This guide outlines the advantages of Non-QM loans and Non-Traditional Mortgages. Gustan Cho Associates serves as your reliable ally for Non-QM and Non-Traditional Mortgages. Non-QM and Non-Traditional Mortgages, also known as alternative financing mortgages, are distinct home loan options. These alternative financing loans diverge from the standard lending criteria of traditional government or conventional loans.

Due to non-QM and non-traditional mortgages, many homebuyers can now qualify for a home loan where they would otherwise not qualify.

Over half of our borrowers at Gustan Cho Associates utilize Non-QM and Non-Traditional Mortgages. These specialized loans cater to many borrowers beyond those with poor credit. Even individuals boasting excellent credit and high credit scores find advantages in non-QM loans.

Gustan Cho Associates provides a diverse array of non-QM and non-traditional mortgages. As a licensed mortgage company operating across multiple states, we have established numerous lending partnerships with wholesale lenders specializing in non-QM products. We aim to explore and highlight the benefits of non-QM mortgages tailored for non-traditional borrowers.

This guide highlights the benefits of Non-QM loans and Non-Traditional Mortgages. Gustan Cho Associates is your trusted partner for these specialized home financing solutions. Non-QM and Non-Traditional Mortgages, often called alternative financing mortgages, offer distinct options for homebuyers. Unlike traditional government or conventional loans, these alternative financing loans deviate from standard lending criteria.

What Are Non-QM Loans and Non-Traditional Mortgages?

Non-Qualified Mortgages are commonly referred to as non-QM loans. Many people are under the belief that non-QM loans are bad credit loans or similar to subprime loans. This is absolutely not the case and a misconception.

Gustan Cho Associates has dozens of non-QM loan programs available. Each non-QM loan program has its own rate and term depending on the lender’s layered risk level.

As with anything else, risks versus rewards. The higher the risk, the higher the rewards for the lender which is the higher the rate. Non-QM mortgage rates for borrowers with higher credit scores and lower loan to value are competitive and similar to mortgage rates on traditional loans.

Don’t Fit the Bank Box? A Non-QM Loan Might Be Perfect for You

Self-employed, 1099, lots of write-offs, recent credit issues, or non-traditional income?

What Are The Differences Between Non-QM Loans and Traditional Qualified Mortgages

Non-QM loans are mortgages that are not Qualified Mortgages. Qualified Mortgages are home loans that fall into compliance with and regulations of the Consumer Financial Protection Bureau (the CFPB) and are regulated by government mortgage agencies. Government and conventional loans and mortgages that are sold in the secondary mortgage markets such as Fannie Mae or Freddie Mac are Qualified Mortgages (QM).

Many mortgage borrowers do not fall within the lending guidelines of government or conventional loans and need an alternative mortgage loan program called non-QM loans.

Many borrowers of non-QM loans are real estate investors, self-employed borrowers, foreign nationals, or wealthy individuals with no positive income on their income tax returns that cannot meet the lending guidelines of qualified mortgages and can only qualify for non-QM or alternative financing loan programs.

Non-QM loans also benefit borrowers with recent bankruptcies or foreclosures. Gustan Cho Associates offers non-QM mortgages one day out of bankruptcy and foreclosure with a 30% down payment.

Type of Borrowers Who Benefit From Using Non-QM Loans and Non-Traditional Mortgages

Non-QM loans and non-traditional mortgages present valuable prospects for prospective homeowners grappling with the requirements of conventional government-backed loans.

These alternative financial avenues guarantee accessibility to suitable home mortgage programs, accommodating various income sources beyond what’s typically considered in tax returns’ adjusted gross income. Such sources encompass asset depletion, cash flow from personal or business accounts, and other non-traditional income channels.

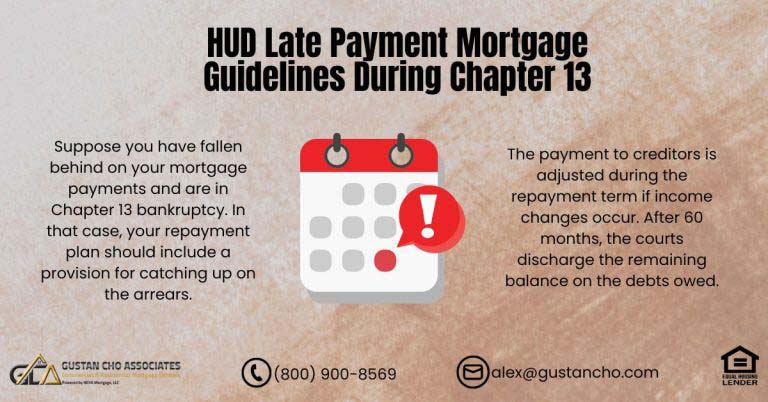

Borrowers who do not meet the mandatory waiting period after bankruptcy or foreclosure on government and conventional loans can now qualify for non-QM loans.

Prospective homebuyers must acknowledge the buoyant housing market. Regardless of their credit standing, whether favorable or unfavorable, recent financial setbacks like bankruptcy, foreclosure, late payments, retirement status, or unconventional income but significant assets, there are avenues to explore.

Gustan Cho Associates provides Non-QM Loans and Non-Traditional Mortgages tailored for individuals who might need to meet the criteria for government or conventional loan programs.

How Does Non-QM and Non-Traditional Mortgages Work

For numerous borrowers, Non-QM Loans and Non-Traditional Mortgages represent the sole pathway to transforming the dream of owning a home into a tangible reality.

At Gustan Cho Associates, we acknowledge that numerous borrowers fall outside government and conventional loan lending criteria. Recognizing this reality, we’ve established partnerships with numerous wholesale mortgage lenders specializing in Non-QM Loans and Non-Traditional Mortgages.

Our mission and goal at Gustan Cho Associates are to make every mortgage loan product in the marketplace available for our borrowers. We have developed a reputation of being a one-stop mortgage shop.

Non-QM Loans and Non-Traditional Mortgages stand apart from traditional mortgage options governed by government and conventional loan guidelines. While those adhere strictly to predefined rules, Non-QM lenders possess greater flexibility, allowing exceptions.

When assessing a Non-QM mortgage application, underwriters evaluate the borrower’s comprehensive credit and financial history. While ensuring the borrower’s ability to repay remains paramount, non-QM lenders consider various income sources beyond the conventional spectrum.

Use Your Real Income, Not Just Your Tax Returns

Bank statements, P&L-only, asset-depletion, and DSCR loans all fall under non-QM benefits most borrowers never hear about

What Are Non-Qualified Mortgages

Non-QM loans and non-traditional mortgages refer to mortgage options that do not adhere to the standard criteria established by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. These financial products are tailored to individuals who might not meet the typical eligibility requirements for conventional mortgages.

Non-QM loans typically feature more adaptable credit standards compared to traditional mortgages. They may also accept alternative income documentation methods, such as bank statements, to assess the borrower’s capacity to repay the loan. Moreover, non-QM loans might be more flexible concerning income requirements for qualification.

Asset Depletion and Other Alternative Loan Programs

Some Non-QM loans consider a borrower’s assets when determining eligibility, enabling individuals with significant assets but unconventional income sources to qualify. Non-QM Loans and Non-Traditional Mortgages may feature interest-only payment options, allowing borrowers to pay solely the interest for a set duration before beginning principal payments.

Compared to conventional mortgages, these loans generally come with higher interest rates. Certain Non-QM loans, such as bank statement loans, no-doc loans, no-ratio mortgages, DSCR loans, and other portfolio loan programs, do not require proof of income for tax purposes. Balloon mortgages start with lower monthly payments but necessitate a lump-sum payment (the “balloon”) at the end of a specified term.

Reverse Mortgages

Reverse mortgages allow homeowners, typically seniors, to use their equity in their homes to no longer make a mortgage payment until the owner passes or they sell their home. The principal balance on a reverse mortgage increases as time passes. You need to be at least 62 years old to qualify for a reverse mortgage. The older the borrower, the higher the loan-to-value which means older borrowers get to take more cash-out.

Interest-Only Non-QM Loans and Non-Traditional Mortgages

In an interest-only mortgage, borrowers only pay interest for a specified period, after which they begin making principal payments. Shared Equity Mortgages: Shared equity mortgages involve sharing the appreciation or depreciation of a home’s value with the lender. This can make homeownership more accessible, especially for first-time buyers.

Subprime Mortgages

Subprime mortgages are another term for non-QM loans. They often come with higher interest rates and may have adjustable rates. It’s important to note that while these non-QM and non-traditional mortgage options provide flexibility, potential borrowers should thoroughly understand the terms and risks of suing them.

Additionally, the mortgage landscape is subject to regulatory changes, so it’s advisable to consult with a qualified mortgage professional for the most up-to-date information.

Types of non-QM Loan Programs Available

Borrowers benefiting from non-QM loans and non-traditional mortgages are the following types of borrowers: Self-employed borrowers who want to use 12 months of bank statement deposits and not use their income tax returns due to a large amount of unreimbursed business expenses on their tax returns.

Borrowers one day out of bankruptcy or foreclosure or those who do not meet the minimum waiting period requirements after bankruptcy or a housing event.

Those who had late payments in the past 12-months including housing late payments. Self-employed borrowers buying higher-end properties and needing to qualify for a non-QM jumbo mortgage with lower credit scores. Real estate investors who need to use alternative financing loan programs such as asset depletion or cash-flow analysis or other creative nontraditional income methods to qualify for rental or investment properties.

Turn Hard Money or High-Rate Loans Into Better Non-QM Financing

Still stuck in a hard money or private loan at a sky-high rate?

No-Doc Mortgage Loans For Self-Employed Borrowers

Non-QM loans are becoming the nation’s most popular loan program. This holds especially true for self-employed borrowers. Over 35% of Americans are self-employed. Until the launch of non-QM bank statement loan programs, most self-employed borrowers had a difficult time qualifying for a home. It was a huge challenge for a successful business owner to qualify for a home loan on a home they wanted to purchase.

With the 12-month bank statement loan program, self-employed borrowers can now qualify for non-qm loans and non-traditional mortgages with no maximum loan limit by just using 12 months of bank statement deposits.

Withdrawals do not matter. Income tax returns are not required. More and more new non-QM and non-traditional mortgages are getting launch every quarter at Gustan Cho Associates.

If you want to learn more about the dozens of non-QM loans and non-traditional mortgages we have available at Gustan Cho Associates, please reach out to us with your contact information at alex@gustancho.com. Or call us at 800-900-8569. Text us for a faster response. The team at Gustan Cho Associates is available 7 days a week, evenings, weekends, and holidays.

FAQ: Benefits of Non-QM Loans and Non-Traditional Mortgages

- 1. What are Non-QM Loans and Non-Traditional Mortgages? Non-QM Loans and Non-Traditional Mortgages are alternative financing options distinct from conventional government-backed loans. They cater to borrowers who don’t meet standard lending criteria.

- 2. How do Non-QM Loans differ from Traditional Qualified Mortgages? Non-QM Loans aren’t subject to the regulations of government agencies like the Consumer Financial Protection Bureau and aren’t sold in secondary mortgage markets like Fannie Mae or Freddie Mac. They offer more flexibility in credit standards and income documentation, making them suitable for various borrowers, including real estate investors, self-employed individuals, and those with recent financial setbacks.

- 3. Who benefits from using Non-QM Loans and Non-Traditional Mortgages? These alternative financing options are beneficial for borrowers with unconventional income sources, recent bankruptcies or foreclosures, or those who can’t meet the requirements of traditional loans. They cater to self-employed individuals, real estate investors, and those needing alternative income verification methods.

- 4. How do Non-QM Loans work? Non-QM lenders evaluate borrowers’ credit and financial history comprehensively, considering various income sources beyond traditional documentation. These loans offer more flexibility than traditional mortgages, accommodating diverse financial situations.

- 5. What are some types of Non-QM Loan Programs available? Non-QM Loan Programs include bank statement loans, no-doc loans, no-ratio mortgages, and other portfolio loan programs. These loans may consider a borrower’s assets, offer interest-only payment options, or have balloon payment structures.

- 6. Are Non-QM Loans suitable for self-employed borrowers? Yes, Non-QM Loans are particularly beneficial for self-employed individuals who may struggle to qualify for traditional mortgages. Bank statement loan programs allow self-employed borrowers to qualify based on 12 months of bank statement deposits without requiring income tax returns.

- 7. How do I apply for Non-QM Loans? To explore Non-QM Loan options and begin the application process, reach out to Gustan Cho Associates, your trusted partner for specialized home financing solutions. Our experienced loan officers can guide you through the process and help you find the right Non-QM Loan program for your needs.

- 8. What should borrowers consider before opting for Non-QM Loans? While Non-QM Loans offer flexibility, borrowers should understand the terms and risks involved. It’s essential to consult with a qualified mortgage professional to ensure you make informed decisions and stay updated on regulatory changes in the mortgage landscape.

This blog about the Benefits of Non-QM Loans and Non-Traditional Mortgages was updated on February 16, 2024.

Credit Bumps, Recent Events, or Unique Situations? Non-QM Can Help

Recent bankruptcy, foreclosure, short sale, or major life event doesn’t always mean you’re locked out of homeownership

I have to express some appreciation to you just for bailing me out of this particular trouble. After surfing through the world wide web and coming across ideas that were not beneficial, I assumed my entire life was over. Being alive devoid of the solutions to the issues you have sorted out by means of your entire post is a serious case, as well as those which might have in a wrong way damaged my career if I had not discovered your web site. Your actual mastery and kindness in taking care of the whole thing was very helpful. I don’t know what I would have done if I had not discovered such a subject like this. I’m able to at this moment look forward to my future. Thanks a lot very much for this reliable and effective help. I won’t be reluctant to suggest the sites to anybody who needs to have direction on this situation.

Hello it’s me, I am also visiting this website regularly, this site is genuinely pleasant and the visitors are genuinely sharing fastidious thoughts.|