This Article is about No Overlay Lender Offering VA Loans Texas.

Texas is one of the fastest-growing states in the U.S. Gustan Cho Associates Mortgage Group has more VA Loans Texas borrowers than any other state in the United States. More and more people are migrating to the Great State of Texas. Among the newcomers to this great state are veterans of our military. There are more veteran homebuyers in the state of Texas than any other state in the Union. A substantial amount of new veteran citizens who are migrating to Texas are veterans from California.

California has more veteran home buyers leaving that state and coming to Texas to make the state of Texas their home. Gustan Cho Associates Mortgage Group has more VA Loans being originated from Texas than any other state in the United States.

What is a No Overlay Lender?

A no overlay lender strictly follows the basic guidelines established by loan programs like VA Loans Texas, FHA, USDA, or Fannie Mae/Freddie Mac without applying additional, more stringent criteria referred to as ‘overlays.’ Overlays are extra requirements added by lenders on top of the standard guidelines set by these agencies, often to mitigate risk.

By following the standard requirements for credit scores, debt-to-income ratios (DTI), down payments, and other qualifying criteria, no overlay lenders offer a more accessible path to homeownership, particularly for borrowers with lower credit scores, higher DTIs, or other challenging financial circumstances.

No overlay lenders provide more flexibility in the approval process, making it easier for a wider range of borrowers, including VA Home Loans, to qualify for a loan. Lenders can provide different loans, such as FHA, VA, USDA, and conventional, without adding extra conditions. This approach is especially beneficial for those with non-traditional credit profiles or who have been turned down by lenders with stricter policies. As a result, no overlay lenders are an appealing option for borrowers who meet the basic qualifications of loan programs but might need help to get approval from lenders with additional, stricter requirements.

Looking for a VA Loan in Texas? We Offer VA Loans with No Overlays!

Contact us today to learn how we can help you secure a VA loan in Texas with no overlays and get you approved faster!

VA Loans Texas: Making Texas Home For Veteran Home Buyers

VA loans Texas are in high demand already as we approach the halfway point of 2018. Why is this?

- Texas is growing, and growing rapidly

- Increasing the demand for homes

- This has also created an uptick in the housing market

- In 2014 there was a 4% growth in the overall population throughout the Lone Star state

- Then in 2015 Texas ranked second in relocation activity

Texas is only behind the state of Florida according to the Texas Association of Realtors.

Why Texas Made National News

What has attracted all of these out-of-state migrants?

- The diverse job market and high quality of life for starters!

- This is true for cities both big and small

- Let’s not forget the weather as well!

- According to the same article, 2019 was the third year in a row where Texas added over 500,000 new residents

- High numbers of new Texans have arrived from California, Florida, Oklahoma, Colorado, Louisiana, and Illinois. Dallas- Fort Worth has the highest growth from out of state residents followed by Houston and Austin

- Many Lenders who specialize in VA Loans Texas have lender overlays

Gustan Cho Associates Mortgage Group is one of the top mortgage bankers who is nationally known for its no VA Loans Texas.

Explosive Texas Veteran Population Growth With No Signs Of Slowdown

We now can agree Texas is adding over 1,000 new residents a day. Many of those new residents served our country and are eligible for VA mortgage financing.

Why choose a VA Loan?

- No Down Payment Required

- Lower Interest Rates

- No Minimal Credit Score Requirements

- Higher Debt-To-Income Thresholds

- Sellers Can Pay Closing Costs

What are the steps to obtaining a VA loan? The answer is very simple:

- Obtain your COE (please see COE Instructions Blog)

- Reach out to Gustan Cho Associates

- Call or Text 800-900-8569

- Email us at Gustan Cho Associates at 800-900-8569

Get Qualified For VA Loan Texas With Direct Lender With No VA Lender Overlays

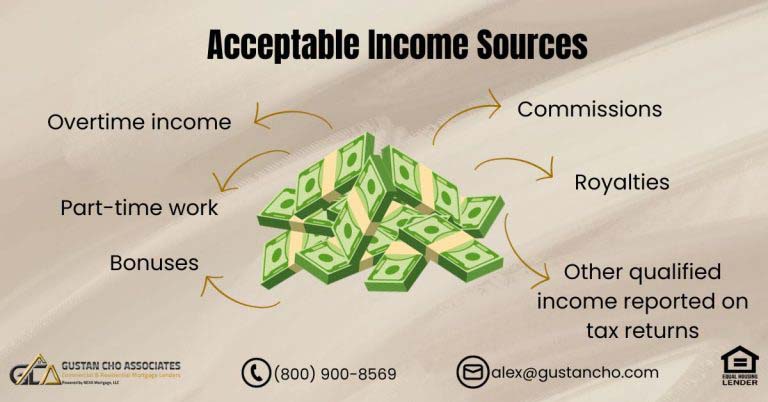

Gather other supporting documentation:

- Last 60 Days Bank Statements – to source money for escrows

- Last 30 Days Pay Stubs

- Last Two Years W2’S

- Last Two Years Tax Returns

- Driver’s License (or other Government-issued photo ID)

Qualify And Become Texas Veteran Homeowner

Once you have these items you will be able to get a FULL PRE-APPROVAL. That’s right, an underwriter from Gustan Cho Associates will thoroughly examine borrowers’ documentation and issue a LOAN COMMITMENT. It is important to understand the difference between a Pre-Qualification Letter and a Pre-Approval Letter.

See TBD UNDERWRITING PROCESS BLOG for more information.

VA Loans is hands down the best mortgage loan program. Unfortunately, only veterans with a valid Certificate of Eligibility can qualify for VA Mortgages.

Here are the basic qualification requirements:

- We are VA lenders with no overlays

- No credit score requirements nor debt to income ratios

- We only go by automated underwriting system approval findings

- Outstanding collections or charge offs does not have to be satisfied

No waiting period during Chapter 13 repayment nor discharged date of Chapter 13 discharged date.

Ready for a VA Loan in Texas with No Overlays? We Make It Easy for You!

Reach out today to see how we can help you qualify for a VA loan in Texas with no overlays.

Is the Texas Vet Loan the Same as a VA Loan?

The Texas Vet Loan and VA Loan are distinct programs. However, they share similarities and can sometimes be used together to maximize benefits. The Texas Vet Loan, offered by the Texas Veterans Land Board (VLB), is available exclusively to Texas veterans, military members, and their spouses.

This program often provides lower interest rates than standard market rates. It can be used for home purchases, home improvements, and land purchases within Texas.

In contrast, VA Loans Texas, part of the VA Home Loans program offered by the U.S. Department of Veterans Affairs, are available to veterans, active-duty service members, and eligible surviving spouses nationwide. VA Loans Texas features benefits such as no down payment requirement, no private mortgage insurance (PMI), and competitive interest rates, although not specifically discounted like the Texas Vet Loan.

While VA Loans Texas are primarily used for home purchases and refinancing, the Texas Vet Loan includes unique benefits like discounted interest rates and the ability to finance land purchases. Veterans in Texas can combine the Texas Vet Loan and VA Home Loans to leverage the advantages of both programs. This means using a VA Home Loan for most of the financing and applying the Texas Vet Loan for additional benefits, such as lower interest rates through the VLB. This combined approach provides Texas veterans with comprehensive financing options and maximizes the benefits available through both programs.

Why Does Texas Not Allow VA Cash-Out Refinance?

Texas has unique laws regarding home equity lending, including cash-out refinancing restrictions to protect homeowners from excessive debt and foreclosure risks. This is why VA Loans Texas does not allow VA cash-out refinance. The Texas Constitution has specific provisions governing home equity loans and cash-out refinancing, designed to protect homeowners by imposing strict regulations on borrowing against home equity.

These restrictions safeguard homeowners from predatory lending practices and ensure they do not take on excessive debt, preventing them from losing their homes due to unmanageable financial burdens.

Furthermore, Texas has strong homestead protections, among the most robust in the nation, which limits the ability of lenders to foreclose on a primary residence. These protections extend to the restrictions on VA cash-out refinance. Texas laws also enforce a maximum loan-to-value (LTV) ratio for home equity loans, including cash-out refinances, limiting the amount of cash homeowners can take out.

While VA Loans Texas restricts cash-out refinances, homeowners still have other options to access home equity, such as home equity lines of credit (HELOCs) and home equity loans, which comply with the state’s specific regulations. This approach ensures that VA Home Loans in Texas maintain the integrity of homeownership and protect homeowners from financial hardship.

Even if you have been turned down for a VA loan before, make sure you contact us. We can help you achieve your home buying goals! Remember most banks and lending institutions have LENDER OVERLAYS which can stop borrowers’ approval. Many of my clients were told they need a 620 or even a 640 credit score before they qualify, THAT IS NOT TRUE. HUD does not have a credit score requirement for VA loans, neither do we. We specialize in manual underwriting VA Loans. I am always available for one-on-one consultations. We have helped many Veterans get themselves and their families into their dream homes! Start building equity in your home today!

FAQs: VA Loans Texas: Mortgage Lender With No Overlays

- 1. What is a No Overlay Lender? A no overlay lender strictly follows the basic guidelines established by loan programs like VA Loans Texas, FHA, USDA, or Fannie Mae/Freddie Mac without applying additional, more stringent criteria known as ‘overlays.’ These lenders offer a more accessible path to homeownership, particularly for borrowers with lower credit scores, higher debt-to-income ratios (DTI), or other challenging financial circumstances.

- 2. Why are VA Loans Texas Popular Among Veterans? Texas is one of the fastest-growing states in the U.S., attracting many veterans due to its diverse job market, high quality of life, and favorable weather. The demand for VA Loans in Texas is high, with many veterans migrating from states like California to take advantage of the state’s benefits.

- 3. What Are the Benefits of VA Home Loans? Remember, VA Home Loans provide numerous advantages, such as not requiring a down payment, offering lower interest rates, not mandating private mortgage insurance (PMI), having higher debt-to-income thresholds, and allowing sellers to cover closing costs. The advantages of VA Home Loans are attractive to eligible veterans, active-duty service members, and surviving spouses.

- 4. How Does the Texas Vet Loan Differ from VA Loans in Texas? The Texas Vet Loan, offered by the Texas Veterans Land Board (VLB), is exclusive to Texas veterans, military members, and their spouses. It often provides lower interest rates and can be used for home purchases, home improvements, and land purchases within Texas. In contrast, VA Loans Texas, part of the VA Home Loans program, are available nationwide and include benefits like no down payment and no PMI. Veterans in Texas can combine both programs to maximize their benefits.

- 5. Why Does Texas Not Allow VA Cash-Out Refinance? Texas has unique home equity lending laws, including cash-out refinancing restrictions to protect homeowners from excessive debt and foreclosure risks. These restrictions, enshrined in the Texas Constitution, safeguard homeowners from predatory lending practices and ensure they do not incur unmanageable financial burdens. While VA Loans Texas restricts cash-out refinances, homeowners can still access home equity through other options like home equity lines of credit (HELOCs) and home equity loans.

- 6. What Steps Should I Take to Obtain a VA Home Loan? To obtain a VA Home Loan, obtain your Certificate of Eligibility (COE). Then, gather supporting documentation such as recent bank statements, pay stubs, W-2s, tax returns, and a government-issued photo ID. Contact a no-overlay lender like Gustan Cho Associates for a thorough pre-approval process, where an underwriter will examine your documentation and issue a loan commitment.

- 7. Can I Qualify for a VA Loan with a Low Credit Score? You can qualify for a VA Loan with a low credit score. Many lenders have overlays requiring higher credit scores. Still, a no overlay lender like Gustan Cho Associates follows the basic guidelines of the VA Home Loans program, which has no minimum credit score requirement. They specialize in manual underwriting to help more veterans achieve homeownership.

If you have about VA Loans Texas or you to qualify for VA loans with a lender with no overlays, please contact us at 800-900-8569. Text us for a faster response. Or email us at alex@gustancho.com. The team at Gustan Cho Associates is available 7 days a week, on evenings, weekends, and holidays.

This blog about VA Loans Texas: Mortgage Lender With No Overlays was updated on June 19th, 2024.

VA Loans in Texas with No Overlays? Get the Financing You Deserve!

Contact us today to explore your options for a VA loan in Texas with no overlays and get pre-approved now.

Good Afternoon. Is there a minimum credit score?

There is no minimum credit score requirement on VA loans. Please reach out to us with your contact information at gcho@gustancho.com