This guide covers conforming versus non-conforming mortgage loans. Homebuyers and homeowners have a variety of mortgage loan programs to choose. There are conforming versus non-conforming mortgage loan programs. Conforming Loans needs to conform to government and/or conventional mortgage guidelines. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about conforming versus non-conforming mortgage loans.

Depending on the borrowers credit profile and the type of property they want to purchase and/or refinance dictates whether they qualify for conforming versus non-conforming mortgage loans.

Lenders can offer government and conventional loan programs. Government and Conventional Loans are called conforming loans because they need to conform to FHA, VA, USDA, FANNIE MAE, FREDDIE MAC mortgage guidelines.

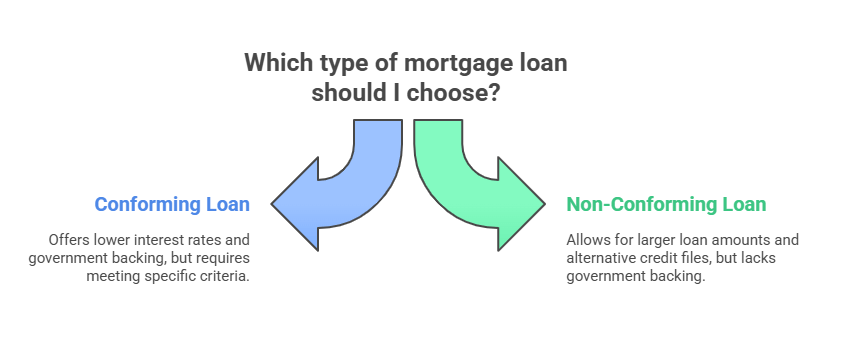

What is a Conforming Versus Non-Conforming Mortgage?

When looking for a mortgage, you’ll often come across the terms “conforming” and “non-conforming.” These labels help describe how a loan stacks up against the rules set by Fannie Mae and Freddie Mac, the two government-supported companies that buy and insure most mortgages in the U.S. John Strange, a senior mortgage loan originator explains the difference between conforming versus non-conforming mortgage loans:

A conforming loan satisfies their benchmark rules, which cover loan size, credit score, debt-to-income ratio, and the paperwork lenders must collect. In contrast, a non-conforming loan fails to meet one or more standards.

Common examples include jumbo loans, which exceed the maximum size the GSEs will buy, loans for borrowers with special income situations, or loans with other higher-risk features. Which mortgage is right for you hinges on your finances, credit score, your income structure, and the type of home you’re buying. Let’s dig into the main differences to find the best option for your needs.

Conforming vs. Non-Conforming Loans: Which Is Best for You?

Compare benefits, guidelines, and rates to find the ideal mortgage loan for your home purchase.

What You Should Know About Conforming Mortgages

Conforming mortgages are loans that conform to the rules set by Fannie Mae and Freddie Mac. The rules cover the loan amount, and these limits change each year. In 2025, the standard limit will be $806,500 for most places, with higher amounts allowed in expensive areas.

Here Are The Other Main Rules for Conforming Mortgage Loans:

- You’ll usually need a credit score of 620 or higher.

- Your debt-to-income ratio can’t go over 45% to 50%.

- You must prove your income and assets with full documents.

- The property must be appraised and meet agency standards.

Because lenders consider these loans safer, they tend to have lower interest rates than loans that don’t follow these guidelines.

What Makes a Mortgage Non-Conforming?

Non-conforming mortgages are loans that don’t fit the mold that the government-sponsored entities Fannie Mae and Freddie Mac have laid out. They might go over the maximum amount allowed (often called jumbo loans), or they can involve borrower situations that are a bit out of the ordinary, such as:

- Credit scores that dip below the usual acceptable level.

- Debt-to-income ratios that are higher than the norm.

- A recent bankruptcy or foreclosure on the record.

- Self-employed income or paychecks that don’t follow a clear pattern.

- Borrowers who are foreign nationals or who don’t live in the U.S. full-time.

Lenders who make these loans can set guidelines or pass them to private investors. Because the risk sits a bit higher, these loans often have steeper interest rates or requests for bigger down payments.

Conforming Versus Non-Conforming Mortgage: Key Differences

The biggest divide between conforming and non-conforming mortgages is whether the loan can be sold to Fannie Mae or Freddie Mac.

Check Out These Main Points of Separation:

- Loan Amount: Conforming loans stay under the maximum caps.

- Non-conforming loans—especially jumbo loans—go past those caps.

- Backer: Conforming loans have the government’s safety net.

- Non-conforming loans don’t share that safety net.

- Rates: Conforming loans generally give you friendlier interest rates and better lending terms.

- Credit Stance: Non-conforming loans let you use alternative credit files or accept lower credit scores.

- Documentation: If you take out a non-conforming loan, you can use profit and loss statements, or skip income proof altogether.

Who Should Think About a Non-Conforming Mortgage?

These mortgages work best for people who don’t fit the mold for regular loans. You might want one if:

- You want to borrow more than the regular limit.

- You run a business and can’t give the usual pay stubs or W-2s.

- Your credit report has a few recent issues, but you can explain them.

- You want to buy a one-of-a-kind property that regular loans won’t cover.

- You don’t have permanent residency status, like foreign nationals or visa holder s.

- A non-conforming mortgage could be the key to your new home even if a standard loan won’t work.

What to Know About Conforming Mortgage Loans

Pros of Conforming Loans:

- Typically lower interest rates.

- Straightforward approval for qualified borrowers.

- Backed by Fannie Mae and Freddie Mac.

- Rules are the same no matter where you go.

Cons of Conforming Loans:

- Rules can be too strict.

- Income and credit score limits can leave some people out.

- There’s a cap on how much you can borrow each year.

- Conforming mortgage gives good rates and a smooth process if you follow the agency guidelines.

Choose the Right Mortgage: Conforming or Non-Conforming

Understand key differences, borrowing limits, and qualifications to secure the best financing fit.

Non-Conforming Mortgage Loans: Pros & Cons

Pros of Non-Conforming Mortgage Loans:

- Flexible Qualifications: Non-conforming loans have looser eligibility rules, making them easier for some borrowers to obtain.

- Great for Freelancers: If you’re self-employed, have gig income, or get paid in stock, lenders are more likely to accept your income.

- Higher Limits: Non-conforming loans can go beyond the usual property price ceiling so that so you can borrow more for bigger homes.

- For Recent Credit Issues: Even if you had a bankruptcy or a low score a couple of years ago, you can still get approved.

Cons of Non-Conforming Mortgage Loans

- Higher Rates: Expect to pay more in interest than you would with conforming loans.

- Bigger Down Payment: You might need to put down 10%-20% or more right away.

- Extra Reserves: Many lenders want you to show 6-12 months of mortgage payments in cash reserves.

- Fewer Lenders: Only a limited number of banks and credit unions offer these loans, so your options are narrower.

If the standard loan programs don’t fit, these loans can help you borrow what you need, even if your file is rough.

Refinancing Non-Conforming Into Conforming Mortgage Loans

Absolutely! You cay refinance a non-conforming mortgage into a conforming loan if your mortgage balance drops below the conforming limit or your credit score improves.

Perks of Refinancing

- Lower Rates: Conforming loans often come with better interest rates.

- Smaller Monthly Payment: A lower rate usually translates into a lower monthly bill.

- More Loan Options: You can access a wider array of conventional loan programs.

- Remember, when you refinance, you must meet all the current conforming rules, so be sure you qualify!

Picking the Perfect Mortgage for You

The best mortgage for you isn’t just about whether the loan is conforming or non-conforming. It’s about what fits your situation. A conforming loan might be straightforward and cost-effective if you’re a W-2 employee with solid credentials. However, a non-conforming loan could get you into a home more easily if you’re self-employed, bouncing back from credit troubles, or buying a higher-priced home.

It’s smart to work with a lender who offers both loan types and specializes in finding the loan program that fits your life, not just your credit score.

Final Thoughts on Conforming versus Non-Conforming Mortgage Loans

Knowing how conforming and non-conforming loans differ helps you feel more in control as you navigate your mortgage journey. At Gustan Cho Associates, we’re experts in both kinds of loans and welcome borrowers that other lenders say no to. Whether you’re buying a starter home or refinancing a jumbo mortgage, we’ll be with you from pre-approval to closing.

Frequently Asked Questions (FAQs) on Conforming versus Non-Conforming Mortgage Loans

What’s The Difference Between a Conforming and a Non-Conforming Mortgage?

- A conforming mortgage sticks to the guidelines set by Fannie Mae and Freddie Mac.

- A non-conforming mortgage falls outside those rules, either because the loan amount is too high or because the borrower’s situation is too different.

What Are the Conforming Loan Limits for 2025?

- In 2025, the general conforming loan limit is $806,500.

- The limit could be even higher if you live in a high-cost area.

Why Would Someone Pick a Non-Conforming Mortgage Loan?

- People choose non-conforming loans when major life events or the housing market don’t fit standard rules, like low credit scores, special income situations, or buying a high-priced home.

Is a Jumbo Loan a Type of Non-Conforming Mortgage?

- Yes, jumbo loans are a specific type of non-conforming mortgage because they exceed the limits set by Fannie Mae and Freddie Mac.

Can I Get a Non-Conforming Loan With Low Credit?

- Some non-conforming loans are open to borrowers with low credit scores, recent bankruptcies, or other credit challenges.

- Terms will be different, however.

Are Interest Rates Higher on Non-Conforming Loans?

- Mostly, yes.

- Non-conforming loans involve more risk for lenders,, so they usually come with higher interest rates.

Can I Refinance a Non-Conforming Loan Into a Conforming Mortgage?

- Absolutely.

- If your loan amount and credit picture meet conforming standards, you can refinance into a conforming loan.

Do Non-Conforming Loans Require Bigger Down Payments?

- Often.

- Jumbo loans and other non-conforming mortgages may ask for 10% to 20% or more down payments.

Are Non-Conforming Loans Harder to Get Approved For?

- They can be, depending on the lender.

- Still many lenders, especially non-QM and portfolio lenders, focus on more flexible loan choices.

Who Offers Both Conforming and Non-Conforming Mortgages?

- Mortgage brokers like Gustan Cho Associates connect you to more than 280 wholesale lender with conforming and non-conforming loan programs.

What Are The Current Conforming Loan Limits?

- Here is the link to your about updated 2025 Conforming Loan Limits.

Simplify Your Loan Choice: Conforming vs. Non-Conforming

Get clear insights into the advantages and eligibility criteria for each type of mortgage loan.

Types of Non-Conforming Mortgage: Non-QM Loans

Jumbo Loans, Non-QM Loans, Bank Statement Loans, and Portfolio mortgage loan programs are called non-conforming loans because they do not conform to agency guidelines. The team at Gustan Cho Associates is a nationwide mortgage brokers and correspondent lenders with no overlays on government and conventional loans.

We are also non-conforming lenders and experts on non-QM loans, bank statement loans, jumbo mortgages, and alternative financing. Loan Officers with The Gustan Cho Team issues pre-qualification letters 7 days a week, including evenings and holidays

Borrowers can either apply online or contact the mortgage loan originator. One of our licensed loan officers can take mortgage loan application over the phone. Most automated approvals via the Automated Underwriting System unless it requires manual underwriting is required prior to issuance of pre-qualifications. There are lenders that have no mortgage lender overlays on all government and conventional loan programs such as FHA, USDA, VA, and conventional loans.

The Importance of Mortgage Lenders with No Overlays

With lenders with no lender overlays, automated approval is final mortgage approval if borrowers can clear conditions stated on AUS. Unique or difficult mortgage files are first reviewed by a mortgage underwriter before issuance of pre-approval. Reputable and experienced loan officers will qualify a borrower very thoroughly. Dale Elenteny, a senior mortgage loan originator at Gustan Cho Associates and an associate contributing editor at GCA Forums says the following about the importance of a pre-approval letter.

Loan officer will review borrowers credit and financial profile so there are no issues during the mortgage process leading to last minute mortgage loan denial.

A loan officer who properly pre-approves a borrower should have no issues in closing in time. They should have no issues during the mortgage approval process. We are both purchase and refinance mortgage brokers and correspondent lenders. Gustan Cho Associates have experts in all mortgage loan programs.

Income Is Most Important Factor To Qualify For Conforming versus Non-Conforming Mortgage

As long as borrowers have documented income, a loan officer who works for a mortgage company who have little to no lender overlays can not just close the loan but close it on time. Borrowers with credit issues such as a bankruptcy, foreclosure, deed in lieu of foreclosure, short sale, late payments, unsatisfied collection accounts, or other forms of bad credit can still qualify for a mortgage loan. Christy Hembree, a senior mortgage loan originator at Supreme Lending says the following about the mandatory waiting period after a bankruptcy or a housing event:

Borrowers need to meet the proper mandatory waiting period after bankruptcy and/or housing event. Need timely on all of their payments for the past 12 month.

Re-established credit after bankruptcy and/or housing event is a must. We help borrowers with prior bad credit and recent late payments by helping them improve their credit scores so they can qualify for a loan. Once borrowers contact us, they are our client and a lifelong relationship starts.

Fixed Rate FHA Mortgage Loans

The team at Gustan Cho Associates offers 30 year and 15 year fixed rate FHA mortgage loans. Require a 580 credit score for a 3.5% down payment FHA loan. Borrowers with credit scores between 500 to 579 are eligible for an FHA loan with a 10% down payment. Below are the agency HUD guidelines on FHA loans:

- 500 to 579 scores require 10% down payment

- 3.5% down payment on FHA loans over 580 credit scores with no lender overlays

- Maximum back end debt to income ratios for borrowers with credit scores between 580 and 620 is 43% to get AUS Approval

- Debt to income ratios 46.9% front end and 56.9% back end for FHA borrowers with credit scores higher than 620 to get AUS Approval

- Multiple non occupied co-borrowers are allowed on FHA loans

- Up to 6% sellers concession allowed with FHA loans

- Open collections, late payments, bank overdrafts, judgments, tax liens, and other prior bad credit allowed.

- Collection and charged off accounts do not have to be repaid or settled to qualify for FHA loans.

- Bankruptcy, Foreclosure, Deed in Lieu of Foreclosure, Short Sales are allowed.

- However, need to adhere to HUD guidelines concerning mandatory waiting period requirements.

- Manual underwrites available on FHA Loans on borrowers who cannot get an automated approval via the Automated Underwriting System.

- 100% gifts allowed on a home purchase by a family member.

- 24-hour mortgage loan underwrites and mortgage approvals. 14-day closings if requested.

- Closings in 14 days if it is a rush file.

- Most closings are in 30 days or less.

- No waiting period for borrowers with a short sale as long as they were current on their loan until the day of the sale.

Conventional Mortgage Loan Programs

Fannie Mae and Freddie Mac Mortgage Lending Guidelines on Conventional Loans

- Minimum 620 credit scores on conventional mortgage loans with no lender overlays.

- Maximum 50% debt to income ratio.

- No overlays. As long as borrowers get an approve/eligible per DU or LP FINDINGS.

- 5% down payment conventional loan with credit scores of 620 with no mortgage insurance required.

- 3% sellers concession allowed on a home purchase.

- Lenders credit towards closing costs in lieu of higher mortgage rates.

- Second home conventional loans require 10% down payment.

- Investment home conventional loans require 20% down payment.

- Conventional loan after 4 years after deed in lieu and/or short sale with 5% down payment and no lender overlays.

- Prior bad credit okay.

- As long as borrowers get an automated approval via AUS, The team at Gustan Cho Associates has no mortgage overlays.

UPDATE on HomePath Mortgage Loans

Fannie Mae no longer offers HomePath mortgage loans. However, home buyers can still purchase Fannie Mae HomePath properties. However, need to seek other sources of financing whether they are FHA loans, FHA 203k loans, Conventional Financing or Non-QM Mortgages.

Mortgage Decisions Made Easy: Conforming vs. Non-Conforming

Quickly learn how to select between loan limits, flexible underwriting, and interest rates.

VA Loans With No Lender Overlays

Most lenders have mortgage overlays on VA loans. Why is it that most lenders require 620 credit scores and 45% debt to income ratios by VA borrowers when the VA does not have a credit score and/or debt to income ratio requirements? The reason is due to VA lender overlays. The team at Gustan Cho Associates has no lender overlays on VA loans:

- 100% financing.

- No minimum credit score requirements.

- No debt to income ratio caps on VA loans.

- The funding fee can be rolled into the loan.

- Open collections, charge offs, late payments, and other prior bad credit allowed.

- 2 year waiting period after bankruptcy and housing event.

- 4% sellers concessions allowed.

- Veteran home buyers can qualify for VA loans during Chapter 13 Bankruptcy repayment period.

- There is no waiting period after Chapter 13 Bankruptcy discharged date to qualify for VA home loans.

Alternative and NON-QM Jumbo Loans

There are Jumbo conforming versus non-conforming mortgage loans. Traditional jumbo lenders require 700 credit scores, 41% DTI, and full documentation. Conforming versus Non-conforming mortgage loans on jumbo mortgages is that Jumbo non-conforming Loans do not require higher credit scores and income tax returns.

Conforming versus Non-Conforming Mortgage Loans: Jumbo Mortgages

Gustan Cho Associates offers non-QM jumbo mortgages with 10% to 20% down payment and 620 credit scores. We also offer non-QM jumbo mortgages for self-employed borrowers where income tax returns are not required. Down payment requirements on non-QM jumbo mortgages depend on borrowers credit scores. Alex Carlucci, a senior mortgage loan originator at Gustan Cho Associates explains about conforming versus non-conforming mortgage loans:

Income tax returns are not required on non-QM bank statement mortgage loan programs for self-employed borrowers. 24 months bank statements are averaged to get qualified monthly income.

Debt-to-income ratio caps at 50% with compensating factors. There is no waiting period after housing event and/or bankruptcy with non-QM loans. All non-QM loans do not require private mortgage insurance. verification of rent and/or verification of mortgage is required on all bank statement mortgage loan programs.

- 90% loan-to-value Jumbo Loans now available with no mortgage insurance premium

- Super Jumbo Loans for loan sizes over $3 million

- Specialty homes with no comparable sales

- The appraisal will go by the cost approach

Condotel And Non-Warrantable Condo Loans

Condotel and Non-Warrantable Condo Financing are non-conforming loans.

- Condotel Financing with 25% down payment

- Non-warrantable condo loans with 20% down payment

- 500 minimum square feet

- Adjustable Rate Mortgages

- 680 credit scores

- 43% DTI

- Reserves required

- No studios

- One bedroom and full kitchen

- Minimum loan size $150,000

FHA 203K Mortgage Loans

HUD, the parent of FHA, has an acquisition and construction loan program for owner occupant home buyers. Home Buyers can now purchase fixer uppers with FHA 203k Loans. There are two types of FHA 203k Rehab Loans:

- FHA Streamline 203k Loans

- Standard FHA 203 Loans

203K Streamline Loans:

- Up to $35,000 in rehab funding

- One closing

- Cannot do structural changes

Full 203K Loans:

- No construction budget

- Can do structural changes

- Gut rehab projects allowed

Multi-Unit Financing

- Owner occupant FHA 2-4 unit mortgage loans require 3.5% down payment.

- 85% of potential rental income can be used for borrower’s extra income on rental units.

- No landlord experience required.

- Conventional 2-4 unit mortgage loans owner occupant properties require 5% down payment.

- 75% of potential rental income can be used as borrower’s extra income to qualify for debt-to-income ratios on conventional multi unit mortgage programs.

- No landlord experience required.

- Reserves required.

There are major differences in conforming versus non-conforming mortgage loans. Viewers who need further clarification on the differences in conforming versus non-conforming mortgage loans can contact us at Gustan Cho Associates at gcho@gustancho.com.

Homebuyers who need to qualify for mortgage with direct lender with no overlays on government and conventional loans can contact us at Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com.

This BLOG on conforming versus non-conforming mortgage loans was UPDATED on August 6, 2025.

Which Loan Works for You? Conforming or Non-Conforming

Explore lending limits, credit guidelines, and approval criteria—so you can confidently apply.

It’s interesting to know that even with bad credit scores, as long as income is documented, a person will still be eligible for a loan. I will keep that in mind in case my finances get a bit bad soon. Medical expenses overlapping with rent and loan interests makes me think that getting a non-conforming loan program would be a good way to make sure I stay afloat. Alex Carlucci of Gustan Cho Associates videos has been very informative.

I’m glad you found that information helpful! You’re right that income documentation can be crucial for loan eligibility, even when credit scores aren’t ideal. It sounds like you’re being proactive about understanding your options, which is smart financial planning.

Medical expenses can definitely create unexpected financial pressure, especially when they coincide with regular obligations like rent and existing loan payments. Non-conforming loan programs can indeed provide more flexible qualification criteria compared to conventional loans, though it’s worth noting they often come with different terms – sometimes higher interest rates or fees.

Since you mentioned Alex Carlucci’s content being informative, it might be worth exploring multiple sources and speaking with a few different lenders to compare your options. Each lender may have different non-conforming programs available, and getting quotes from several can help you find the most favorable terms for your situation.

If you do find yourself needing to explore these options, consider also looking into whether there are any medical payment plans or financial assistance programs that might help with those medical expenses directly – sometimes addressing the root cause of the financial strain can be more cost-effective than taking on additional debt.

What is a conforming loan? I am getting mixed answers. Some loan officers is telling conforming loans are conventional mortgage loans, while other loan officers are telling me any mortgage loan that is a government-backed mortgage or conventional loan is a conforming loan, and any loan that is not conforming. I really appreciate your answer.

I will explain both conforming and non-conforming mortgage loans and its difference on your reply, Manual. A conforming loan is a mortgage that meets the guidelines set by government-sponsored enterprises (GSEs) like Fannie Mae or Freddie Mac. These guidelines include limits on loan amount, borrower credit, debt-to-income (DTI) ratio, and other criteria. Conforming loans are typically easier to qualify for and have lower interest rates due to their standardization and lower risk for lenders.

Key Features:

Loan amount within the conforming loan limit (e.g., $766,550 for a single-family home in most U.S. areas in 2025; higher in high-cost areas like parts of California or New York).

Borrower must meet credit score, DTI, and down payment requirements (often as low as 3–5% for conventional loans).

Eligible for purchase or guarantee by Fannie Mae or Freddie Mac, making them less risky for lenders.

2. What is a non-conforming loan?

A non-conforming loan does not meet Fannie Mae or Freddie Mac guidelines. These loans are riskier for lenders, often leading to higher interest rates or stricter qualification criteria. They’re typically used for unique borrower situations or properties that don’t fit standard criteria.

Key Features:

Loan amounts often exceed conforming limits (e.g., jumbo loans).

May cater to borrowers with lower credit scores, higher DTI ratios, or non-traditional income sources (e.g., self-employed individuals).

Not eligible for purchase by GSEs, so lenders may hold them in their portfolio or sell to private investors.

What are examples of non-conforming loans?

What are examples of non-conforming loans?

Jumbo Loans: Loans exceeding the conforming loan limit for a given area.

Non-QM Loans: Non-qualified mortgages that don’t meet standard Qualified Mortgage (QM) rules, often for borrowers with irregular income (e.g., self-employed) or high DTI.

Interest-Only Loans: Borrowers pay only interest for a set period, leading to lower initial payments but higher risk.

Subprime Loans: Designed for borrowers with lower credit scores, often with higher interest rates.

Who should consider a conforming loan?

Conforming loans are ideal for:

Borrowers with good credit (typically 620 or higher).

Those purchasing a primary residence or second home within the loan limits.

Buyers seeking lower interest rates and more lenient down payment requirements.

First-time homebuyers who qualify for programs like Fannie Mae’s HomeReady or Freddie Mac’s Home Possible.

Who should consider a non-conforming loan?

Non-conforming loans suit:

Borrowers purchasing high-value properties in expensive markets (e.g., jumbo loans for homes above $766,550).

Self-employed individuals or those with non-traditional income sources.

Investors buying properties like vacation homes or multi-family units.

Borrowers with lower credit scores or higher DTI ratios who don’t qualify for conforming loans.

What are the advantages of conforming loans?

Lower Interest Rates: Due to GSE backing, lenders offer competitive rates.

Easier Qualification: Standardized guidelines make approval straightforward for qualified borrowers.

Lower Down Payments: Options like 3–5% down for conventional loans.

Wider Availability: Offered by most banks, credit unions, and mortgage lenders.

What are the advantages of non-conforming loans?

Flexibility: Accommodates unique financial situations or property types.

Higher Loan Amounts: Suitable for luxury homes or high-cost areas.

Customizable Terms: Some non-conforming loans offer features like interest-only payments or extended terms.

What are the risks of non-conforming loans?

Higher Costs: Higher interest rates and fees due to increased lender risk.

Stricter Requirements: May require larger down payments or reserves.

Limited Availability: Not all lenders offer non-conforming loans, reducing options.

Market Risk: Harder to sell on the secondary market, which may affect terms.

How do conforming loan limits change?

Conforming loan limits are set annually by the Federal Housing Finance Agency (FHFA) based on average home prices. For 2025:

The baseline limit for a single-family home is $766,550 in most areas.

High-cost areas (e.g., parts of California, New York, or Hawaii) have higher limits, up to $1,149,825 for a single-family home.

Limits are higher for multi-family properties (e.g., duplexes or triplexes).

Can I switch from a non-conforming to a conforming loan?

Yes, through refinancing, if your financial situation or property qualifies for a conforming loan. For example:

If home prices drop or you pay down a jumbo loan to within conforming limits.

If your credit score improves or DTI decreases to meet GSE guidelines.

How do I know which loan is right for me?

Assess Your Needs: Consider your budget, property type, and location.

Check Loan Limits: Verify if your loan amount falls within conforming limits for your area.

Evaluate Finances: Review your credit score, income stability, and DTI.

Consult a Lender: A mortgage professional can help compare options and rates.

Where can I find more information?

For conforming loan guidelines, visit Fannie Mae (fanniemae.com) or Freddie Mac (freddiemac.com).

For general mortgage information, check Consumer Financial Protection Bureau (consumerfinance.gov).

Contact lenders or mortgage brokers for personalized advice.

If you have specific questions about your situation or need real-time data (e.g., current interest rates or lender options), let me know,

How do I know if my mortgage is conforming or non-conforming?

Your mortgage is conforming if it meets Fannie Mae/Freddie Mac guidelines and is within the loan limit (e.g., $806,500 in most areas). If it exceeds that limit or doesn’t follow those standards, it’s non-conforming. Check your loan amount and ask your lender to confirm

What happens if my loan amount exceeds the conforming limit?

If your loan amount is above the conforming limit, it’s considered a jumbo loan—meaning it won’t be insured or guaranteed by Fannie Mae or Freddie Mac and will typically require more stringent underwriting, a bigger down payment, and a higher interest rate.

Are the repayment terms different between conforming and non-conforming loans?

Conforming and non-conforming loans can share standard 15- or 30-year amortization. Still, non-conforming loans often offer more varied repayment structures (shorter/longer terms, interest-only, or balloon payments), whereas conforming loans stick to Fannie Mae/Freddie Mac’s standardized schedules.

Can I refinance a non-conforming loan into a conforming loan later?

Which type of loan is better for a first time homebuyer?

FHA loans are normally the best for first-time homebuyers.

FHA loans require 3.5% down payment but eligible first-time homebuyers can get down payment assistance.

Will choosing a non conforming loan affect my chances of refinancing later?

Can I get a conforming loan with an FHA or VA loan?

Yes, you can. Please contact us at 800-900-8569.

Is it harder to qualify for a non-conforming mortgage?

No, usually it is easier. No documentation and normally use 12 months of bank statement deposits.