This guide covers how to boost credit scores with collection accounts. Borrowers can qualify for FHA loans with outstanding collection accounts as well as charged-off accounts without having to pay them off. Borrowers can have outstanding collections and charge-off accounts and do not have to pay them off to qualify for a mortgage on a primary home. However, the automated underwriting system and lenders want to see borrowers have timely payments in the past twelve months. Dale Elenteny, a senior mortgage loan officer at Gustan Cho Associates says the following about how to boost credit scores with collection accounts:

One or two late payments in the past 12 months may not always be a deal killer. However, to get approved with one or two late payments, you should have the highest credit score possible to offset the recent late payment.

FHA loans are the most popular loan programs in the U.S.. Borrowers can qualify for FHA Loans with less than perfect credit and credit scores down to 500 FICO. There are minimum credit score requirements to qualify for FHA loans. There are ways on how to boost credit scores with collection accounts. In this article, we will cover and discuss how to boost credit scores with collection accounts.

How to Boost Your Credit Scores With Collection Accounts

Learn how to boost your credit score after a recent collection account. Discover strategies to improve your credit profile and raise your score, even with collection accounts on your report.

Yes—You Can Boost Your Credit With Collections on Your Report

Learn how to handle collection accounts the smart way to raise your score fast.

Why Collections Can Hurt Your Credit Score

Having a recent collection account on your credit report can bring your score down fast. Collections tell lenders that you fell behind on payments. If you want a new credit card, a car loan, or a mortgage, these marks can stand in your way and cost you higher interest rates.

The United States Department of Housing and Urban Development commonly referred to as HUD, is the parent of the Federal Housing Administration, known as FHA.

But you still have hope. There are proven steps you can take to boost your credit score, even if collections are staring you in the face. Once you know how collection accounts work, you can plan to rebuild your credit for good.

How Collection Accounts Hurt Your Credit Scores

When a debt lands in the hands of a collection agency, it lands on your credit report as a collection account. Each of the big three bureaus—Equifax, Experian, and TransUnion—will log it. Lenders see these accounts as bright red flags, and your score can drop by 100 points or more, depending on how your credit looked before the account appeared.

Three main things shape how badly a collection hurts your score:

- The age of the account: A brand-new collection stings more than one that’s a few years old.

- The dollar amount: Bigger debts carry heavier weight in the eyes of credit scorers.

- Paid vs. unpaid: An unpaid account leaves a deeper bruise than one you’ve already settled.

- Quick Tip: Collection accounts linger on your credit report for seven years from your last payment or activity date.

- Still, they hurt your score less and less with time, especially if you take smart actions.

Steps on How to Boost Credit Scores With Collection Accounts

Seeing a collection account on your report may feel stressful, but you can quickly improve your score and bounce back.

Here’s what you can do:

Boost Credit Scores With Collection Accounts: Pay Off the Collection Account

Start by settling the collection account. While paying the debt won’t erase the collection from your credit report, it signals to future lenders that you’re dealing with your financial obligations. Some collection agencies will accept a pay-for-delete deal, promising to take the collection off your report once you pay. Make sure to get that promise in writing before you hand over any money.

How to Boost Credit Scores With Collection Accounts: Request a Goodwill Deletion

After you’ve paid the debt or settled the collection, you can contact the collection agency and ask them for a goodwill deletion. This means you’re asking them to erase the collection account from your credit report as a kind favor, especially if you’ve been a trustworthy customer before the problem started.

When you contact them, be polite and straightforward. Explain why you’re asking, state that the debt is paid, and request the deletion. Not every agency will say yes, but some might agree, especially if the balance is zero.

How to Boost Credit Scores with Collection Accounts: Dispute Any Errors on Your Credit Report

If you see a collection account that is wrong or doesn’t belong to you, you can dispute it with the credit bureaus. The bureaus must investigate your claim within 30 days. If they find the account is false or has a mistake, they will delete it from your report, and your credit score can increase. Keep copies of everything you send and receive during the dispute.

Remember, you can get a free credit report once a year. Just visit Annual Credit Report.

- Settle or Pay Off the Debt in Full: If you still have an unpaid collection account and have the money, think about paying it off completely.

- When you do this, the collection agency can’t add more late payments or extra fees to your report, and it closes the account.

- Even if you settled the debt for less than you owed, your credit report shows the problem is resolved, which still helps your score.

- Remember, newer credit scoring models—like FICO 9 and Vantage Score 3.0—penalize paid collections much less than older models, so wiping out your collection account can boost your score.

- Work on Other Areas of Your Credit: While tackling collection accounts, don’t forget to strengthen the rest of your credit. Use these tips to lift your score even higher:

- Pay Bills on Time: Always make your credit card, auto loan, and utility payments on or before the due date.

- Timeliness is key.

- Cut Credit Card Balances: Work to keep how much you owe on credit cards below 30% of your total available credit.

The Lower Your Credit Card Balance, the Better

- Hold Off on New Credit: Avoid applying for new cards or loans until your score improves.

- Every hard inquiry can ding your score for a while, so it’s best to wait.

Don’t Let Collections Drag You Down

There are proven strategies to improve your credit—even with recent collection accounts.

Consider Getting Professional Help

Suppose you’re having a hard time juggling several debt accounts or want to boost your credit score. In that case, reaching out to a credit counseling agency or a credit repair service can help. Experts in these agencies can walk you through repairing your credit and advise you on habits that will raise your score over time.

Learn More: How to Choose a Credit Repair Service

Does Paying Off a Collection Help My Score?

Paying off a collection account won’t instantly skyrocket your score, but it creates a better picture for the future. A collection marked as “paid” is generally looked at less harshly than one that stays unpaid, and newer credit score models pay less attention to collections that have been settled.

FHA loans is the mortgage loan of choice for borrowers with bad credit and low credit scores. Borrowers can qualify for an FHA loan with credit scores down to 500 FICO.

Keep in mind that both FICO 9 and VantageScore 3.0 ignore collections that have been paid, which can boost your score. Still, some older FICO models will “see” the paid collection. Luckily, the weight it carries will shrink over time.

How Long Until I See a Boost Credit Scores with Collection Accounts?

Patience is part of the journey when you’re working to bounce back from a collection account. Usually, you can expect to notice a small lift in your score about 3 to 6 months after you’ve started to take the right steps. Dale Elenteny, a senior mortgage loan originator with Gustan Cho Associates says the following about FHA loans:

FHA was created to promote homeownership to every day hard-working Americans without the need for a substantial down payment.

Your score will climb a bit more each time you chip away at outstanding debt, hit your bills on time, and clear inaccurate negative entries from your report.

Role and Function of The Federal Housing Administration

Many Americans are under the impression that FHA is a governmental agency that is a mortgage lender. However, FHA is not a lender and has nothing to do with the origination, processing, underwriting or funding of FHA loans. FHA is a subsidiary of the United States Department of Housing and Urban Development, HUD. John Strange, a senior mortgage loan officer at Gustan Cho Associates says the following about the role of FHA and mortgage lenders and how they view recent late payments in the past 12 months.

The role of FHA is to work with lenders and encourage them to lend money to home buyers with little down payment and lenient credit requirements and standards.

Most lenders are extremely careful with originating and funding home loans to borrowers with little down payment because they do not have skin in the game. Lenders are also extremely credit conscious lenders are very careful in funding borrowers with prior credit issues such as bankruptcies, foreclosures, deed-in-lieu of foreclosures, short sales, judgments, tax liens, outstanding collection accounts, charge off collection accounts, and late payments.

Can I Get a Mortgage With Bad Credit?

The answer is yes. Both government-backed loans and conventional mortgage loans are very forgiving with prior bad credit. However, the automated underwriting system and most lenders want to see timely payments in the past 12 months. FHA loans are one of the most popular mortgage loan programs in the United States. John Strange, a senior mortgage loan originator at Gustan Cho Associates says the following about how to boost credit scores with collection accounts:

FHA loans has very generous lending requirements for home buyers where a home buyer with a 580 FICO credit score can purchase a home with only a 3.5% down payment with a low mortgage rate.

How can this be? The reason why lenders are willing to finance home buyers with less than perfect credit and higher debt-to-income ratios, as well as little down payment on FHA loans. FHA loans are insured by HUD. In the event, if the borrower defaults on their FHA loan, HUD will partially guarantee the lender against losses. In order for HUD to insure defaulted FHA loans, the lender needs to follow HUD Guidelines when processing and underwriting an FHA loan. HUD has minimum mortgage requirements, especially with regards to credit scores and collection accounts.

How To Boost Credit Scores With Collection Accounts due to Cases Where Borrowers Need Higher Credit Scores

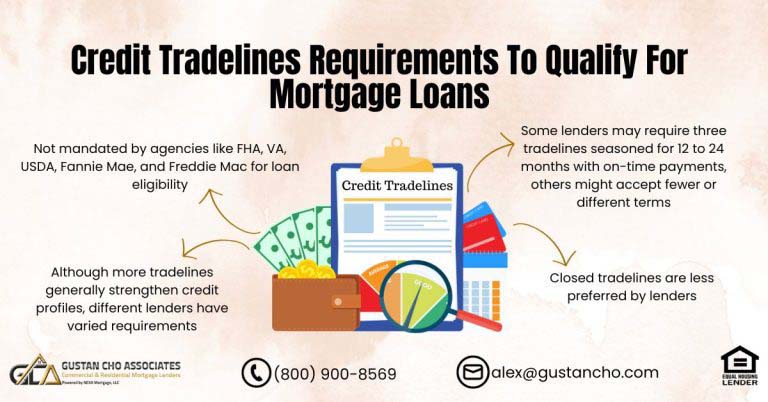

Even though FHA only requires a 580 FICO credit score to qualify for an FHA loan, there are times where a borrower needs to have a 620 FICO credit score to qualify. Lenders need to submit a borrower’s mortgage application and credit report to Automated Underwriting System in order to proceed with a borrower’s mortgage process.

If the Automated Underwriting System issues an automated approval, the borrower needs to satisfy all of the conditions of the AUS findings.

Lenders have tougher requirements for borrowers with under 620 FICO scores and so does HUD. For example, debt to income ratio requirements on borrowers under 620 FICO is capped at 43% DTI. If a borrower has over 620 credit scores, the debt-to- income ratio can go up to 46.9% front-end and 56.9% back-end DTI. The automated underwriting system findings may require verification of rent for borrowers with under 620 credit scores. Mortgage rates under 620 FICO are substantially higher than rates priced over 620 FICO.

Turn Collections Into a Comeback Story

We’ll show you how to manage, dispute, or settle collection accounts the right way.

Recent Collection Account on Credit Report

A recent collection account on your credit report can be extremely damaging to your credit scores. One recent collection account can mean that you may no longer qualify for a home loan and may take months to get your credit scores back up to where you can meet the minimum credit score requirement to qualify for an FHA loan.

Loan officers should not ever issue a pre-approval letter if a borrower has credit disputes on non-medical collection accounts with outstanding balances and charge off accounts.

The purpose for me writing this blog is to help our viewers a few tricks of the trade. Consumers can easily spike up your credit scores temporarily to boost up your credit scores when you have a recent collection account that appears on your credit report. Many times, collection agencies sell your dormant collection account for pennies on the dollar. Whenever they do that, it may update your credit report as a recent collection account where it can plummet your credit report.

How Does Credit Disputes Affect The Mortgage Process

There are strict rules and regulations on credit disputes during the mortgage process. Credit disputes are when a consumer disputes a derogatory erroneous credit item on their credit report to the credit bureaus in hopes of getting it corrected and/or removed from their credit report.

The way it works is by writing a letter to the credit bureaus stating that the derogatory information on the credit report is wrong and to have the credit bureaus remove it. The credit bureaus will notify the creditor reporting the disputed item and that creditor has 30 days to provide the validity of the reported item to the credit bureaus.

No Response By Credit Bureaus And How To Boost Credit Scores With Recent Collection Account

If the credit bureaus do not get a response back by the creditor, the credit bureaus need to remove them off the consumer’s credit report. If the creditor does respond with proof of the derogatory credit item, the disputed credit item remains on the credit report. Dustin Dumestre, a senior mortgage loan originator with F1 Lenders and an associate contributing editor at GCA Forums says the following about how to boost credit scores with collection accounts.

The minimum credit scores required to qualify for a 3.5% down payment FHA loan is 580 FICO. There are big lending requirements for borrowers with credit scores under 620 and over 620 FICO.

Many consumers and/or credit repair companies use this credit dispute method in hopes of removing derogatory credit items off one’s credit report. Unfortunately, you cannot have credit disputes on charge off accounts and non-medical collection accounts if your total outstanding collection account balance is greater than $1,000 during the mortgage process. You are allowed to have credit disputes on medical collection accounts and you can also have credit disputes on non-medical collection accounts with zero balances on them. Credit disputes on medical collection accounts as well as non-medical collection accounts without any outstanding balances are permitted and do not have to be retracted.

Why Are Credit Disputes Prohibited During The Mortgage Process?

Whenever a consumer does a credit dispute on derogatory credit, the credit bureau will remove that particular derogatory credit item from the credit scoring formula. So even though the derogatory credit item remains on the credit report and the verbiage of “consumer disputes this credit item” is added on the disputed item

What this means is that the consumer’s credit scores will go up since the derogatory credit item is not factored in on the scoring model

This is the reason why lenders will not allow credit disputes on non-medical collection accounts and charge-off accounts. So when a consumer retracts the consumer credit dispute from a tradeline, the derogatory item will get re-factored into the credit scoring model and the consumer’s credit scores will drop. The amount on how much the credit scores will drop will depend on how recent the derogatory item is.

How To Boost Credit Scores With Collection Accounts To Qualify For a Mortgage

As mentioned earlier, when you have a credit dispute, the mortgage process will come to a halt until the credit dispute is retracted and the retraction is posted on the consumer’s credit report. Also, if you do a credit dispute, the consumer’s credit scores will increase. This is because the credit bureaus will take out the negative credit item from its credit scoring formula. Medical collections and non-medical collection accounts are exempt from credit disputes. If you had recent medical collection accounts or non-medical collection accounts with zero balances or the total outstanding unpaid balance of your non-medical collection accounts is less than $1,000, you can go ahead and do credit disputes.

By disputing derogatory credit tradelines, your credit scores will increase because the credit bureaus algorithms negative the derogatory credit tradelines on all credit disputes from the credit scoring model.

This is a good strategy that you can use to boost your credit scores if you need to meet the minimum credit score requirements. Your credit scores will drop once the credit dispute has been resolved and the credit bureaus were to state that the negative credit item has been verified by the creditor and that it will remain. However, if your loan officer pulls credit, that credit score will be used throughout the mortgage process. The initial tri-merger credit report pulled by the lender is good for 120 days.

Rebuild Credit and Boost Credit Scores with Collection Accounts

A collection account can leave a mark but doesn’t have to shadow your entire credit history. Settle the account or work out a payment plan, dispute any mistakes, and keep each account on track, and your score will slowly but surely rise. You’re not just lifting a number. Y but building a stronger financial future.

If you’re unsure how to move forward or need a game plan for dealing with collections, the team at Gustan Cho Associates can guide you.

Our mortgage pros understand the ins and outs of credit bumps, and we’ve helped many people secure a loan even with recent collections. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays. To get qualified and pre-approved for a mortgage, contact us at Gustan Cho Associates at 800-900-8569 or text us for a faster response. Or email us at alex@gustancho.com for tailored advice on credit repair and mortgage programs designed for you.

Got Collections? You’re Still in the Game

You can qualify for a mortgage—even with collections—if you follow the right credit steps.