This article will cover underwriting credit guidelines during the mortgage process. Mortgage borrowers should not stress during the mortgage process. There is no reason for any pre-approvals to get a last-minute mortgage denial.

The main reason for a last-minute mortgage loan denial or stress during the mortgage process is the borrower’s inability to qualify by the loan officer properly.

As long as the borrower can be properly qualified and pre-approved, all mortgage loans should close 100%. There should not be any stress during the mortgage process.

What Are Lender Overlays on Mortgage Loans

Mortgage lenders can have lending requirements higher than the minimum agency mortgage guidelines of HUD, VA, USDA, Fannie Mae, and Freddie Mac called lender overlays. It is not illegal for a lender to have higher mortgage guidelines above the minimum agency guidelines on government and conventional loans. Mortgage loan originators need to follow two important Underwriting Credit Guidelines:

- Federal Minimum Underwriting Credit Guidelines

- Lender Underwriting Credit Guidelines are also known as overlays.

Gustan Cho Associates, empowered by NEXA Mortgage, LLC, are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. We have a reputation for being able to do mortgage loans other mortgage companies cannot do. With a lending network of 210 wholesale mortgage lending partners, there is no mortgage loan program we do not have at Gustan Cho Associates. In the following paragraphs, we will cover underwriting credit guidelines during the mortgage process.

Federal Minimum Underwriting Credit Guidelines

Credit / Underwriting guidelines in the mortgage application process: Federal Minimum Underwriting Credit Guidelines are the minimum mortgage guidelines set by specific mortgage programs. There are government loans and conventional loans. Government Loans are owner-occupant mortgage loan programs guaranteed by a government agency.

Underwriting Credit Guidelines on Government Loans

Here are the three government loan programs:

- HUD, the parent of FHA, insures and guarantees all FHA loans to lenders who originate and fund FHA loans.

- The United States of Veteran Affairs (VA) insures all VA loans that are originated and funded by VA-approved private banks and lenders.

- Department of Agriculture is the federal agency that insures and guarantees against loss on all USDA loans.

For the government agency to guarantee government loans, the financial institution must follow its minimum federal Underwriting Credit Guidelines.

Fannie Mae Underwriting Credit Guidelines on Conventional Loans

Any government agency does not guarantee conventional loans. Any conventional loans with less than 20% equity require private mortgage insurance. Any conventional loans that banks and private lenders originate need to conform to Fannie Mae and Freddie Mac Underwriting Credit Guidelines for Fannie/Freddie to purchase these loans on the secondary market.

Credit Report and Credit Scores

All government loan programs and conventional loans have minimum credit score minimum requirements. Just because borrowers meet the minimum credit score requirements does not automatically qualify them for a loan program. The Automated Underwriting System will thoroughly review and analyze each borrower’s credit report. A tri-merge credit report is required on all mortgage loan programs.

Underwriting Credit Guidelines on Tri-Merger Mortgage Credit Reports

A tri-merge credit report is a credit report from all three major credit bureaus:

For FHA and VA Streamline Refinance Mortgage transactions, it is used solely to validate the credit score.

Credit Scores Used By Mortgage Lenders

Lenders use the middle credit score of borrowers:

- If there are multiple borrowers, whether they are co-borrowers or non-occupant co-borrowers, then the lowest borrower’s middle credit scores are the credit scores used for qualification purposes

- If a borrower has three credit scores and two out of the three credit scores are the lower scores, those lower duplicate credit scores are used for qualification purposes by underwriters

If a borrower has only one credit score, then that score is used to qualify by mortgage underwriters.

Lender Overlays Versus Agency Underwriting Credit Guidelines

As mentioned, there are two types of underwriting credit guidelines:

- Federal Minimum Underwriting Credit Guidelines

- Lender Overlays

Gustan Cho Associates has no lender overlays on government and conventional loans. So lender overlays are not an issue with our borrowers. However, most lenders have overlays. What overlays are additional mortgage guidelines above and beyond those of federal minimum underwriting credit guidelines.

Common Overlays By Mortgage Lenders

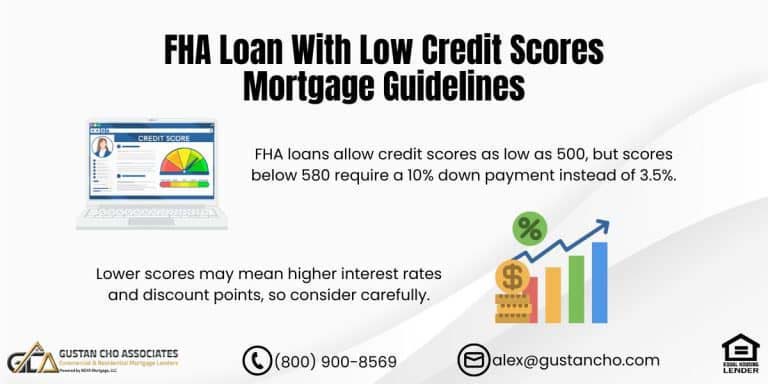

In this section, we will cover common overlays imposed by mortgage lenders. HUD, the parent of FHA, requires a minimum credit score of 580 to qualify for FHA Loans with a 3.5% down payment on home purchases.

A lender can require a higher than 580 credit scores, such as 620 or 640, for a 3.5% down payment FHA home purchase loan. In the above example, the lender has overlays on credit scores. Another example is that most lenders have FHA DTI Overlays requiring a maximum of 45% to 50% debt-to-income ratio caps. However, under HUD Guidelines, a borrower can get an approve/eligible per Automated Underwriting System with a front-end debt-to-income ratio of 46.9% and a back-end debt-to-income ratio of 56.9%.

Another example is that HUD does not require borrowers to pay off outstanding collections and charge off accounts to qualify for FHA loans, no matter how much the outstanding balance is. However, most lenders have overlays on collections and charge-off accounts where they require them to have it paid off and a cap on the maximum outstanding balance they can have, even though HUD does not require it.

Best Lenders For Bad Credit With No Overlays

Gustan Cho Associates is a full service mortgage broker licensed in 48 states with no overlays on government and conventional loans. Borrowers who need a five-star direct lender with no overlays can contact us at 800-900-8569 or text us for a faster response.

Most lenders require a minimum of 620 credit scores on VA loans. However, VA does not have any credit score requirements on VA loans. Most VA lenders have debt-to-income ratio requirements on VA loans, such as a cap of 41% to 50% DTI. However, VA does not have any debt-to-income ratio requirements on VA loans,

You can email us at gcho@gustancho.com. The FHA Bad Credit Lenders team is available seven days a week, evenings, weekends, and holidays. We are proud to say that we have closed 100% of our pre-approvals and have zero mortgage lender overlays. We go off automated findings.