BREAKING NEWS: COVID-19 pandemic impact on investors of rental properties. The COVID-19 pandemic impact on investors of rental properties: The housing market has been booming prior to the coronavirus pandemic. Many real estate investors who have been impacted after the 2008 financial crisis have gotten back to investing in real estate.

Non-QM loans was introduced by many lenders. Non-QM loans made investing in rental properties possible. Not too many real estate investors qualified for Fannie Mae’s 5 to 10 property mortgage guidelines.

Non-QM and alternative financing was the way to go to get started in real estate investments. Bank statement loans, fix and flip mortgages, asset depletion loans, and other non-QM mortgage programs became a hit. In the following paragraphs, we will cover the Covid-19 pandemic impact on investors of rental properties.

COVID-19 Pandemic Impact on Investors of Rental Properties Due Unemployed Tenants

Many general investors started investing in real estate: Many hard working investors were increasing their real estate portfolios. Then the COVID-19 pandemic hit tanking the U.S. economy. With the economic shut down in the U.S., millions of businesses closed. With the countless business closures, millions of Americans were out of work. Over 33 million Americans filed unemployment claims in the past seven weeks.

Many of these workers may not have a job to go back to. With people out of work, many cannot make their rental payments to their landlords.

Without receiving rental payments, landlords are hurting. Many cannot make their mortgage payments. Landlords have other expenses besides paying the mortgage payments of their rental properties. Property taxes, insurance, maintenance costs still need to get paid. Many investors of real estate properties may be facing foreclosure if tenants do not start paying rent. In this article, we will discuss and cover the COVID-19 pandemic impact on investors of rental properties.

COVID-19 Pandemic Impact on Investors of Rental Properties and Tenants

Over 33 million Americans filed for unemployment claims in the past seven weeks. Most state governors have issued a stay at home order for the past two months. All non-essential businesses were ordered to remain closed until further notice. Just last week, a handful of state governors released the stay at home order and allowed certain businesses to reopen. However, many unemployed and/or furloughed workers may not have a job to go back to. Millions of renters are struggling to pay their monthly rent

President Trump and his administration are doing everything possible to help Americans get back to work while trying to put the COVID-19 virus in remission.

The longer the economy remains closed, the more damage it will do to small businesses where many will be closed permanently. Many states have ordered a moratorium on evictions for 90 days or more. The moratorium and bans on evictions and rent strikes could bankrupt many real estate investors who own rental properties.

The $2.2 Trillion Coronavirus Pandemic Economic Package

The Trump Administration approved the $2.2 trillion coronavirus pandemic economic package to help Americans. Included in the economic package was a law requiring lenders to offer forbearance to unemployed homeowners. Homeowners can skip mortgage payments up to one year on federally-backed mortgage loans. Forbearance is not forgiveness. However, the stimulus package has nothing to protect renters and landlords due to the coronavirus pandemic. Over 50% of tenants in lower to middle income housing rental units are not paying their rent due to the economic impact of the COVID-19 pandemic.

Once the forbearance period is over, the homeowner need to repay the missed payments, accrued interest, and escrow shortage. Most lenders will spread the delinquent payments over a course of six months to one year

Tenants not paying rent is causing a major financial burden on landlords. Most states like Connecticut, Illinois, New York, and dozens of others have banned evictions until July and August 2020. State governors are ordering emergency orders banning landlords from evicting tenants and charging any late fees and/or penalties during the eviction moratorium period. More than $1 trillion in mortgages is held by real estate investors of residential rental properties.

Are We in a Housing Crisis Due To The COVID-19 Pandemic?

Whether or not we are in a housing crisis yet remains to be seen. The longer the economy is shut down, the longer it will take to recover. Millions of businesses have remained closed for the past two months since the pandemic hit the United States. Over 33 million Americans are out of work.

The very few non-QM lenders who will reopen will tighten up their credit standards and may require higher down payments and equity positions.

Will real estate investors flood the housing market with foreclosures? Again, this remains to be seen. It is too early to tell. However, landlords of residential and commercial properties are stressing with the uncertainty on who will be paying rent and who will not. The once 3.5 unemployment rate can hit as high as 25% in the coming weeks and months. Real estate investors will be facing a mortgage crisis on non-QM loans. Many non-QM lenders will not be coming back.

Gustan Cho Associates is a real estate investor himself.

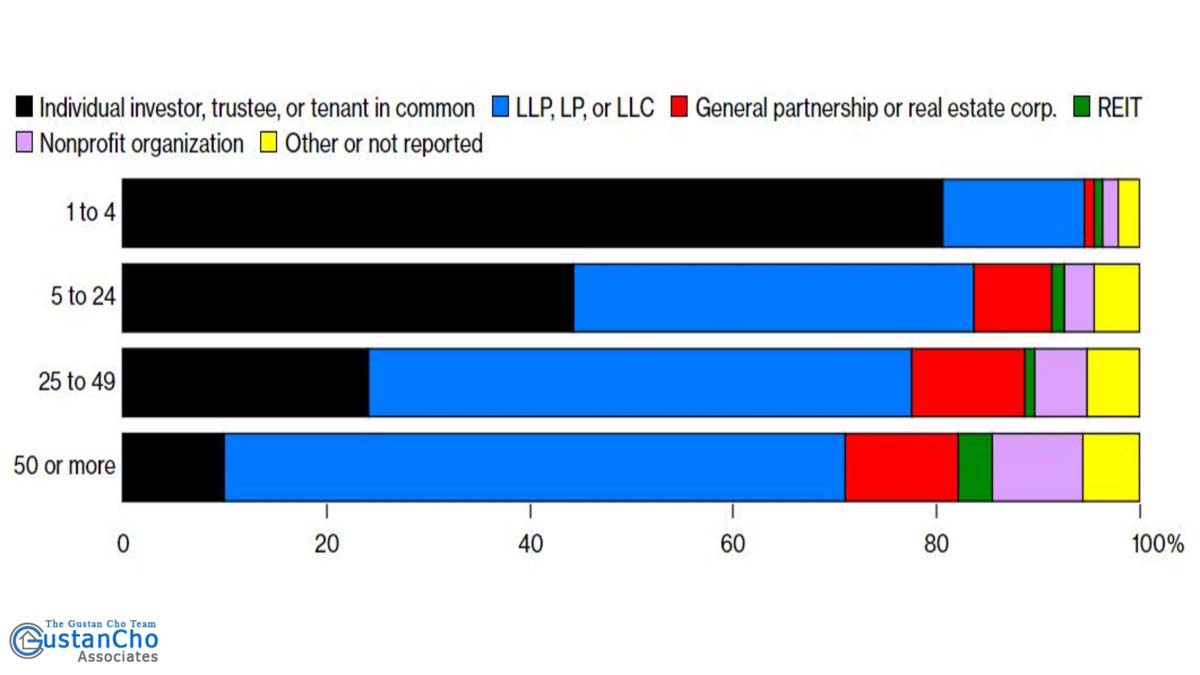

Property Ownership By The Number Of Units

Once non-QM loans was introduced to the market in 2012, more and more investors started investing in real estate. Many real estate investors who went through bankruptcy after the 2008 real estate meltdown went back to investing in real estate. Seasoned veteran real estate investors never thought they may see another housing crash after the 2008 financial crisis. Then the COVID-19 pandemic hit the United States. Look at the chart below:

After the coronavirus pandemic hit the United States, the economy came to an abrupt close. The U.S. economic shut down affected the mortgage markets. Non-QM lenders shut down their operations until further notice. Some non-QM lenders went bankruptcy while others said they will not continue on lending non-QM loans. All correspondent lenders offering non-QM loans suspended their operations. It is just too early to tell what the future on non-QM loans will be. Many non-QM lenders are worried about getting a flood of foreclosures from their borrowers due to unemployed tenants not paying their rent.

Devastating Impact of Unemployment Has on Investors of Rental Properties

There are approximately 50 million rental housing units in the United States. Over 25 million rental housing units are owned by small investors who depend on the rental payments by tenants to be profitable. Without the rental revenues, these small real estate investors cannot make the mortgage payments and afford the expenses. Many landlords depend on rent from tenants to pay for mortgages, property taxes, insurance, and maintenance.

Many landlords are understanding about the difficulty unemployed tenants face in paying rent. However, without rental revenues, the landlord may face eviction themselves.

Congress yet has come up with any plans to help renters and landlords. The government is working on the next phase of the stimulus package that may include financial relief for tenants and landlords. Renters who have lost their jobs due to the coronavirus pandemic may take some time for them to find another job. Landlords need to contact their lenders and see if they can get forbearance and/or loan modification. It is not a question if the economy will recover. The key question is how long will it take for the economy to return to normalcy prior to the COVID-19 pandemic. Nobody has the answer to this question. This is a developing story. Gustan Cho Associates will keep our viewers updated on developments to this story in the coming days and weeks. STAY TUNED!!!