This guide covers the eligibility guidelines for VA Jumbo Home Mortgages. Most veterans know they do not need a down payment to purchase a home. But there are many things Veterans are not aware of, such as the removal of loan limits for VA mortgage loans. Up until 2020, VA loan limits required a down payment for any amount loan amount above the conforming loan limit. That limit is $726,200 in common areas and $1,089,300 in high-cost counties in the United States. Any amount over that would require a down payment of 25% of the difference between the loan amount and the FHFA county loan limit. Dale Elenteny explains qualifying for VA Jumbo Home Mortgages and how the VA eliminated the VA loan limit as follows:

President Donald Trump signed the Blue Water Navy Vietnam Veterans Act of 2019 into legislation that eliminated the maximum VA loan limit on VA loans. Veterans eligible with a certificate of eligibility no loan has a maximum loan limit on VA loans.

The Blue Water Navy Vietnam Veterans Act implemented the removal of the Low limits for VA mortgage lending. A veteran does not need a down payment to buy any home. In this blog, we will detail how to qualify for VA Jumbo Home Mortgages with Gustan Cho Associates and how to apply for VA Jumbo home mortgages.

The Blue Water Vietnam Veterans Act Eligibility Guidelines on VA Jumbo Home Mortgages

The Blue Water Navy Vietnam Veterans Act benefits our nation’s veterans. Removing the loan limit will help thousands of veterans purchase and refinance homes in higher property value markets such as Denver, Colorado, or San Francisco, California. The U.S. Department of Veterans Administration realized veterans were getting priced out of the housing market and, therefore, eliminated the maximum loan limit on VA loans, says John Strange, a senior loan officer at Gustan Cho Associates:

It is next to impossible to purchase a home below the FHFA loan limit in many areas of the country. Of course, for this to have sustainability, the VA will need more funding. The VA funding fee increased in 2020. First-time use went from 2.15% up to 2.3%. Subsequent use went from 3.3% up to 3.6%.

These increases will allow the U.S. Department of Housing and Urban Development (HUD) and the U.S. DEPARTMENT OF VETERANS AFFAIRS to continue to lend without loan limits. The increased funding fee was implemented for two years and will be re-examined in 2022. We may see another increase to keep these loans available to our nation’s veterans.

Importance Of Residual Income To Get AUS Approval On VA Jumbo Home Mortgages

RESIDUAL INCOME: Residual income is a major factor for every VA mortgage. The residual income must be passed to close any VA mortgage transaction. What is residual income? Residual income is funds left over after paying monthly expenses, including your housing payment. HUD guidelines want to ensure you have enough money to live your life and feed your family after your housing expenses and monthly debts. While there is no set-in-stone debt-to-income requirement for VA mortgage lending, residual income must be passed 100% of the time. Residual income is based on the area you live in and family size. Different parts of the country have different costs of living. This is factored into your residual income requirements. The larger your family is, the higher your residual income requirements.

VA Agency Guidelines On Debt-to-Income Ratios

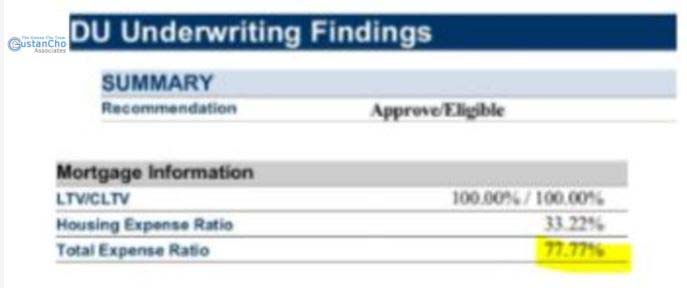

VA loans have no minimum credit score requirements with an approved/eligible per automated underwriting system. VA loans have no maximum debt-to-income ratio caps as long as you can get an approve/eligible per automated underwriting system (AUS)—77% DTI automated approval. Sonny Walton, a dually licensed realtor and loan officer, explains about VA Jumbo Home Mortgages:

In Florida, there are not high-cost counties like California. VA Jumbo Home Mortgages are helping homebuyers buying beachfront property in Florida at over one million price tag.

As stated above, there is no set-in-stone guideline for VA mortgages and debt-to-income ratio. The lower your debt-to-income ratio, the higher your chances of requalification are. We strongly recommend you stay within your budget. Just because your loan is approved with a high debt-to-income ratio does not mean it is the best decision for you and your family. You want to ensure you have plenty of money outside your housing payment. Being house poor is not a good situation for any individual or family.

See the DU AUTOMATED UNDERWRITING SYSTEM (AUS) below on a borrower who got an approve/eligible per AUS with a 77% debt-to-income ratio:

Applying for a VA jumbo home mortgage is no different than applying for your standard VA mortgage. The lending guidelines are no different because of removing the maximum VA loan limit cap. A veteran can borrow any amount of money without a down payment. Most wholesale lending partners can easily lend up to $3 million. However, there is a way to go higher. This gives our hard-working veterans great opportunities to own a luxury primary residence.

Agency Guidelines On VA Jumbo Home Mortgages

The steps to apply are simple. You will first call Alex and 262-716-8151. The borrower and we will discuss applying for the initial mortgage application and see if the borrower will meet the VA agency guidelines. Assuming the criteria are met, We will send you a link from a licensed loan officer in your state. This application link will be the start of the process. As soon as you fill the information out, you will want to send in the following documentation.

When your loan officer receives your documentation and application, they will run your credit report. Assuming everything checks out and you qualify for a VA mortgage loan. Your loan officer will then tell you the maximum payment you qualify for. As mentioned above, you must pass your residual income requirements.

Qualifications will be different for each veteran based on family size and area of the country. Assuming you have passed residual income, you can buy a home for any amount without a down payment. Many veterans live in parts of the country where homes are expensive, such as San Francisco, California; Denver, Colorado; Naples, Florida; Chicago, Illinois. The loan limit was removed not to limit where veterans can buy a higher-end home without a down payment.

Qualify For VA Jumbo Home Mortgages With A Lender With No Overlays

The majority of VA mortgage lenders have LENDER OVERLAYS. The good news is Gustan Cho Associates do not have lender overlays on their mortgage products. This includes a loan limit overlay. Most lending institutions will cap their VA mortgage loans at $1 million. We do not. Gustan Cho Associates can go well above that number.

Most of our wholesale lending investors will go beyond the $3 million mark. We do have ways to go even higher. With today’s low-rate environment, veterans can qualify for a higher-priced home. Gustan Cho Associates are experts in VA mortgage lending.

If you or a veteran friend has difficulty qualifying for VA jumbo home mortgages, please send them to Gustan Cho Associates. We are available seven days a week to answer your questions on lending guidelines on VA jumbo home mortgages. There is much-contradicting information on the internet surrounding VA mortgage lending. Most of this information has to do with specific lender overlays. Remember, we do not have lender overlays to get in our way. Michael Gracz and the team at Gustan Cho Associates look forward to helping you and your family purchase your next home with a VA mortgage loan.

This VA Jumbo Home Mortgages guide was updated on June 26th, 2023.

Let us know if you have any questions. The team at Gustan Cho Associates is available seven days a week including evenings, weekends, and holidays at 800-900-8569. Text us for a faster response.