Non-QM loans after bankruptcy and foreclosure allow homebuyers to purchase a home with no waiting period after bankruptcy and/or a housing event. There are mandatory waiting period requirements after bankruptcy, foreclosure, short-sale, and deed in lieu of foreclosure with government and conventional loans.

Until the launch of non-QM loans, home buyers were required to meet the mandatory waiting period after bankruptcy and housing event on government and conforming loans. NON-QM Loans After Bankruptcy and Housing Event is offered by Gustan Cho Associates.

Non-QM Lenders For Bad Credit

Gustan Cho Associates, a licensed mortgage company in multiple states, offers government and conventional loans without overlays. A significant portion of our services revolves around non-QM mortgages. With our non-QM loans after bankruptcy, foreclosure, deed instead of foreclosure, or short sale, homebuyers can qualify for a mortgage without waiting for years.

Bankruptcy or Bad Credit? You Still Have Options

Non-QM loans make homeownership possible—even with low credit scores.

Can You Get a Mortgage With Poor Credit?

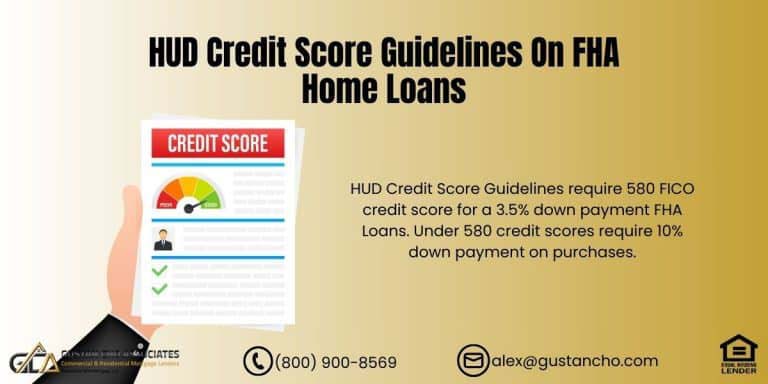

If you’re looking for more flexible credit requirements, consider exploring FHA loans as an option rather than conventional ones. For FHA loans, you may qualify with a credit score as low as 500, although having a higher score, typically 580 or above, can lead to better terms.

Yes, it is possible to secure a mortgage even with poor credit, although the process may be more challenging.

Another option is VA loans, available to veterans and active-duty service members, offering flexibility in credit requirements. Similarly, USDA loans for rural homebuyers may be accessible to those with lower credit scores, although lenders may have their criteria.

Some lenders focus on non-QM loans after bankruptcy, designed for borrowers with poor credit histories. However, these loans typically carry higher interest rates and fees. Enhancing your credit profile beforehand, providing a substantial down payment, or securing a cosigner with strong credit can bolster your mortgage application for non-QM loans after bankruptcy.

Exploring offerings from various lenders specializing in poor credit situations is advisable to identify the most suitable option for your needs.

Can You Get Approved for a Loan With a 500 Credit Score?

Securing loan approval with a credit score of 500 is feasible but presents challenges and may limit available options. One avenue is through FHA loans, which accept a minimum credit score of 500; however, meeting this threshold often requires a larger down payment, typically around 10%, demonstrating strong compensating factors like steady income and a low debt-to-income ratio.

Subprime mortgages from specialized lenders cater to borrowers with lower credit scores, albeit with higher interest rates and fees. Credit unions and local banks might be more flexible, especially if you have a good standing with them or can provide additional supporting documentation.

Improving your credit beforehand by reducing debts, rectifying errors on your credit report, and maintaining timely payments can expand loan possibilities and improve terms. Additionally, having a cosigner or co-borrower with a higher credit score can enhance approval chances and potentially lead to better loan terms.

>Evaluating terms, interest rates, and overall affordability is crucial when exploring loan options with a 500 credit score, and comparing offers from various lenders can help find the most suitable solution for your financial circumstances.

What is the Lowest Credit Score for a Mortgage?

The credit score needed for a mortgage depends on the type of loan. For example, FHA loans can accept scores as low as 500, although most lenders prefer a score of 580 or higher. VA and USDA loans typically look for 580 to 620 or more scores. Conventional loans often require 620 to 640, but some lenders may accept lower scores with adjusted terms. Subprime mortgages cater to scores below 620 but come with higher rates.

Understanding that various lenders may have distinct criteria is crucial. Although specific loans may be available to borrowers with lower credit scores, enhancing your credit score can result in better loan terms and a broader range of options.

Mortgage After Bankruptcy And Housing Event

Non-QM loans can be a viable option for homebuyers looking to qualify for a mortgage after bankruptcy or other housing events. While government and conventional loans have waiting period requirements post-bankruptcy, foreclosure, deed instead of foreclosure, or short sale, Non-QM loans after bankruptcy offer more flexibility in this regard.

This flexibility can benefit homebuyers who are ready to purchase a new home but are hindered by the waiting periods imposed by traditional loan programs like FHA, VA, USDA, Fannie Mae, and Freddie Mac.

Gustan Cho Associates is a licensed mortgage broker operating in 48 states, with a reputation for successfully facilitating mortgage loans that other lenders typically cannot approve. Over 75% of our clients faced challenges with traditional lenders due to overlays, stress, sudden loan denials, or limited access to suitable mortgage products.

At Gustan Cho Associates, we specialize in offering mortgage solutions that are both feasible and competitive, including government and conventional loans with no lender overlays. Additionally, we provide various non-prime mortgage programs, such as non-QM loans after bankruptcy, ensuring borrowers have access to diverse and favorable mortgage options.

Many prospective homebuyers missed out on favorable home deals in recent years because of waiting period constraints before the advent of non-QM loans after bankruptcy. As real estate values surged in many areas, the waiting period requirements became a hurdle.

However, with non-QM loans, there are no waiting period prerequisites for individuals seeking home loans after experiencing bankruptcy, foreclosure, a deed in lieu of foreclosure, or a short sale. Qualified homebuyers can access non-QM loans without meeting waiting period conditions following these financial events.

Can’t Get Approved by a Bank? We’ve Got You Covered

We specialize in Non-QM mortgages for borrowers with past credit issues or bankruptcies.

Waiting Period Requirements on Government and Conventional Loans

In this paragraph, we will discuss government and conventional loans’ mandatory waiting period requirements. There are three different types of government-backed loans. FHA, VA, and USDA loans. HUD, the parent of FHA loans sets the waiting period requirements after bankruptcy and foreclosure on FHA loans.

The veterans administration sets the waiting period guidelines after bankruptcy and foreclosure on VA loans. The United States Department of Agriculture Rural Development sets the waiting period guidelines after bankruptcy and foreclosure.

The following paragraphs cover the waiting period guidelines after bankruptcy and foreclosure on government and conventional loans.

Fannie Mae and Freddie Mac Guidelines After Bankruptcy and Foreclosure

Fannie Mae and Freddie Mac are the two giant government-sponsored enterprises (GSEs). Fannie Mae and Freddie Mac set the guidelines for conventional loans. Fannie and Freddie are the two largest buyers of mortgages in the nation.

Fannie and Freddie will not purchase loans that do not conform to Fannie Mae and Freddie Mac agency guidelines. Fannie Mae and Freddie Mac set the mandatory waiting period after bankruptcy and foreclosure on conventional loans.

FHA Loan Requirements After Bankruptcy

There is a two-year waiting period requirement after the Chapter 7 Bankruptcy discharge date to qualify for FHA loans. There is a three-year waiting period to qualify after foreclosure, a deed in lieu of foreclosure, and a short sale for FHA loans. Borrowers can qualify for FHA loans one year into their Chapter 13 Bankruptcy Repayment Plan with Trustee Approval. There is no waiting period to qualify for FHA Loans after a Chapter 13 Bankruptcy discharge date.

VA Loan Requirements After Bankruptcy

There is a two-year waiting period after the Chapter 7 Bankruptcy discharged date, foreclosure, deed in lieu of foreclosure, or short sale to qualify for VA loans. Borrowers can qualify for VA loans one year into their Chapter 13 Bankruptcy Repayment Plan with Trustee Approval. There is no waiting period to qualify for VA loans after a Chapter 13 Bankruptcy discharge date.

Waiting Period After Bankruptcy On Conventional Loan

Below is the waiting period after bankruptcy and a housing event on conventional loans. There is a four-year waiting period after the Chapter 7 Bankruptcy discharged date, foreclosure, deed in lieu of foreclosure, or short sale to qualify for Conventional Loans.

There is a seven-year waiting period to qualify for conventional loans after a standard foreclosure. There is a two-year period to qualify for conventional loans after a Chapter 13 Bankruptcy discharge date. There is a four-year waiting period after a Chapter 13 Bankruptcy dismissal date to qualify for conventional loans.

NON-QM Loans After Bankruptcy And Housing Event Mortgage Guidelines

Non-QM Loans are alternative financing mortgage programs. There are no waiting period requirements after bankruptcy and housing event. There are no maximum loan limits.

Non-QM Loans offer bank statement loans for self-employed borrowers where no income tax returns are required. A 10% to 20% down payment is required. The down payment requirement depends on the borrower’s credit scores and the seasoning of the bankruptcy and housing event.

Do Non-QM Mortgage Rates Higher Versus Conforming Loans?

NON-QM Mortgage Rates are higher than government and conventional loans. However, no private insurance is required. NON-QM Mortgage Rates depend on the borrower’s credit scores, down payment, and how long the bankruptcy and housing event has been seasoned.

Low Credit Score? Recent Bankruptcy? You’re Not Out of the Game

Explore flexible Non-QM loan programs designed for real-life situations.

What is a No FICO Loan?

A no FICO loan refers to a type of loan where the borrower’s creditworthiness is assessed without relying on a traditional FICO credit score. Instead of using the FICO scoring model, lenders may evaluate alternative factors such as payment history, income stability, employment history, and overall financial health.

These loans are designed for borrowers who may not have a FICO credit score or have a limited credit history. They can be particularly beneficial for individuals with thin credit files, such as first-time borrowers or those primarily using cash and debit cards rather than credit cards.

It’s important to note that while a no FICO loan may not require a traditional credit score, lenders may still assess credit risk using alternative methods to determine loan eligibility and terms.

Please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Gustan Cho Associates team is available seven days a week, evenings, weekends, and holidays.

FAQ: NON-QM Loans After Bankruptcy With Bad Credit and Low FICO

- 1. What are non-QM loans after bankruptcy and foreclosure? Homebuyers can purchase a home with no waiting period after bankruptcy or a housing event through non-QM loans after bankruptcy. These loans offer flexibility in qualifying for a mortgage without adhering to mandatory waiting period requirements typically associated with government and conventional loans.

- 2. What were the requirements before the introduction of non-QM loans? Before the launch of non-QM loans, homebuyers were required to meet mandatory waiting period requirements after bankruptcy and housing events when applying for government and conforming loans. These waiting periods often posed challenges for homebuyers seeking to purchase the property.

- 3. Who offers Non-QM Loans After Bankruptcy and Housing Event? Non-QM Loans After Bankruptcy and Housing Events are offered by Gustan Cho Associates, a licensed mortgage company specializing in various mortgage programs, including non-QM loans.

- 4. Can borrowers with bad credit qualify for non-QM loans? Gustan Cho Associates provides non-QM loans for borrowers with bad credit, offering alternative financing options without strict credit score requirements commonly found in traditional loans.

- 5. What is a No FICO loan? A no FICO loan is a type of loan that evaluates a borrower’s creditworthiness without relying on a traditional FICO credit score. To determine loan eligibility and terms, lenders assess alternative factors like payment history, income stability, and employment history.

This blog on non-QM loans after bankruptcy was updated on November 22nd, 2022

Start Over with a Non-QM Loan Built for You

No waiting periods, no perfect credit required—just real solutions.