Quick Answer: Credit Report Analysis by Mortgage Underwriters

Credit report analysis by mortgage underwriters is when an underwriter reviews your full credit file—not just your score—to confirm your debts, payment history, and any negative items meet loan guidelines. They compare what’s on your credit report to your mortgage application and your supporting documents, then decide what conditions (if any) you must satisfy before final approval.

Most delays happen when the report shows recent late payments, undisclosed debts, high credit card balances, active disputes, collections, or incorrect information, such as wrong dates or duplicated accounts. The best way to avoid problems is to review your credit early, keep balances low, avoid new credit before closing, and fix errors quickly (often with documentation and, when appropriate, a rapid rescore).

What Underwriters Check

During a credit report analysis by mortgage underwriters, they review:

- Personal information (name, date of birth, Social Security number, address history, employment)

- Open accounts (credit cards, auto loans, student loans, mortgages)

- Closed accounts and payment history

- Derogatory marks (late payments, collections, charge-offs)

- Public records (bankruptcy, foreclosure, deed in lieu, short sale, judgments)

- Credit inquiries

- Debt-to-credit usage (credit utilization ratio)

Even small details, like a wrong address or account date, can affect your Automated Underwriting System (AUS) findings.

Underwriter Workflow: Step-by-Step Credit Report Review (What Happens and When)

Here’s the typical credit report analysis by mortgage underwriters follows—from the moment your file hits underwriting to the moment you get “clear to close.” This is the behind-the-scenes process most borrowers never see.

Step 1: Credit Report Is Pulled and Uploaded to Your Loan File

Your lender pulls a tri-merge credit report (Experian, Equifax, TransUnion) and uploads it with your loan application. The underwriter checks that the report is current and valid for underwriting.

What they’re verifying:

- Your identity matches your application

- The report date is within the allowable timeframe

- Your score and tradelines match the loan program requirements

Step 2: Automated Underwriting System (AUS) Decision Is Run

The lender runs your loan through AUS (Desktop Underwriter or Loan Product Advisor). The underwriter reviews the AUS findings and confirms the file matches what the system evaluated.

What this impacts:

- Approve/Eligible vs Refer/Caution (or similar findings)

- Required documentation, reserves, and conditions

- Whether certain credit events require additional waiting time or documentation

Step 3: Underwriter Validates Identity + Credit Profile Consistency

Underwriters look for inconsistencies that could signal errors, mixed files, or fraud flags.

They check for:

- Name variations, SSN mismatches, and address inconsistencies

- Unusual account patterns

- Recently opened accounts that don’t align with your application

Step 4: Underwriter Reviews Tradelines and Payment History Line-by-Line

This is the “deep dive.” Underwriters examine each account for recent late payments, patterns of delinquency, and overall credit behavior.

They focus on:

- The last 12–24 months of payment history

- Any 30/60/90-day late payments

- Charge-offs, collections, and repossessions

- Whether negative items are still active or resolved

Step 5: Underwriter Confirms Liabilities Used in DTI Calculations

Your credit report drives your monthly debt payments, which directly impact your debt-to-income ratio (DTI). Underwriters confirm that the correct monthly payment is applied to each account.

Common underwriting conditions here:

- “Provide documentation for deferred student loans”

- “Provide terms for undisclosed debt”

- “Verify the payment for an installment loan”

- “Pay off or reduce a revolving account to qualify”

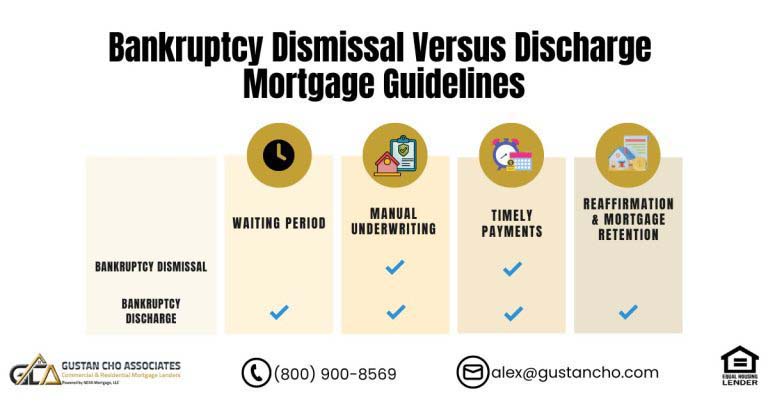

Step 6: Underwriter Reviews Public Records and Third-Party Reports

Underwriting often includes third-party checks to verify that nothing major is missing from your file.

Examples of what they may verify:

- Bankruptcy, foreclosure, and short sale timing

- Judgments or liens (where applicable)

- Alerts related to identity or address history

Step 7: Credit-Related Underwriting Conditions Are Issued

If something doesn’t match guidelines—or the underwriter needs proof—they issue conditions. This is normal.

Typical credit-related conditions include:

- Letter of explanation (LOE) for late payments or credit events

- Proof that a collection was paid (if required by the program)

- Documentation to correct reporting errors

- Evidence-disputed accounts are resolved/removed (depending on the program)

- Updated credit supplement for new or unclear accounts

Step 8: Borrower Submits Documentation (and Updates Are Verified)

Your loan officer and processor gather the underwriting-requested information. If credit errors are involved, this is when disputes, creditor letters, or rapid rescore updates may be needed.

Key point: Underwriters don’t “take your word for it”—they need a paper trail.

Step 9: Final Credit Check Before Closing (Soft Refresh)

Many lenders do a final credit refresh shortly before closing to confirm you haven’t opened new accounts, increased balances, or missed payments.

Avoid these right before closing:

- Financing furniture or a car

- Opening new credit cards

- Maxing out revolving lines

- Co-signing for anyone

Step 10: Clear to Close (CTC)

Once conditions are satisfied and the final credit review passes, underwriting issues Clear to Close, and your file moves to closing.

Unlock the Secrets of Credit Report Analysis by Mortgage Underwriters

Understand how mortgage underwriters analyze your credit report and what you can do to improve your chances of approval.

What Credit Report Analysis by Mortgage Underwriters Really Means

When you’re looking for a mortgage, your lender will check your credit report, which combines information from the three leading credit bureaus: TransUnion, Experian, and Equifax.

This report is more than just a score. It’s a complete profile of your credit history, payment habits, and financial behavior. The credit report analysis by mortgage underwriters goes beyond a quick glance—they review it line-by-line to make sure everything meets loan guidelines.

Why Credit Report Accuracy Is Critical in 2026

The credit report analysis by mortgage underwriters is closely tied to the AUS—Fannie Mae’s Desktop Underwriter (DU) or Freddie Mac’s Loan Product Advisor (LPA). These systems pull every piece of data from your credit report to decide if you get an Approve/Eligible result.

If your report has errors, it could trigger a “Refer” or “Caution” finding instead of an approval. That’s why checking your credit report before applying is more important than ever in 2025, especially with new credit scoring models like FICO 10T and VantageScore 4.0 on the horizon.

How Mortgage Underwriters Verify Your Credit Beyond the Report

Credit report analysis by mortgage underwriters isn’t just reading your file. They also run third-party public records searches to confirm nothing is missing. This is part of the FraudGuard or DataVerify checks.

For instance, even if a judgment or bankruptcy is absent from your credit report, it can still be identified during underwriting. Additionally, if a debt has been paid off but the record hasn’t been updated correctly, it could lead to potential concerns during evaluation.

Common Credit Report Errors That Can Kill a Loan Approval

Mistakes on credit reports are more common than most people realize. During a credit report analysis by mortgage underwriters, the following errors can cause delays or denials:

- Wrong bankruptcy discharge date

- Paid collections still showing as unpaid

- Duplicate accounts inflating your debt

- Incorrect late payment reporting

- Old addresses linked to fraud alerts

Example: If your Chapter 7 bankruptcy was discharged in March 2022 but the report says March 2023, the AUS will think you are still within the 2-year waiting period for FHA and VA loans. This could block your approval.

How to Fix Credit Report Errors Before Underwriting

If you find mistakes, fix them before or during the credit report analysis by mortgage underwriters.

- Contact the credit bureaus directly:

- Experian

- Equifax

- TransUnion

- Provide documentation proving the correct information.

- Wait 30–60 days for updates.

If you can’t wait that long—say you’re under contract on a home—ask your lender about a rapid rescore. This process updates your credit report in days instead of weeks, but typically costs about $100 per tradeline.

What Do Mortgage Underwriters Look for in Your Credit Report?

Get insider tips on how underwriters review your credit report and how to optimize it for mortgage approval.

2026 Updates: How New Credit Scoring Changes Affect Underwriting

In late 2025, Fannie Mae and Freddie Mac will begin using newer credit scoring models like FICO 10T and Vantage Score 4.0 for mortgage approvals.

The models assess trended data, focusing on your payment patterns from the past 24 months. They place greater emphasis on credit utilization and may approach medical collections in a distinct manner.

This means the credit report analysis by mortgage underwriters will be even more detailed. Consistently paying down balances and avoiding large new debts right before applying will matter more than ever.

How to Prepare for Credit Report Analysis by Mortgage Underwriters

Before applying for a mortgage:

- Check your credit report for free at www.annualcreditreport.com.

- Dispute inaccuracies early.

- Avoid new credit inquiries in the months before applying.

- Pay bills on time—even one late payment can hurt.

- Try to keep your credit card balances below 30% of your limits.

This proactive approach can help ensure your credit report analysis by mortgage underwriters goes smoothly.

What Happens If Your Credit Isn’t Perfect?

At Gustan Cho Associates, we specialize in helping borrowers with less-than-perfect credit get approved. Even if another lender has denied you because of:

- Low credit score

- Past bankruptcy or foreclosure

- High debt-to-income ratio

- Credit report errors

We have mortgage programs with no lender overlays. That means we go strictly by agency guidelines; there are no extra credit scores or debt rules beyond what FHA, VA, USDA, or Fannie Mae require.

Case Study: Credit Report Analysis in Action

Scenario:

A borrower applied for an FHA loan but was denied because the AUS showed a recent late payment.

What We Did:

- Reviewed the credit report analysis by mortgage underwriters and found the late payment was a reporting error.

- Requested a rapid rescore with proof from the creditor.

- Updated the credit report in three days.

- Re-ran AUS—result: Approve/Eligible.

Outcome:

Borrower closed on their home within 30 days.

Why Work With Gustan Cho Associates for Your Mortgage Approval

Here’s why borrowers across the country choose us:

- No overlays on FHA, VA, USDA, and Conventional loans

- Fast closings—even after fixing credit report issues

- Expert credit guidance before and during underwriting

- Licensed in 50 states including DC, Puerto Rico, Guam, and the U.S. Virgin Islands

We understand the stress that comes with the credit report analysis by mortgage underwriters process. Our team helps you prepare, fix issues, and get to the closing table.

Final Tips for a Smooth Credit Report Analysis by Mortgage Underwriters

- Start early—review your credit months before applying.

- Be honest—disclose past issues so your loan officer can prepare your file.

- Stay consistent—don’t make major financial changes during the process.

- Work with experts—a lender who understands complicated credit situations can improve your chances of getting approved or denied.

Understand Credit Report Analysis by Mortgage Underwriters

Discover the hidden factors underwriters consider when reviewing your credit report for loan approval.

Get Started Today

Don’t let credit report mistakes or misunderstandings keep you from buying your dream home. Contact Gustan Cho Associates today for expert help with your mortgage, whether your credit is perfect or still a work in progress.

Borrowers who need a five-star national mortgage company licensed in 50 states with no overlays and who are experts on credit report analysis by mortgage underwriters, please contact us at 800-900-8569, text us for a faster response, or email us at alex@gustancho.com.

With the proper guidance, the credit report analysis by mortgage underwriters can be the first step—not the final hurdle—on your path to homeownership.

Frequently Asked Questions About Credit Report Analysis by Mortgage Underwriters:

What do Mortgage Underwriters Look for on Your Credit Report?

Underwriters review your payment history, current debts, credit utilization, derogatory accounts (collections/charge-offs), public records (bankruptcy/foreclosure where reported), and recent inquiries to judge risk and confirm you meet the loan program’s guidelines.

How far Back do Mortgage Underwriters Look at Credit History?

They can see much further back depending on what’s still reporting, but underwriting usually places the most weight on your most recent 12–24 months (especially late payments) while still considering older major events if they appear on the report.

What Credit Score do You Need to Get Approved for a Mortgage?

It depends on the loan type and the lender, but approval is based on more than score—underwriters also evaluate income, debts, and overall credit patterns. (A lower score can still be workable with the right program and compensating factors.)

Will a Single Late Payment Stop a Mortgage Approval?

Not always. A single late payment may trigger additional documentation or conditions, but underwriters mainly look at recency and pattern (recent lates and multiple lates carry more weight than older isolated ones).

Do Collections have to be Paid Off to Qualify for a Mortgage?

Sometimes—but not always. Requirements vary by loan type, the amount, and whether the collection is medical or non-medical. Paying collections can help in some cases, but it should be a strategic decision based on your file.

Do Underwriters Deny Loans for Credit Report Disputes?

Disputes can be problematic if they affect the accuracy of the debts used to qualify, or if program rules require certain disputes to be resolved before closing. The key is whether the disputed account changes your risk profile or DTI.

Can Errors on a Credit Report Delay Underwriting or Cause a Denial?

Yes. Incorrect balances, duplicated accounts, wrong dates, or misreported late payments can lead to conditions, delays, or a different AUS result. So fixing errors early is important in the credit report analysis by mortgage underwriters process.

What is a “Rapid Rescore,” and When is it Used?

A rapid rescore is a lender-initiated process to update verified credit data faster than the normal dispute timeline—typically used when you have documentation (such as a creditor letter or an updated statement) proving a reporting change.

Will Opening a New Credit Card Hurt My Mortgage Approval?

It can. New accounts can change your score, increase your DTI, and trigger additional review—plus many lenders do a final credit check before closing. Best move: avoid new credit until after closing.

Do Mortgage Underwriters Look at More Than Your Credit Report?

Yes. In addition to the credit report, underwriting evaluates income/employment documentation, assets. It may use third-party verifications to confirm your overall risk profile.

This article about “Secrets to Credit Report Analysis by Mortgage Underwriters” was updated on January 27th, 2026.

Secrets to a Successful Credit Report for Mortgage Underwriting

Get the knowledge you need to ensure your credit report is ready for mortgage approval.