In this blog, we will cover and discuss the steps to buying your first home in Wyoming. Buying your first home in Wyoming should not be stressful. It should be an exciting point in your life where you are making your single largest investment and starting a new chapter in your life as a homeowner. By reading this guide on steps to buying your first home in Wyoming, you will realize that the homebuying and mortgage process is not all that bad. In the following paragraphs, we will cover the steps to buying your first home in Wyoming without stress.

How To Avoid Stress Buying Your First Home In Wyoming

By investing a little time in learning the steps of the homebuying and mortgage process, you will have a stress-free exciting journey to buying your first home in Wyoming. In the following sections of this guide to buying your first home in Wyoming, you will learn the basic steps to your journey to homeownership in Wyoming. We will cover the steps of the mortgage process, shopping for a home in the most popular areas in Wyoming, and going through the mortgage application, underwriting process, and home loan closing.

The Importance of Teamwork For Your Journey To Homeownership

Many homebuyers who experience stress during the mortgage process are folks who did not realize the overall mortgage process. The mortgage process is a true process. Everyone in the mortgage process, from the borrower, loan officer, real estate agent, mortgage process and support staff, attorneys, insurance agent, title company, and third-party vendors all need to work as a team. Do you remember the saying it is great people that make a great team? On the flip side, one rotten uncooperative team member can destroy any organization. The property market in Wyoming has been on steady growth over the last couple of years. This growth could be attributed to low property prices, low tax rates, beautiful nature, and basically fresh air.

How Much Home Can I Afford Versus Qualify In Wyoming

The first step before buying your first home in Wyoming starts with figuring out your finances. The key is how much house can I afford and NOT how much home can I qualify for from my lender. We have attached the Best Mortgage Calculator powered by Alex Carlucci of Gustan Cho Associates on this link. Also, watch the video about Gustan Cho Associates Best Mortgage Calculator.

Ready to Buy Your First Home in Wyoming? Let’s Make the Process Easy and Stress-Free!

Contact us today to learn how we can help you navigate the process with ease and confidence.

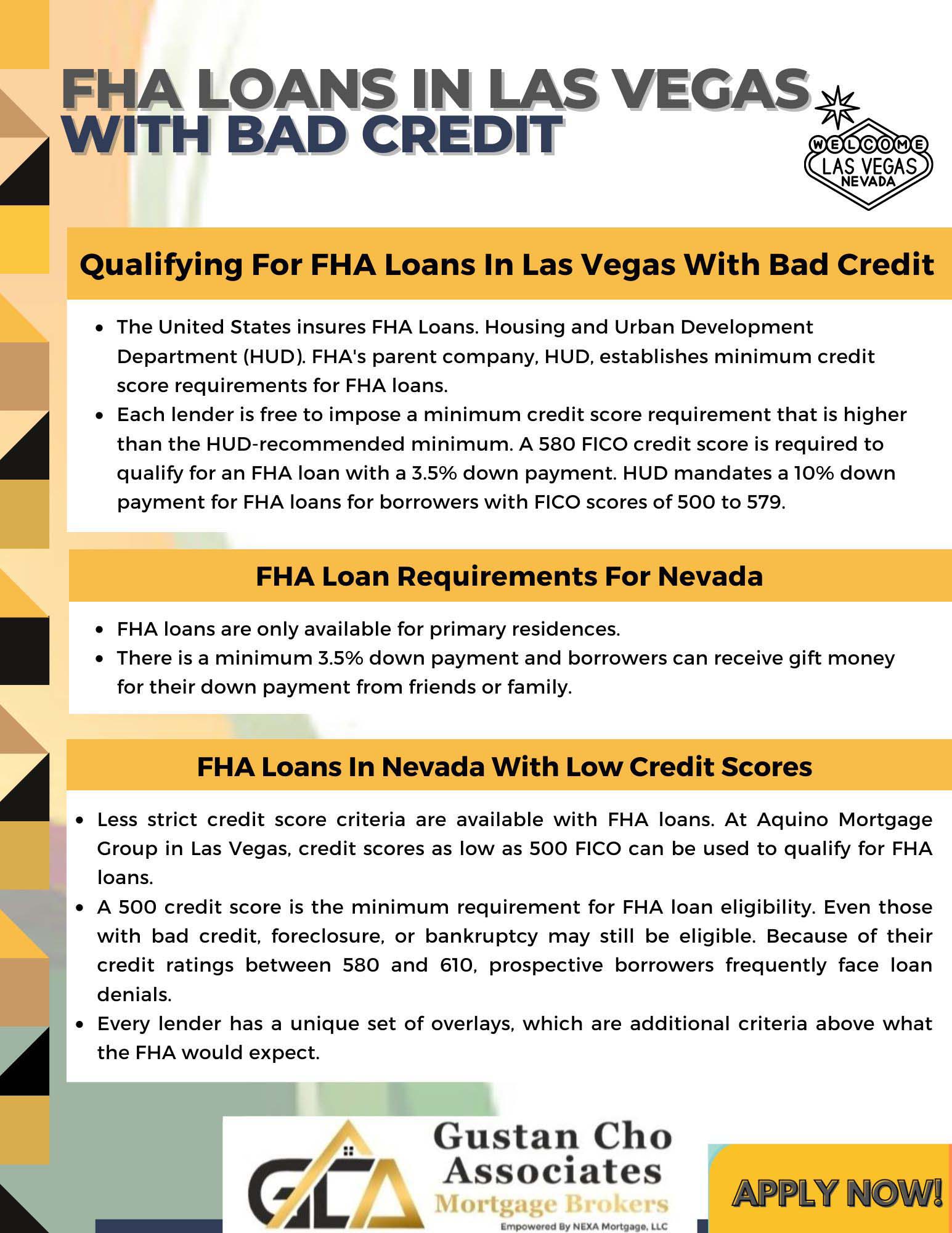

Buying a House in Wyoming With Bad Credit

Anyone with a 700 credit score, 30% debt to income ratio, perfect credit paying history, and 20% down payment will have no issue getting qualified, pre-approved, and close buying a house a house in Wyoming. However, that is not the facts of life. Even the best of us go through hard times due to unemployment, loss of business revenues, business partnership breakups, divorce, illness, or death in the family. With extenuating circumstances comes disruption in income. Disruption in income leads to not being able to pay bills on time which leads to bad credit. Now worries. You can qualify for a mortgae with bad credit and low credit scores. Gustan Cho Associates we are mortgage brokers licensed in 48 states including Wyoming, and have a reputation for being to help homebuyers with credit scores down to 500 FICO.

Can I Buy a House in Wyoming With a Credit Score of 500?

One of the frequently asked questions at Gustan Cho Associates is how can I buy a house with a credit score of 500? Now, to a first-time buyer, and especially one who is new to the Wyoming property market, buying a home can seem intimidating. The situation could even be worse for buyers with bad credit! But don’t worry, in this article, we are going to tell you what you can do to acquire a mortgage with bad credit, and also walk you through the home-buying process in Wyoming.

Can You Get a Mortgage With Bad Credit In Wyoming?

Many homebuyers in Wyoming, especially first-time homebuyers often doubt they can get a mortgage with bad credit in Wyoming. a frequently asked question at Gustan Cho Associates is can you get a mortgage with bad credit in Wyoming? Michael Gracz, a top producer for Gustan Cho Associates and an expert in helping many folks in Wyoming buy their first home in Wyoming with credit scores down to 500 FICO said the following:

The First Step In Buying Your First Home in Wyoming

The first step in any home-buying process is figuring out where you are, financially. This is because realistically, there is no point in going house hunting, much less making an offer before you understand your financial situation. Here we are talking about your income, credit score, and debt-to-income ratio. Let’s concentrate on your credit score here first. The truth is, in Wyoming, any individual looking for a traditional loan to finance their property purchase is required to have a credit score of at least 620. But what if your score is below this level? In this case, you will still qualify for a mortgage, only that it may not be the traditional one, but with alternative options. What we mean is that there are different types of mortgages in Wyoming.

FHA and VA Loans With Credit Scores Down To 500 FICO

While some require a credit score of 620 as we mentioned above, there are other types of loans such as VA (veterans administration) and FHA (federal housing administration) loans which can accept a credit score as low as 500. The VA option is, of course, meant for service members and their spouses, or veterans.

Buying Your First Home in Wyoming With Non-QM Loans

You can also decide to go for non-QM loans (Non-Qualified) that also don’t have a strict rule on credit score, and you can qualify for a loan even if you had declared bankruptcy at some point in your past. With these loans, all you need to present are your bank statements or any other documentation that indicates that your financial situation has since improved – that your Debt-to-Income ratio is at low and if you have a sizeable down payment – at least 20% or higher.

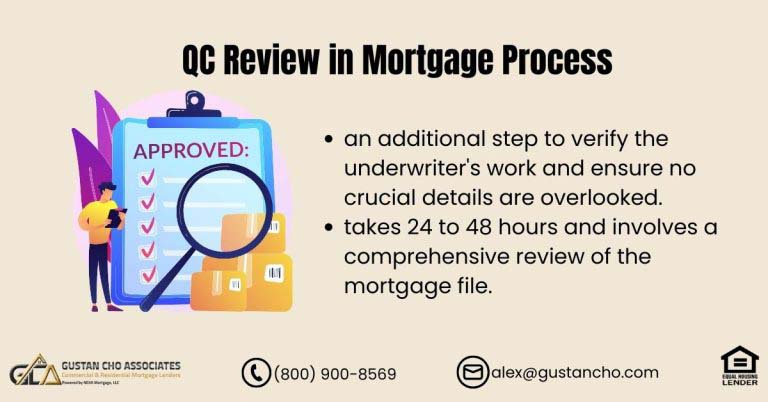

The Start of The Mortgage Process in Buying Your First Home In Wyoming

The home-buying process in Wyoming is a process. If you are buying your first home in Wyoming, we will cover step-by-step homebuying and mortgage process. We will guide you through the steps of the qualification process leading to the pre-approval process. Once you are fully pre-approved, you are now ready to shop for a home. It is highly recommended to consult with a loan officer as soon as you have decided you will want to purchase a home. A sharp experienced loan officer is able to guide you on how to boost your credit score so you can not only qualify for a mortgage but can get the lowest possible mortgage rates.

Excited to Buy Your First Home in Wyoming? We’ll Help You Every Step of the Way!

Reach out now to get personalized support and ensure a smooth experience from start to finish.

How To Get Pre-Approved For a Mortgage In Wyoming

Before you start house hunting, you need to have your choice of mortgage pre-approved. By getting qualified and pre-approved, you will be able to show home sellers the letter for them to see that you are serious about the transaction. Also, having been pre-approved, you will have a much more secure financial footing, which will help you in your negotiations.

Shopping For a Lender in Wyoming

To get pre-approved for a mortgage, you just need to apply with a loan officer licensed in Wyoming. Not all mortgage lenders in Wyoming have the same lending requirements for the same loan program. Lenders have overlays. Not all lenders have the same lender overlays. Shop with several lenders and interview various loan officers.

Get Qualified and Pre-Approved For a Mortgage

Make sure you feel comfortable with the lender and your assigned loan officer. Check their online reviews and like what you see. Once you have checked rates, and terms and the lender have the loan program best suited for you, you can start the mortgage loan application process. Getting qualified and pre-approved is easy. Provide all the documentation that will be required from you by the lender. If you are eligible for a mortgage, the lender will then provide you with a pre-approval letter.

Get a Real Estate Agent

Truth be told, finding a house that you can call home in Wyoming isn’t a walk in the park, which is why you will certainly need to hire a real estate agent. Even though it’s not a requirement in the state of Wyoming to have an agent, hiring a good one can be extremely helpful. When looking for an agent, make sure to get someone who is experienced in the local property market, and also one with excellent communication skills too as you will need those skills at some point during the negotiations.

Buying Your First Home in Wyoming? Let Us Help You Do It Stress-Free!

Contact us today to learn about your options and get pre-approved for your new Wyoming home.

Look For a House in Wyoming

Now it’s time to look for your dream house! The best place to start the search is from the local listing, which the agent can help you go through. By this point, you probably already know how much you will be spending, and you will be able to narrow down your search only to properties that are within your budget. Even as you keep perusing the listings, you need to know where exactly in Wyoming you are looking to settle in. With that said, here are the top places you should concentrate your search in:

Cheyenne, Wyoming

Cheyenne is the most populated city in Wyoming that lies north of Denver, Colorado – about 100 miles – and has a population of about 65,000 people. When it comes to property prices, the price for an average home is about 200,000USD, with a single-family home going for as little as $60,000. If you want a home on a ranch, it will go for about 10 million USD. Considering the interest a lot of people are showing towards Cheyenne, especially those planning to move there, the property market has been on steady growth, which means you can’t ignore it in your search. It is a very safe place, and employment opportunities are ever-present.

Casper, Wyoming

Casper, Wyoming has a lot of activities and adventures associated with this great town in Wyoming, which makes it another potential location you should really consider, especially if you are an adventurous person. Home values have been on the rise recently, which indicates a thriving property market. Mike Gracz, the top first loan officer assistant to Gustan Cho who assists in most mortgage loan approvals in Wyoming said the following:

Laramie, Wyoming

Laramie, Wyoming is a city with an abundance of historic activities and nature and attracts a lot of tourists every year. This makes this city such an ideal location for investment properties, including Airbnb’s short-lets, hotels, motels, cottages, and also bed and breakfasts. Even those looking for residential properties will have plenty of options at affordable prices, so you should also check it out.

Gillette, Wyoming

Gillette is one of the areas in Wyoming with the lowest cost of living. And considering the beautiful nature and scenery, including coal mine museums, breweries, and ranches, it would be a great place to live. The area is safe, there are employment opportunities, as well as plenty of basic amenities.

Make an Offer on Your Dream Property in Wyoming

After you select your dream property in the most ideal location for you, the next step would be to make an offer! Your real estate agent will for sure come in handy at this point, as he or she will help you with all the paperwork and negotiations on the final price of the property. The closing process will involve an attorney, especially when it comes to signing contracts and title deeds. But don’t worry because your agent should be in a position to recommend a reputable property attorney in the state for you to choose one.

Making The Dream of Homeownership Become a Reality in Wyoming

As you have seen, having a bad credit history should never stand in the way of you from owning a dream home in the amazing and adventurous state of Wyoming. All you need is to approach or get in touch with a mortgage broker who would help you find a suitable mortgage in Wyoming for your case. To start the qualification and pre-approval process with a mortgage lender licensed in Wyoming, contact us at Gustan Cho Associates at (800) 900-8569 or text us for a faster response. Or email us at alex@gustancho.com.

Wyoming Mortgage With No Overlays

Gustan Cho Associates has a national reputation for being able to close mortgage loans other lenders can’t. Over 80% of our borrowers are folks who could not qualify at other mortgage companies due to a last-minute mortgage loan denial or because the lender did not have the mortgage option suited for the borrower. Besides government and conventional loans with no overlays, we have hundreds of non-QM and non-prime mortgage options for owner-occupant, second homes, and investment properties.

Get Pre-Approved 7 Days a Week

The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and during the holidays. Gustan Cho Associates is licensed in 48 states, including Washington DC, Puerto Rico, and the U.S. Virgin Islands. We have a lending network with over 190 wholesale lending partners. Any mortgage loan program you are looking for, you can rest assured you will find it at Gustan Cho Associates You can be rest assured buying a home in Wyoming with no stress is a given and that is guaranteed. We will walk you step by step through the mortgage loan and underwriting process. The team at Gustan Cho Associates are experts in helping homebuyers with credit scores down to 500 FICO.

This blog on buying your first home in Wyoming without stress was published on May 22nd, 2024.

Don’t Let the Stress of Buying a Home Hold You Back in Wyoming! We’re Here to Help!

Contact us today to learn how we can make the process easy and stress-free.