This guide covers the mortgage loan programs for homebuyers. There are several types of mortgage loan programs. The mortgage process can be quite complex and confusing due to the many different types of mortgage loan programs and the countless regulations and the constant changes in mortgage regulations. Not all borrowers will qualify for a particular type of mortgage loan program. But may qualify for a different type of mortgage loan program.

A borrower who had a mortgage part of bankruptcy may not qualify for an FHA loan but may qualify for a Conventional loan. This is because there is a four-year waiting period to qualify for a Conventional loan from the discharged date of a Chapter 7 Bankruptcy.

This holds true even though the foreclosure is recorded at a later date. With FHA loans, there is a three-year waiting period to qualify for an FHA loan from the recorded date of the foreclosure. The waiting period on FHA Loans does not start from the discharged date of the Chapter 7 Bankruptcy but from the actual date of the foreclosure recorded date, unlike Conventional Loans where the recorded date does not matter and the time clock starts from the Chapter 7 Bankruptcy discharged date. There are so many variables to choose from when selecting the types of mortgage loan programs that best suit your needs as a borrower

The Down Payment Required on Home Purchases

The down payment is another barrier for many home buyers. Every type of mortgage loan programs require a minimum down payment with the exception of VA and USDA loans. On VA and USDA loans, the down payment is not required. These types of mortgage loan programs allow 100% loan to value financing. Closing costs and the upfront mortgage insurance or VA funding fee can be rolled into the mortgage loan balance.

There are several types of mortgage loan programs are available for homebuyers, each designed to cater to different financial situations and preferences.

Not everyone can qualify for VA or USDA loans. With VA loans, only Veterans with a Certificate of Eligibility can qualify for VA loans. With USDA loans, the borrower has to meet the maximum income requirements and the property needs to be in a USDA designated area. In the following paragraphs we will cover some of the most common types of mortgage loan programs. Click here to purchase a home

Home Equity Loans

Home equity loans or home equity lines of credit allow homeowners to borrow against the equity in their homes. They can be used for various purposes, such as home improvements, debt consolidation, or major expenses. Homebuyers must research and compare different mortgage loan programs’ features, requirements, and terms to find the best fit for their financial goals and circumstances. Additionally, consulting with a mortgage lender or financial advisor can provide personalized guidance in choosing the right loan program.

Interest-Only Mortgages

With interest-only mortgages, borrowers pay only the interest on the loan for a certain period (usually the first few years), after which they must start repaying both the principal and interest. These loans can offer lower initial payments but come with higher risks and potential payment increases later.

Types of Mortgage Loan Programs: Fixed Rate Mortgages Versus Adjustable Rate Mortgages

There are two types of mortgage loan programs for mortgage loan borrowers. The most popular types of mortgage loan programs are the fixed-rate mortgage program. There are the 30 years fixed-rate mortgages, also referred to as FRM and the 15 years fixed rate mortgage program.

Mortgage rates on 15-year fixed-rate mortgages are lower than the 30-year fixed-rate mortgages. Borrowers will have higher monthly principal and interest payments on a 15 year-fixed rate mortgage due to lower amortization schedule.

The fixed-rate mortgage program offers the borrower a sense of financial security because your mortgage rates are fixed for the term of your loan and your principal and interest payments will be the same throughout the term of your fixed-rate mortgage loan.

Adjustable-Rate Mortgages Versus Fixed Rate

Adjustable Rate Mortgages, also known as ARM, is a great mortgage loan program for homebuyers who do not plan on living in their home for a long time and maybe are just buying a starter home and plan on upgrading to a larger home in the next five to ten years. Interest rates on Adjustable Rate Mortgages, or ARMs, are much lower than fixed-rate mortgages. How an adjustable-rate mortgage works are as follows:

The interest rate on a home loan is fixed for a period of a certain amount. After the fixed-rate period is over, the rate will adjust every year until the term of the loan which is normally 30 years.

The mortgage payments, principal and interest payments, may be different every year. The new rate after the fixed-rate period is over is based on the margin and index. The margin will remain constant. The index will change depending on which index your mortgage lender will base your mortgage loan. With a fixed-rate mortgage, the interest rate remains unchanged for the entire loan term, providing predictability in monthly payments. These are available for various loan programs, including conventional, FHA, VA, and USDA loans.

Types of Adjustable-Rate Mortgages

There are 3/1 ARM, 5/1 ARM, and 7/1 ARM types of mortgage loan programs available. For example, on a 7/1 ARM, the mortgage rates will be fixed for the first 7 years of the 30-year mortgage loan. It will then start to adjust starting year 8. Every year after that based on the index plus the constant margin for the term of the 30-year mortgage loan term.

Adjustable-rate mortgages have mortgage interest rates that can change periodically after an initial fixed-rate period. They often start with lower initial rates than fixed-rate mortgages.

Adjustable rate mortgages can fluctuate over time, potentially increasing or decreasing the borrower’s monthly payments. An adjustable-rate mortgage is recommended for homebuyers who are first time home buyers who are buying a starter home and plan on upgrading to another home in the next five to ten years.

Types of Mortgage Loan Programs: Conventional Loans

Fannie Mae and Freddie Mac are the two mortgage giants in the United States that govern Conventional loans: Fannie Mae and Freddie Mac create and implement the mortgage lending guidelines on Conventional loans. Conventional Loans are not government loans. The government does not guarantee them against borrower’s defaulting on them as FHA, VA, and USDA does.

Conventional loans are traditional loans not insured or guaranteed by a government agency. Conventional loans require a higher profile and have a higher down payment of at least 3% to 20% of the purchase price.

There is no private mortgage insurance required for Conventional borrowers who put at least a 20% down payment on their home purchase. Conventional Borrowers who put less than 20% down payment are required to obtain private mortgage insurance. Once you build your equity to 20% or more through market appreciation or paying down your Conventional Loan, your private mortgage insurance can be canceled. An appraisal will be required.

Down Payment Requirements on Conventional Loans

The minimum down payment for Conventional loans is a 3% to 5% down payment on a home purchase for a primary home. Second homes require 10% down payment. Investment properties require between 15% down payment for a single-family home investment home up to 25% down payment for a 2 to 4 unit investment properties. Conventional loans is the only types of mortgage loan programs you can get for second homes and investment homes. FHA, VA, and USDA loans are for owner occupant properties only. Speak With Us for apply for conventional loans

Mortgage Guidelines on Conventional Loans

The minimum credit scores required to qualify for a Conventional Loan is 620 FICO credit scores. The maximum debt to income ratios required for Conventional Loans is 50% DTI. There is a four year mandatory waiting period after the Chapter 7 Bankruptcy discharged date to qualify for a Conventional loan.

There is a two year mandatory waiting period to qualify for Conventional loan after a Chapter 13 Bankruptcy discharged date. The waiting period is 4 years after the Chapter 13 dismissal date.

There is a four-year mandatory waiting period to qualify for a Conventional loan after a deed in lieu of foreclosure or short sale. There is a seven-year waiting period to qualify for a Conventional loan after a foreclosure. If you had a mortgage part of bankruptcy there is a four-year waiting period to qualify for a Conventional loan from the discharged date of your Chapter 7 Bankruptcy discharged date. This holds true even though your foreclosure happened at a later date.

Types of Mortgage Loan Programs: FHA Loans

FHA Loans is the most popular mortgage loan program in the United States today. This is because of the lenient mortgage lending guidelines, lower down payment requirement, lower credit scores requirements, and the high debt to income ratios it permits.

FHA loans (Federal Housing Administration) are insured are popular among first-time homebuyers and borrowers with bad credit and lower credit scores due to their lower down payment and lenient credit requirements.

The minimum credit scores required to qualify for a 3.5% down payment FHA loan is 580 credit scores. Borrowers with credit scores between 500 and 579 are eligible to qualify for FHA loans if they can put a 10% down payment on their home purchase. HUD allows up to a maximum of 56.9% debt-to-income ratios for borrowers who have at least a 620 credit score or higher.

HUD Guidelines on FHA Loans

Any FHA borrowers with credit scores of under 620 FICO credit scores will have their debt to income ratios reduced to 43% DTI. There is a two year mandatory waiting period after the Chapter 7 Bankruptcy discharged date to qualify for FHA loan.

Borrowers can qualify for an FHA loan one year into a Chapter 13 Bankruptcy repayment plan with the approval of the Chapter 13 Bankruptcy Trustee.

This holds true as long as they can provide that they have made at least 12 timely payments to their creditors. There is no mandatory waiting period to qualify for an FHA loan after the Chapter 13 Bankruptcy discharged date. There is a three-year mandatory waiting period to qualify for an FHA loan after a foreclosure, deed-in-lieu of foreclosure, or short sale.

FHA 203(k) Loans

These loans allow homebuyers to finance both the purchase price of a home and the cost of renovations or repairs into a single mortgage. They are popular for buyers looking to purchase fixer-upper properties.

Types of Mortgage Loan Programs: VA Loans

VA loans is the best mortgage loan program out today: Lenders offer 100% financing on home purchases and cash-out VA refinancing. There is no mortgage insurance premium required. Mortgage rates on VA loans are even lower than Conventional, FHA, and USDA loans. Unfortunately, only veterans of the United States Armed Services with a valid Certificate Of Eligibility are eligible for VA loans. There are no credit score requirements or debt to income ratio requirements with VA loans. It is up to the VA mortgage lender. Most lenders will require 620 credit scores and want debt-to-income ratios of no greater than 43% DTI.

Gustan Cho Associates has have originated and funded VA loans with credit scores of 580 FICO credit scores and debt-to-income ratios of higher than 50% DTI.

I have no lender overlays on VA loans and as long as I can get you an approve/eligible per automated findings, I can close on your VA loan. If you need a VA mortgage lender with no lender overlays, please contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Our staff and I are available 7 days a week, evenings, weekends, and holidays to take your calls and answer your question.

VA Agency Mortgage Guidelines

There is a two-year waiting period to qualify for a VA loan after a Chapter 7 Bankruptcy discharged date. There is a two-year waiting period to qualify for a VA loan after a foreclosure, deed-in-lieu of foreclosure, and short sale.

VA loans is available to eligible veterans, active-duty service members, and certain military spouses, VA loans offer favorable terms such as no down payment requirement, private mortgage insurance (PMI), and competitive rates.

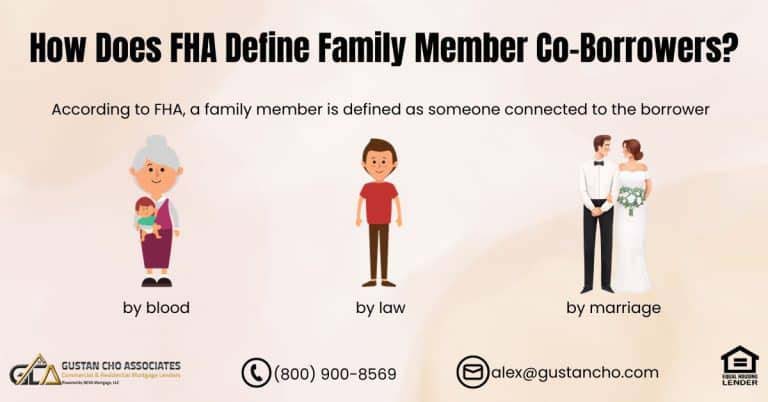

VA, unlike FHA, will exempt deferred student loans that have been deferred for 12 or more months from debt to income ratio calculations. VA will only allow spouses of the veteran to be added on the VA loan as a co-borrower. Non-occupant co-borrowers are not allowed on VA loans. VA Loans (Department of Veterans Affairs):

Types of Mortgage Loan Programs: USDA Loans

USDA loans offer 100% financing on home purchases. Homeowners can refinance but cash-out refinancing is not allowed with USDA loans. Only rate and term refinancing are allowed with USDA loans. The property needs to be in a USDA Rural Development Area in order to qualify for a USDA loan.

USDA loans are designed for rural homebuyers who meet income and property eligibility requirements; USDA loans offer 100% financing and often come with lower interest rates than conventional loans.

Borrowers need to meet the maximum household income guidelines set the USDA Rural Development in order to qualify for USDA loans. There is a three-year waiting period to qualify for a USDA Rural Development mortgage loan after bankruptcy, foreclosure, deed-in- lieu of foreclosure, or short sale. The maximum debt-to-income ratios allowed with USDA loans is 29% front-end and back-end DTI of 41% DTI. Most mortgage lenders will require a 580 credit score from USDA mortgage borrowers.

Click here to apply for VA, FHA, USDA loans

Types of Mortgage Loan Programs: Jumbo and Non-Conforming Loans

Jumbo mortgages are also called non-conforming loans: This is because they do not conform to Fannie Mae’s or Freddie Mac’s maximum $776,550 loan limit. Jumbo mortgages are mortgage loans that are higher than $776,550 loan limits. Jumbo mortgages have much stricter mortgage lending guidelines. Lenders will normally require the following:

- a 680 credit score

- no greater than a 40% debt-to-income ratio

- three or more months in reserves or P.I.T.I.

- no bankruptcies or foreclosures in the past 7 years

Most Jumbo lenders will require a 20% down payment and mortgage rates on jumbo mortgages are higher than conforming and government loans. Jumbo loans are underwritten on a case by case scenario. The underwriter will look at the overall credit and financial profile of the borrower. Jumbo loans are mortgages that exceed conforming loan limits set by Fannie Mae and Freddie Mac. They are often used for high-priced or luxury properties and typically require higher down payments and credit scores.

Non-QM Mortgages

Gustan Cho Associates offers Non-QM loans to our borrowers. There is no waiting period after bankruptcy, foreclosure, deed in lieu of foreclosure, short sale. There are no maximum loan limits. There is no private mortgage insurance required. 10% to 20% down payment on home purchases. No income tax required on bank statement loans for self-employed borrowers. 10% down payment Jumbo Non-QM Mortgages for qualified borrowers with at least a 720 credit scores. Late payments in the past 12 months allowed. Up to 50% debt to income ratios with compensating factors. For more information about the types of mortgage loan programs offered at Gustan Cho Associates, please contact us at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com.