This guide covers comparison of mortgage rates on purchase and refinance loans. Mortgage rates have been steadily going up to all time highs for home buyers shopping for a home loan or homeowners thinking of refinancing their current home loans. Mortgage rates have been steadily increasing and are at the highest rates since the 1980’s. 30 year and 15 year fixed mortgage rates have skyrocketed more than 70 basis points since the beginning of 2022. Even with rumors of rising mortgage rates and the Federal Reserve Board warning that rates will go down in the second half of 2024, mortgage rates have been going up. In this blog, we will discuss comparison of mortgage rates on purchase and refinance.

Comparison of Mortgage Rates on Purchase and Refinance

Mortgage rates for purchase and refinance loans often differ due to factors influencing lender risk and market dynamics. Here’s a detailed comparison of these two types of mortgage rates: Basic Definitions of Mortgage Terminology:

- Purchase Loans: These are mortgages obtained to buy a home. The loan is secured by the home being purchased.

- Refinance Loans: These involve replacing an existing mortgage with a new one, typically to reduce the interest rate, lower monthly payments, or change the loan terms. Refinancing can also tap into home equity (cash-out refinance).

- Interest Rates: Refinance loans often have slightly higher interest rates than purchase loans. This difference can be attributed to several reasons

- Risk Factor: Lenders may perceive it refinances, especially cash-out refinances, as higher risk. In a cash-out refinance, borrowers increase the loan amount to convert home equity into cash, potentially increasing the lender’s risk if the borrower defaults.

- Economic Factors: During economic uncertainty or when interest rates generally rise, the spread between purchase and refinance rates can widen.

Choosing whether to take out a purchase loan or refinance and selecting the type of refinance involves considering the costs, potential savings over time, and how long you plan to stay in the home. It’s important to compare offers from multiple lenders and calculate the break-even point to decide if refinancing is worthwhile, especially if the difference in rates is marginal.

Lender Fees and Closing Costs

Both loans incur closing costs, but the specifics vary. For instance, refinancing might involve fees similar to purchase loans, such as appraisal, origination, and processing fees. No-Lender Fee Options: Some lenders may offer no-fee refinancing, which generally incorporates fees into the interest rate, potentially making it higher.

Rate and Term Refinance vs. Cash-Out Refinance

Rate and Term Refinance: This type aims to improve the rate or term of your existing mortgage without advancing new money. This type often has rates closer to purchase loan rates because the loan amount doesn’t increase. Cash-Out Refinance: This involves taking out a new mortgage for more than you owe, often at a higher rate due to the increased risk of providing additional cash to the borrower.

Looking for the Best Mortgage Rates on a Home Purchase or Refinance? We’ve Got You Covered!

Contact us today to explore your mortgage options and get pre-approved.Comparison of Mortgage Rates Based on Market Conditions

Interest Rate Environment: If market rates have decreased since the home was purchased or last refinanced, a refinance can make financial sense, even if refinance rates are slightly higher than current purchase rates. Economic Policies: Changes in economic policies that affect interest rates can impact the rates available for purchase and refinance mortgages.

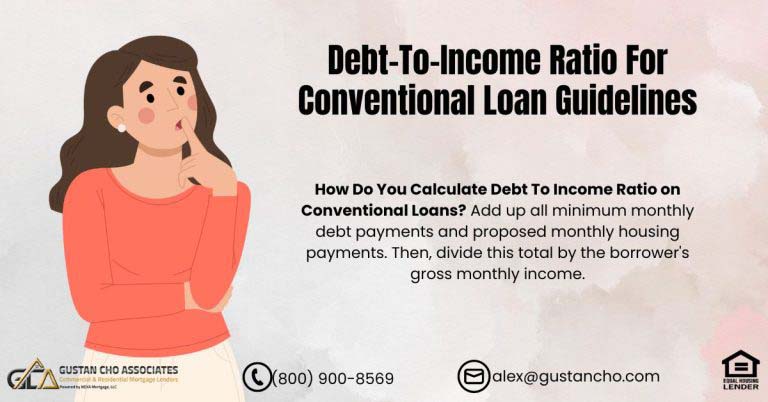

Comparison of Mortgage Rates Based on Loan-to-Value Ratio (LTV)

Higher LTV for Refinances: If the LTV ratio increases, lenders might offer higher rates due to perceived increased risk, especially with cash-out refinances.

Credit Score Impact

Credit Requirements: Similar credit score requirements apply to both types of loans, but the impact of your credit score can be more pronounced in refinancing, especially if your financial situation has changed.

Mortgage Rates and Loan Programs

Mortgage rates are different for different mortgage loan programs. For example, conventional rates are different than mortgage rates on FHA loans. VA mortgage rates are different than FHA and conventional mortgage rates. Mortgage rates on VA loans are lower than FHA and Conventional mortgage rates. Conventional loans have the highest mortgage rates today when it comes to government and conforming loans.

Mortgage Rates on VA Loans Are The Lowest of All Loan Programs

The great advantage of being a veteran of the United States Armed Services is being able to qualify for VA loans: VA loans have the lowest mortgage rates. VA mortgage rates are on the average 0.31% lower than conventional loans. VA rates are even lower than the most popular rates on FHA loans. VA loans also do not require mortgage insurance premiums.. Homebuyers who qualify for VA loans can purchase a home with no money down. Borrowers can get the best mortgage rates available than any other loan program. Borrowers do not have to pay monthly mortgage insurance. There is no maximum loan limit on VA Loans. There are no minimum credit score requirements. There is no maximum debt-to-income ratio caps on VA loans. There is a funding fee that is required but the VA funding fee can be rolled into the VA loan balance.

Comparison of Mortgage Rates Versus Credit Scores

When mortgage rates are announced, the rates quoted are rates for prime borrowers on conventional loans. Prime borrowers are borrowers with 740 credit score or higher and with 20% down payment. Freddie Mac and Fannie Mae are the Government Sponsored Entities that set conventional mortgage rates. Normally, when conventional mortgage rates go up or down, other mortgage rates from other loan programs, such as VA, FHA, USDA follow their lead and go up and down as well.

Credit Scores and Loan-to-Value Are Biggest Factors Pricing Mortgage Rates

There are other factors with regards to the comparison of mortgage rates that determine rates such as the property type and the amount of down payment.