programs with no overlays, Gustan Cho Associates have a network of over 180 wholesale lending partners. One of our most popular mortgage loan programs with no overlays is our Bank Statement mortgage loan program for self-employed borrowers.

On bank statement loans, income is the average of 12 months of business or personal bank statements. Only deposits are counted and withdrawals do not matter.

If business bank statements are used, 50% of the deposits are averaged over 24 months. If personal bank statements are used, then 100% of the deposits are averaged. No overdrafts in the past 24 months. No income tax returns are required. Up to 50% debt-to-income ratios. Homebuyers looking to get qualified with a mortgage company with hundreds of mortgage loan programs with no overlays, please contact Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, on evenings, weekends, and holidays.

Get Approved Today For a Non-QM Mortgage

This BLOG on mortgage loan programs with no overlays was UPDATED on January 10th, 2024

Do you serve Texas?

Yes, we are licensed in Texas. Please email us your contact information at gcho@gustancho.com or call us at 262-716-8151. Or text us for a faster response.

Are you licensed in Indiana?

Yes, we are licensed in Indiana.

Are you licensed in California?

Yes, we are licensed in California. Please reach out to us at gcho@gustancho.com or call us at 262-716-8151. Or text us for a faster response.